Author: Frank, PANews

In the frenzy of the cryptocurrency market, "Digital Asset Treasury Companies" (DAT companies) have played the role of an "infinite ammunition depot," absorbing massive funds from traditional markets through innovative financial instruments, continuously "transfusing" resources into the crypto ecosystem. However, as the market's enthusiasm wanes and recent trends remain sluggish, these once "buyers" are facing severe tests. Can they continue to support the market? Or will they transform from "blood transfusion pumps" into "invisible bombs," becoming accelerators that amplify market declines due to their inherent structural risks?

DAT Company Stock Prices Plummet, Asset Purchases Drop by 95%

According to BBX data, the number of publicly listed cryptocurrency treasury companies has reached 248, with 187 companies holding Bitcoin. The number of listed companies holding Ethereum is 42, and those holding SOL is 20. As of November 6, many DAT companies' stock market values have fallen far below their NAV. Among those holding BTC, 15 companies have an mNAV below 1, while 5 companies holding ETH have an mNAV below 1. Overall, 37 companies have an mNAV below 1, accounting for approximately 14.9% (mNAV = circulating market value / value of held coins), meaning about 85% of cryptocurrency treasury companies have a market value greater than the scale of their held crypto assets.

From a market capitalization perspective, companies holding BTC are the largest, with a total of $417.8 billion in assets. Therefore, the performance of these DAT enterprises is more representative. PANews has compiled the performance of 34 non-mining listed companies holding more than 100 BTC over the past three months from SoSovalue.

Overall, these listed companies have experienced an average decline of -24.51% over the past three months, with only 5 companies seeing their stock prices rise during this period. The largest decline was for Next Technology, which saw a drop of over 95% in three months. During this period, these companies had also experienced significant increases, with an average maximum increase of 49%, and 6 companies had maximum increases exceeding 100%.

However, the drop after the rise is equally dramatic, with these companies averaging a 51.8% retracement.

In comparison, BTC's price saw a 14% decline during the same period, with the largest retracement being 21%. Clearly, the volatility of these cryptocurrency treasury companies is stronger; whether rising or falling, their movements are more exaggerated than BTC's.

Overall, as the cryptocurrency market has recently shown weakness, these cryptocurrency treasury companies are generally more subdued. Taking the absolute leader Strategy as an example, in July this year, Strategy's stock price reached $455, but as of November 4, it had dropped to a low of $246, an overall decline of 45.9%. This trend continues, with no signs of a rebound in the near term.

The decline in stock prices reflects the market's pessimism towards DAT-themed companies. From the perspective of investing in Bitcoin, a large number of companies have BTC holding costs higher than the current spot price. For example, as of November 6, the current price of BTC is approximately $102,900. There are 23 companies whose holding costs exceed this price. However, since most of these companies are newly established DAT companies, their overall proportion is not high, with the highest average cost for Strategy being $74,000, still leaving a significant profit margin.

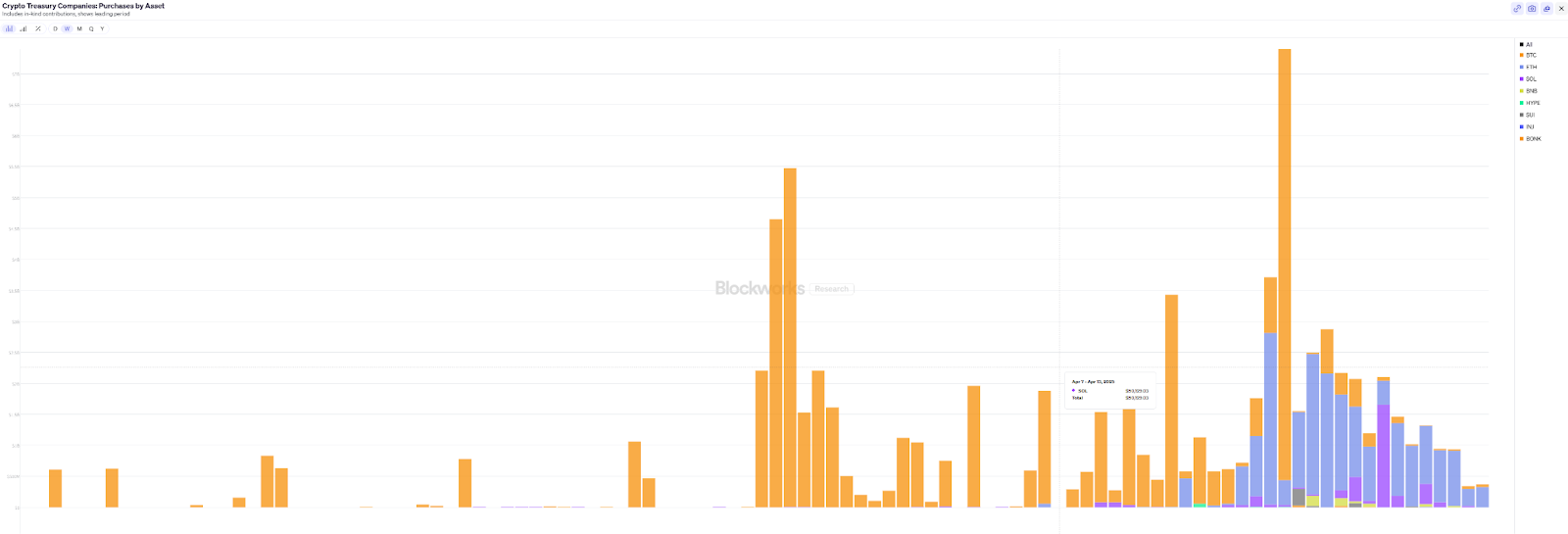

Additionally, as prices decline, the buying pace of these cryptocurrency treasury companies has gradually slowed. According to Blockworks data, from October 27 to November 2, the total cryptocurrency asset purchases amounted to approximately $342 million, a 95% drop compared to the peak week of $7.39 billion. The ETF data during the same period also showed a similar trend.

From this perspective, the traditional financial market's ability to supply funds to the cryptocurrency market tends to be more of a "nice-to-have" rather than a "lifeline."

Who Will "Crash the Market"? Potential Liquidation Risks of Three DAT Treasury Models

The general concern in the market is that DAT companies may panic sell due to "losses." It is actually difficult to provide a standard answer to this question, as these DAT companies differ significantly in their financing methods, debt designs, or asset management strategies. However, PANews has selected three typical models for analysis to address whether these DAT enterprises could become a hidden danger of dumping during market declines.

First, the most typical example is Strategy (MSTR), whose strategy is to "permanently accumulate" Bitcoin.

Over the past five years, Strategy has borrowed a total of $7.27 billion through the issuance of various "convertible notes." These notes typically have zero or very low interest rates, making their financing appear almost "free." Investors accept zero interest because they are betting not on the company's profitability but on the embedded "stock call options" in the notes — the right to convert the bonds into high-priced MSTR stock in the future. Therefore, essentially, the issuance of Strategy's convertible notes resembles the issuance of an option product; for investors, once Bitcoin rises, they will convert these notes into company stock to enjoy the benefits.

However, it is worth noting that when Bitcoin prices continue to fall, investors will not choose to "convert" to stock. Instead, they will exercise the "put option" hidden in the bond terms — that is, upon the bond's maturity, they will demand Strategy to repay 100% of the cash principal. In the case of insolvency, Strategy's only option would be to sell Bitcoin.

However, the maturity dates of these bonds are generally between 2028 and 2030. As long as Bitcoin's price during that period is significantly higher than the current price, these bonds are likely to be converted into stock. Additionally, Strategy has designed a mechanism where if the price rises and the stock is not converted, the company has the right to redeem these bonds at face value (plus interest), which is also a strategy to indirectly prevent potential declines.

Overall, companies like Strategy or those adopting similar mechanisms are unlikely to sell their held crypto assets in the short term.

Of course, Strategy is a well-known publicly listed company in the entire cryptocurrency market, and its appeal allows it to maintain strong financing capabilities even under extremely harsh conditions. For other emerging DAT companies, they can only resort to different tactics.

Take Sonnet BioTherapeutics as an example. This originally biopharmaceutical company is undergoing a "reverse merger" led by crypto-native VCs such as Paradigm, Pantera, and Galaxy Digital.

These VCs are using a near-bankrupt biotech company (SONN) as a "shell," injecting $888 million worth of HYPE tokens and cash, transforming it into a pure HYPE treasury listed on NASDAQ (renamed Hyperliquid Strategies Inc., HSI). As of now, this acquisition has not yet been completed.

The potential risk for this company lies in the announcement of the acquisition transaction on July 14, 2025. On the same day, Bitcoin reached a historical high of $123,000, and the HYPE token also hit a historical high of $49.75 (which later rose to $59). This company was born at the peak of market enthusiasm, making its balance sheet extremely vulnerable during market corrections.

As of November 5, the price of HYPE had dropped to $39.7. As a NASDAQ-listed company, the new FASB rules force it to report unrealized losses from the decline in HYPE prices in its quarterly financial reports. Huge paper losses may scare off traditional investors, leading to a stock price collapse and cutting off its financing channels.

This could trigger a chain reaction. When its stock market value is far below the net asset value of its holdings, aggressive hedge funds may find arbitrage opportunities: buying HSI stock cheaply on the open market and then using shareholder rights to initiate a proxy war, forcing the company to liquidate its entire HYPE treasury and distribute the cash obtained (above the stock price's net asset value) to shareholders.

From this perspective, similar shell-listed companies, combined with unstable crypto assets, may face the outcome of being sold off.

Moreover, there are companies whose operational rules explicitly state that selling off will become part of the game rules. For example, TONX (formerly VERB Technology) is a listed company that has undergone a massive $558 million PIPE (private equity) financing, supported by institutions such as Kingsway Capital, Pantera, and Kraken, and has been restructured into a TON treasury company. Its design includes the following rules:

If the stock price of TONX is above NAV (premium), the company will issue more shares to purchase more TON.

If the stock price of TONX is below NAV (discount), the company has authorized a stock buyback plan of up to $250 million.

Currently, this company's mNAV is 0.495, indicating it is at a discount level. Once the stock buyback plan is activated, its current cash of only $67 million will not be sufficient to support the $250 million buyback, directly resulting in the need to sell TON assets. Once this step is taken, it will fall into a vicious cycle where the price of TON declines, potentially affecting the stock price of TONX as well. Even a buyback may not restore market confidence.

In summary, it seems that there is no perpetual upward flywheel in this world. The DAT companies that appear to have infinite ammunition also harbor many hidden dangers behind their mechanisms, and many public chain foundations seem to be adopting similar models to amplify leverage.

"Bull Market Accelerators," Also Potential Drivers of "Bear Market Downward Spirals"

So, in a market lacking confidence, we must ask a question: Is the rise of DAT companies merely a brief frenzy at the end of a bull market, or is it a long-term source of funding with potential for the cryptocurrency industry?

From the short-term market performance perspective, even though the pace of entry has slowed, these DAT companies remain a relatively stable source of fresh blood in the cryptocurrency market, and under normal circumstances, these enterprises will not easily sell their held crypto assets. In some altcoins, the proportion of holdings by DAT companies has exceeded 5% of the total market capitalization or even more.

These companies have collectively injected hundreds of billions of dollars from traditional capital markets into the cryptocurrency ecosystem. They are one of the largest and most concentrated buyer groups in the market.

However, due to the differing motivations and rule designs of these enterprises, these DAT companies are also unstable sources of funding. In a bull market, they act as perfect "bull market accelerators." They leverage the advantages of traditional financial markets to continuously absorb funds, effectively driving market upswings.

In a bear market, these enterprises may be forced to liquidate due to their debt covenants, corporate bylaws, and shareholder demands. Although the probability of such events occurring is low, if they do happen, they inevitably become "death spiral" accelerators that amplify systemic risks.

Of course, even though the current market sentiment is heavily pessimistic, the objective reality is that the "black swan" has not yet arrived. Regarding the DAT treasury strategy as a business model, everything is still in its early stages, and the final outcome still needs to be tested by the market and time. Perhaps, after this round of market correction, DAT companies will become the new driving force for the next round of growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。