In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

The bull market is not over, but it hasn't fully dropped yet.

To start with the conclusion, the bull market has not ended. Moreover, from an annual cycle perspective, the current bull market is only in the middle position.

However, the extent of the index decline is unbearable for most investors. Lin Chao is reluctant to repeat how to hedge; for those who are determined to only trade spot and believe that holding will yield profits, the market will give them a good lesson.

Since the sudden drop in the K-line on the night of November 3rd, everyone's mood has likely hit rock bottom. A nearly 6000-point fluctuation in Bitcoin in one day is indeed significant, but the betrayal from altcoins is even more fatal. Lin Chao knows everyone is feeling very suppressed right now, especially since we just escaped the jaws of the tiger on October 11th, only to be caught in a month-long fluctuation. Most people are probably either dead or severely injured. However, Lin Chao wants to tell everyone that the decline is not over yet; at least in early November, it will continue. So what should we, who are left with only a bit of blood, do? The answer is to not act recklessly and to stabilize our mindset. It truly is the darkness before dawn.

The continuous decline has led to my own spot holdings being deeply trapped, but fortunately, my position is not heavy, and I can free up some positions to hedge. Historically, the entire cryptocurrency market is currently at historical highs. Bitcoin's monthly volatility can reach as high as 51.94%. This means that a 50% asset drawdown is quite common. Panic emotions are starting to spread, and many people are at a loss due to this continuous decline. Why is it that interest rates have been cut, and tapering is about to begin, yet the market reacts this way?

If we must find a reason, it ultimately comes down to the government shutdown. But as we can see, the U.S. stock market remains strong, while the cryptocurrency market always seems to get hurt. There's nothing we can do; after all, the cryptocurrency market has been tamed. The U.S. stock market is undoubtedly a source of confidence in the U.S. economy. When liquidity is abundant, the cryptocurrency market can indeed soar, but at this stage, transitioning from an independent system to working under another system means that the cryptocurrency market will inevitably be drained. Simply put, starting from this year onward, the cryptocurrency market is a reservoir of liquidity; when there is excess, it absorbs it, and when there isn't, it quickly takes it out to contribute. Even if the U.S. stock market continues to hit new highs later, but the cryptocurrency market goes bearish, I wouldn't be surprised. Therefore, for those who do not know how to use leverage or hedge, investing in the cryptocurrency market will become increasingly difficult. The era of simply putting money in and watching the market cap grow day by day is gone; if you don't learn to hedge, you can only become fuel for the market. But that said, the cryptocurrency market remains the highest-risk investment market globally. As the computing power of each country continues to increase, the application of blockchain will certainly become more widespread, so risk and return will always be proportional. The places with the most investment miracles in the future will still exist in the cryptocurrency market.

Now for some good news: as of today, the U.S. government has been shut down for 34 days, just one day away from breaking the record. For the first time, there are signs of easing between the two parties in Congress. Leaders from both parties in the Senate have hinted at the possibility of finding an "exit strategy," indicating that the month-long deadlock may be approaching a turning point.

Senate Republican leader John Thune expressed an "optimistic attitude," and Senate Democratic whip Dick Durbin also stated that he "feels the same way," marking a rare consensus in the deadlock. Senate Appropriations Committee Chair Susan Collins revealed that the Democrats have proposed a specific text for the plan, and both sides' staff are working overtime over the weekend to advance negotiations.

Moreover, it is important to understand that the impact of a government shutdown is akin to an invisible interest rate hike. Due to the inability to obtain normal funding during the shutdown, the Treasury's General Account (TGA) balance has skyrocketed from $300 billion to $1 trillion within three months, equivalent to withdrawing $700 billion in liquidity from the market. So, conversely, considering the extremely adverse external environment, as a secondary pool of liquidity for the U.S. stock market, under the circumstances where the U.S. dollar index breaks through 100 counter-cyclically, the cryptocurrency market has only dropped this little, which is already quite impressive. Brothers just need to hold on for another week or two; once the U.S. government reopens and the Treasury begins to consume its massive TGA cash balance, with as much as $900 billion in cash flowing back into the banking system, it will be akin to an invisible quantitative easing, and good days will come. Let's look forward to it together.

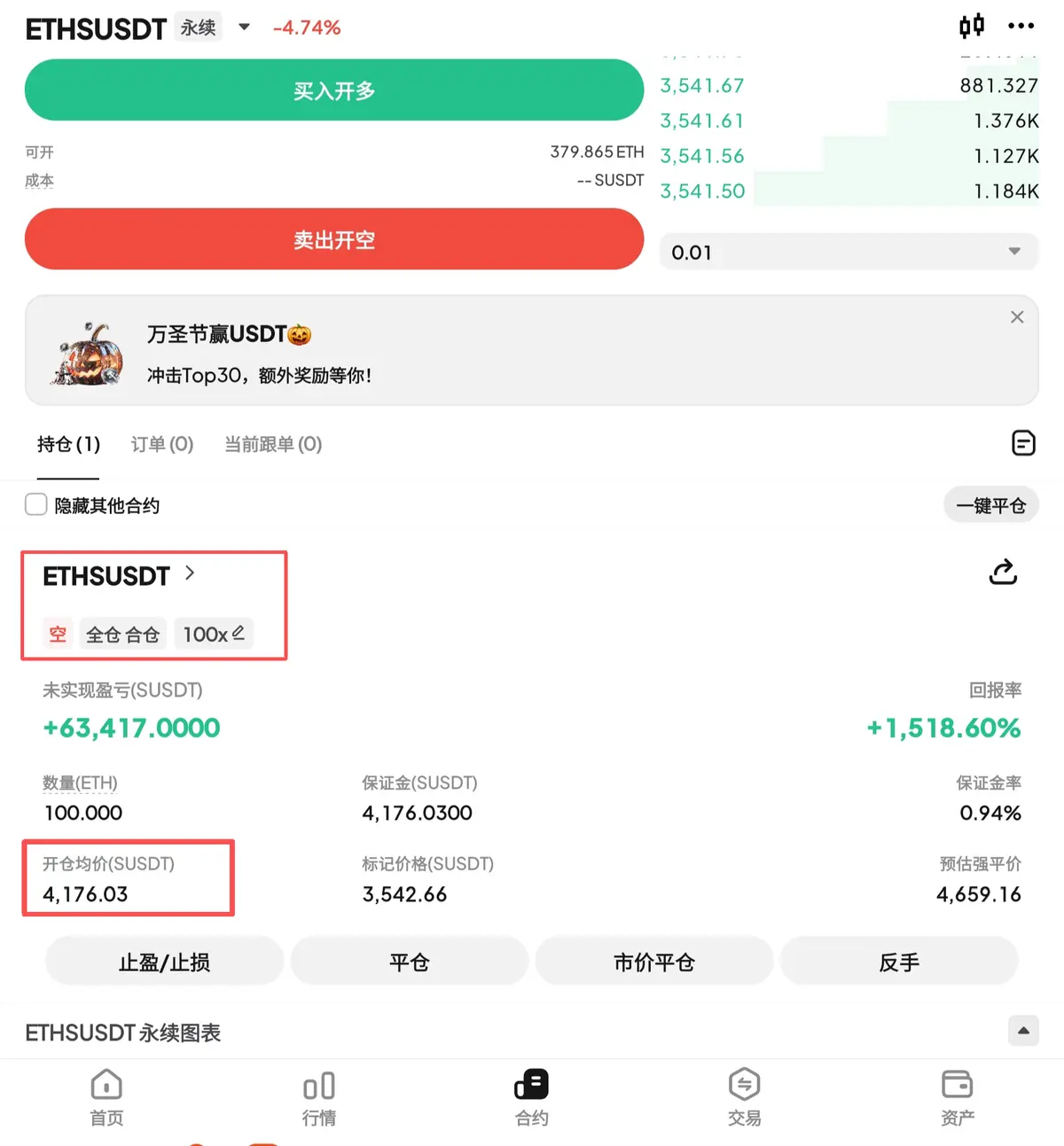

In the future, I will also share the basic operational ideas and results of short-term contract hedging with everyone, updating it irregularly. If you are interested in day trading or want to learn short-term trading, feel free to message Lin Chao for discussion.

If you are feeling lost—unable to understand technology, unsure how to read charts, not knowing when to enter the market, unable to set stop losses, not understanding take profits, randomly increasing positions, getting trapped while trying to catch the bottom, unable to hold onto profits, missing out on market opportunities… these are common issues for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade speaks louder than a thousand words; finding the right direction is better than repeatedly facing defeat. Instead of frequent operations, it is better to strike precisely, making each trade more valuable.

The success of investing depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocations are essential for steady progress in the ocean of investments. Life is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or a moment, but rather planning before action and knowing when to stop to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market is risky; invest with caution!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。