Some crypto funds have outperformed Bitcoin during bull markets through leverage or early positioning, providing risk hedging and diversification opportunities; however, their long-term performance has been mixed.

Written by: PANews, Zen

Recently, Akshat Vaidya, co-founder and investment director of Arthur Hayes' family office Maelstrom, publicly disclosed a dismal investment performance on X, sparking widespread discussion in the crypto community.

Vaidya stated that he invested $100,000 in an early token fund from Pantera Capital (Pantera Early-Stage Token Fund LP) four years ago, and now only $56,000 remains, nearly losing half of his principal.

In comparison, Vaidya pointed out that during the same period, the price of Bitcoin approximately doubled, while many seed-stage crypto projects saw returns soar by 20–75 times. Vaidya lamented, "While the specific year of market entry is important, losing 50% in any cycle is considered the worst performance." This sharp critique directly questioned the fund's performance, igniting heated debates in the industry regarding the performance and fee structures of large crypto funds.

The "3/30" Fee Structure During Market Boom

Vaidya specifically mentioned and criticized the "3/30" fee structure, which refers to a 3% management fee charged annually and a 30% performance fee on investment returns. This is significantly higher than the traditional "2/20" model commonly seen in hedge funds and venture capital funds, which consists of a 2% management fee and a 20% performance fee.

During the peak of the crypto market frenzy, some well-known institutional funds charged investors fees above traditional standards, such as 2.5% or 3% management fees and 25% or even 30% on excess returns. Pantera, which Vaidya criticized, is a typical example of high fees.

As the market has evolved, the fee structures of crypto funds have also gradually changed in recent years. After experiencing the ups and downs of market cycles, and under pressure from LPs and fundraising difficulties, crypto funds are generally shifting towards lower fee structures. Recently launched crypto funds have begun to make concessions on fees, such as reducing management fees to 1-1.5% or only charging higher performance fees on excess returns, attempting to align more closely with investor interests.

Currently, cryptocurrency hedge funds typically adopt the classic "2% management fee and 20% performance fee" structure, but funding allocation pressures have led to a decrease in average fees. Data from Crypto Insights Group shows that current management fees are close to 1.5%, while performance fees tend to range from 15% to 17.5%, depending on strategy and liquidity conditions.

Challenges in Scaling Crypto Funds

Vaidya's post also sparked discussions about the scale of crypto funds. He bluntly stated that, with few exceptions, the returns of large cryptocurrency venture capital funds are generally poor and detrimental to limited partners. He mentioned that the purpose of his tweet was to remind and educate everyone with data that cryptocurrency venture capital cannot scale, even for well-known brands with top-tier investors.

Some support his view, arguing that the large fundraising scale of early crypto funds has become a performance drag. Leading institutions like Pantera, a16z Crypto, and Paradigm have raised billions of dollars for crypto funds in recent years, but efficiently deploying such large capital in the relatively early crypto market is quite challenging.

With limited project reserves, large funds are forced to invest in numerous startup projects in a "broad net" manner, resulting in low investment proportions for each project and a mix of quality, leading to excessive diversification that makes it difficult to achieve excess returns.

In contrast, smaller funds or family offices, due to their moderate capital size, can more rigorously select projects and concentrate their bets on high-quality investment targets. Supporters argue that this "small but refined" strategy is more likely to achieve market-beating performance. Vaidya himself also expressed agreement in the comments, stating that "the problem is not with early tokens, but with fund size," and that "an ideal early-stage crypto fund must be small and flexible."

However, there are differing opinions that question this radical assertion. The argument is that while large funds may face diminishing marginal returns when chasing early projects, their value in the industry should not be entirely negated by a single poor investment performance. Large crypto funds often possess abundant resources, professional teams, and extensive industry networks, enabling them to provide value-added services post-investment and promote the development of the entire ecosystem, which is difficult for individual investors or small funds to match.

Additionally, large funds are typically able to participate in larger financing rounds or infrastructure projects, providing the deep capital support needed for the industry. For instance, projects like public chains and trading platforms that require hundreds of millions in financing rely on the participation of large crypto funds. Therefore, there is a rationale for the existence of large funds, but they should manage the alignment of fund size with market opportunities to avoid excessive expansion.

It is worth mentioning that in this controversy, some commentators believe Vaidya's public criticism of peers carries a "marketing" implication—being the head of Arthur Hayes' family office, he is also formulating differentiated strategies and raising funds for his own fund—Maelstrom is preparing a new fund exceeding $250 million, aimed at acquiring mid-sized crypto infrastructure and data companies.

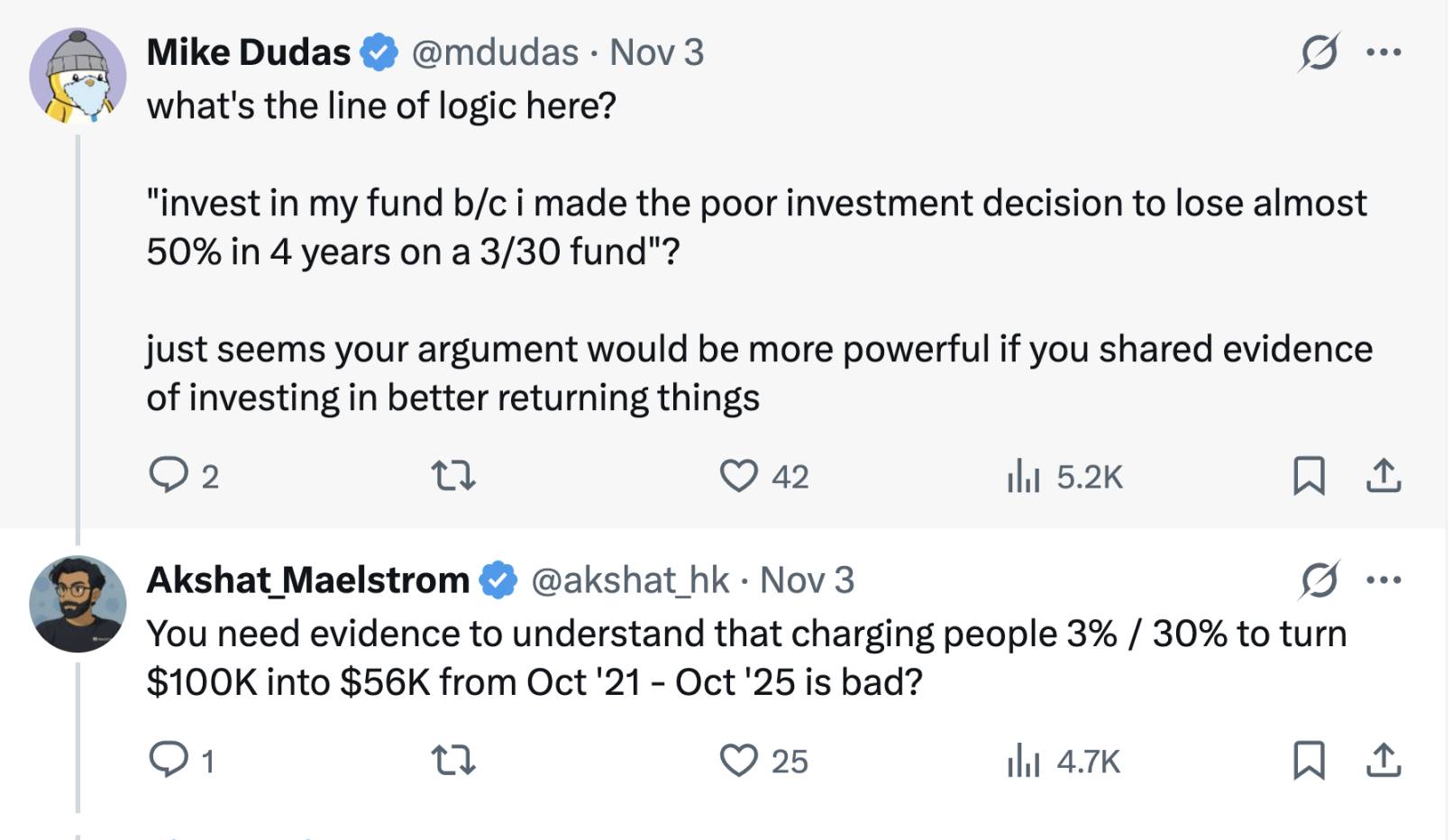

Thus, Vaidya may be using criticism of competitors to highlight Maelstrom's differentiated positioning focused on value investing and cash flow. Mike Dudas, co-founder of 6th Man Ventures, stated that if he wanted to promote the performance of his family office's new fund, he should let the results speak for themselves rather than drawing attention through attacks on others.

"Any strategy is inferior to just buying BTC"

Vaidya compared fund returns with a simple buy-and-hold strategy for Bitcoin, leading to a long-standing question: for investors, is it better to hand money over to a crypto fund or just buy Bitcoin directly?

This question may have different answers at different times.

During earlier bull market cycles, some top crypto funds significantly outperformed Bitcoin. For example, during the market booms of 2017 and 2020–2021, astute fund managers achieved returns far exceeding Bitcoin's gains by positioning themselves early in emerging projects or using leverage strategies.

Excellent funds can also provide professional risk management and downside protection: during bear markets, when Bitcoin's price plummeted or fell deeper, certain hedge funds successfully avoided massive losses and even achieved positive returns through shorting and quantitative hedging strategies, thereby relatively reducing volatility risk.

Furthermore, for many institutional and high-net-worth investors, crypto funds offer diversified exposure and professional channels. Funds can engage in areas that are difficult for individual investors to access, such as private round token projects, early equity investments, and DeFi yields. The seed projects that Vaidya mentioned, which surged 20–75 times, would be challenging for individual investors to participate in at early valuations without the channels and professional judgment of funds—provided that fund managers indeed possess exceptional project selection capabilities and execution.

From a long-term perspective, the rapidly changing crypto market presents applicable scenarios for both professional investment and passive holding.

For practitioners and investors in the crypto field, the controversy surrounding the Pantera fund provides an opportunity—to rationally assess and choose investment methods that suit their strategies in the fluctuating crypto market, maximizing wealth appreciation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。