On November 4, 2025, at 20:00 (UTC+8), Momentum (MMT) officially launched on trading platforms such as Binance and OKX. Many investors viewed it as another strong and popular "AI+DeFi" narrative, but the market was soon pierced by harsh reality.

Less than 24 hours after its launch, the market was in turmoil, with liquidation data hitting new highs. Many traders who initially hoped to seize the opportunity of capturing a "new cycle star token" unexpectedly became victims of a meticulously planned initial harvest.

Twitter KOL Bitcoin Sub-Chess (@cloakmk) wrote during a review: "I hardly ever review project manipulation techniques, but this time I really couldn't stand it. Several of my brothers got liquidated, and I couldn't sleep all night! This MMT is a distinct Chinese project with Chinese manipulation techniques… it can be called a textbook example."

This analysis reveals the intense pace of manipulation and the ferocity of the psychological warfare involved.

The following text is based on @cloakmk's organization and review, combined with real market data from November 4 to 5, systematically breaking down the causes and consequences of this event.

01 The Precise Layout of the Initial Phase

Before the project officially launched, the manipulators had already set the stage. Through a carefully designed "chip withdrawal mechanism," they successfully attracted key opinion leaders: first allowing KOLs to invest funds to obtain quotas, then returning the principal, creating the illusion of "free quota acquisition."

This strategy had an immediate effect: KOLs actively promoted the project, bringing in huge traffic, while retail investors, caught in information asymmetry, entered the market in confusion.

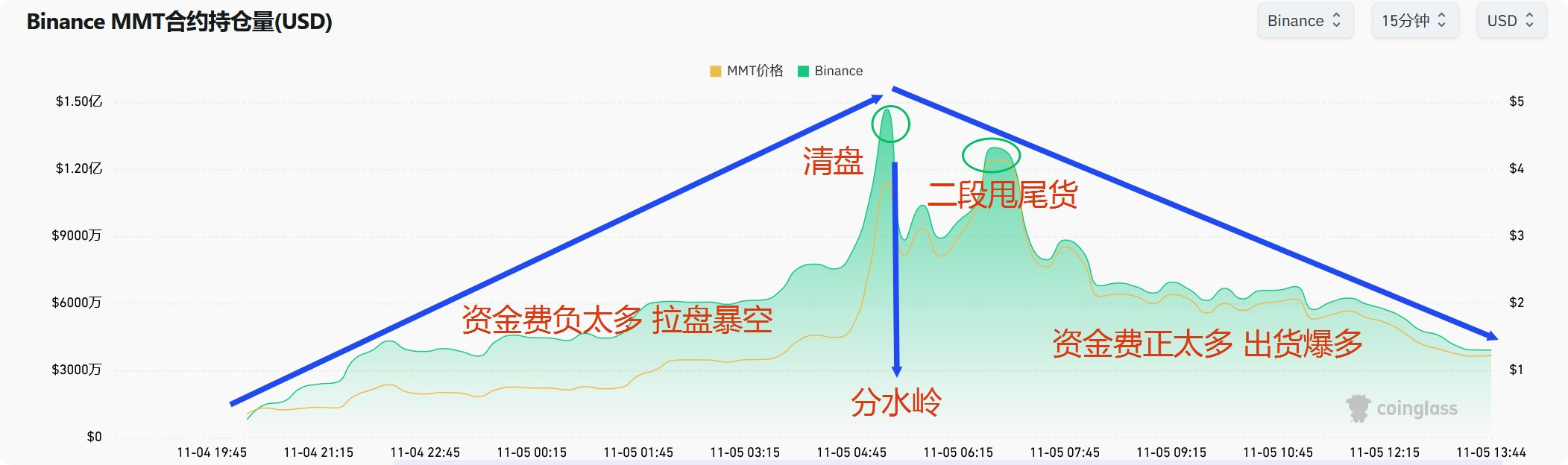

The manipulation at the opening moment was even more precise and ruthless. The spot price was maintained at around $0.40, while the contract price was suppressed to $0.28, creating a significant discount. This obvious price difference induced the market to form a misjudgment, leading to a massive build-up of short positions, and the funding rate skyrocketed. The "low open high rise" strategy successfully completed the first precise cut.

02 The Aggressive Mid-Game Tactics

The first wave of attack employed a cycle of pumping and short squeezing. Through the positive cycle formed by short squeezes and pumps, the contract open interest continued to rise, allowing the manipulators to establish long positions at the bottom, achieving a perfect start of "one fish, multiple eats."

The second wave of attack shifted to psychological warfare. The manipulators released misleading information stating "0.7-0.8 USD hedging, will not break 1 USD," using KOLs as secondary dissemination nodes to amplify market influence. This scene once again confirmed the market's iron law that "free is always the most expensive."

The third wave of attack was a killer move. The price suddenly shifted from a gentle rise to a rapid breakout, soaring to the peak within five minutes, causing shorts to be completely liquidated and unable to exit in time. Meanwhile, the manipulators successfully distributed their long positions. By this point, the market's short sentiment had been completely exhausted.

03 The Cruel Harvesting Phase

The first step of the harvest was a rapid decline. After the short squeeze, the price fluctuated violently, dropping by as much as 70%. This rapid decline made it impossible for longs to take profits in time, and the market instantly fell into a panic sell-off.

The second step of the harvest employed a classic false breakout strategy. By briefly lifting the price to wash out new shorts while attracting "revenge longs," the manipulators took the opportunity to establish short positions.

Subsequently, a one-sided downtrend officially began, never to return. The manipulators gradually closed their short positions during the decline, and the market fell into a deathly silence and despair.

The final outcome is lamentable: the manipulators achieved comprehensive profits, while most traders suffered heavy losses.

04 In-Depth Analysis of Manipulation Techniques

From the illusion of free quotas before the launch, to the low open and absolute control at the opening, followed by the three-stage short squeeze during the pump, and finally the rapid kill combined with baiting longs before the crash, the entire operation process was intricately linked, a perfect execution.

After the market ended, three major characteristics emerged: an absolute high control state persisted, the tokens had not yet been fully released, and the market fell into a spontaneous long-short game. At this point, the manipulators may have already been celebrating.

As @cloakmk sharply pointed out: "I will have the young models, you will live or die."

05 Profound Insights into Market Nature

This grand performance has made it clear to us: delayed token issuance means mastering absolute control, low open high rise is systematic baiting, concentrated traffic leads to precise target accumulation, short squeezes and pumps complete leveraged strangulation, while rapid kills combined with baiting longs before crashing constitute a cruel cycle of mutual destruction.

This is not just a simple market operation, but a typical combination of liquidity warfare and psychological tactics.

In the global liquidity tightening cycle, we need to remain clear-headed: the "new cycle dream" depicted by highly controlled projects often hides the greatest risks. The purpose of this review is not merely to complain, but to enhance our market immunity.

Remember: do not treat the game as an opportunity, and do not regard promotion as proof.

Respect the market, keep learning. Every candlestick in the crypto world reflects the eternal struggle between human nature and capital.

May we not become prey next time.

Original text: https://x.com/cloakmk/status/1985960712846655658

For more content, feel free to join our community and discuss together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。