As the entire market cheers for the future of AI, Goldman Sachs strategists are sounding the alarm.

Author: Jin Shi Data

The market is worried that the current U.S. tech stock sector is showing shadows of 1999. Despite the heated debate over whether AI is a bubble, history provides some signals revealing what investors should specifically pay attention to.

Goldman Sachs strategists stated, they believe the market's AI frenzy is at risk of repeating the collapse of the early 2000s internet bubble.

In a report to clients on Sunday, senior advisor Dominic Wilson and macro research strategist Vickie Chang from the bank's global market research team wrote, the U.S. stock market does not yet seem to be at the moment it was in 1999. However, they noted that the AI craze increasingly resembles the fervor of the 2000s, and the risks are rising.

“We see that as the AI investment boom continues, the imbalances accumulated in the 1990s are becoming more apparent. Recently, the market has shown some echoes of the turning point of the 90s boom,” the bank wrote, adding that the current AI trading looks like tech stocks in 1997, just a few years before the bubble burst.

Wilson and Chang pointed out several warning signs that appeared before the collapse of the internet bubble in the early 2000s, which investors should be wary of.

1. Investment spending peaks

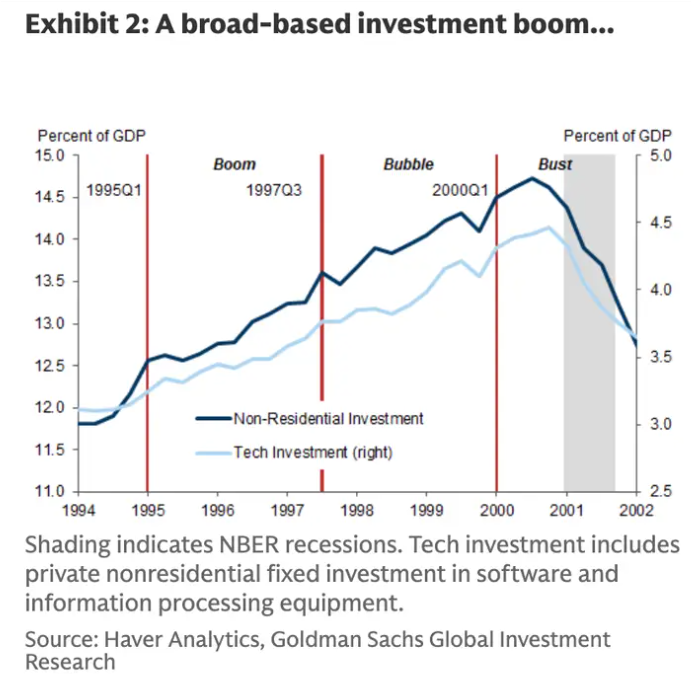

In the 1990s, investment spending on technology equipment and software rose to “abnormally high levels,” peaking in 2000, when non-residential investment in the telecommunications and technology sectors accounted for about 15% of U.S. GDP.

According to Goldman Sachs' analysis, investment spending began to decline in the months leading up to the internet bubble's burst.

“Thus, the high valuations of asset prices had a significant impact on real spending decisions,” the strategists stated.

This year, investors have become increasingly wary of the massive spending by large tech companies in the AI sector. Amazon, Meta, Microsoft, Alphabet, and Apple are expected to invest about $349 billion in capital expenditures by 2025.

Goldman Sachs noted that tech investment peaked in the early 21st century, coinciding with the beginning of the internet stock bubble's collapse.

2. Corporate profits begin to decline

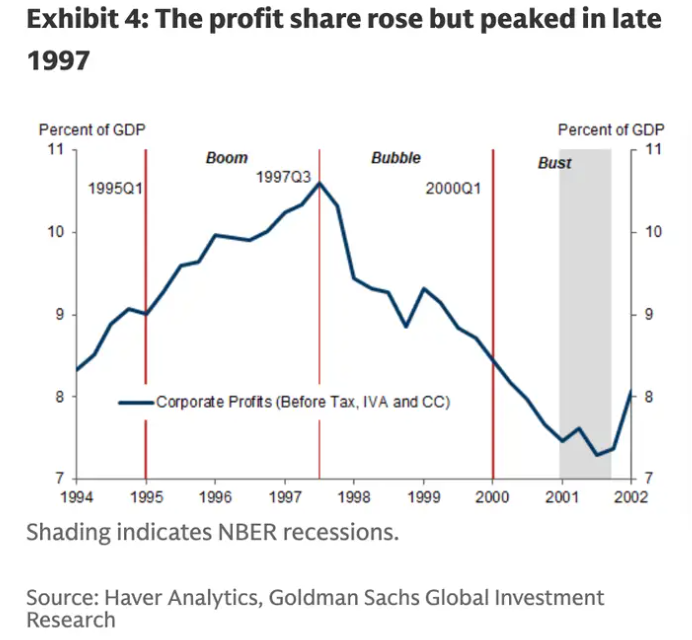

Corporate profits peaked around 1997 and then began to decline.

“Profitability peaked long before the end of the boom,” Wilson and Chang wrote. “While reported profit margins were stronger, the decline in profitability in macro data occurred simultaneously with the accelerated rise in stock prices during the late boom.”

Currently, corporate profits are performing strongly. According to FactSet, the blended net profit margin for the S&P 500 in the third quarter is about 13.1%, above the five-year average of 12.1%.

Corporate profits peaked at the end of 1997, a few years before the bubble burst.

3. Corporate debt rapidly increases

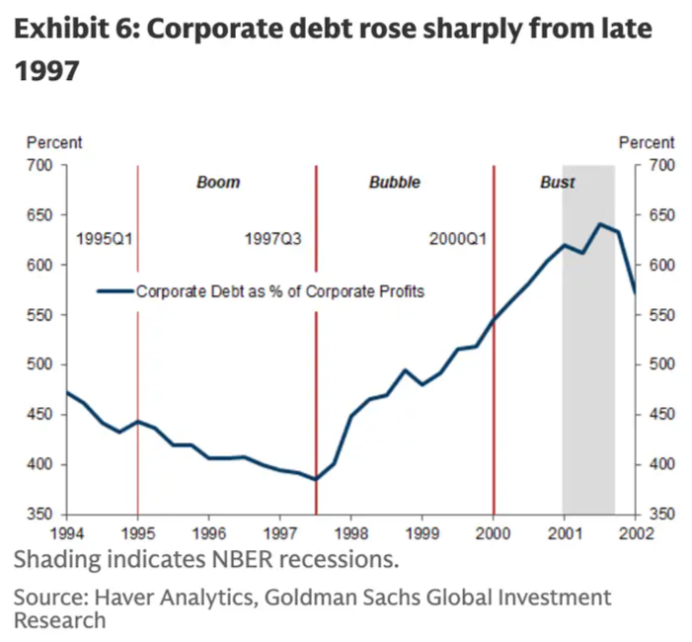

Corporate debt as a percentage of profits peaked in 2001.

Before the internet bubble burst, corporate debt was on the rise. Goldman Sachs' analysis shows that corporate debt as a percentage of profits peaked in 2001, just as the bubble was bursting.

“The combination of rising investment and declining profitability pushed the financial balance of the corporate sector—i.e., the difference between savings and investment—into deficit,” the strategists stated.

Some large tech companies are partially financing their AI spending with debt. For example, Meta issued $30 billion in bonds at the end of October to bolster its AI spending plans.

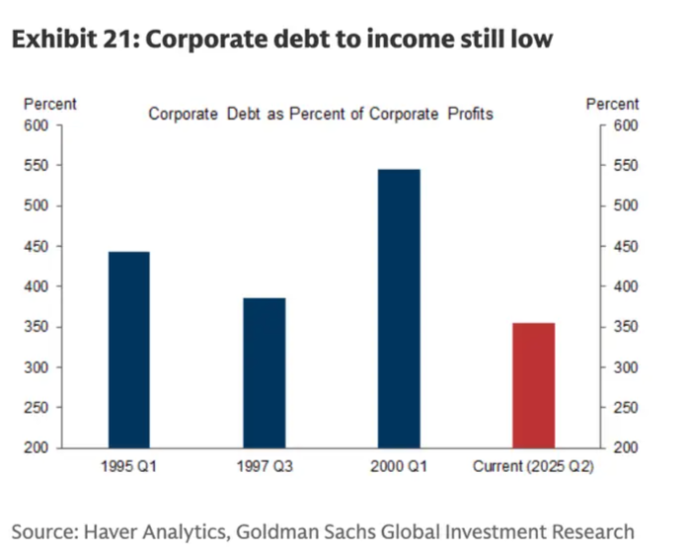

However, Goldman added that most companies today seem to be financing capital expenditures with free cash flow. The percentage of corporate debt to profits is also far below the peak levels seen during the internet bubble.

Compared to 2000, the ratio of corporate debt to profits appears low.

4. Federal Reserve interest rate cuts

In the late 1990s, the Federal Reserve was in a cycle of interest rate cuts, which was one of the factors boosting the stock market. Goldman wrote, “Lower interest rates and capital inflows fueled the stock market.”

The Federal Reserve cut rates by 25 basis points at its October policy meeting. According to the CME Group's FedWatch tool, investors expect the Fed to cut rates again by 25 basis points in December.

Other market professionals, such as Ray Dalio, have also warned that the Fed's easing cycle could fuel market bubbles.

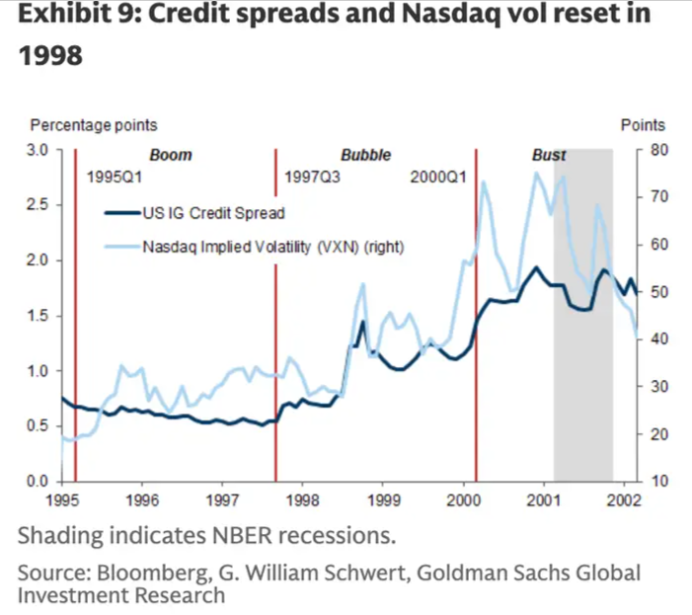

5. Widening credit spreads

Entering the early 21st century, credit spreads widened.

The bank noted that credit spreads widened before the internet bubble burst.

Credit spreads—the difference between the yields on bonds or credit instruments and benchmark rates like U.S. Treasuries—widen when investors perceive higher risk and demand greater compensation.

Credit spreads remain at historically low levels but have begun to widen in recent weeks. The ICE Bank of America U.S. High Yield Index option-adjusted spread rose to about 3.15% last week, up 39 basis points from a low of 2.76% at the end of October.

Wilson and Chang stated that in the 1990s, these warning signs appeared at least two years before the internet bubble truly burst, and they added that they believe there is still room for AI trading to rise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。