In the previous cycle, Sonic (formerly Fantom) public chain founder Andre Cronje was known as the "King of DeFi."

Now, this former king has returned, bringing a new financing paradigm to the crypto market.

In the current extremely cautious market environment, Flying Tulip completed approximately $200 million in seed round financing last month and plans to raise another $800 million through public offerings, expanding the total fundraising scale to a $1 billion valuation.

How is this possible?

AC's latest project—Flying Tulip—is positioned as a "full-stack on-chain financial market," aiming to integrate functions such as spot trading, lending, and perpetual contracts through a unified risk and pricing model. Technically, it emphasizes a hybrid AMM (Automated Market Maker) + order book, volatility-adjusted lending, and cross-chain support.

More straightforwardly, its goal is to reuse "the same unit of collateral" across different functions to enhance capital efficiency.

The most innovative aspect of the project is that its financing mechanism is reversible, meaning "non-consumable financing," which mainly includes:

- On-chain redemption rights: The financing structure of Flying Tulip includes an "on-chain redemption right" (where investors can redeem their original investment by destroying tokens under certain conditions). All private and public investors have a redemption right that can be exercised at any time (similar to a perpetual put option), allowing them to redeem at the original investment amount, achieving an asymmetric return structure of "limited downside, potential upside."

- Redemption mechanism: Executed through audited smart contracts, with rate limits and a queuing system to ensure solvency.

- Fund deployment: The raised funds will not be directly spent but will be invested in protocols like Aave, Ethena, and Spark to obtain approximately 4% annualized returns.

- Cash flow arrangement: Part of the funds will be invested in low-risk DeFi strategies or structured products, using the returns to cover operating expenses and redemption needs.

- Risk isolation: Redemption reserves are separated from operating funds to ensure safety.

This model allows the financing funds themselves to remain intact, using returns to support operations, achieving "sustaining the project with returns rather than principal."

In terms of incentives, the FT team's incentive model innovatively references the practices of leading decentralized trading platform hyperliquid and proposes incentive methods and buyback mechanisms based on this:

- Zero initial allocation: The team does not receive an initial token allocation and instead earns returns through public market buybacks funded by protocol revenue.

- Income linkage: Team earnings are entirely dependent on the actual use and long-term performance of the protocol.

- Continuous buybacks: All sources of income (trading fees, lending spreads, stablecoin earnings, etc.) are used for buybacks and token destruction.

- Public transparency: The buyback plan will have a clear timetable to avoid the opaque token releases common in traditional projects.

- Fixed supply and deflationary mechanism: FT has a total cap of 10 billion tokens, with 10 tokens corresponding to every $1 of collateral, ensuring no inflation and continuously increasing token scarcity and holder value through a deflationary mechanism.

The essence of this financing is that investors purchase a long-term put option that can redeem the principal at any time, while the project side supports operations with low-risk DeFi returns.

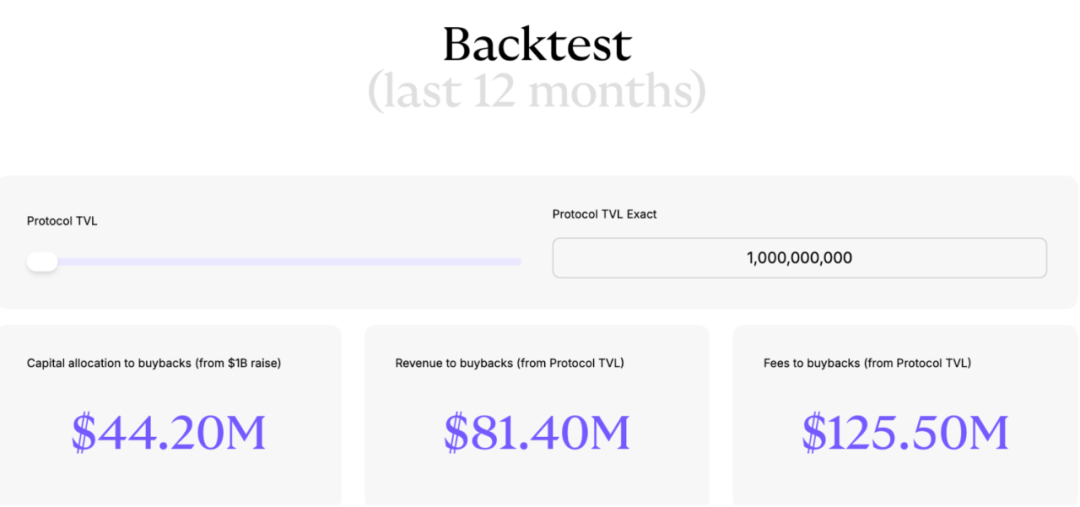

In other words, in this investment, investors can exchange their tokens back for the original invested dollars (or equivalent stablecoins) at any time. The $200 million raised is locked into low-risk DeFi yield strategies (such as Aave, Ethena, Spark), generating approximately 4% annualized returns, which means that for every $1 billion raised, about $40 million can be generated annually to cover the project's operating expenses.

This allows the raised funds to serve as foundational capital, not consumed, and only the generated passive income is used to maintain project operations. The sustainability of the project requires revenue generated from the platform to achieve long-term self-sufficiency.

For investors, participating in the financing incurs the opportunity cost of using funds. This model is the key innovation that distinguishes the project from traditional financing methods. It allows investors to only bear opportunity costs; however, in a bull market, this form, which may develop slowly in the early stages, could lead to some funds being redeemed in pursuit of higher returns.

Currently announced or rumored institutional investors include: Brevan Howard Digital, CoinFund, DWF Labs, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, and others.

For the project, this method establishes a sustainable funding pool and stable cash flow. In the future, if other projects wish to attract institutional funds, they may also need to provide similar principal protection and income linkage mechanisms, binding team earnings to platform usage to avoid early sell-offs. This will drive the industry towards financing models of "income buybacks" and "performance alignment."

Regardless, the interests of original investors typically take precedence over those of secondary market buyers and the team, which is emphasized in the mechanism design. This model has the potential to reshape the financing standards of the crypto primary market, providing investors with stronger safety margins and sustainability.

Indeed, the success of the project ultimately depends on whether its core product can stand out in fierce market competition. Even if this requires time to verify, we still look forward to it generating a positive flywheel. This model may be setting a new, higher starting point for subsequent startups.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。