For individuals, the true scarcity is not capital, but the courage to push thoughts to the extreme and be willing to stake chips for it.

Silicon Valley is never short of star investment institutions, but only Founders Fund has consistently hit super unicorns like PayPal, Facebook, SpaceX, Airbnb, and Anduril over 20 years, while maintaining the dual attributes of "high returns + high controversy." This venture fund, created by Silicon Valley godfather Peter Thiel, not only established an investment aesthetic contrary to the mainstream venture capital ecosystem but also continuously reshapes the power boundaries of the venture capital world.

Mario Gabriele, through 18 months and 35,000 words of in-depth reporting, attempts to answer a question: How did Peter Thiel transform an ordinary venture fund into Silicon Valley's most difficult-to-replicate investment kingdom?

We believe that understanding Founders Fund is not just about understanding a fund, but also an extreme embodiment of the Silicon Valley spirit. It carves out a lonely path to the future between rationality and rebellion, calculation and faith.

In the rapidly iterating flood of information, a truly "annual masterpiece" of technology reporting is particularly rare. Mario Gabriele, as the head of The Generalist, focused on one of Silicon Valley's most influential venture capital firms—Founders Fund—when searching for institutions worthy of being "epicized."

With the industry reputation and open cooperation of his PR team, he gained deep access to 12 core members of the fund and obtained some previously undisclosed fund return data. In constructing this report, Mario combined interview materials with AI tools to build a timeline, fill in the background, and narrate the spiritual lineage of Founders Fund through four major chapters: "Prophet, Disciples, Gospel, Kingdom." He firmly believes that only by telling the truth, including flaws, can trust be earned from readers.

### A Concise Version of the Four Major Chapters

Peter Thiel and his led Founders Fund have maintained an astonishing hit rate in the ever-changing world of venture capital. A glance at its core investment portfolio reveals a commonality: a high concentration of funds. According to data, the fund's average investment in its top five projects exceeds 60%, with almost all major victories stemming from heavy bets on "few but excellent projects."

1. Prophet: Macroeconomic Narratives Guide Betting Directions

In the past two years, two keywords frequently mentioned by Peter Thiel have been key to judging his betting direction:

- "Industrial Re-Onshoring" — Betting on Supply Chain Sovereignty

This trend has prompted the fund to deeply invest in strategic industries such as hydrogen metallurgy, rare earth smelting (e.g., MP Materials), and industrial robotics (Figure AI). From energy security to industrial automation, the underlying logic is that "manufacturing returning to the U.S." will leverage the next decade's dividends.

- "AI ≠ AGI" — Rejecting Illusions, Seeking Practical Breakthroughs

In the face of the large model craze, they do not blindly chase the "application layer bubble," but heavily support AI companies like Cognition that possess "code-level reasoning capabilities." According to Silicon Valley Tech Review's AI venture capital database, Founders Fund, with substantial capital, chooses investment targets in the AI wave with high selectivity and restraint, but once selected, they make significant bets. Currently, they have invested over $30 billion in 48 AI startups. Visit Silicon Valley Tech Review's official website (svtr.ai) for detailed analysis.

2. Disciples: Building a Talent Lineage and Product Faith Chain

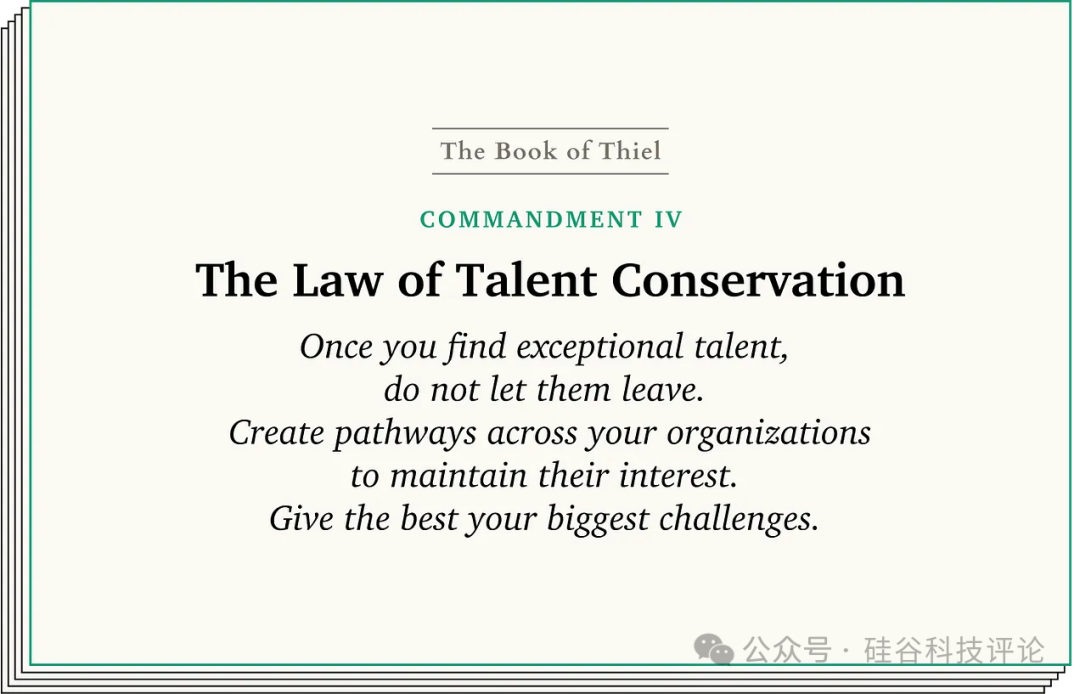

Founders Fund has always valued the inheritance of "talent background" and "technological faith." From the early days of the Stanford Review editorial team, to the PayPal Mafia, and to today's partners and founders of invested companies, they have collectively built a deep network of connections.

This talent mechanism acts like a "faith incubator," where investors and entrepreneurs engage in deep collaboration and long-term support around certain technological ideas.

3. Gospel: Heavy Bets Remain the Key to Winning Rates

Large-scale betting remains the secret to Founders Fund's success. Whether participating early, continuously increasing stakes, or precisely controlling exit rhythms, it reflects the strategy of "focus and patience."

Specifically, the investment in SpaceX was $671 million, with returns reaching $18.17 billion, yielding a 27.1x return rate; early bets on projects like Airbnb, Palantir, and Postmates have also brought over 10x returns. The core of this strategy lies in deeply believing in one's judgment of future trends and then letting capital speak.

4. Kingdom: Dual Drive of Content Soft Power and Capital Structure

Founders Fund is not just a fund; it resembles a composite of a think tank + public opinion engine + investment machine.

From founder Peter Thiel establishing the Stanford Review on Stanford's campus, to publishing the globally popular venture capital bestseller Zero to One, and to today's podcast media, a chain of "narrative-driven → public diffusion → investment conversion" is forming a closed loop of influence.

The podcast Anatomy of Next has expanded into a complete documentary, strengthening the discourse power of cutting-edge technology;

The media platform Pirate Wires has surpassed 2 million monthly active users, demonstrating strong topic creation capabilities;

On the capital side, past LPs (limited partners) were primarily Middle Eastern capital and university endowment funds, but now Founders Fund is attracting more and more family offices and sovereign funds to participate. This diversified LP structure enhances cyclical resistance and capital stability.

### Investment Philosophy: Three Core Principles + Twelve Commandments

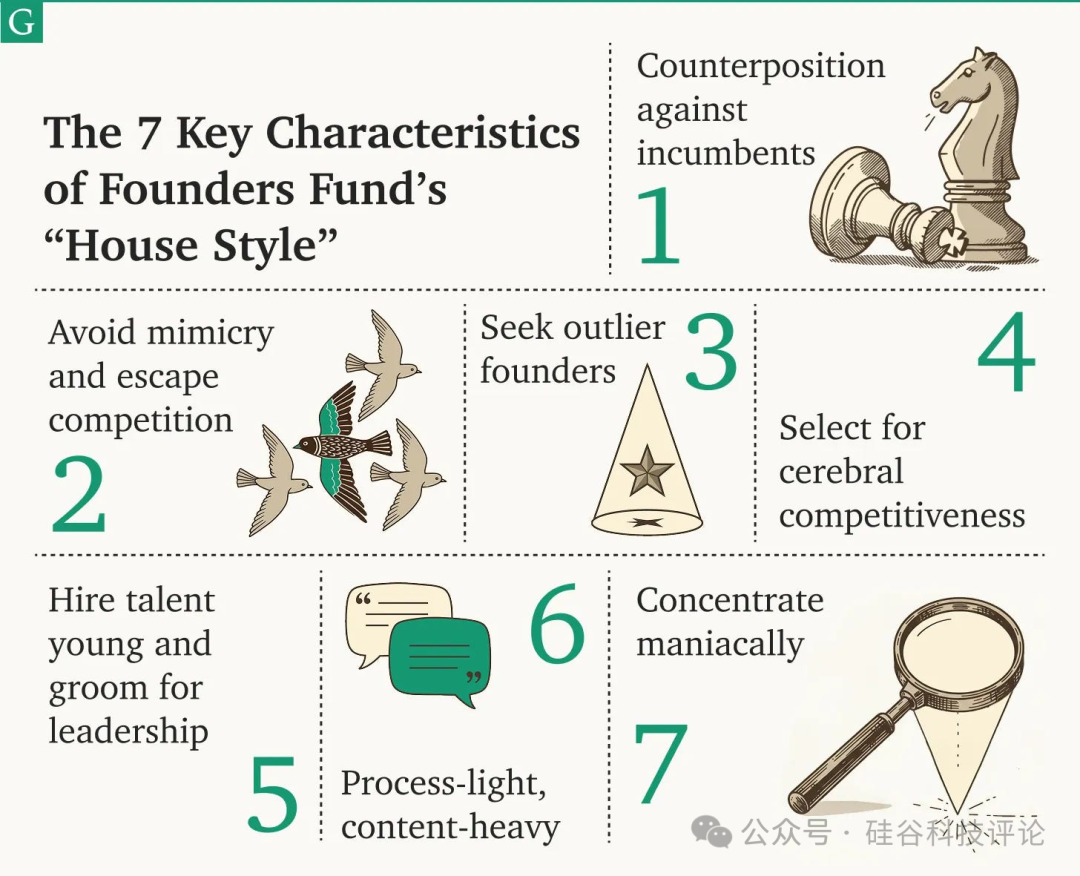

In the turbulent world of venture capital, Founders Fund stands out as one of the few truly "against the wind" betting entities with its distinctive style and firm beliefs. Rather than simply betting on the future, they have constructed a systematic cognitive methodology that includes both a high-level philosophical framework and practical decision-making guidelines.

The dual drive of Pirate Wires (media) + Founders Fund (capital) repeatedly proves that the most valuable brand asset remains a true perspective.

1. Three Core Principles: Cognition-Driven, Anti-Consensus Betting, Talent First

- First understand where the world is heading, then decide what to invest in.

True successful investments stem from foresight of the era's trends. In Founders Fund's worldview, investing is not a fill-in-the-blank question, but a deductive reasoning question. For example, their early bets on SpaceX and Palantir were not based on financial models, but on insights into the misalignment of national capabilities and technological innovation.

- Dare to bet against consensus, but must do thorough homework.

Being anti-mainstream is not an emotional expression, but a result of information advantage. The internal investment decision-making brain "Super Excel" built by partner Napoleon Ta (add Kerry WeChat for specific details) is not a gimmick, but a tool for quantitatively modeling risk and return, reflecting extreme rationality and self-verification mechanisms. Acting without preparation is just another version of speculation.

- Talent takes precedence over the track.

In Peter Thiel's view, what determines a company's ceiling is not the market trend, but the complexity of the founder's mental model. The hallmark of top talent is: high intelligence (raw intelligence), exceptional curiosity, and open-mindedness. Founders Fund is often referred to as the training ground for the “Thiel School,” and this is not an empty title.

2. Twelve "Investment Commandments": How to Bet on the Future Amid Uncertainty

Insiders undervalue break-up startups.

Back the founders religiously.

True opportunities lie in anti-mimesis.

The law of talent conservation: top talent is always scarce.

The world does not need more apps.

Move away from heat.

Invert, always invert.

Make variance your friend.

Pro rata is lazy thinking.

A college degree is a faulty credential; ability is king.

Find cerebral gladiators.

Hire talent, not experience.

### Next Stop: The "Anti-Consensus" Window of Bio & Energy?

Mario candidly admitted in the interview that he "cannot see the next chapter of FF." However, based on deep tracking from SVTR.AI's venture capital database, clues about Founders Fund's investment trajectory from 2024-25 can be gleaned:

Industrial-grade biomanufacturing: In partnership with Laura Deming, they have quietly invested in the synthetic enzyme factory Solugen-II and the bio-jet fuel project Koloma.

Small Modular Reactors (SMR): Participated in Radiant's Series B, betting on the beryllium-graphite technology route.

Hydrometallurgy / Rare Earth Refining: Increased investment in MP Materials and led the round for ElectraSteel, providing a material foundation for "re-industrialization."

These directions possess the characteristics of long cycles, high CAPEX, and extremely high technical barriers, which align perfectly with Founders Fund's historical preference for "unexplored territories."

### Summary of the Full Text

Mario wrote at the end:

“The world will consume all good ideas and then ask you: ‘What’s next?’”

For Founders Fund, the next "big narrative" may be biotechnology, energy, or even deeper into the defense industry. But regardless of the direction, the "triangular engine" built on macro perspectives + anti-mimesis thinking + top talent networks will continue to drive them to discover value first in "unexplored territories."

For individuals, the true scarcity is not capital, but the courage to push thoughts to the extreme and be willing to stake chips for it. If Founders Fund has a replicable secret, it is to give oneself enough mental freedom to transcend the boundaries of common sense.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。