The company raised funds at a valuation of $40 billion, but it already holds $80 billion worth of $XRP.

Author: Steven Ehrlich

Compiled by: Deep Tide TechFlow

Ripple completed a $500 million financing round at a $40 billion valuation, but it already owns $80 billion worth of XRP.

Ripple Labs recently announced the completion of a $500 million financing round, with investors including well-known institutions such as Brevan Howard, affiliates of Citadel Securities, and Marshall Wace. Additionally, prominent crypto investment firms Galaxy and Pantera also participated in this round of financing.

However, what exactly did investors buy with this $500 million?

Recently, Ripple itself has been actively acquiring companies. In the past few months, Ripple has acquired the custody platform Palisade, the $1.25 billion prime broker Hidden Road, and the stablecoin infrastructure platform Rail. Furthermore, Ripple launched its proprietary stablecoin RLUSD, which has surpassed a market cap of $1 billion. At the same time, Ripple's XRP token is expected to see the first spot ETF (exchange-traded fund) in the U.S. next week and plans to apply for a national bank charter with the Office of the Comptroller of the Currency.

Despite Ripple's rapid development recently, finding a reasonable basis for its $40 billion valuation seems challenging. Especially considering that the revenue generated from transaction fees on the XRP Ledger is less than $200,000 per month. So, what logic is hidden here?

According to several anonymous investors and venture capitalists who spoke to Unchained, this financing is more about acquiring the XRP assets held by Ripple, potentially at a significant discount to the spot price.

“[This company] is worthless aside from its XRP holdings. No one uses their technology, and no one generates usage on their network or blockchain.” stated a well-known venture capitalist.

Another investor added, “Ripple's equity itself may not be worth much, let alone reaching a $40 billion valuation.”

XRP Wealth

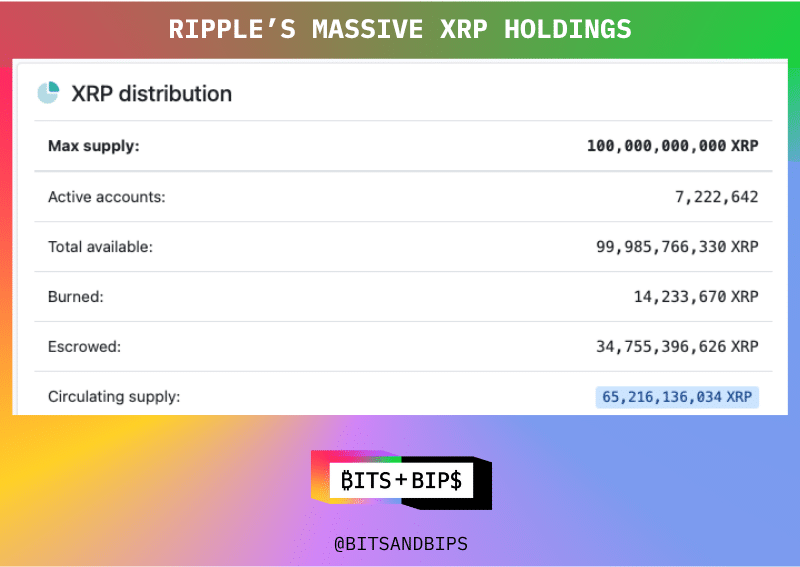

Although Ripple Labs may not be the highest-valued company in the crypto industry, it might be one of the wealthiest. At the inception of the company and the blockchain, as part of an early distribution strategy, Ripple Labs was allocated 80 billion of the total supply of 100 billion XRP, which is released quarterly through a custody account.

As of now, Ripple Labs still holds 3.476 billion XRP tokens, releasing 1 billion each month. Typically, 60%-70% of these tokens are re-locked, while the remainder is used to cover operational expenses. At the current price of $2.32 per XRP, the nominal value of these tokens reaches $8.063 billion.

Private XRP Digital Asset Treasury (DAT)?

If this investment is viewed as an investment in Ripple's Digital Asset Treasury (DAT), then the deal seems quite attractive for investors. After all, investing in a company with $80 billion in assets at a $40 billion valuation is akin to buying in at a 50% discount, with an mNAV (multiple of net asset value) of only 0.5. Generally, DAT investment proposals have an mNAV close to 0.7 or 0.8.

But it’s not that simple. Even if Ripple were willing and able to sell all its XRP on the spot market today, it would be nearly impossible to approach an $80 billion valuation. However, even applying a 50% discount to these held assets—an estimate deemed reasonable by an investor not involved in this financing—still means investors are buying in at an mNAV of 1, while enjoying the potential upside from Ripple's recent actions and acquisitions.

All investors participating in this financing round declined to respond to Unchained's inquiries about the investment, particularly regarding the role of Ripple's XRP in the decision-making and pricing process. Ripple also did not respond before the publication of the report.

However, a source familiar with one of the participants revealed that these companies have had business dealings for years. Especially in the payments sector—following the passage of the GENIUS Act in July and the market's focus on stablecoins, the payments sector is heating up—investors need to bet on multiple "horses" in this "race."

Additionally, this source hinted at Ripple's substantial treasury reserves, stating, “Even if they cannot build a successful business themselves, they can directly buy a company.”

Ripple's Calculation: What is the Deeper Meaning Behind the Financing?

Although Ripple did not respond to requests for comment, a former employee pointed out that this financing brings multiple benefits to the company. First, it solidifies Ripple's $4 billion valuation for shares traded on platforms like Carta. This individual mentioned that the company may have spent over $1 billion to repurchase shares from early investors and employees.

Moreover, this financing provides the company with additional funding support for further acquisitions without needing to raise funds by selling XRP—avoiding the risk of potentially causing market panic.

Ironically, this company, which is the most capital-rich in the crypto space, may actually be facing a cash shortage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。