Deutsche Bank and JPMorgan Warn Investors May Underestimate the Persistence of Inflation and the Lagging Impact of Tariffs

Written by: Zhang Yaqi

Source: Wall Street Insights

As recent international trade tensions have eased, financial market concerns about inflation have significantly cooled. However, the latest analysis from Deutsche Bank and JPMorgan warns that this optimism may be premature. Investors may be underestimating the multiple price pressures lurking in the economy, facing the risk of a "hawkish surprise" from central banks that is stronger than expected, which could impact stock and bond markets.

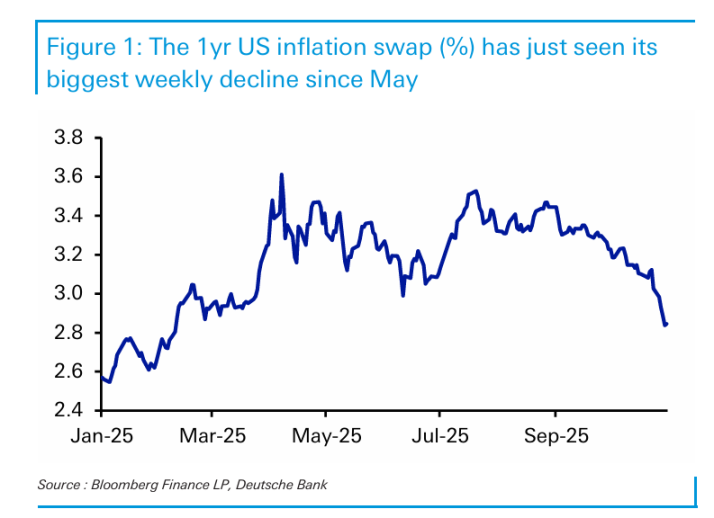

According to reports from the trading desk, Deutsche Bank noted in its November 3 report that, benefiting from last week's trade easing, the U.S. 1-year inflation swap recorded its largest weekly decline since May. Meanwhile, the price of gold, a traditional inflation hedge, has also retreated from its highs.

However, central bank officials have been more cautious. The Federal Reserve signaled a hawkish stance after last week's meeting, with Chairman Powell suggesting that another rate cut in December is not a certainty. This statement contrasts with the market's dovish expectations and adds uncertainty to the future policy path. JPMorgan emphasized in a report on October 31 that the inflation impact of tariffs, although lagging, will eventually manifest and may be more persistent than expected.

If inflation proves to be more resilient than the market imagines, investors will face multiple risks. First, a more hawkish turn from central banks than expected could re-emerge, putting pressure on asset prices. Second, physical assets like gold, which have performed well in inflationary environments, may regain favor. Finally, historical experience shows that a hawkish turn from central banks often accompanies stock market sell-offs, as seen in 2015-16, late 2018, and 2022.

Deutsche Bank: Six Factors That May Keep Inflation Above Expectations

Despite strong market optimism, Deutsche Bank believes there are several reasons to suggest that the market may again underestimate the stickiness of inflation, a situation that has repeatedly occurred in the post-pandemic cycle. The report lists six key factors:

Significant demand-side pressures: Recent global economic activity data has generally exceeded expectations. The Eurozone's October composite PMI preliminary reading hit a two-year high, U.S. PMI data has also shown resilience, and the Atlanta Fed's GDPNow model forecasts a 3.9% annualized growth rate for the third quarter. The strong stock market rally has also brought about a positive wealth effect.

Lagging effects of monetary easing: The Federal Reserve has cumulatively cut rates by 150 basis points since September 2024, while the European Central Bank is set to cut rates by 200 basis points from mid-2024 to mid-2025. The effects of monetary policy typically have a lag of over a year, meaning the impacts of these easing measures will last until 2026.

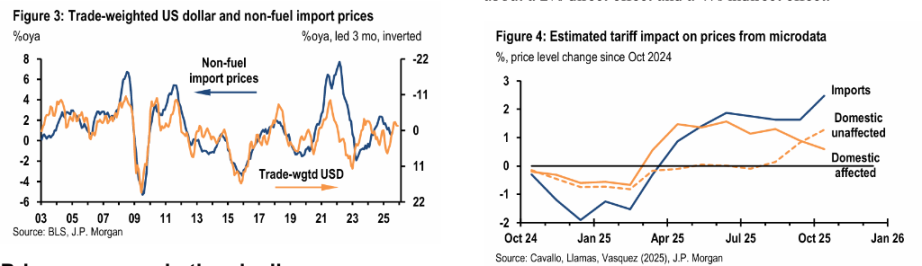

Tariff impacts have not fully manifested: Although market turmoil peaked in April, many tariff measures did not take effect until August. These costs take months to fully transmit to the consumer end. There is still a possibility of additional tariffs in the future.

Upcoming fiscal stimulus in Europe: Planned fiscal stimulus in Europe will further increase demand pressures, while the current unemployment rate in the Eurozone is near historical lows, and the idle capacity in the economy is far less than in the 2010s.

Oil prices rising again: Recent sanctions and OPEC+'s decision to halt production increases are driving oil prices back up.

Inflation remains above targets: Inflation rates in major economies continue to exceed central bank targets. The U.S. September CPI data was strong, with the core CPI's three-month annualized growth rate reaching 3.6%. The latest core inflation rate in the Eurozone was 2.4%, above expectations, and has remained above 2% since the end of 2021. Japan's October Tokyo CPI data also exceeded expectations, with the national inflation rate in September still at 2.9%, consistently above the Bank of Japan's target since early 2022.

Lagging Transmission of Tariffs, But It Will Eventually Arrive

Among the many inflation-driving factors, the impact of tariffs is particularly noteworthy. JPMorgan's research report delves into this issue, arguing that although the transmission process is slower than expected, U.S. consumers will ultimately bear most of the tariff costs.

According to JPMorgan's estimates, as of late October, this year's tariff revenue has exceeded $140 billion compared to the same period last year, and is expected to be about $200 billion higher for the entire year. These costs were initially absorbed by U.S. companies by squeezing profit margins, but surveys show that companies plan to pass a larger proportion of these costs onto consumers.

The bank predicts that U.S. core CPI inflation may peak in the first quarter of 2026 at 4.6% (quarter-on-quarter annualized). Tariffs are expected to cumulatively push core CPI up by about 1.3 percentage points by mid-next year.

The lag in the transmission of tariffs to consumer prices is due to several reasons: tariffs being implemented in phases, importers delaying payments through bonded warehouses, the time it takes for production chains to transmit costs, and some companies using inventory to stabilize prices. However, companies cannot indefinitely absorb profit squeezes. Surveys from the New York Fed, Atlanta Fed, and Richmond Fed all show that companies plan to pass on 50% to 75% of tariff costs. JPMorgan warns that if companies lack pricing power and cannot pass on costs, the result will be cost control through reduced investment and layoffs, which will also significantly drag on economic activity.

"Hawkish Surprises" Could Hit Stocks and Bonds Hard, Physical Assets Like Gold Will Regain Support

If the market's judgment on inflation is incorrect, investors will face threefold risks.

First, more "hawkish surprises" from central banks. Deutsche Bank's report points out that last week's hawkish leanings from the Federal Reserve are an example. Looking back at this cycle, investors have repeatedly been surprised by premature expectations of rate cuts. The report also mentions that the Federal Reserve has implemented the fastest round of rate cuts since the 1980s during non-recession periods since September 2024, and further easing may be limited.

Second, higher-than-expected inflation will provide renewed support for physical assets like gold. The report argues that the recent pullback in gold prices coincided with a decline in inflation concerns, and if inflation resilience exceeds expectations, this trend will reverse. History shows that during inflationary periods, physical assets that can retain value often perform exceptionally well.

Finally, in addition to being a clear negative for bonds, the central bank's "hawkish turn" has historically often been accompanied by significant corrections in the stock market. The report cites data showing that the Federal Reserve's hawkish actions in 2015-2016 (first rate hike), late 2018 (continuous rate hikes), and 2022 (significant rate hikes) all coincided with notable sell-offs in the S&P 500 index. Historically, rate hikes are one of the most common factors leading to significant corrections in U.S. stocks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。