Regardless of whether ZEC's price strength can be sustained, this market rotation has successfully forced the market to reassess the value of privacy.

Written by: Will Owens

Translated by: AididiaoJP, Foresght News

The term "cryptocurrency" literally means "hidden" or "secret" currency. However, for most of its development history, privacy issues have long been overlooked by the industry. Only recently has the situation begun to change.

In the past few weeks, the narrative around privacy has once again taken center stage. As one of the oldest and most well-known privacy coins, Zcash (ZEC) has surged over 700% since September, as if overnight, everyone in the circle has become a privacy expert. However, some prominent figures in the Bitcoin space have criticized this surge as "artificially manipulated," warning buyers that they will ultimately become "bag holders." Economist Lyn Alden has cautioned investors not to fall into the trap of "joint pumping."

But investor Naval Ravikant quickly countered, providing a fundamental reason for Zcash: "Transparent cryptocurrencies cannot survive under the government's harsh crackdown."

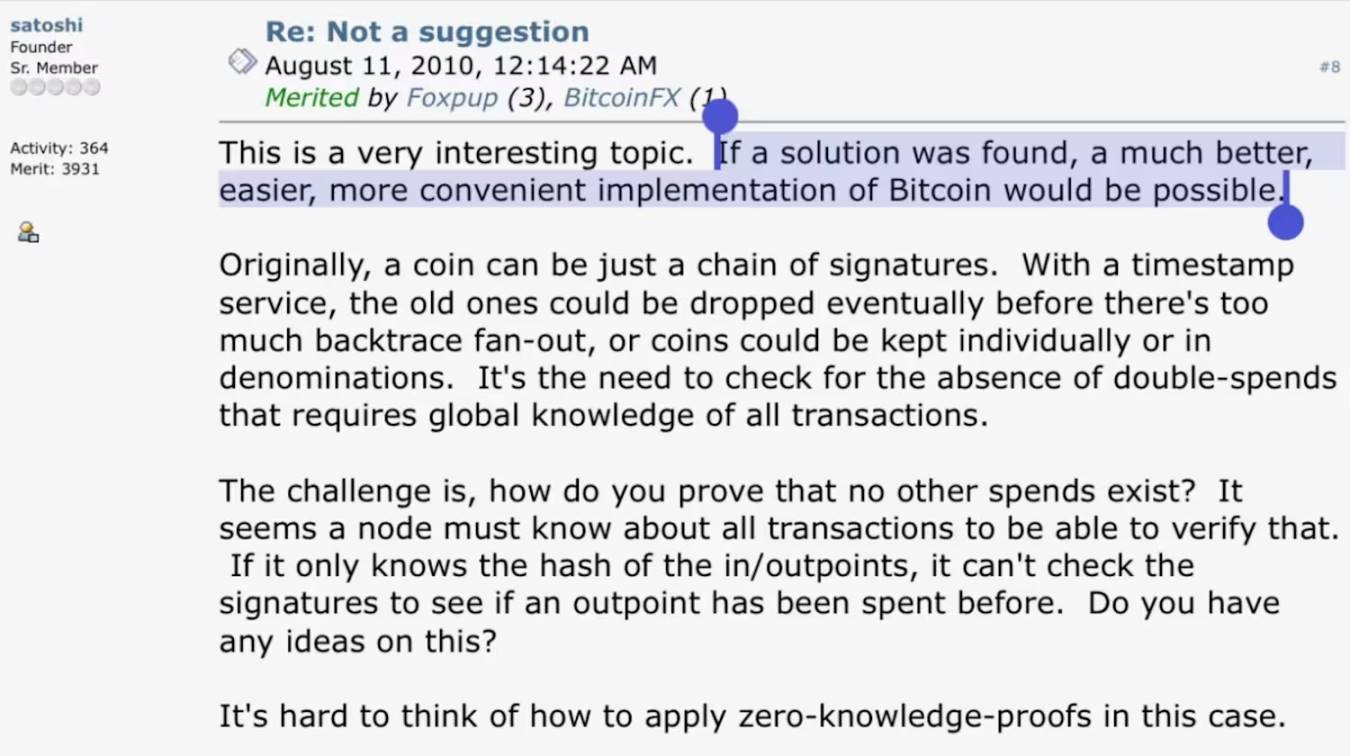

Let’s not forget that Bitcoin's anonymous creator, Satoshi Nakamoto, acknowledged the limitations of Bitcoin's privacy in the white paper back in 2008.

While CoinJoin services like Samourai and Wasabi were once popular on Bitcoin, they now face increasing regulatory pressure. Samourai has effectively shut down due to the arrest of its founder, and Wasabi will stop its CoinJoin functionality and block U.S. users in June 2024 due to regulatory concerns.

Payjoin is a simple tool that can break the "multiple inputs belong to one person" inference and is gradually gaining attention, but it still requires interaction between users. The broader issue pointed out by Satoshi in the previous quote is the transparency of Bitcoin. As a fork of Bitcoin, Zcash allows users to use zero-knowledge proofs to shield transactions, directly addressing the privacy limitations mentioned by Satoshi.

Satoshi also acknowledged the privacy limitations of Bitcoin in forum posts.

Key Points

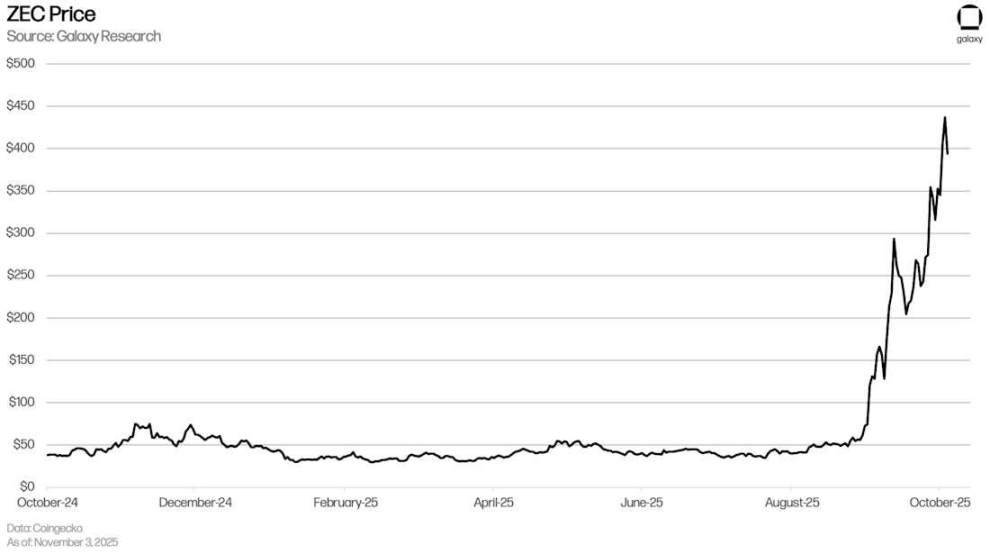

After years of dormancy, ZEC has surged about 8 times in the past month, far exceeding the broader market, forcing people to seriously discuss "privacy features."

This discussion has revived the early debates about "privacy rights" versus "regulatory realities" in Bitcoin.

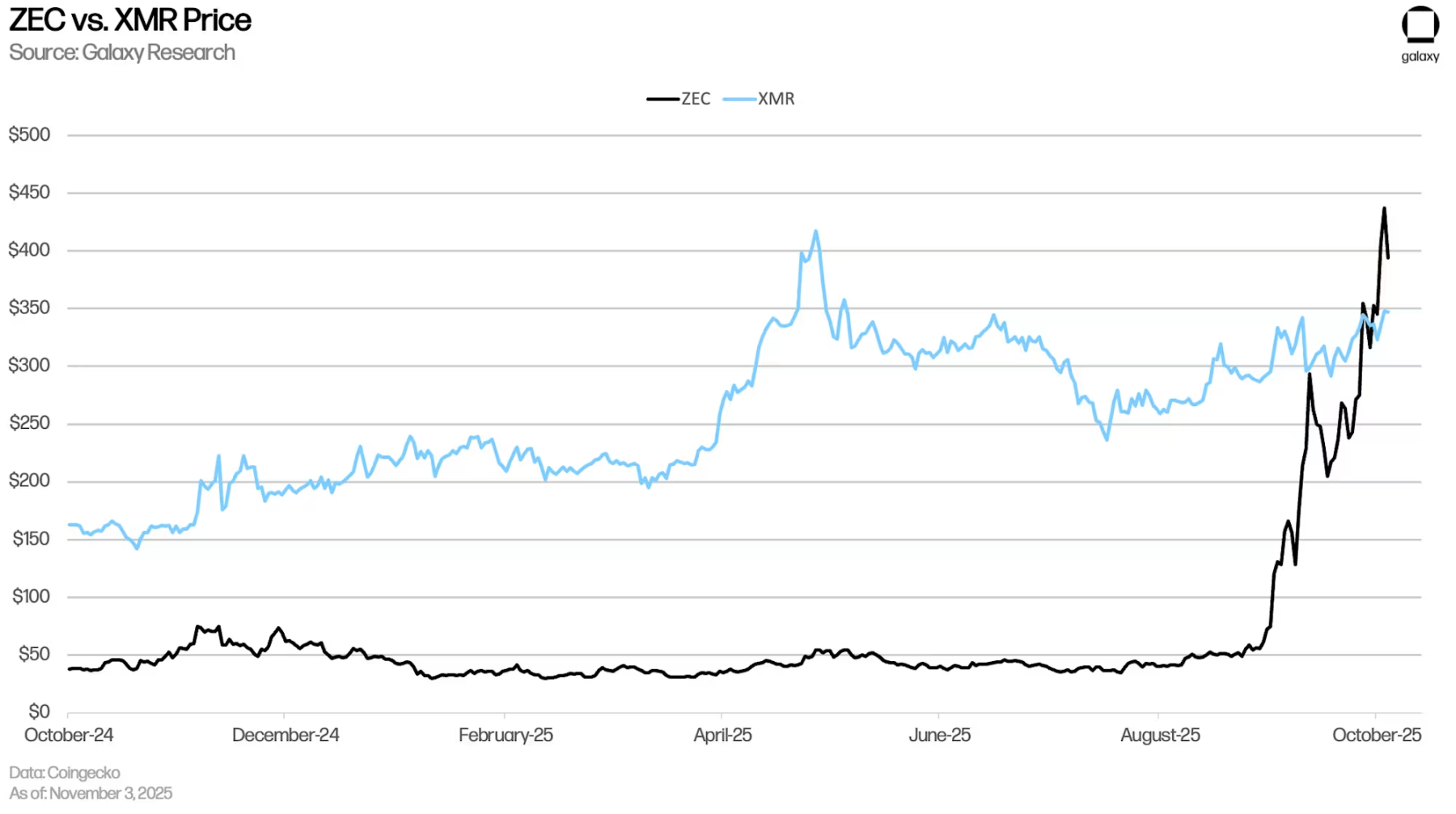

Zcash's market capitalization has surpassed that of Monero.

The user experience of Zcash has improved (e.g., Zashi wallet).

Cross-chain intent channels have lowered the operational threshold (NEAR Intents).

The anonymous pool is expanding.

For the first time, over 30% of the ZEC supply is stored in shielded pools.

However, compared to Bitcoin, the number of full nodes for Zcash remains very low.

Development History and Network Upgrades

Zcash originated from academic research in 2013, when cryptographers at Johns Hopkins University developed the Zerocoin protocol. To improve efficiency, the protocol later evolved into Zerocash and was ultimately launched in 2016 by cypherpunk Zooko Wilcox and his Electric Coin Company as a fork of Bitcoin. Its goal is simple: to retain the monetary characteristics of Bitcoin while fixing its most frequently mentioned design flaw (which Satoshi himself acknowledged): the lack of transaction privacy.

Unlike Bitcoin, where all transactions are publicly visible on-chain, Zcash uses a zero-knowledge proof technology called zk-SNARKs. This allows users to prove the validity of a transaction without revealing the sender, receiver, or amount. While Monero was launched earlier and employs techniques like ring signatures to protect privacy, Zcash is the first mainstream blockchain to implement zk-SNARKs at the protocol level.

Zcash adopts an on-chain funding model that allocates part of the block rewards to community-led projects rather than specific organizations. According to the ZIP 1016 proposal, 8% of the block rewards go to the Zcash Community Fund, while 12% is managed by a fund voted on by coin holders. The Electric Coin Company and the Zcash Foundation do not automatically receive a share; they must also apply for funding through these mechanisms.

Zcash has undergone several network upgrades:

Sapling (2018): Significantly improved the efficiency of shielded transactions.

Heartwood (2020): Introduced shielded miner rewards, allowing miners to receive block rewards privately.

Canopy (2020): Accompanied by the first halving, it completely reformed the funding model, replacing the original founder's reward with a four-year development fund managed jointly by ECC, the Zcash Foundation, and community grants.

NU5 / Orchard (2022): Marked the most important milestone since launch, replacing the complex trusted setup ceremony with Halo 2 recursive proofs and adding unified addresses to simplify privacy operations. The Orchard shielded pool was thus launched.

NU6 (2024): Implemented an on-chain funding vault to manage the treasury in a decentralized manner, enhancing the transparency of the development fund's usage.

Next, the protocol is preparing for the NU7 upgrade.

Market Performance and Current Status

For most of the time, ZEC has underperformed in the market, not only lagging behind BTC but also overshadowed by Monero. Monero provides basic privacy by default, but it relies on small bait anonymous sets, mixing real inputs with 15 decoys in its ring signature design. This moderate anonymous set has been successfully deanonymized in some studies.

Regulators often scrutinize Monero more closely because its privacy is enforced by default. In 2020, the U.S. IRS even hired companies like Chainalysis to study ways to track Monero transactions. In contrast, Zcash achieves optional privacy through zk-SNARKs, allowing for complete data encryption and providing a larger anonymous set when using shielded addresses.

This dual-mode design also makes it easier for users to make operational security mistakes (such as misusing transparent addresses), but as long as operations are conducted correctly, Zcash's cryptography can provide substantially stronger and mathematically more reliable privacy. Additionally, Zcash's privacy layer is quantum-resistant, while Monero's current ring signature scheme is not (its developers have acknowledged this issue and plan to fix it in future upgrades).

Now, just looking at ZEC's price trends tells a completely different story.

ZEC price trends over the past year.

(This section originally contained price chart descriptions: ZEC price over the past year; ZEC vs. XMR price comparison; ZEC/BTC exchange rate daily chart.)

Technical Details

Zcash follows Bitcoin's monetary model: a fixed supply of 21 million ZEC, proof-of-work consensus, and approximately halving every four years. It uses the Equihash algorithm, designed to be more resistant to ASIC centralization than Bitcoin's SHA-256. The block time is about 75 seconds, making it approximately 8 times faster than Bitcoin. Zcash halves approximately every four years, with the next expected in November 2028, when the block reward will drop to 0.78125 ZEC.

Zcash has two types of addresses:

Transparent addresses: Function similarly to Bitcoin, with balances and transfers publicly visible.

Shielded addresses: Use zk-SNARKs to hide the transaction parties and amounts while proving that no coins are created out of thin air.

When users transfer between shielded addresses, the network verifies cryptographic proofs rather than transaction details. This proof states: "I have the right to spend these coins, and the calculations are correct," but does not disclose any extraneous information. The core of privacy lies in sharing only the minimum information necessary to establish trust.

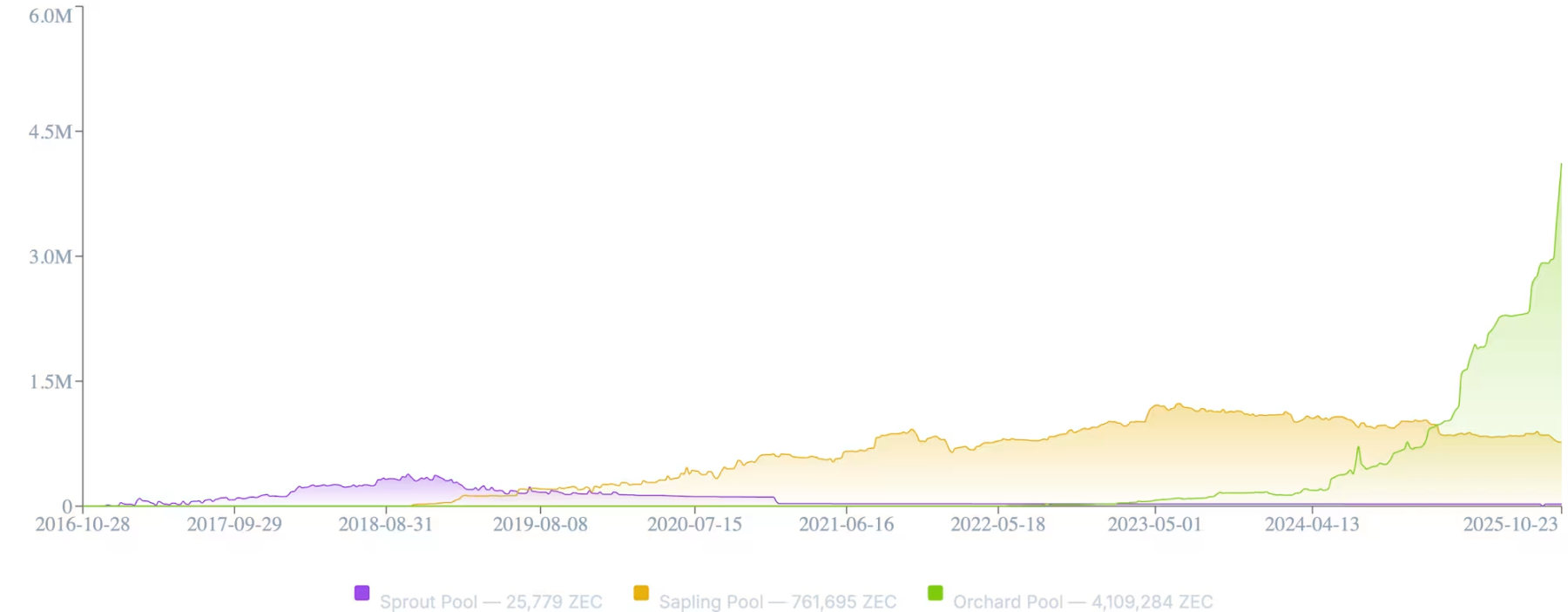

The larger the shielded pool, the harder it is to trace the flow of funds. This is why the recent breakthrough of the shielded pool size exceeding 30% of the total supply is so significant. The largest shielded pool is Orchard, launched on May 31, 2022, which replaced the old pool, adopted a Halo 2 proof system that does not require a trusted setup, and introduced unified addresses to simplify the user experience.

Currently, the Orchard shielded pool holds over 4 million ZEC (about 25% of the circulating supply), making up the vast majority of the approximately 4.9 million shielded ZEC in total.

(This section originally contained a chart description of shielded supply growth.)

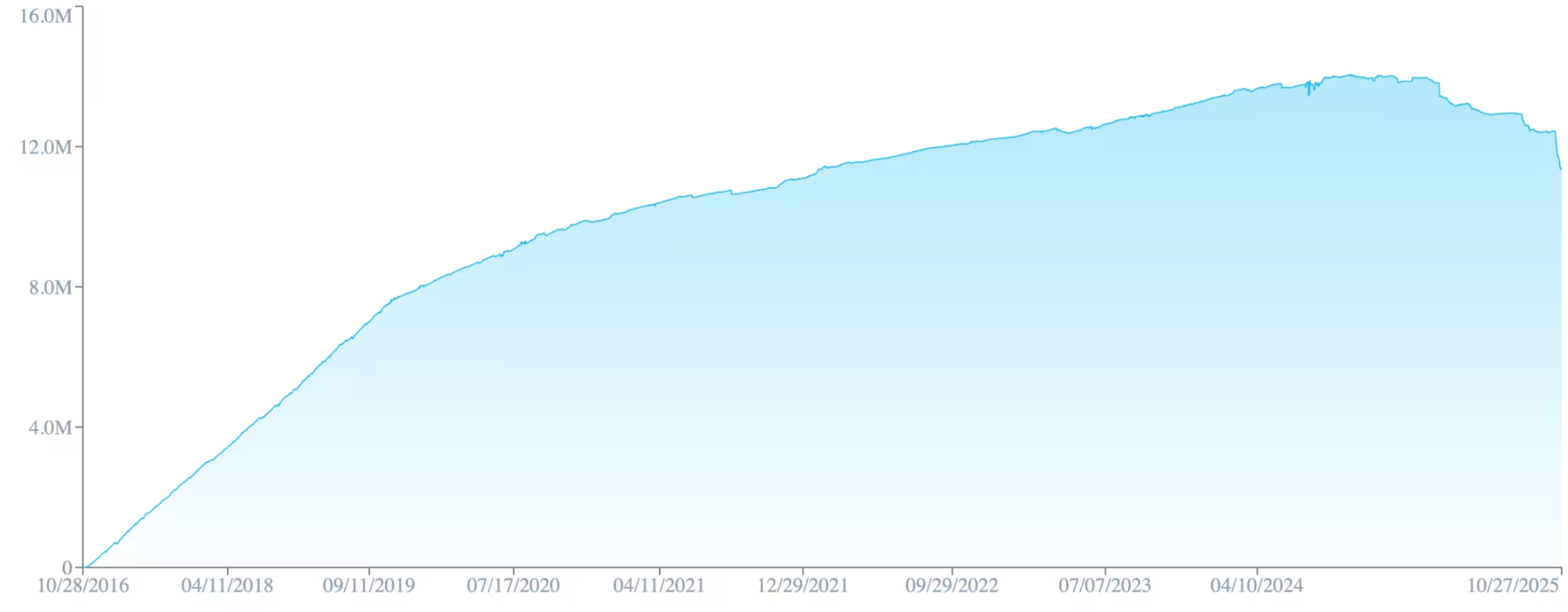

The transparent supply has decreased by nearly 3 million ZEC, dropping from about 14 million at the beginning of the year to about 11.4 million now (about 70% of the total supply).

(This section originally contained a chart description of the decline in transparent supply.)

Nodes and Future Development

The Zcash network currently has about 100-120 full nodes, up from a low of about 60 earlier this year. However, this is still very few compared to Bitcoin (about 24,000) or Monero (about 4,000), mainly because running a Zcash node is much more resource-intensive (shielded transaction verification is more resource-consuming), and the multi-funding pool architecture and frequent network upgrades also increase complexity and maintenance costs.

In the future, developer Sean Bowe is advancing the "Tachyon project," an expansion solution that significantly enhances the throughput of shielded transactions by restructuring synchronization and storage methods. Bowe claims that Tachyon can achieve performance leaps without a new protocol, using relatively simple cryptography to solve all bottlenecks. One could say that Tachyon is to Zcash what Firedancer is to Solana.

What are NEAR Intents?

NEAR Intents is a cross-chain coordination layer built on the NEAR protocol. It allows users to express intentions without manually operating cross-chain bridges, exchanges, or wallets.

The intent executor automatically allocates liquidity, executes exchanges, and completes cross-chain settlements behind the scenes.

For Zcash, integrating Intents means that users can easily transfer assets from the transparent chain into the Zcash shielded pool and back without exposing each step. This allows traders or institutions to move from the transparent chain (like Ethereum) into Zcash to regain privacy, conduct shielded transactions, and then (if needed) return to the original chain, with no direct association between the two addresses.

After integrating NEAR Intents, the Zashi wallet (the official wallet of ECC and the most commonly used wallet for Zcash) abstracts away the technical friction of cross-chain and shielding for users. Zcash also natively supports view keys, which can be used for auditing or compliance purposes, allowing for selective disclosure of shielded transaction details. These features make Zcash's privacy user-friendly for individuals while meeting institutional requirements.

Why the Outburst Now?

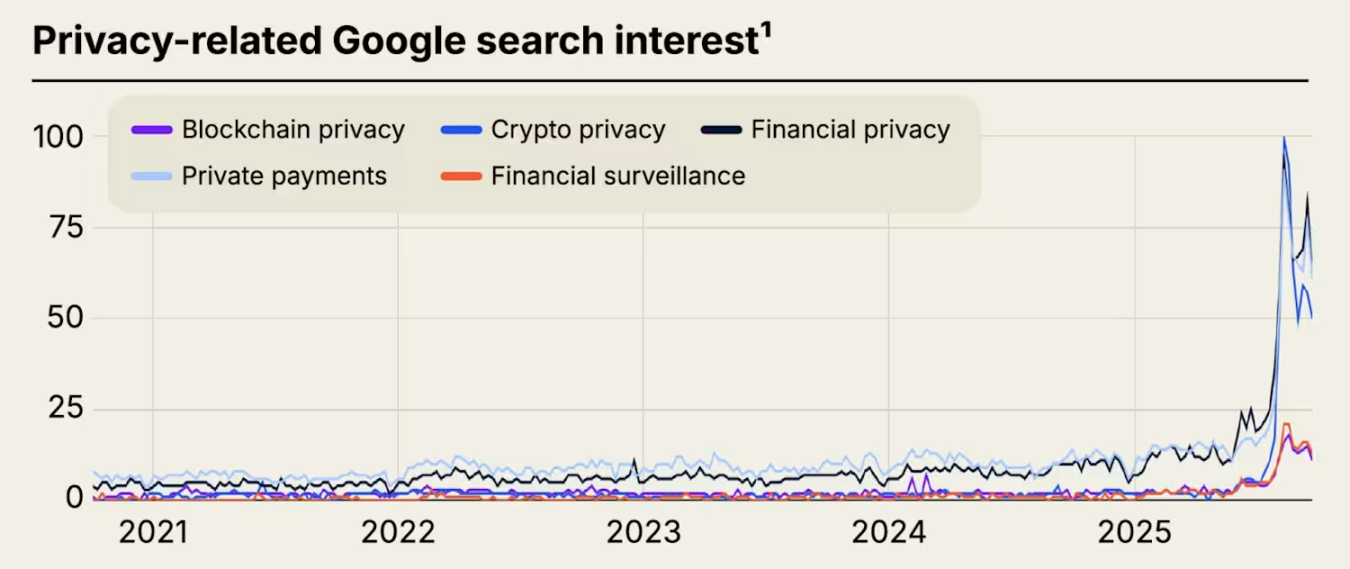

Zcash's sudden surge seems to reflect a shift within the crypto culture. As noted in a16z's "2025 Crypto State Report," there has been a recent spike in search interest for privacy-related terms on Google.

Many Bitcoin critics lament its "institutionalization," claiming it is dominated by ETFs and centralized custodians. Bitcoin itself has always been transparent, and ETFs merely add intermediaries without changing its transparent nature. In contrast, Zcash supporters position it as the "crypto version of Bitcoin," a return to the cypherpunk spirit, resonating in the current environment of pervasive surveillance from Chainalysis to on-chain detectives. The rise of Zcash has reopened the old rift between "privacy as a right" and "transparency for regulation."

As its privacy tech stack finally reaches consumer-grade usability (the Zashi wallet launched in March 2024 simplifies shielded operations), and with the continued growth of shielded supply, Zcash is gaining more attention. More ZEC being shielded means an expanded anonymous set, making Zcash overall more private.

Another clear signal that Zcash is "back" is that a few weeks ago, Hyperliquid launched ZEC perpetual contracts, allowing traders to leverage privacy coins on this popular decentralized exchange. This indicates a strong demand in the market for this long-forgotten gem. The launch of perpetual contracts has increased ZEC's market liquidity, with open interest at one point reaching about $115 million, also intensifying spot price volatility.

From a technical fundamental perspective, Zcash has not undergone an overnight transformation. However, the market's perception of it has changed. This surge is attributed to the continued vocal support from top figures in the space and a renewed recognition that privacy is crucial for permissionless currency.

Regardless of whether ZEC's price strength can be sustained, this market rotation has successfully forced the market to reassess the value of privacy.

After years of dormancy, this surge has brought Zcash back into the spotlight. Whether it can convert speculative momentum into sustained network growth remains to be seen. However, the renewed focus on privacy reveals a deeper truth: in an increasingly transparent financial system, the ability to transact privately is being regarded once again as a valuable feature.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。