Compiled by: Felix, PANews

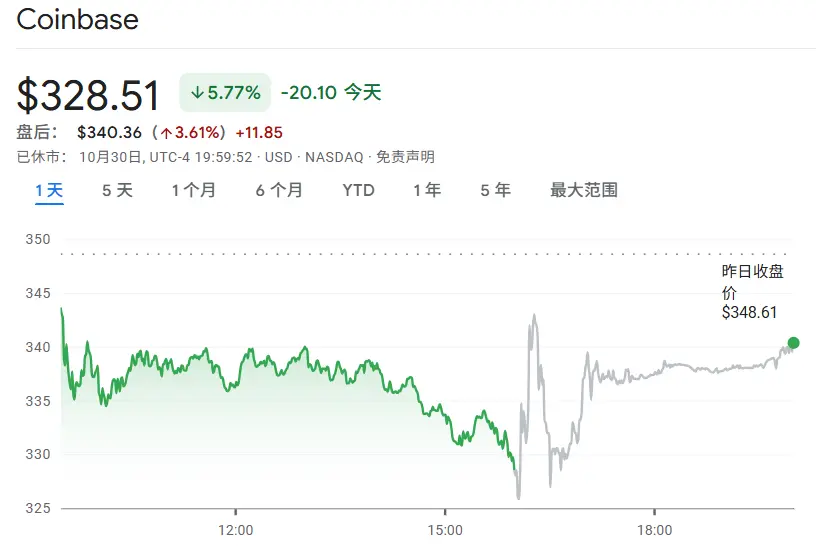

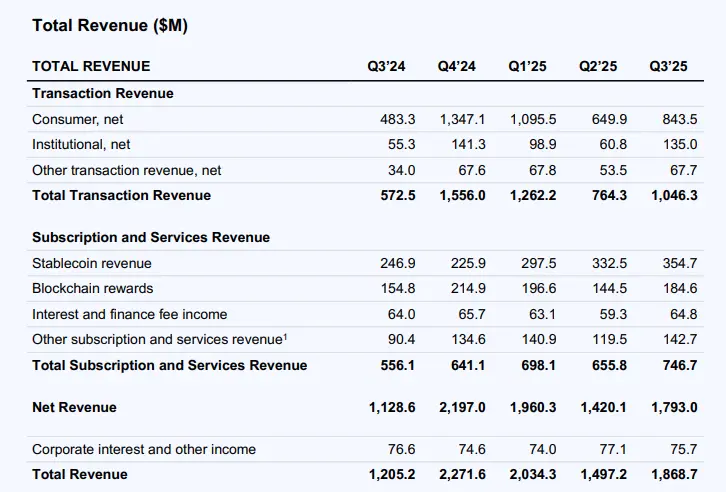

On October 30, local time, the American cryptocurrency exchange Coinbase announced its third-quarter (Q3) financial report, with total revenue of $1.869 billion, a quarter-on-quarter increase of 25% and a year-on-year increase of 58%, surpassing FactSet analysts' expectations of $1.8 billion; net profit was $433 million. Among them, trading revenue reached $1 billion, a quarter-on-quarter increase of 37%; trading volume also rose from $185 billion in the same period last year to $295 billion, showing quarter-on-quarter growth.

Coinbase's revenue growth is mainly attributed to a surge in trading activity, a rebound in asset prices, and the continued growth of its subscription and services business. As a result of this news, Coinbase (COIN) stock price rose by 3.61% in after-hours trading.

Trading Remains the Main Source of Revenue, but Has Significantly Declined Since the Beginning of the Year

As of September 30, Coinbase's revenue increased from $1.21 billion in the same period last year to $1.869 billion. Net profit rose from $75.5 million (equivalent to $0.28 per share) in the same period last year to $432.6 million (equivalent to $1.5 per share). This earnings report exceeded the London Stock Exchange Group's (LSEG) previously announced consensus expectation of $1.1 per share.

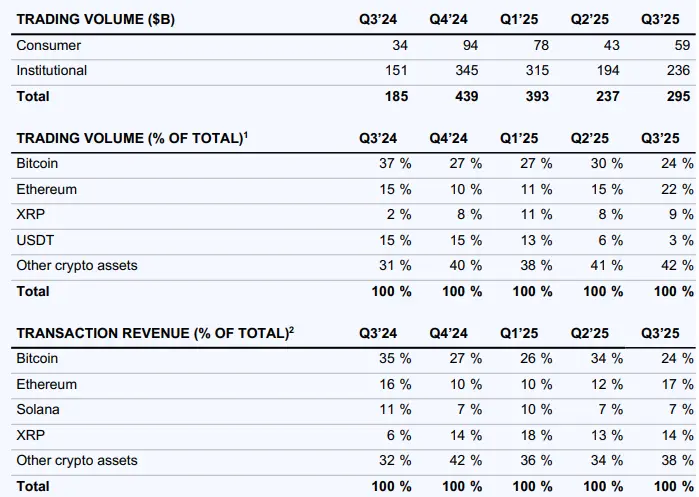

Coinbase's financial report shows that trading remains its primary source of revenue. Coinbase's total trading revenue for Q3 was $1 billion, a quarter-on-quarter increase of 37%. Total trading volume was $295 billion, a quarter-on-quarter increase of 24%.

It is noteworthy that the $1 billion in trading revenue is still far below the peak at the beginning of the year. Q4 trading revenue for 2024 is projected to be $1.6 billion, while Q1 2025 is expected to be $1.3 billion. This trend indicates that despite the rise in Bitcoin prices and increased market activity, trading volume is still insufficient to support significant revenue growth for Coinbase.

In terms of retail trading, the trading volume was $59 billion, a quarter-on-quarter increase of 37%, better than the U.S. spot market; trading revenue was $844 million, a quarter-on-quarter increase of 30%. Coinbase attributes this to retail investors chasing meme coins and other speculative assets.

In terms of institutional trading, the trading volume was $236 billion, a quarter-on-quarter increase of 22%; trading revenue was $135 million, a quarter-on-quarter increase of 122%. The revenue growth was driven by multiple factors, the most significant being the acquisition of the derivatives exchange Deribit completed on August 14, which contributed $52 million in revenue during the 47 days Coinbase held Deribit.

In asset trading, Ethereum's trading activity significantly increased in Q3, with ETH trading volume accounting for 22% of total trading volume, up from 15% in the previous quarter. Revenue from Ethereum trading also rose from 12% to 17%. Although BTC trading volume and revenue remain the highest, its share of overall trading volume and revenue has decreased due to the expanding market share of ETH.

Stablecoins Account for Half of Subscription and Service Revenue

Q3 subscription and service revenue was $747 million, a quarter-on-quarter increase of 14%. Among this, stablecoin revenue was $355 million, a quarter-on-quarter increase of 7%, accounting for about half of all subscription and service revenue. The average balance of USDC held in Coinbase products increased by 9% quarter-on-quarter to $15 billion. Meanwhile, the average balance of USDC outside the platform increased by 12% quarter-on-quarter to $53 billion.

Other subscription and service revenue was $143 million, a quarter-on-quarter increase of 19%, mainly driven by revenue sharing from ecosystem partners and custody fee income, with the scale of custody assets growing to $30 billion, setting a new record.

Q3 other trading revenue reached $68 million, a quarter-on-quarter increase of 26%. The L2 public chain Base supported by Coinbase is a major component of "other trading revenue," with this growth primarily benefiting from the rise in average ETH prices and increased trading volume, although the average revenue per transaction decreased due to network scaling, partially offsetting the gains. Coinbase emphasized in its letter that Base remains a leading L2 network, excelling in speed, scalability, and cost efficiency.

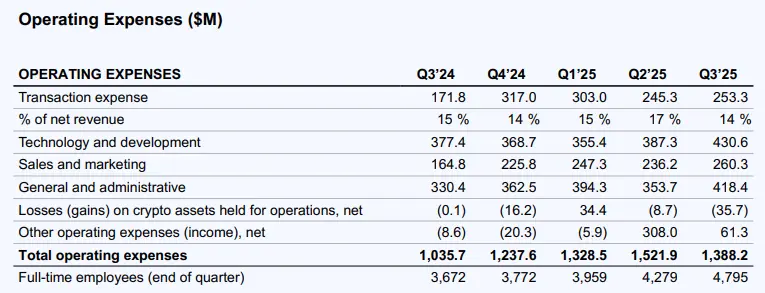

Employee Count Reaches 4,795, Q3 User Reward Spending at $250 Million

Total operating expenses in Q3 decreased by $134 million quarter-on-quarter, a decline of 9%, to $1.388 billion. Among them, trading expenses were $253 million, a quarter-on-quarter increase of 3%, mainly driven by increased blockchain reward costs (due to the rise in token prices in Q3) and increased customer trading activity.

Technical and development expenses were $431 million, a quarter-on-quarter increase of 11%, mainly driven by an increase in the number of employees, with the full-time employee count increasing by 12% quarter-on-quarter to 4,795, including employees from Deribit.

General and administrative expenses were $418 million, a quarter-on-quarter increase of 18%. Sales and marketing expenses were $260 million, a quarter-on-quarter increase of 10%. The two main drivers of growth were certain amortization costs related to the acquisition of Deribit and higher USDC rewards.

Other operating expenses were $61 million, a quarter-on-quarter decrease of 80%. This includes $48 million related to a theft incident disclosed in May. Equity incentive expenses were $222 million, a quarter-on-quarter increase of 13%.

In summary, Coinbase's Q3 net profit was $433 million. Adjusted net profit was $421 million, and adjusted EBITDA was $801 million. After deducting $7.2 billion in long-term debt, Coinbase has $4.7 billion in assets.

Coinbase increased its Bitcoin holdings by $299 million in Q3, adding 2,772 BTC. Coinbase CEO Brian Armstrong tweeted: “Coinbase will hold Bitcoin for the long term. We will continue to increase our holdings in the future.”

Details on Predictive Markets and Tokenized Stocks to be Announced

Additionally, according to Bloomberg, Brian Armstrong stated during the conference call that Coinbase plans to hold a product showcase on December 17, where more details on tokenized stocks and predictive markets will be announced. The company will continue to focus on merger and acquisition opportunities, especially in the trading and payment sectors.

Regarding performance in the next quarter, Coinbase stated in a letter to shareholders that it expects trading revenue for October to be approximately $385 million. Q4 subscription and service revenue is expected to be between $710 million and $790 million. The expectations for Q4 are driven by the market capitalization of USDC (which reached an all-time high in October) and the growth of the Coinbase One user base.

In terms of expenses, Coinbase expects technical and development as well as general and administrative expenses to be between $925 million and $975 million. The quarter-on-quarter increase of about 50% is due to Coinbase's acquisition of Deribit and Echo, as well as an increase in the number of employees, with the growth rate of employee count in Q4 expected to be lower than in Q3. Sales and marketing expenses are expected to be between $215 million and $315 million.

Coinbase previously outlined its vision of being a "Universal Exchange" and increased the number of tradable spot assets in Q3 while expanding its derivatives products. Coinbase added trading functionality for over 40,000 assets through DEX integration on the Base platform. The Coinbase platform currently covers approximately 90% of the total market capitalization of cryptocurrency assets. With the launch of U.S. perpetual contracts and around-the-clock futures trading, as well as the acquisition of Deribit, Coinbase's derivatives business has reached historic highs in multiple markets, including U.S. cryptocurrency futures and global cryptocurrency options. In Q4, Coinbase will continue to focus on launching innovative products and building the infrastructure for the "Universal Exchange."

Related articles: Coinbase's Ecological "Testbed": How to Ambush the BASE Ecosystem with Based APP and x402's Frequent Moves?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。