Famous short-seller James Chanos has officially closed his 11-month hedge trade involving Strategy Company ($MSTR) and Bitcoin, marking the end of his high-profile shorting operation against Bitcoin-related stocks and this benchmark stock.

The closing of institutional short positions is a trend reversal signal, which may indicate that the darkest hour for Bitcoin reserve companies has passed.

In recent weeks, the ecosystem of Bitcoin reserve companies has been severely impacted.

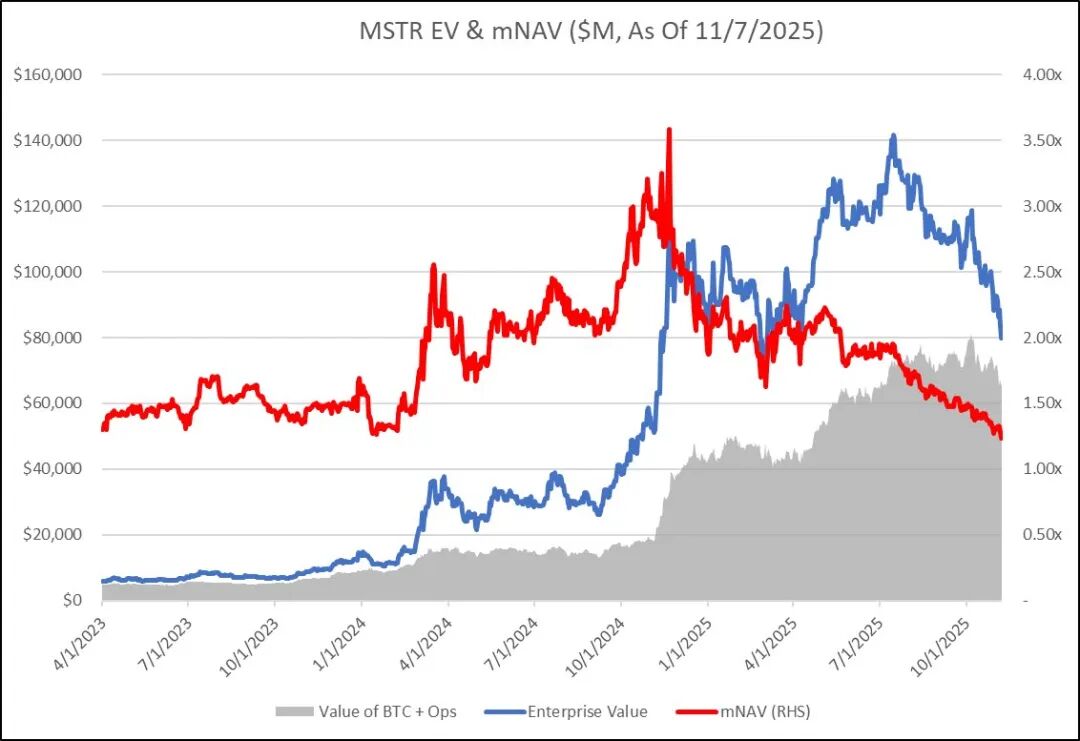

The stock prices of most related companies have significantly declined from their highs earlier this year, and analysts have previously advised investors to short stocks like Strategy, warning that a bubble has formed in the Bitcoin reserve sector, which could burst without warning at any moment.

However, just as short-selling pressure reached its peak, a turning point may be on the horizon. Last Saturday, Pierre Rochard, CEO of The Bitcoin Bond Company and a veteran expert in the cryptocurrency reserve field, declared that the bear market for Bitcoin reserve companies is "gradually coming to an end."

In his view, the closing of institutional short positions is one of the clearest signals in the industry, indicating that market sentiment may be shifting: "The market is expected to remain volatile, but this signal is precisely what is needed for a trend reversal."

While this is still far from a cause for celebration, for those investors who have long struggled with negative sentiment and are still troubled by adjusted net asset value (mNAV) issues, this glimmer of hope is as precious as rain after a long drought.

James Chanos is a central figure among these short holders. This well-known investor has always held a negative attitude towards all assets related to Bitcoin.

His closure of the 11-month hedge trade involving Strategy and Bitcoin also signifies the official end of his high-profile shorting against this "corporate Bitcoin hoarding benchmark company."

It is worth mentioning that MicroStrategy currently holds over 640,000 Bitcoins and continues to accumulate more at lower prices. This operation seems as if its founder, Michael Saylor, has never heard of the concept of "risk management."

Chanos confirmed this operation on the X platform, which quickly sparked heated discussions in the cryptocurrency Twitter community, with many posts discussing whether the current situation has hit bottom.

He posted: "Given that many have inquired, I confirm that I closed my hedge position in MicroStrategy against Bitcoin at the market open yesterday."

Meanwhile, institutional attitudes towards cryptocurrencies are quietly changing. Traditional financial giants are entering the space; they are no longer naysayers but have become stakeholders and market participants in the industry. More importantly, they are now part of the innovators in cryptocurrency reserves.

JPMorgan's recent moves in the BlackRock spot Bitcoin exchange-traded fund (ETF) related business, along with a series of recently announced custody and clearing partnership agreements, indicate that corporate acceptance of Bitcoin is no longer a "wild and chaotic exploration," but is gradually becoming a strategic decision at the board level.

Whether it is driving inflows into exchange-traded products, adjusting reserve yield strategies, or equating digital assets with real-world securities, this transformation is quietly advancing.

Of course, this does not mean that Bitcoin reserve companies will soon escape the troubles of volatility. The uncertainty of the macro environment and the fluctuations in regulatory policies still hang over Bitcoin like the sword of Damocles.

However, the closure of significant short positions by well-known skeptics like Chanos is not merely a matter of capital flow; it represents an important psychological turning point in the market.

Whether for Bitcoin prices or institutional narratives, the signals are very clear: the darkest hour may have passed, and the authors of the industry's next chapter will no longer be the familiar faces of the past.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。