Author: Nancy, PANews

Making money has become a common sentiment among retail investors in this round of the crypto cycle. Although Bitcoin once surged to $120,000, the real "money-making opportunities" are becoming increasingly rare. In contrast, various losing strategies are emerging, leaving investors walking on thin ice.

The reasons behind this are not singular: on one hand, the threshold for issuing tokens continues to lower, leading to a surge in the number of new tokens in the market, making it difficult for investors to identify quality projects; on the other hand, the pace of iteration in the crypto market is accelerating, and the popularity of various new narratives is hard to maintain. Even experienced investors find it challenging to seize all potential opportunities in real-time.

In such an environment, safeguarding one's finances and seeking breakthrough points for returns has become a financial defense battle that investors must face. Huobi HTX aims to create the "first entry point" for investors to discover potential new stars by carefully selecting projects, focusing on key tracks, and providing full-cycle support.

"Ice Point Moment" in the Crypto Market: Achieving Counter-Cyclical Growth Through New Coin Effects

Who would have thought that this four-year crypto bull market cycle would fail this time? The market did not usher in the expected prosperity but instead brought about the coldest "halving market" in history.

Unlike previous cycles, most participants in this round have hardly gained any substantial profits. Altcoins continue to decline, and the market is accelerating towards a chaotic PVP game, with investors' psychological defenses being breached time and again as rebounds fall flat; narratives are frequently replaced but lack sustainability, leading to capital migrating back and forth between sectors without forming real increments; liquidity remains critically low, and the "10·11 incident" became the final blow to confidence, plunging the entire market into silence. The so-called "bull-bear rhythm" has long lost its reference value amid the dual collapse of liquidity and confidence.

This is not just a withdrawal of funds but also a retreat of confidence. Trading volume has plummeted, new user growth has stagnated, and sentiment remains at a freezing point… Most centralized exchanges (CEX) have chosen to defend, but Huobi HTX has delivered a counter-cyclical growth report.

In the third quarter of 2025, Huobi HTX's overall trading volume increased by 25% month-on-month, and the number of registered users grew by 13%; the platform's asset accumulation surpassed $6.87 billion, a month-on-month increase of 6.4%, continuing to rank among the top global mainstream exchanges. In terms of traffic, Huobi HTX's overall exposure increased by 7% month-on-month, reaching 13 million; PV (page views) increased by 37%, and UV (unique visitors) grew by 43%, reaching 46 million and 19 million, respectively.

In such a sluggish market cycle, this growth can be described as "flying against the wind." Behind the data is Huobi HTX's precise control over asset selection, user service, and market strategy. In response to market cycle changes, Huobi HTX launched "Huobi Select," with the core strategy of "early discovery, early layout, early participation," quickly listing quality assets to provide users with the most promising new coin entry.

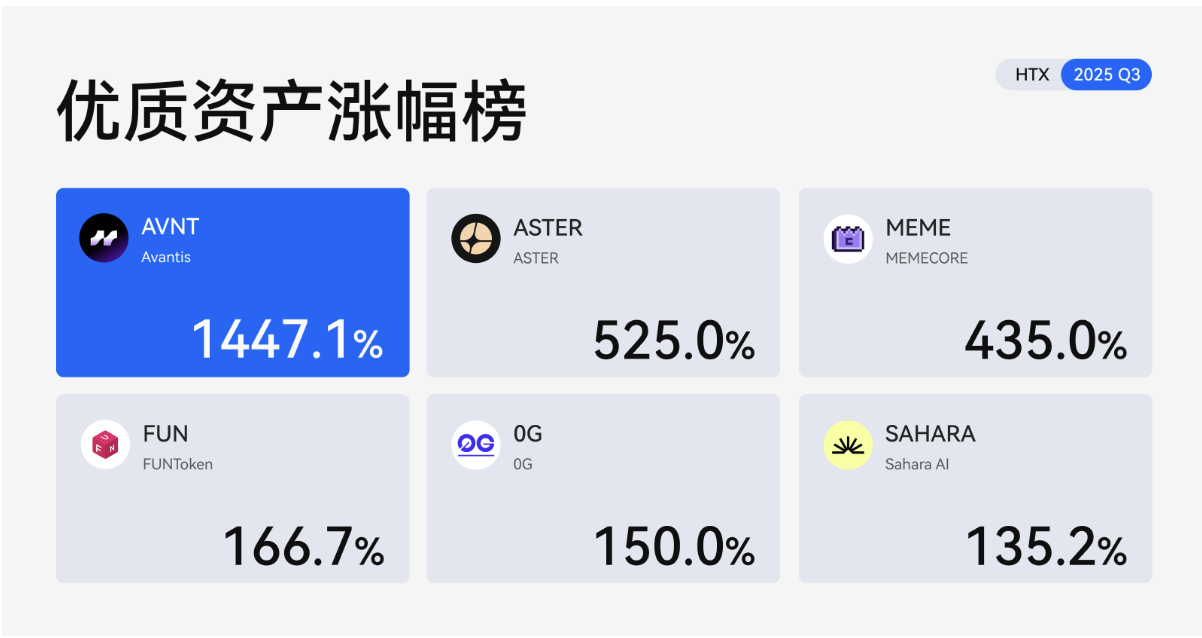

In the third quarter, Huobi HTX launched a total of 39 quality new projects, becoming a major launchpad for new assets, including popular projects like TREE, CAMP, WLFI, HOLO, LINEA, AVNT, ASTER, 0G, XPL, and FF, covering multiple mainstream tracks such as MEME, DeFi, AI, infrastructure (L1/L2), and derivatives (Perp DEX), with many projects achieving significant price increases after launch.

For example, ASTER, with its innovative mechanism of "no MEV and low slippage," saw a quarterly increase of 525%, becoming a star asset of the quarter; AVNT, as a quality asset debuting on the Base chain, saw its price increase by more than 14 times after launch, attracting a large number of investors. WLFI became a focal project of the quarter due to its endorsement by the Trump family and its combination with DeFi narratives; the Web3 entertainment ecosystem FUNToken, which integrates gaming and payment scenarios, rose approximately 166.7% during the quarter; Sahara AI, focusing on AI computing power sharing and model training resources on-chain, saw a launch increase of 135.2%.

These data not only showcase Huobi HTX's sensitivity in asset selection but also reflect its precise grasp of structural opportunities in a low liquidity environment.

From Narrative Mainline to Asset Strategy: Huobi HTX's Coin Selection Philosophy

As market liquidity tightens, crypto assets face short-term pressure, and returns may even lag behind stocks and gold, leading to a generally cautious approach to funding. Meanwhile, rapid rotation of hot topics leaves investors with little time for thorough research and layout. In such a high-noise, low-signal market, valuable opportunities are often drowned in a sea of information and short-term speculation, posing a more severe challenge to the exchange's coin selection capabilities.

In the face of a market lacking a main narrative, Huobi HTX has chosen to focus on two core tracks. On one hand, Huobi HTX targets the infrastructure track, concentrating on underlying technological innovation and long-term industry value; on the other hand, Huobi HTX captures community sentiment and liquidity trends through "Meme culture." This dual-mainline strategy, rooted in technology on one end and embracing culture on the other, serves both long-term value investors and maintains the ability to capture short-term market sentiment, becoming key to Huobi HTX's vitality and growth during periods of narrative failure.

Looking ahead to the fourth quarter, Huobi HTX will continue to deepen its focus on the infrastructure sector (such as MONAD) and increase its layout efforts in the Chinese MEME track, striving to capture and launch quality assets with growth potential in real-time, reflecting its firm belief in cultural consensus and long-term value.

In addition to track layout, in the face of token proliferation and short-term speculation, Huobi HTX has also established a multi-dimensional project evaluation mechanism to balance innovation and risk. In terms of technological innovation, the platform emphasizes underlying architecture and technological breakthroughs to ensure projects have practical landing potential; regarding team background, strict due diligence is conducted on founding teams, and top institutional endorsements are referenced to assess project foundations; community activity is focused on the community's autonomy and cultural extensibility, remaining vigilant against false prosperity; token economic models are evaluated for fairness and sustainability to ensure long-term value binding rather than short-term speculation. With this system, Huobi HTX can accurately capture projects capable of crossing cycles in the early stages while also reducing platform asset risks to some extent.

A typical case is the spot debut of "Binance Life." This MEME coin, originating from the Chinese community and highly social in nature, quickly ignited the Chinese circle upon its launch. When other exchanges failed to respond promptly due to language barriers and approval processes, Huobi HTX leveraged its keen insight into the Chinese community, real-time on-chain data monitoring system, and efficient internal decision-making mechanism to complete the launch ahead of others. For Huobi HTX, this was not only a successful coin listing decision but also a victory in speed and judgment.

Relying on professional asset selection, precise market judgment, and efficient execution, Huobi HTX's coin selection strategy has created a reliable value entry for investors, allowing long-termism to traverse each crypto cycle.

From Launch to Star Creation: Leveraging Multi-Dimensional Support to Activate the Growth Flywheel

Currently, the crypto market is becoming increasingly competitive, and the cold start of new projects is becoming more challenging. In the past, as long as the story was new enough and the narrative strong enough, a coin could break out in a short time; now, with liquidity dispersed and user fatigue, new coins often find themselves in a "dousing" situation before they even take off.

Huobi HTX seems to have found a solution: by carefully selecting projects and providing multi-dimensional support, it injects initial momentum into potential assets, helping them complete the cold start from 0 to 1, thus becoming the preferred launchpad for new coins entering the market.

Huobi HTX does not just list coins; it provides full-cycle support for projects. In addition to meticulously selecting potential projects during the listing phase, Huobi HTX also offers comprehensive market exposure through trading activities, media matrices, and community events. According to Huobi HTX's quarterly report, during the launch period of hot assets like TRUMP, USD1, and WLFI, the platform initiated multiple participatory activities, with over 100,000 users signing up, significantly boosting trading activity. At the same time, the platform distributed hundreds of billions of $HTX tokens to users, further amplifying market enthusiasm.

For example, the TRUMP coin, symbolizing the "MAGA movement," saw its price rapidly climb after its debut on Huobi HTX, briefly ranking among the top six cryptocurrencies by market capitalization globally. Huobi HTX employed multi-dimensional operational strategies such as registration incentives, trading rewards, and community interactions to help TRUMP accumulate high popularity in a short time, attracting a large number of new users to register. Similarly, ASTER also achieved dual growth in user scale and trading activity with the support of Huobi HTX, becoming a star asset of the quarter.

This model has created a virtuous flywheel between the "platform-project-user": quality new coins activate user enthusiasm, user activity feeds back into project value, and project popularity in turn boosts the overall trading volume and traffic growth of the platform. It can be said that Huobi HTX's new coin preferred platform not only continuously injects fresh blood into the industry in a low liquidity, high competition market but also builds a sustainable value growth mechanism for investors and the platform.

"Buy new coins, go to Huobi." This slogan is no longer just a marketing phrase; Huobi HTX is becoming the consensus entry point for crypto users, a platform that can capture early potential assets ahead of others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。