Crypto Market Update Today: Coinbase Q3 Profit $433M & Strategy $2.8B

Overall Crypto Market Update:

-

The global cryptocurrency market cap stands at $3.76 trillion, showing 2% fall in the last 24 hours.

-

Daily trading volume reached $193B

-

Bitcoin remains the leader with a 58.2% dominance, while Ethereum holds a 12.3% share.

-

A total of 19,393 cryptocurrencies are currently being tracked.

-

The largest gainers of the industry are Privacy and the XRP Ledger Ecosystem.

Major Crypto Events Today

Source: Forex Factory

24 Hour Crypto Market Update

Bitcoin (BTC) and Ethereum (ETH) Price:

-

Bitcoin price today: $109534, Down: 0.9%, Trading Volume: $74 billion, Market Cap: $2.1 trillion in the last 24 Hours. BTC still continues to dominate cryptocurrency globally.

-

Ethereum price today: $3841, Down: 2%, Trading Volume: $37.5 billion, Market Cap: $463 billion in the last 24 hours

Top 5 Trending Coins in 24 Hours

-

BlockchainFX (BFX) Price: $0.03787, down 42.9%, TV: $10.38M.

-

Bitcoin (BTC) Price: $109,650, up 1.0%, TV: $74.56B.

-

Aster (ASTER) Price: $0.9361, down 8.3%, TV: $729.55M.

-

Solana (SOL) Price: $186.21, down 4.3%, TV: $8.68B.

-

Aerodrome Finance (AERO) Price: $1.08, up 6.5%, TV: $185.16M.

Top 3 Gainers:

-

Jelly-My-Jelly (JELLYJELLY) Price: $0.1596, TV: $120.02M, surged 39.3%.

-

Aurora (AURORA) Price: $0.09724, TV: $46.29M, gained 38.8%.

-

Impossible Finance Launchpad (IDIA) Price: $0.05261, TV: $0.42M, up 38.2%.

Top 3 Losers:

-

Figure Heloc (FIGR_HELOC) Price: $0.234, fell: 76.6%, TV: $28.77M.

-

ChainOpera AI (COAI) Price: $1.93, decrease: 41.5%, TV: $74.88M.

-

Niza Global (NIZA) Price: $0.05268, dips: 32.4%, TV: $0.84M.

Stablecoins and Defi Update:

-

Stablecoins hold a market cap of $311 billion with $148 billion in trading volume, representing 0.3% negative change.

-

The DeFi market cap stands at $137 billion, down 3.4% in the last 24 hours, with a trading volume of $10 billion. DeFi dominance remains at 3.7%.

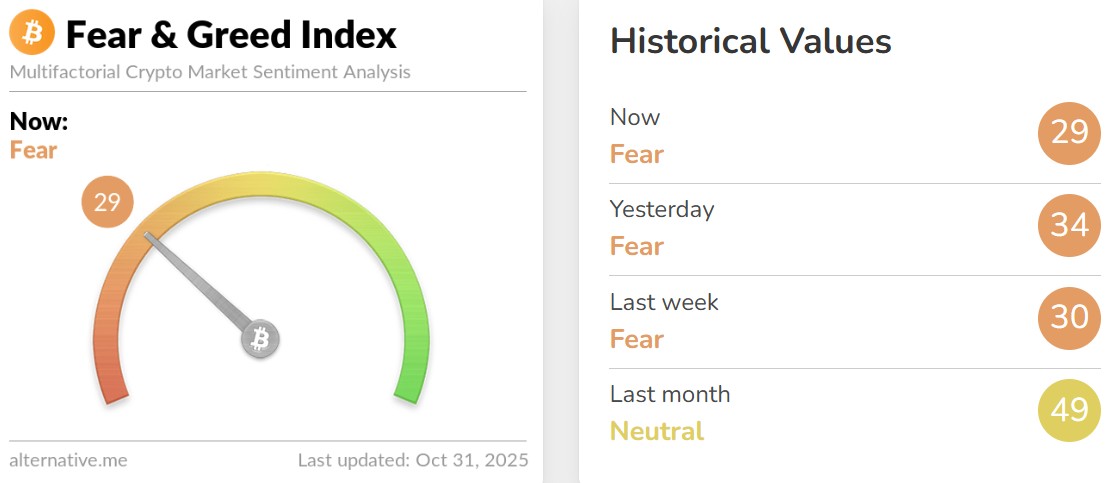

Fear and Greed Index Today

Source: Alternative Me

The Fear & Greed Index has dropped to 29, signaling strong market fear. This decline reflects investor caution amid recent Bitcoin volatility, macroeconomic uncertainty, and weak liquidity.

Concerns over the Fed rate cut , profit-taking by large holders, and slowing retail participation have deepened bearish sentiment. Regulatory risks and global trade tensions also weigh on confidence.

Historically, such fear often marks accumulation phases, as long-term investors buy while short-term traders react to uncertainty.

Latest Market News Today

Michael Saylor’s Microstrategy Q3 Report: Strategy Inc. reported a Q3 profit of $2.8 billion, or $8.42 per share, thanks to gains from its $69 billion Bitcoin holdings. Despite this, shares remain 45% below their 2024 peak. The firm plans to issue credit securities overseas.

Coinbase Q3 Report: Coinbase reported a strong Q3 2025 profit of $433 million ($1.50 per share), up from $75.5 million last year. The surge came as crypto market volatility boosted trading volumes, lifting transaction revenue to $1.05 billion.

Garden Finance Hacked: Blockchain sleuth ZachXBT reported that Garden Finance hacked for over $5.5 million. The team offered the hacker a 10% bounty to return the funds, with links found to Bybit and Swissborg incidents.

Japan’s New Regulation Restricts Bybit: Bybit will stop accepting new users in Japan from October 31 to follow local regulations and protect investors. Existing users can continue using the platform, but more restrictions may come. Japan’s regulator had warned Bybit in 2021 and 2023.

Japan Bank Interest Rates: The Bank of Japan kept interest rates unchanged at 0.5% but hinted at a possible hike in December. Governor Kazuo Ueda said the decision depends on wage growth data, even as some board members pushed for earlier action.

dYdX Plans: Decentralized exchange dYdX plans to enter the U.S. market by year-end, starting with spot trading for Solana and other cryptos. Perpetual contracts won’t launch yet. President Eddie Zhang said trading fees will drop to 0.5–0.65%.

Avalon Labs Whitepaper Released: Avalon Labs has released a whitepaper introducing the first on-chain AI-powered RWA marketplace and AI-Model-as-a-Service (AI-MaaS) on BNB Chain. The project features a Reinforcement Learning model and a new Commercial Rights Tokenization (CRT) standard, backed by YZi Labs and Framework Ventures.

About x402: A new crypto payment standard called x402 has launched in 2025, enabling AI agents and software to make instant, automated micropayments using stablecoins. Backed by Cloudflare, Google, and Visa, x402 could power a machine-driven internet economy.

Nordea Bitcoin Investment: Nordea, the biggest bank in the Nordic region, will let customers invest in Bitcoin-linked synthetic ETPs from CoinShares starting December 2025. The bank will only offer trading services, not investment advice, showing Europe’s growing crypto maturity.

Crypto is Real: JP Morgan CEO Jamie Dimon has admitted he was wrong about cryptocurrencies, saying crypto is “real.” Dimon, who was once a strong critic of Bitcoin, now acknowledges the growing role of digital assets in global finance.

Trump Xi Meeting News : US President Trump said his meeting with China’s President Xi was successful, with deals for China to buy more US farm goods and energy, keep mineral supplies steady, and work together to stop fentanyl smuggling.

CoinGabbar’s Opinion

Given the current Fear & Greed Index at 29 and a 2% market decline, the cryptocurrency is in a fear phase, signaling caution but also long-term accumulation potential.

Investors may avoid aggressive entries now and instead gradually accumulate strong assets like Bitcoin, Ethereum, or Solana on dips. Avoid highly volatile or newly hacked projects. Focus on blue-chip cryptos and regulated exchanges while waiting for clearer recovery signals.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。