Author: Azuma, Odaily Planet Daily

The recent occurrence of two major security incidents (Balancer, Stream Finance) has once again brought the issue of DeFi security to the forefront, especially the Stream Finance incident, which has exposed the significant potential risks associated with the role of Curator, which has become crucial in the DeFi market.

The so-called Curator primarily exists within DeFi lending protocols (such as Euler and Morpho, which were affected by the Stream incident). It generally refers to individuals or teams responsible for designing, deploying, and managing specific "strategic funds pools (vaults)." Curators typically package relatively complex yield strategies into user-friendly funds pools, allowing ordinary users to "deposit with one click to earn interest," while the Curator decides the specific yield strategies for the assets on the backend, such as allocation weights, risk management, rebalancing cycles, withdrawal rules, and so on.

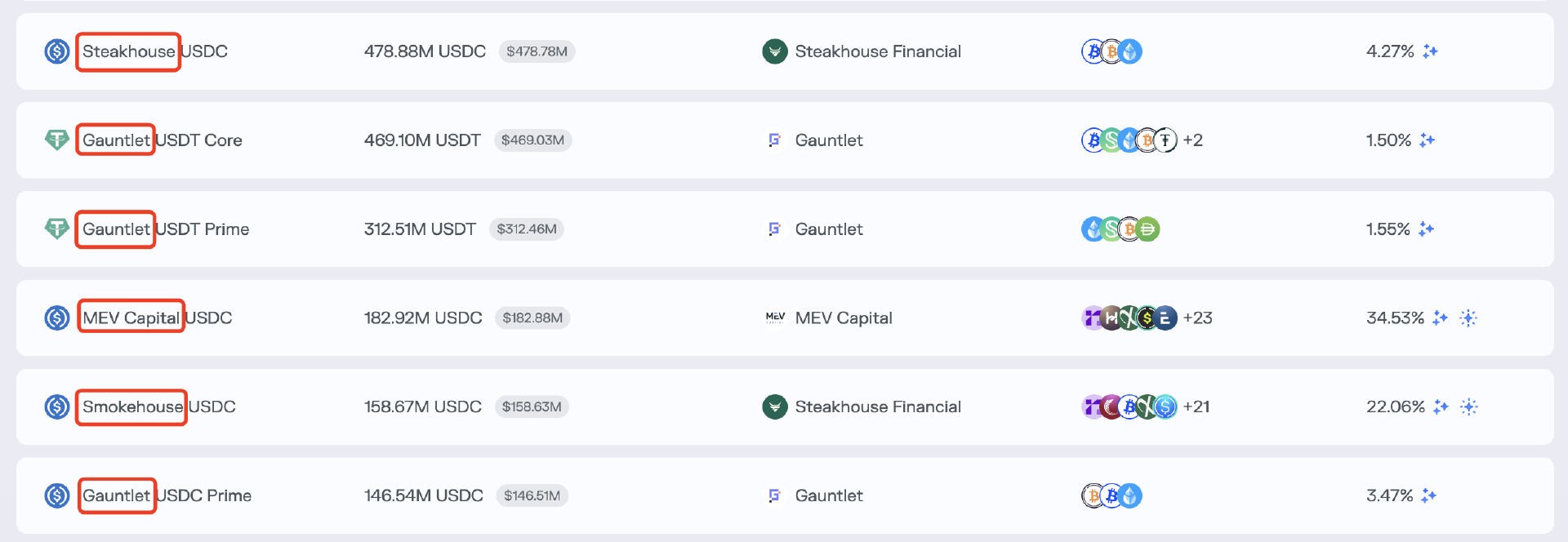

Odaily Note: The image above shows the Curator funds pool on Morpho, with the names of Curator entities such as Steakhouse and Gauntlet highlighted in red, representing the entities responsible for designing, deploying, and managing the funds pool.

Unlike traditional centralized financial services, Curators cannot directly access or control user funds. The assets deposited by users in the lending protocol will always be stored in non-custodial smart contracts, and the Curator's authority is limited to configuring and executing strategy operations through contract interfaces, with all operations subject to the security constraints of the contract.

Market Demand for Curators

The original intention of Curators was to leverage their expertise in strategy management and risk control to bridge the supply-demand mismatch in the market—on one hand, helping ordinary users who struggle to keep up with the increasingly complex DeFi landscape to amplify their yields; on the other hand, assisting lending protocols in expanding their TVL while reducing the probability of systemic events.

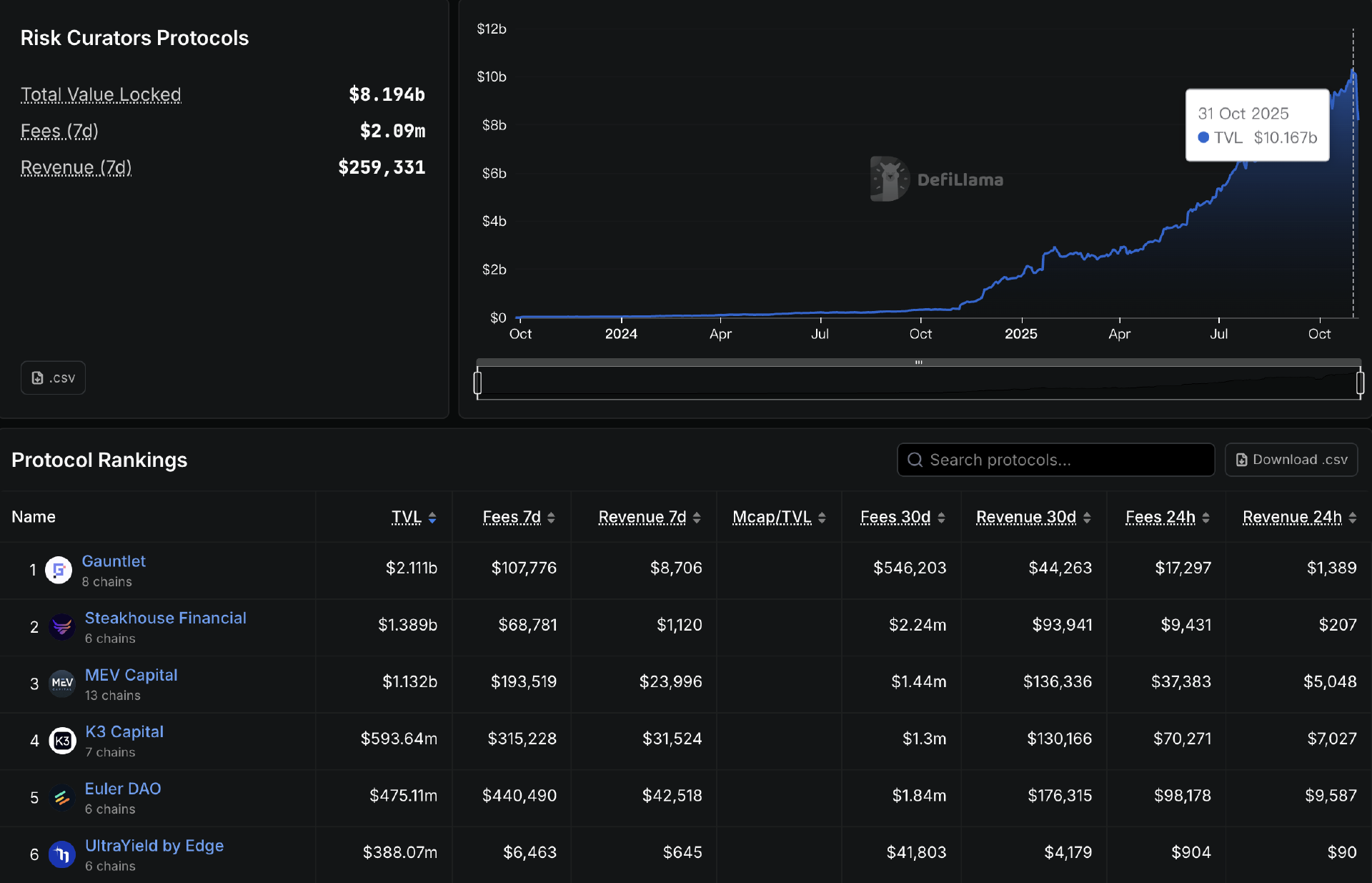

Since the funds pools managed by Curators often provide more attractive yields than classic lending markets (like Aave), this model naturally attracts capital. Data from Defillama shows that the total scale of funds pools managed by Curators has rapidly increased over the past year, surpassing $10 billion on October 31, and as of the time of writing, it still reports at $8.19 billion.

In the fierce competition, Gauntlet, Steakhouse, MEV Capital, and K3 Capital have gradually become the largest Curators managing substantial amounts of capital, each managing funds in the hundreds of millions. Meanwhile, lending protocols like Euler and Morpho, which focus on the Curator funds pool model, have also achieved rapid growth in TVL, successfully positioning themselves in the market.

Curator's Profit Model

At this point, the role of Curators seems clear, and there is sufficient market demand. So why does this pose a potential risk threatening the DeFi world?

Before analyzing the risks, we need to understand the profit logic behind the Curator business. Curators primarily profit through the following methods:

- Performance sharing: After the strategy earns returns, Curators share a certain percentage of the net profits;

- Asset management fees: Charged based on the total asset size of the funds pool at a certain annualized rate;

- Protocol incentives and subsidies: Lending protocols generally issue token incentives to Curators to encourage them to create new high-quality strategies;

- Brand-derived income: For example, Curators can launch their own products or even tokens after establishing their brand.

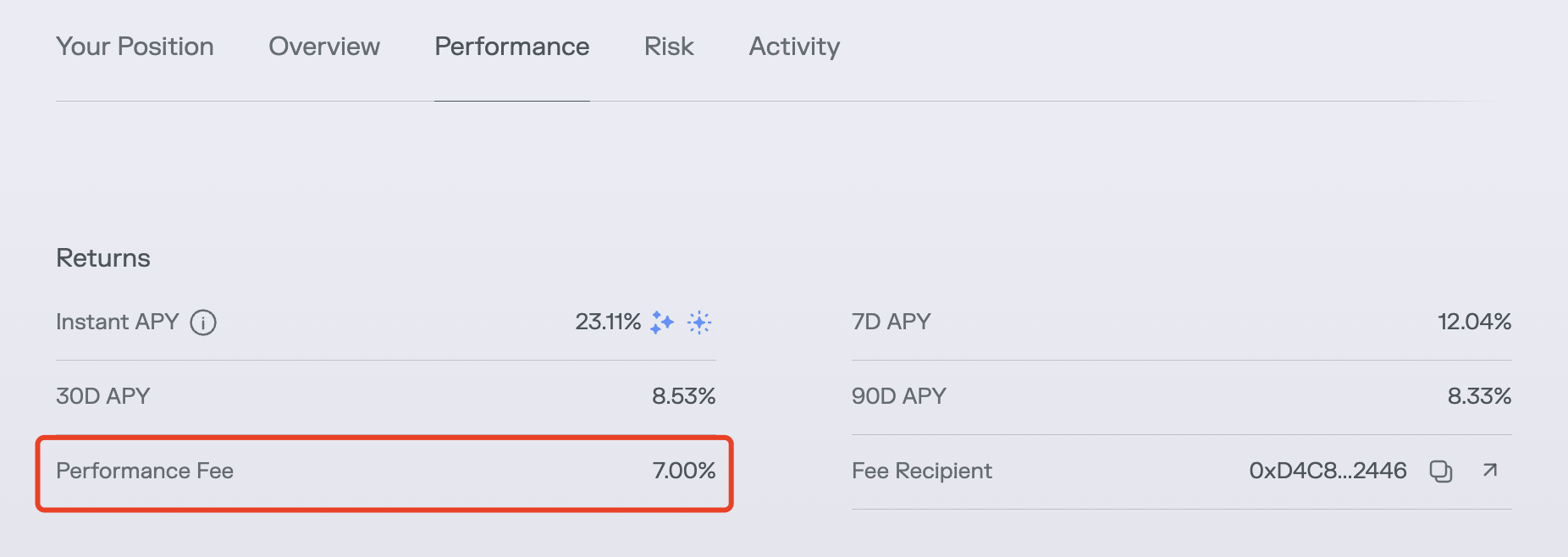

In reality, performance sharing is the most common source of income for Curators. As shown in the image below, the USDC funds pool on the Ethereum mainnet managed by MEV Capital charges a 7% performance fee.

This profit model determines that the larger the scale of the funds pool managed by the Curator and the higher the strategy yield, the greater the Curator's profit will be—of course, theoretically, Curators could also increase their share percentage to boost income, but in a relatively competitive market, no Curator dares to arbitrarily take from users.

At the same time, since most deposit users are not sensitive to the brand differences among Curators, the choice of which pool to deposit into often depends solely on the apparent APY figures. This means that the attractiveness of the funds pool is directly linked to the strategy yield, making the strategy yield the core factor determining the Curator's income status.

Risks Gradually Ignored Under Yield Pressure

Sensitive readers may have already realized that a problem is emerging. In a yield-driven model, Curators must continuously seek higher-yield "opportunities" to achieve greater profits, and yield is often positively correlated with risk. This leads some Curators to gradually blur the safety issues that should be prioritized, choosing to take risks—"after all, the principal is the user's, and the profit is mine."

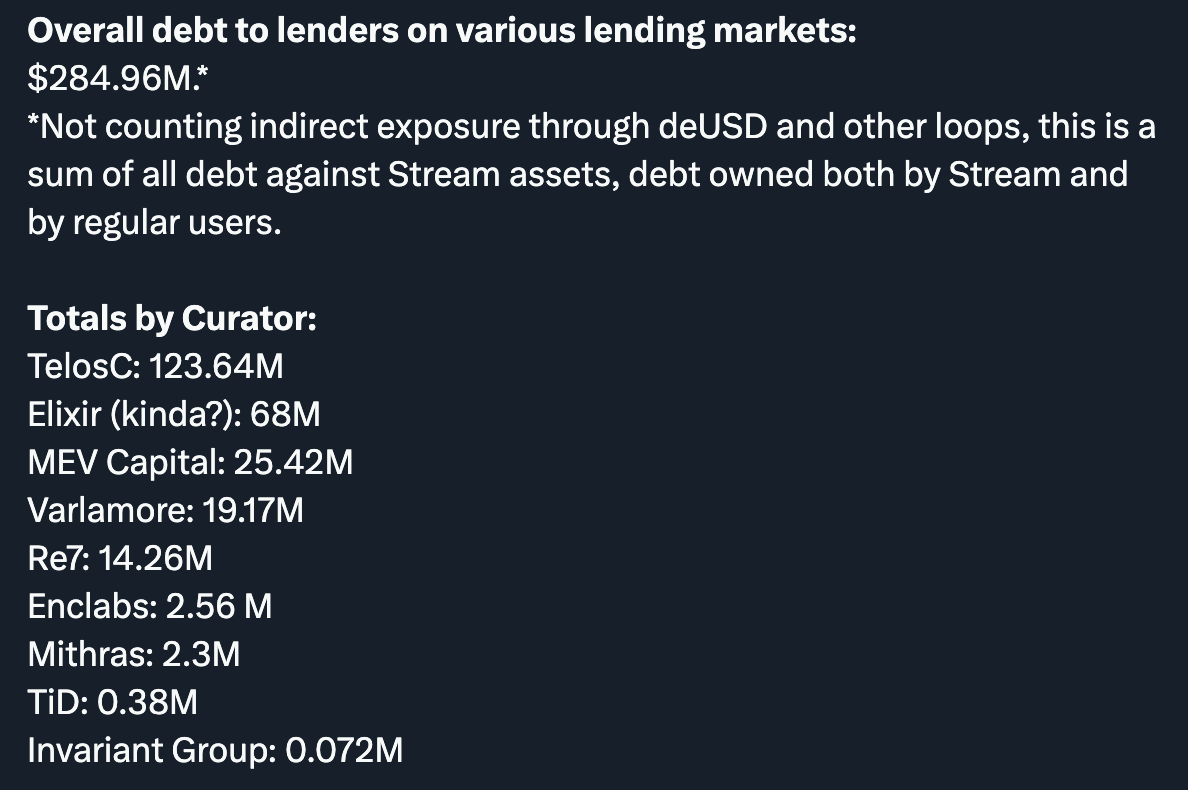

Taking Stream Finance as an example, a key reason for the large-scale impact was that some Curators on Euler and Morpho (including well-known brands like MEV Capital and Re7) ignored risks and allocated funds to the Stream Finance xUSD market, directly affecting users who deposited into the related Curator funds pools, which in turn led to bad debts in the lending protocol itself, indirectly expanding the impact.

Odaily Note: The image shows the organization of various Curator-related debt positions in the Stream Finance incident by the DeFi community YAM.

Moreover, just days before the Stream Finance incident, several KOLs and institutions, including CBB (@Cbb0fe), had already warned about the potential transparency and leverage risks of xUSD, but these Curators clearly chose to ignore them.

Of course, not all Curators were affected by Stream Finance; major Curators like Gauntlet, Steakhouse, and K3 Capital never deployed funds to xUSD, which also indicates that professional entities like Curators can identify and avoid potential risks when effectively fulfilling their safety responsibilities.

Will Curators Trigger Greater Risks?

After the Stream Finance incident, the potential risks associated with Curators have drawn more attention.

Chorus One investment analyst Adrian Chow directly compared Curators and their related lending protocols to Celsius and BlockFi during this cycle in a post on X. Indeed, from a data perspective, the total value of Curator funds pools exceeding $8 billion has an impact scale comparable to the black swan events of the previous cycle, and the presence of Curators across mainstream lending protocols means that the scope of influence cannot be ignored.

So, will Curators trigger larger-scale risk incidents in this cycle? This is a difficult question to answer. From the original intention of Curators, their role should be to reduce the individual risks of ordinary users through their specialized management capabilities, but their business model and profit path make it easy for Curators to become entry points for concentrated risks. For example, if multiple lending protocols in the market rely on a few Curators, any unexpected deviation in their models (such as oracle price errors) could lead to simultaneous misadjustments of all parameters, thereby affecting multiple funds pools at once.

Additionally, it is worth mentioning that in the current market environment, many users depositing in lending protocols are not even aware of the role or existence of Curators, simply believing they are investing in a well-known lending protocol to earn interest. This leads to the role and responsibility of Curators being obscured, and when incidents occur, it is the lending protocols that must directly face user anger and accountability, further pushing some Curators to pursue profits too aggressively.

Arthur, the founder of DeFiance Capital, also discussed this phenomenon yesterday: "This is why I have always been skeptical of the Curator-based DeFi lending model. Lending platforms bear the reputational risk and responsibility to care for users, and whether they like it or not, a few poorly managed and non-compliant Curators will also impact the platform."

I personally do not believe that leveraging Curators to operate funds pools is a failed business model, and I still have funds in some Curator funds pools (currently only remaining in Steakhouse), but I also agree that the aggressive tendencies of some Curators may brew broader risks. The deeper reason for this situation lies in the inadequacies of the user base and some Curators in risk control, and due to the profit-driven motives mentioned earlier, the latter may have certain subjective factors.

While we always call for users to evaluate protocols, funds pools, and strategy configurations on their own, this is clearly difficult to achieve, as most users lack the time, expertise, or willingness to do so. In this context, most users unconsciously invest their funds into Curator funds pools with generally higher yields, driving the rapid growth of the capital managed by Curators. Conversely, some Curators are also adept at leveraging this situation to attract more funds, using more aggressive strategies to increase the yield of the funds pools, and then attracting more capital inflow through higher yields.

How to Improve the Current Situation?

Growth always requires going through growing pains. Although the Stream Finance incident has dealt another blow to the DeFi market, it may serve as an opportunity for users to enhance their understanding of Curators and for the market to improve constraints on Curator behavior.

From the user's perspective, we still recommend that users conduct their own research as much as possible. Before investing funds into a specific Curator funds pool, they should pay attention to the reputation of the Curator entity and the design of the related funds pool. Research considerations include, but are not limited to:

- Is there a publicly available risk model or stress test report?

- Are the permission boundaries transparent? Are they subject to multi-signature or governance restrictions?

- What is the historical drawdown frequency of past strategies, and how did they perform in extreme market conditions?

- Has there been a third-party audit?

- Is the incentive mechanism aligned with user interests?

Most importantly, users need to realize that risk is always positively correlated with yield. Before making investment allocation decisions, they should mentally prepare for the worst-case scenarios—always keep in mind the words of Bitwise Chief Investment Officer Matt Hougan: "The vast majority of cryptocurrency crashes occur because investors mistakenly believed in double-digit risk-free yields, when in fact there are no risk-free double-digit yields in the market."

As for Curators, they need to enhance both their risk self-discipline awareness and risk management capabilities. The DeFi research institution Tanken Capital has summarized the basic requirements for an excellent Curator in terms of risk control, which include:

- Awareness of compliance in traditional finance;

- Risk management and yield optimization of investment portfolios;

- Understanding of new tokens and DeFi mechanisms;

- Knowledge of oracles and smart contracts;

- Ability to monitor the market and perform intelligent reconfiguration.

As for the lending protocols directly associated with Curators, they should continuously optimize constraints on Curators by requiring them to publicly disclose strategy models, independently verify model data, introduce staking penalty mechanisms to maintain accountability for Curators, and regularly assess Curator performance to decide whether to replace them. Only through ongoing proactive monitoring can the risk space be minimized, effectively avoiding systemic risk resonance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。