For long-term investors, the core idea is to ignore short-term noise and focus on long-term value and trends.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.71 trillion, with BTC accounting for 59.3%, which is $2.2 trillion. The market cap of stablecoins is $307.1 billion, decreasing by 0.59% in the last 7 days. Notably, the number of stablecoins has shown negative growth this week, with USDT accounting for 59.69%.

Among the top 200 projects on CoinMarketCap, most have declined while a few have risen, including: ZEC with a 7-day increase of 58.98%, VIRTUAL with a 7-day increase of 57.8%, DASH with a 7-day increase of 47.23%, ZEN with a 7-day increase of 79.8%, and HNT with a 7-day increase of 29.57%.

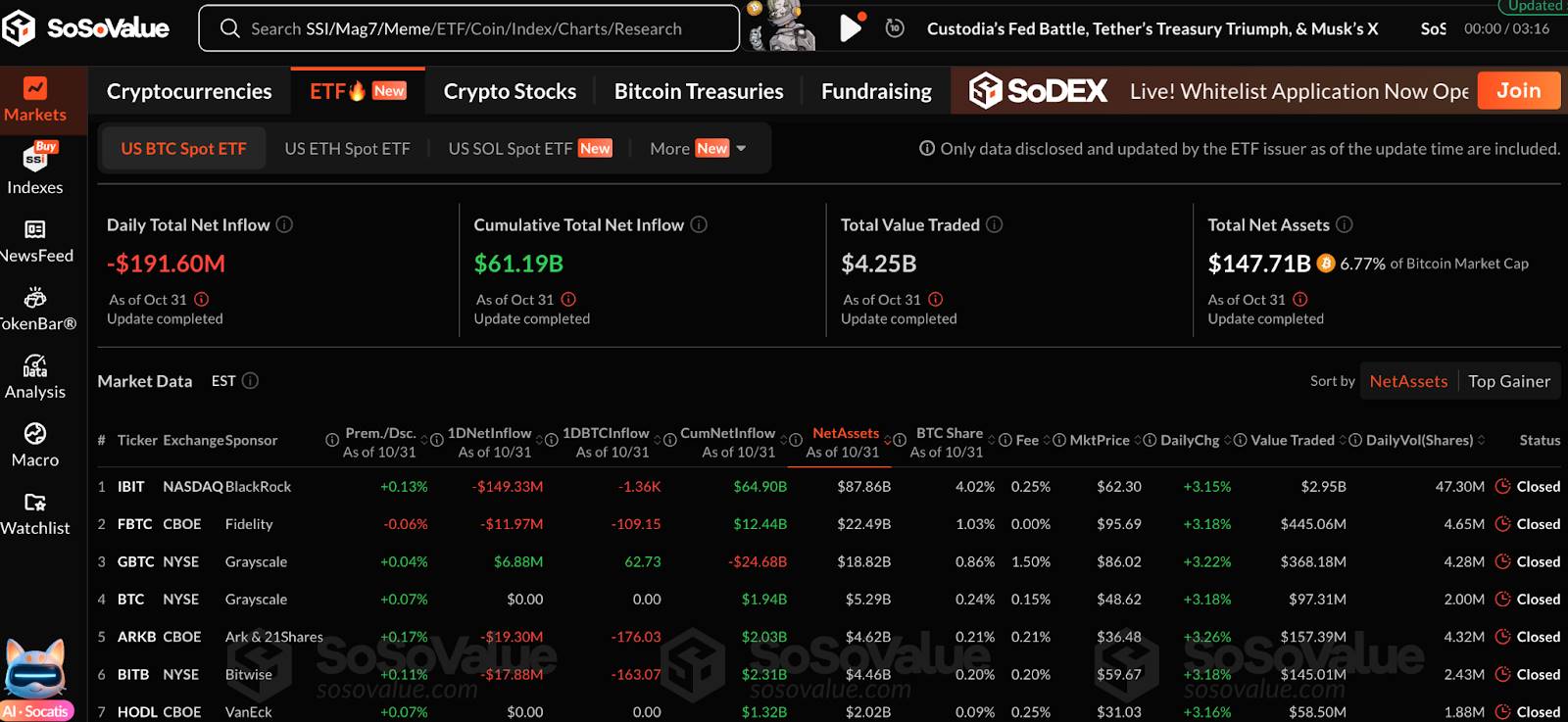

This week, there was a net outflow of $800 million from Bitcoin spot ETFs in the U.S.; while there was a net inflow of $16.4 million into Ethereum spot ETFs.

Market Forecast (November 3 - November 7):

The current RSI index is 46.56 (neutral range), and the fear and greed index is 32 (lower than last week, in the fear range), with the altcoin season index at 43 (lower than last week).

BTC core range: $107,000-112,000

ETH core range: $3,600-4,100

SOL core range: $175-205

This week, the Federal Reserve lowered interest rates by 25 basis points as expected, but Powell maintained a "hawkish" stance on whether to cut rates in December, which has had a certain impact on the market. Some long-term holders took profits, leading to a "buy the expectation, sell the fact" situation. In the future, it is essential to focus on new statements that may influence interest rate decisions and the inflow and outflow status of spot ETFs, as these are core variables for the market. In summary, the market is at a critical technical node, and next week will be a phase of volatility and direction selection.

For long-term investors, the core idea is to ignore short-term noise and focus on long-term value and trends.

For short-term traders, next week will be a critical technical battleground, requiring more flexible and sensitive responses. When the direction is unclear, it is crucial to maintain low leverage or even zero leverage to avoid forced liquidation due to severe fluctuations.

Understanding Now

Review of Major Events of the Week

On October 27, on local time October 26, the China-U.S. economic and trade teams concluded a two-day consultation in Kuala Lumpur, Malaysia. According to Reuters, this is the fifth face-to-face consultation between the China-U.S. economic and trade teams since May this year. After the talks, U.S. Treasury Secretary Basant stated in an interview with U.S. media that after the two-day talks in Kuala Lumpur, both sides reached a "very substantive framework agreement," and the U.S. side "no longer considers" imposing a 100% tariff on China;

On October 27, at the opening on Monday, spot gold gapped down significantly by $40 before rebounding, currently reported at $4,102 per ounce;

On October 26, the U.S. and Thailand issued a joint statement indicating that the U.S. will maintain a 19% tariff on Thailand. Thailand will eliminate tariff barriers on about 99% of goods, covering all U.S. industrial products as well as food and agricultural products;

On October 28, GMGN officially posted on social media stating, "In response to recent false rumors regarding GMGN being hacked, resulting in user fund losses, a comprehensive security audit has been initiated. It is now confirmed that there are no security issues on the platform, and user funds are safe";

On October 28, according to official news, Coinbase's global company, the wholly-owned investment management firm Coinbase Asset Management (CBAM), announced a strategic partnership with asset management giant Apollo (NYSE: APO) to jointly launch a credit strategy based on stablecoins. This move aims to build a bridge connecting stablecoins, private credit, and asset tokenization, seeking quality credit opportunities in the rapidly expanding stablecoin ecosystem;

On October 29, TheBlock reported that Visa will accept payments in four stablecoins across four independent blockchains, which can be converted into two target fiat currencies and can be further converted into over 25 traditional fiat currencies;

On October 30, Reuters cited insiders reporting that OpenAI is preparing for an IPO, with a valuation potentially reaching $1 trillion. Insiders revealed that the company is considering filing with regulators as early as the second half of 2026, with a minimum fundraising amount of $60 billion, and the specific valuation and timing will depend on business growth and market conditions. OpenAI CFO Sarah Friar indicated to some that the company's goal is to go public in 2027;

On October 30, Axios reported that Consensys, the parent company of MetaMask, has hired JPMorgan and Goldman Sachs to lead its initial public offering (IPO). The IPO could take place as early as 2026, but details regarding scale and valuation have not been disclosed;

On October 31, researchers from the Ethereum Foundation officially set a date for its mainnet hard fork (codenamed "Fusaka"). During Thursday's "all core developers" conference call, Ethereum Foundation researchers stated that Fusaka will go live on December 3;

On October 31, CNBC reported that Coinbase's Q3 earnings exceeded expectations, with Q3 net profit rising from $75.5 million (28 cents per share) in the same period last year to $432.6 million ($1.50 per share). Earnings per share exceeded the consensus estimate of $1.10 compiled by the London Stock Exchange Group;

On October 31, Bloomberg reported that Strategy announced its Q3 earnings after U.S. stock market hours, achieving a net profit of $2.8 billion driven by unrealized gains from its approximately $69 billion cryptocurrency holdings.

Macroeconomics

On October 29, the Bank of Canada lowered its benchmark interest rate by 25 basis points to 2.25%, in line with market expectations, marking the second consecutive rate cut;

On October 30, the Federal Reserve FOMC statement announced that it will end the balance sheet reduction on December 1. (Currently reducing $5 billion in U.S. Treasuries and $35 billion in MBS monthly);

On October 30, the Federal Reserve lowered its benchmark interest rate by 25 basis points to 3.75%-4.00%, marking the second consecutive meeting of rate cuts, in line with market expectations;

On October 31, according to the Federal Reserve rate observer, the probability of a 25 basis point rate cut in December is 60.8%.

ETF

According to statistics, from October 27 to October 31, there was a net outflow of $800 million from U.S. Bitcoin spot ETFs; as of October 31, GBTC (Grayscale) had a total outflow of $24.638 billion, currently holding $18.833 billion, while IBIT (BlackRock) currently holds $88.421 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $149 billion.

U.S. Ethereum spot ETFs had a net inflow of $16.4 million.

Envisioning the Future

Event Preview

Bitcoin MENA will be held from December 8 to 9 at the Abu Dhabi National Exhibition Centre (ADNEC);

Solana Breakpoint 2025 will take place from December 11 to 13 in Abu Dhabi.

Project Progress

The first project launched on the YGG Play Launchpad platform is the in-game loyalty and reward token LOL for the game LOL Land, which will officially launch on November 1 and start trading on DEX;

The airdrop claim deadline for Monad is November 3.

Important Events

Nasdaq has applied to the U.S. SEC to add XRP, SOL, ADA, and XLM to the cryptocurrency index, with a final decision expected by November 2;

The trial date for the Bitcoin privacy wallet Samourai Wallet has been set for November 3, 2025.

Token Unlocking

Sui (SUI) will unlock 43.96 million tokens on November 1, valued at approximately $103 million, accounting for 1.21% of the circulating supply;

EigenCloud (EIGEN) will unlock 36.82 million tokens on November 1, valued at approximately $33.99 million, accounting for 12.10% of the circulating supply;

Omni Network (OMNI) will unlock 7.99 million tokens on November 2, valued at approximately $17.34 million, accounting for 30.30% of the circulating supply;

Memecoin (MEME) will unlock 3.45 billion tokens on November 3, valued at approximately $5.23 million, accounting for 5.98% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. We analyze market trends through "Weekly Insights" and "In-Depth Reports"; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening) to identify potential assets and reduce trial and error costs. Each week, our researchers will also interact with you through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。