Author: Nancy & Frank, PANews

Last weekend, a tweet from Ethereum co-founder Vitalik triggered a surge in the price of the established L2 token ZKsync, also boosting the overall interest in the Layer2 ecosystem. Meanwhile, as leading projects continue to make strides, the trading activity within the Ethereum L2 ecosystem is steadily increasing.

Vitalik Supports ZKsync, Activity Rises but Overall Still at Low Levels

Amid a general downturn in the crypto market, Vitalik's tweet led to an overall rise in the Layer2 ecosystem, with ZKsync at the forefront, becoming one of the few bright spots against the trend.

On November 1, ZKsync co-founder Alex published an article on social media titled "Ethereum is now the main capital hub of ZKsync." Subsequently, Vitalik retweeted the article, stating that ZKsync has done much undervalued but valuable work within the Ethereum ecosystem and expressed anticipation for its upcoming new features.

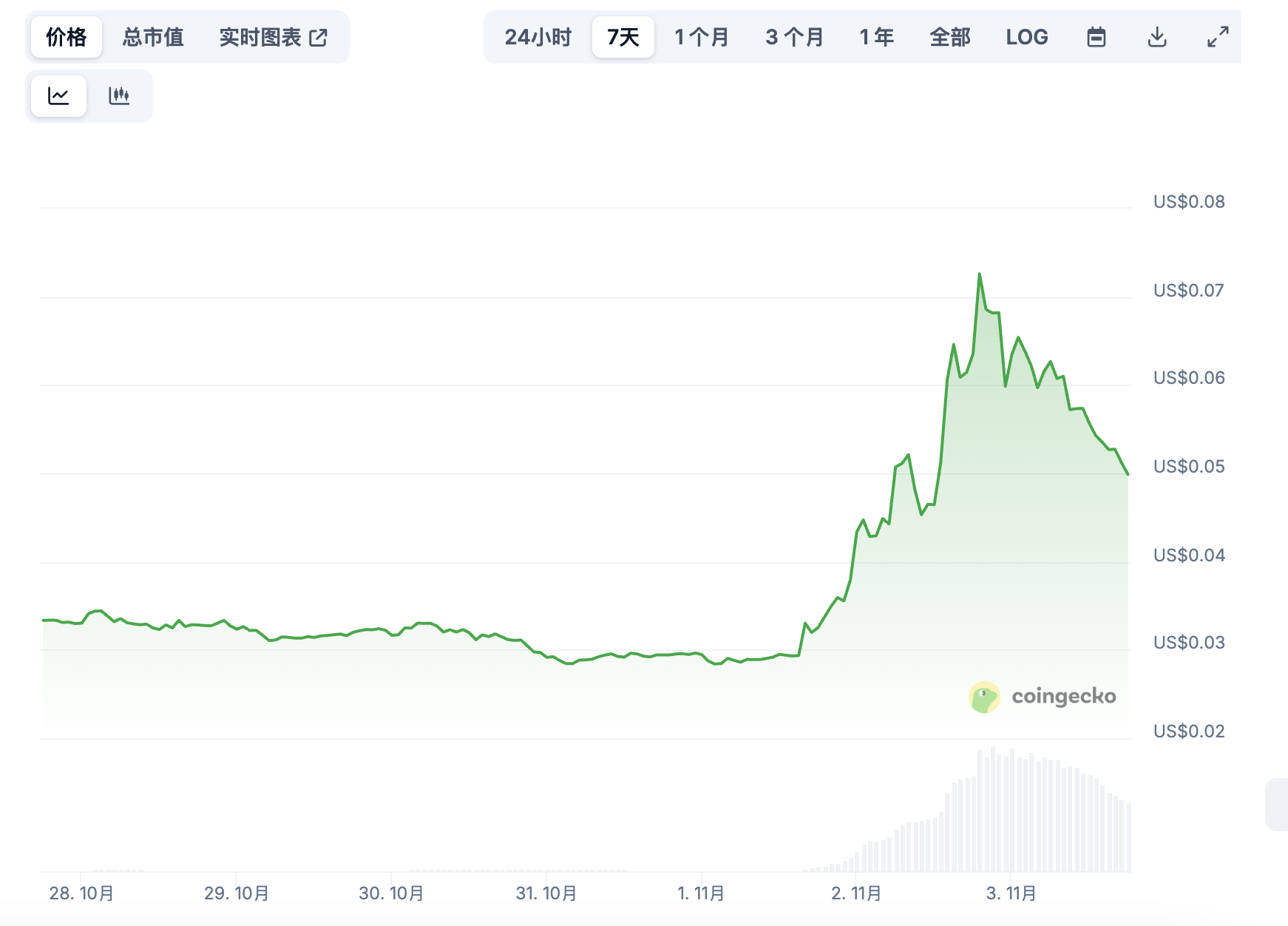

As a result, Coingecko data shows that the price of the ZKsync token ZK surged by as much as 150.34%, reaching a nearly six-month high. At the same time, tokens in the Layer2 sector, including MINA, SCR, and STRK, also saw significant increases.

The surge in ZKsync's price is not only due to Vitalik's attention; he has interacted with ZKsync multiple times before. A more critical driving factor is the Atlas upgrade.

According to Alex, the Atlas upgrade has made Ethereum its capital hub, allowing ZKsync-based chains to directly access Ethereum liquidity without relying on independent liquidity pools, fundamentally reshaping the funding structure between L1 and L2. This upgrade not only achieved real-time liquidity interoperability between L1 and L2 but also brought core performance improvements such as over 15,000 TPS, one-second ZK finality, and nearly zero transaction fees, enabling Ethereum to become an institutional-grade real-time settlement center.

From a practical perspective, the more important aspect of the Atlas upgrade is not just the TPS exceeding 15,000 but the core value of addressing the liquidity island problem among various L2s. By facilitating communication between ZK chains through the "ZK Gateway" middleware component, the direct result is that L2 to L2 transactions can be completed in about one second. If this technology can achieve its expected development goals, it is likely to truly integrate Ethereum's L2s into a cohesive whole. This is extremely important for the Ethereum ecosystem.

Additionally, the performance improvements have opened up more possibilities for institutions in areas like RWA. Previously, ZKsync has been promoting institutional business and even ranked as the third-largest RWA asset public chain. Not long ago, ZKsync also launched the institutional private blockchain infrastructure Prividium, aimed at providing enterprise-level privacy protection, built-in compliance, and seamless connection with Ethereum. The official disclosure indicates that since its launch, over 30 traditional institutions, including Citibank, Deutsche Bank, and Mastercard, have joined.

Moreover, the core technology behind ZKsync, zero-knowledge proofs (ZK), is a key innovation in Ethereum's scalability field, balancing high scalability with strong privacy, and is recognized within the industry as a production-ready technological foundation. Recently, the "Cryptocurrency 2025 Report" released by a16z crypto pointed out that the prosperity of applications relies on the maturity of infrastructure. Over the past five years, the total transaction throughput of blockchain has increased by 100 times, and the popularity of Ethereum L2 has reduced the average transaction cost to below one cent, making the block space connected to Ethereum both cheap and abundant. Among various technologies, zero-knowledge proofs (ZK) are rapidly transitioning from academic research to critical infrastructure, having been integrated into Rollups, compliance tools, and mainstream network services.

Under the positive stimulus, ZKsync's active addresses have also seen a rare rebound, increasing by 26% in the past 30 days. As of October 27, the daily active users were only 10,400, still in a very low state. This data ranks it 60th among all labor union groups and places it at the lower end among Ethereum L2s.

From the perspective of TVL performance, ZKsync's mainnet data is still in a state of stagnation, with only $44.55 million. According to its official website, ZKsync's elastic network currently has 18 chains, with a total TVL of $3.3 billion. From this perspective, ZKsync essentially resembles a B2B technology service provider, with its own ecological performance still lacking. In summary, as a green leaf of the Ethereum L2 ecosystem, ZKsync performs quite well, while its own red flower part has yet to bloom.

Leading Projects Drive Strong Rebound in L2 Trading, Overall Valuation Still Shrinks by Nearly 90%

According to a recent tweet from Routescan, the top five blockchain ecosystems in terms of trading activity in October all achieved positive growth. This includes several L2s, such as Optimism Superchain reaching 486 million TXs and Boba reaching 1.9 million TXs, indicating that the activity in the L2 ecosystem is warming up.

Overall, the Layer2 ecosystem shows signs of recovery driven by leading projects, with several core indicators rebounding, and some data even reaching historical highs.

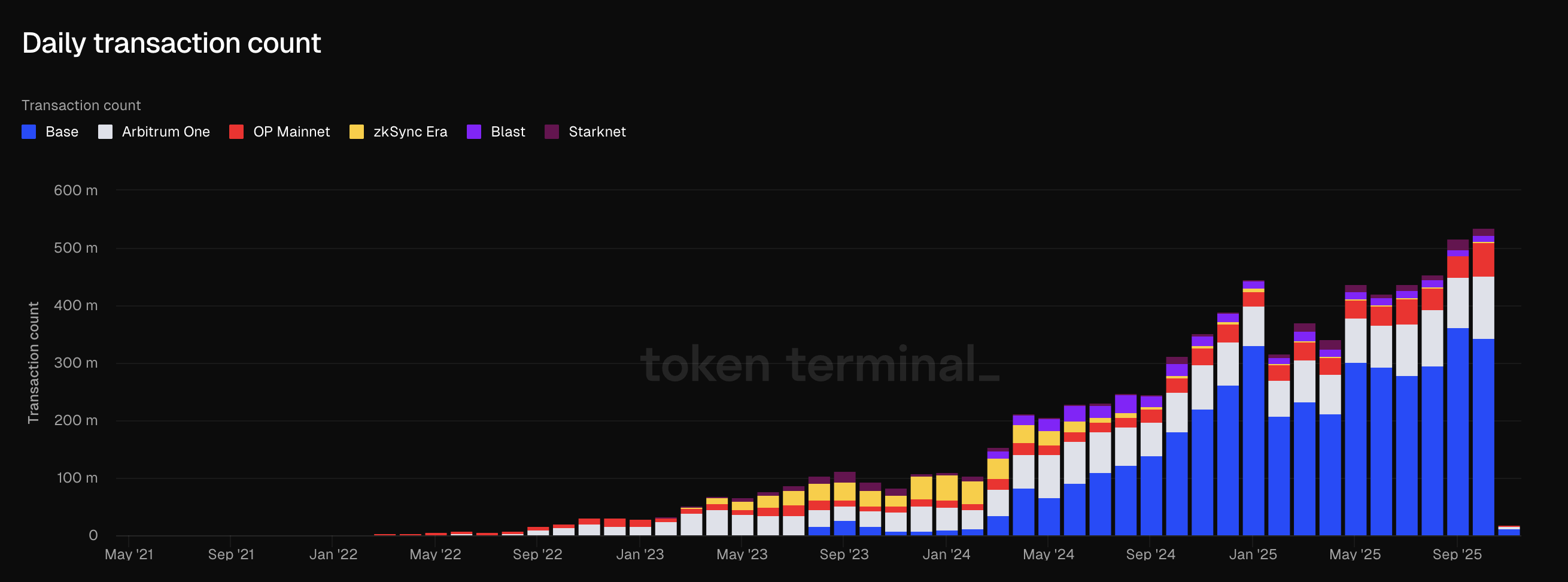

According to the latest data from Token Terminal, the monthly transaction volume of Ethereum Layer2 networks has continued to grow strongly, with over 530 million transactions completed in October this year, setting a historical high, approximately 11 times that of the mainnet (48 million transactions) during the same period. Among various L2 networks, Base contributed an absolute majority of 64.2% of the transaction volume (about 340 million transactions), becoming the most active chain in the ecosystem, with its transaction surge possibly stimulated by its token issuance plan. Following closely are Arbitrum One and OP Mainnet, with transaction shares of approximately 15% and 12%, respectively.

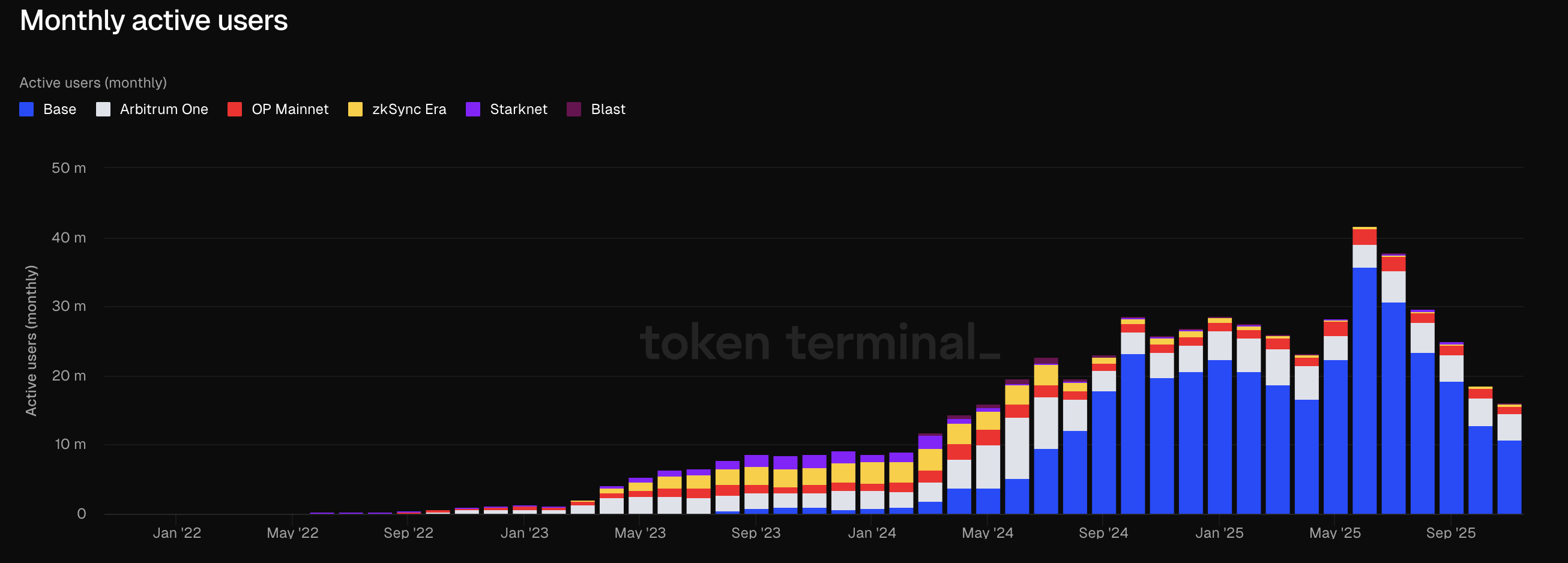

From the monthly active user data, L2 networks showed a trend of decline and increasing differentiation in October. The latest data from Token Terminal shows that L2 monthly active users reached 16.1 million, down 61.4% from the historical peak of 41.7 million in June this year, but still far exceeding the 8.3 million of the Ethereum mainnet. Among them, Base maintains an absolute lead, accounting for 67.1%, but its user growth rate has noticeably slowed compared to previous months; Arbitrum One follows closely with a share of 22.9%, showing relatively stable performance; other chains like zkSync Era, Starknet, and Blast have also seen significant user losses compared to historical peaks.

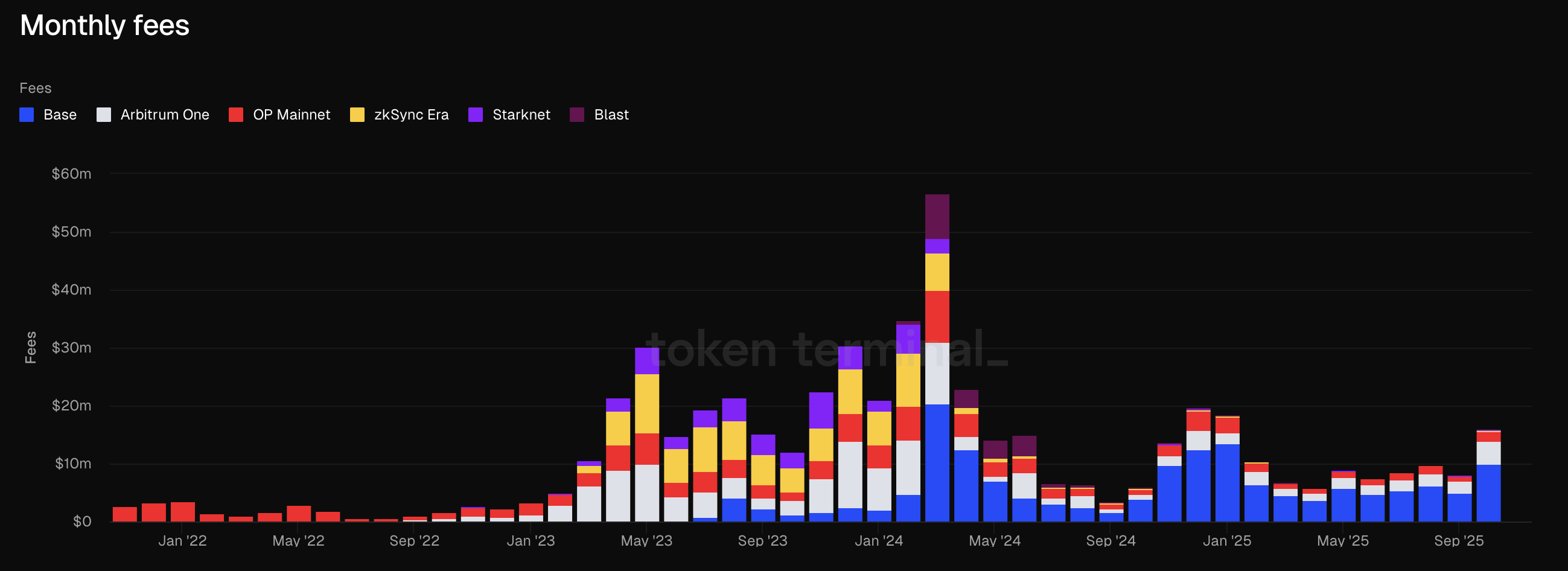

Additionally, the fees for L2 networks have recently shown a significant rebound. From the daily fee income perspective, after reaching a historical peak of over $560 million in May 2024, the L2 sector experienced a sharp decline. Despite the Dencun upgrade significantly reducing data costs and more L2 projects launching expansions, fee income did not recover; instead, it accelerated its shrinkage due to a decline in on-chain activity, a cooling narrative around Gas, and multiple factors leading to underwhelming ecosystem performance. By October 2025, the monthly fees for the entire L2 sector approached $160 million, only 28.1% of the peak, but it set a new high since February this year. Among them, Base, Arbitrum One, and OP Mainnet accounted for about 98.3% of the total fees.

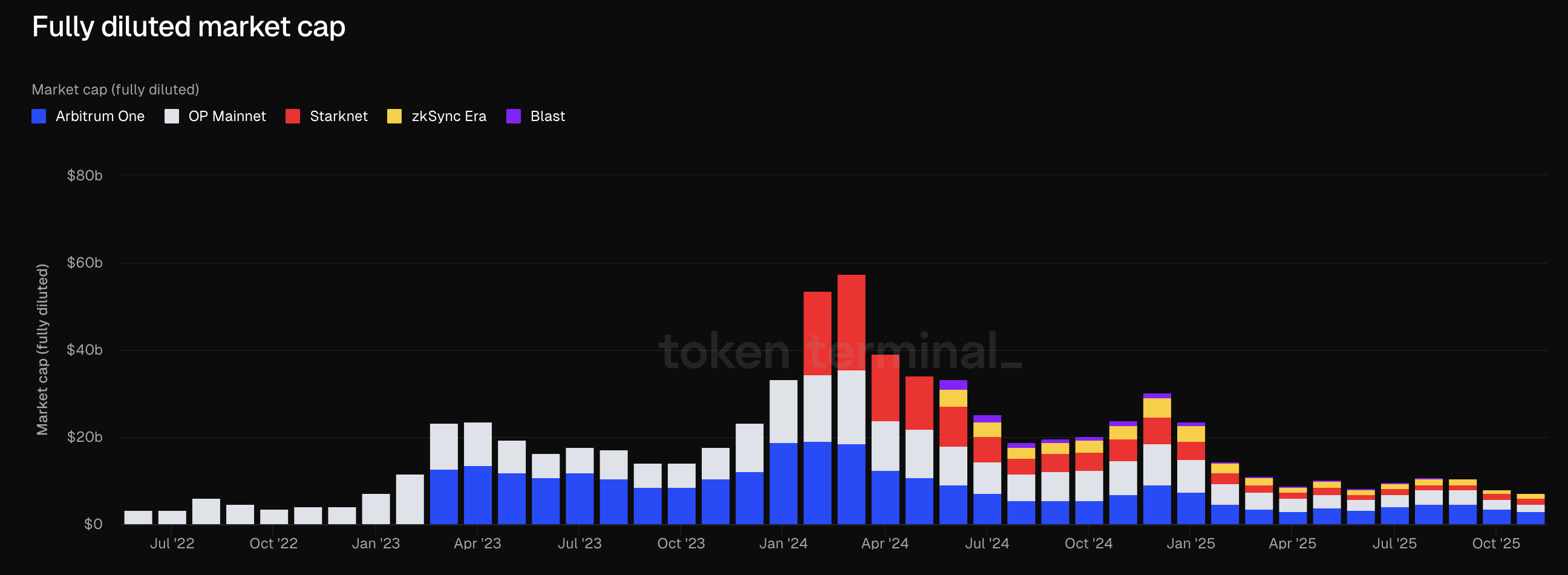

In terms of fully diluted valuation (FDV), since reaching a historical peak of over $57.37 billion in July last year, the L2 sector has shown a continuous downward trend. Although more L2 projects have issued tokens during this period, the market capitalization has not rebounded; instead, it has accelerated evaporation due to unlocking waves, narrative fatigue, and underwhelming ecosystem performance. By October 2025, the entire L2 sector's FDV was only about $7.23 billion, just 12.6% of the peak, equivalent to a nearly 90% evaporation of valuation bubble in just 15 months. Among them, Arbitrum, OP Mainnet, zkSync Era, and Starknet accounted for about 85% of the total FDV.

It is worth mentioning that Ethereum developers have officially set the Fusaka upgrade date for December 3, which will reduce L2 operating costs and improve throughput, further catalyzing explosive growth and mainstream adoption of the L2 ecosystem.

Overall, the Layer2 ecosystem is experiencing a phase of recovery, with technological upgrades and infrastructure improvements solidifying the long-term value of L2. However, whether the ecosystem can develop steadily will depend on the actual implementation capabilities of core projects, the performance of the ecosystem, and the optimization of market funding structures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。