"Investing in IREN is a bet on the current AI infrastructure sector's most scarce computing resources, combining the stability of a utility with the explosive potential of tech stocks."

Author: RockFlow

Key Points

IREN has completed one of the most remarkable strategic transformations in the U.S. stock market: evolving from a miner constrained by the Bitcoin cycle to a "utility company" focused on AI computing infrastructure. This identity transformation allows it to directly participate in the most certain long-term trends in the tech sector, gaining extraordinary attention and value reassessment.

In the context of the AI computing bottleneck shifting from chips to power and land, IREN's vertical integration model brings it structural low-cost advantages and several years of first-mover advantage. The company's turnaround to profitability and 168% revenue growth in its fiscal year 2025 report is a financial realization of its AI cloud business's extremely high "hardware profit margins" and "heavy asset" experience.

The RockFlow research team believes that IREN's rapid expansion coincides with the most imbalanced supply and demand phase in the "AI gold rush." Investing in IREN is a bet on the current AI infrastructure sector's most scarce computing resources, combining the stability of a utility with the explosive potential of tech stocks.

Main Text

In the U.S. stock market, there are many companies and potential targets filled with drama and grand narratives. The protagonist of this article, IREN, is one such example.

IREN is one of the most captivating transformation stories in the crypto and tech fields. The company emerged during the Bitcoin mining boom and achieved a strategic leap in just three years, becoming one of the companies most likely to benefit from the surge in AI infrastructure demand.

During its transformation, IREN did not abandon its mining DNA—its Bitcoin mining business continues to generate cash. However, it is no longer satisfied with being a miner constrained by Bitcoin price fluctuations; instead, it has set its sights on a broader and more certain trillion-dollar arena: AI computing infrastructure.

Recently, the company has been highly sought after due to its stock price increase of over 1000% in six months. The RockFlow research team believes that IREN is not simply a crypto or AI concept stock, but a representative of the new generation of "AI computing utility companies." Its core investment value lies not in temporary speculation but in the moat it has built in power, land, and high-density design that cannot be quickly replicated by others.

This article will deeply analyze the underlying logic of IREN's potential for a tenfold return in the future from three dimensions: "IREN's transformation story," "current core investment value," and "why now is a good time to invest."

1. IREN's Transformation: From Bitcoin Miner to AI Computing Infrastructure

IREN's story began in the Bitcoin mining field. The company was founded in 2018 in Sydney, Australia, by brothers Daniel Roberts and Will Roberts, who are currently co-CEOs. At that time, the company was named Iris Energy.

Daniel Roberts became interested in cryptocurrency in 2013. He and his brother Will bought Bitcoin when it reached $1000, but soon witnessed a price crash, selling it for $500. Later, they participated in the presale of Ethereum, reaping substantial profits.

When the next Bitcoin bull market began at the end of 2017, the Roberts brothers delved into the history of currency and understood the significance of Bitcoin as a hedge.

The brothers firmly believed in the unstoppable rise of Bitcoin but also recognized its enormous energy costs: mining one Bitcoin requires the electricity consumption of a household for nine years. From that point on, the Roberts brothers aimed to solve the energy problem while continuing to increase their investment in Bitcoin. In 2018, they quit their jobs and founded Iris Energy.

"We realized that the world would need high-energy-consuming data centers designed specifically for raw processing power," Daniel said in a recent interview. Clearly, they could be used for AI, high-performance computing, analytics, and machine learning. They do not need to establish expensive centers in capital cities; they just need energy.

The brothers set off with backpacks, traveling around the world in search of such places. Their initial strategy focused on rapidly deploying capacity, not out of opportunism, but to integrate an operational platform that could bring cost competitive advantages.

Over the past few years, IREN has proven its ability to manage large-scale operations and has a dense and stable energy consumption, allowing it to weather periods of extreme Bitcoin price volatility.

This experience in designing, building, and operating high-density data centers later became their stepping stone to compete in the broader market—artificial intelligence infrastructure.

In November 2021, shortly after Bitcoin reached an all-time high, Iris Energy went public on NASDAQ. Days later, Bitcoin plummeted. In 2022, Iris Energy's stock price also fell sharply.

As Bitcoin prices languished, they planned to enter the AI field, purchasing NVIDIA H100 GPUs to provide high-performance, low-cost processing powered by green energy. After raising $126 million, Poolside AI became their first customer. They invested $22 million to purchase more NVIDIA chips and developed a two-year return on investment plan.

In January 2024, Iris Energy rebranded to IREN, reflecting its diversification. This transformation is largely attributed to the foresight of its management team. They did not fall into the trap of endless expansion in the mining industry but decided to pause when the company reached critical scale and allocate resources to the AI field. This rigorous capital allocation is one of its advantages.

The most significant marker of IREN's transformation is its successful qualification as a preferred partner of NVIDIA in 2024. This is not just a new title but a strategic endorsement for obtaining the most scarce resources in the AI infrastructure field—GPU supply and customer channels.

In terms of GPU scale, IREN's AI cloud has committed to providing approximately 10,900 GPUs of capacity and plans to further surge to over 23,000 GPUs.

IREN has successfully completed its strategic transformation from a "Bitcoin mining company" to "AI computing infrastructure." Today, it is a vertically integrated computing infrastructure provider, whose business model can be defined by three keywords: power, hardware, and services.

Given that IREN has complete control over land, data centers, power infrastructure, and hardware, this model allows it to quickly respond to customer needs, achieve rapid low-risk expansion, and directly manage project progress, reducing reliance on third parties.

2. Core Investment Value: "Heavy Asset" Experience + High-Growth Track

The RockFlow research team believes that IREN's investment value lies in its successful integration of the "heavy asset" experience accumulated during the Bitcoin mining period into the current most explosive AI infrastructure track, becoming a composite entity that combines infrastructure, cloud computing, and energy arbitrage.

At the end of August, IREN's fiscal year 2025 report marked a turning point in its development, with multiple financial data showcasing the feasibility of its business model:

Turnaround and High Growth: Total revenue increased by 168% year-on-year to $501 million, with net profit turning positive to $87 million after a loss in 2024. Notably, the fourth quarter of fiscal year 2025 marked IREN's first reported quarterly profit.

AI Profitability: Even with a small-scale base, the "hardware profit" margin (revenue minus electricity costs) of the AI cloud is extremely high, proving that operating the most advanced chips in areas with low electricity costs can yield substantial profits.

Low-Cost Advantage: IREN's electricity costs remain at extremely low levels, providing it with a structural cost competitive advantage in AI hosting and AI cloud services that is difficult for other competitors to match.

Behind such impressive financial performance is IREN's unique competitive barrier—power + liquid cooling + contracts at play.

In the AI infrastructure field, IREN's competitive advantages are striking:

Scarce Power and Licensing Advantage: In today's environment where grid capacity prices are soaring and interconnection queues can take years, IREN's 2.91GW secured power capacity is the highest barrier. It saves years of grid access time compared to companies building ultra-large-scale data centers from scratch.

High-Density Liquid Cooling Technology: IREN's new campus is designed specifically for Blackwell-level liquid cooling clusters. For example, the Sweetwater campus is designed to support over 700,000 liquid-cooled NVIDIA Blackwell GPUs. This high-density, low PUE (Power Usage Effectiveness) design is essential for running the next generation of GPUs, increasing revenue output per megawatt.

"Colo 3.0" Model: IREN is transitioning from traditional leasing of power and space (Colo 1.0/2.0) to a "manufacturer collaboration model" (Colo 3.0), directly signing agreements with chip manufacturers to acquire GPUs through financing or leaseback models, thereby matching capital costs with revenue growth, achieving light asset operations and rapid expansion while retaining control over power and infrastructure.

The narrative that IREN could reach a market value of $100 billion is not unfounded but is based on the high leverage effect of its business model. According to relevant research institutions' calculations based on the unit economics of Blackwell-level racks, IREN's each megawatt (MW) of AI-specific capacity can generate approximately $15.6 million to $17.5 million in revenue annually at 85%-90% utilization.

Furthermore, as AI labs and ultra-large enterprises (such as the Stargate project) are signing multi-year, take-or-pay capacity contracts with professional suppliers in advance, this gives IREN's future cash flow strong financing capabilities, leading investors to assign extremely high valuations.

3. Why Now? The AI Gold Rush and IREN's Unique Position

As mentioned earlier, IREN's transformation and rapid expansion coincide with a historic macro trend.

Currently, the trillion-dollar demand for computing is exploding, and the market size for AI infrastructure is expanding at an astonishing rate. Recently, NVIDIA CEO Jensen Huang estimated that the AI arms race will evolve into a $3 to $4 trillion opportunity. McKinsey predicts that in the next decade, approximately $3.5 trillion of the $7 trillion capital expenditure on data centers will be allocated to server chips.

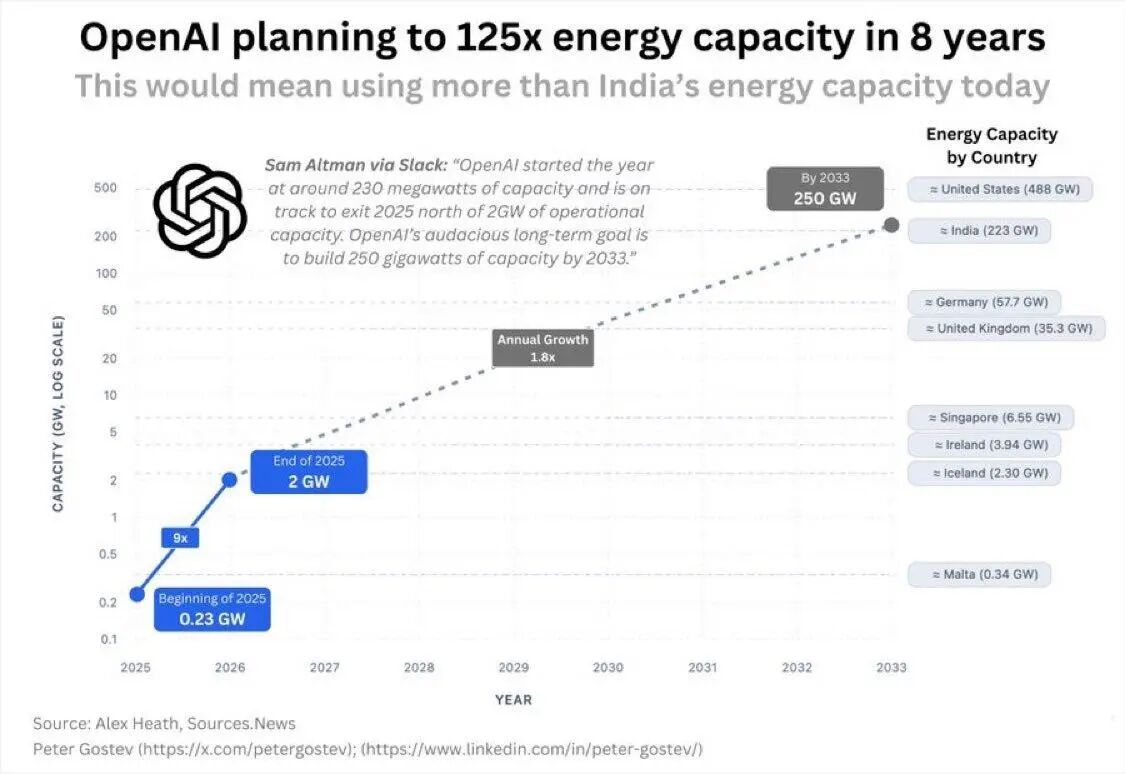

OpenAI itself estimates that by 2033, its capacity will reach 250 GW, which will be 125 times the capacity at the end of 2025 (2 GW).

However, in such a vast market, there is currently an imbalance between supply and demand. As a result, chip leasing has emerged as a new popular AI revenue model.

In addition to directly providing millions of GPUs to OpenAI, NVIDIA has another possible plan to complete the collaboration—leasing its GPUs to large clients like OpenAI.

Chip leasing offers tech giants, cutting-edge AI labs, and other AI-focused companies a way to control future expenditures, plan project budgets more accurately, and reduce reliance on expensive capital expenditure construction, thereby stabilizing future free cash flow.

Contracts like the multi-billion dollar CoreWeave-OpenAI agreement and the launch of NVIDIA DGX Lepton services indicate that "chip leasing" is becoming mainstream. This presents a potential growth point for companies like IREN that possess infrastructure.

In the competition among AI infrastructure providers, IREN is in a favorable position:

Difference from CoreWeave/Nebius's model: Although CoreWeave and Nebius have seen their valuations soar (with a combined market value reaching $100 billion), they mostly acquire infrastructure through contracts, while IREN is the original owner of the infrastructure and a vertically integrated builder. IREN's model resembles that of a "utility" company with pricing power over power and land.

Compared to other crypto miners transitioning to AI (like CIFR), IREN's advantages lie in its scale, strategic partnership with NVIDIA, and clear GW-level expansion plans. It is not merely attaching GPUs to mining facilities but is designing next-generation AI data centers from the ground up.

IREN's strong balance sheet is also impressive: after achieving profitability in 2025, IREN has $565 million in cash, with a net debt to EBITDA ratio of about 1.98 times, indicating a healthy balance sheet. This provides financing flexibility for its capital expenditures, which could reach billions of dollars.

Finally, if investors are optimistic about IREN's future, they also need to acknowledge the investment concerns. The RockFlow research team believes that IREN's potential risks are threefold:

Execution risk: Future larger-scale project construction has long cycles, and power and licensing risks remain core challenges; interconnection timelines and substation deliveries may be delayed.

Cyclicality: Although the AI business is growing rapidly, most of the company's revenue still comes from Bitcoin mining, and stock prices will continue to be affected by Bitcoin price fluctuations in the short term.

Valuation and capital expenditure: The hype in the AI sector is high, and high capital expenditure is an inherent characteristic of its model. Although financing can be achieved through contracts, potential dilution risks should still be monitored.

However, the market currently seems to favor maintaining optimistic estimates, particularly noteworthy are the recent catalysts for IREN's stock price:

AI Cloud ARR update: With 10,900 GPUs coming online, annualized revenue is expected to reach $200 million to $250 million by the end of the year.

Large customer contracts: Any announcement of multi-year, take-or-pay CoreWeave-OpenAI template contracts.

Sweetwater debugging rhythm: Phased power-up for Sweetwater 1 (2026) and Sweetwater 2 (2027).

Conclusion

IREN's story is one of "structural scarcity." In a world where global AI demand is growing exponentially while physical infrastructure is severely lacking, IREN has successfully taken a key step toward a hundred billion dollar computing empire, leveraging its first-mover advantages in power, land, and high-density liquid cooling.

The RockFlow research team believes that investing in IREN is a bet on a new industrial revolution, combining the stability of a utility with the explosive potential of tech stocks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。