Bitcoin Ethereum ETF Outflows Spike as QT Ends and Traders Fear Crash

When the Fed rate cut 25bps news surfaced in the crypto market after yesterday’s FOMC meeting and confirmed the end of Quantitative Tightening (QT) on December 1st, most investors expected a surge across digital assets.

But instead, the crypto market crashed around 3% in the last 24 hours and was hit by rock of Bitcoin Ethereum ETF outflows with massive crypto liquidations. Enough to share the entire industry right? Let’s dive into how it happened and what now?

Massive Bitcoin Ethereum ETF Outflows Shake Market Confidence

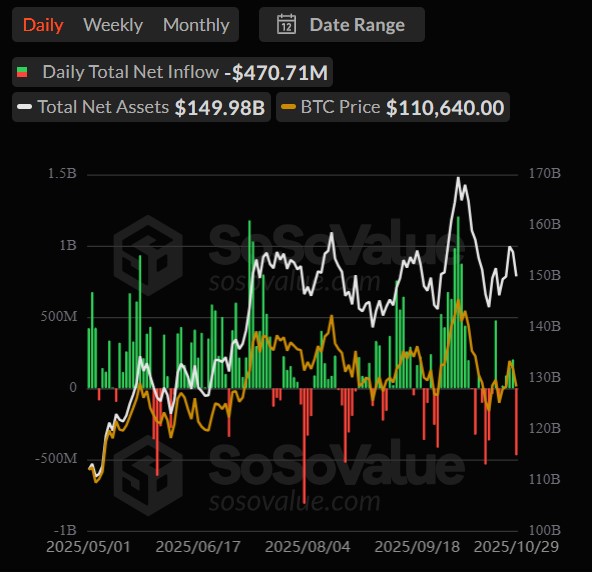

According to SoSo Value data , on October 29 (ET), a total Bitcoin ETF outflows of all the 12 institutions hit $471 million, with zero inflows across the board.

At the same time, ETH ETF outflows recorded $81.44 million, with only BlackRock’s ETHA posting a positive inflow.

This sudden trend reversal marks the biggest Bitcoin Ethereum ETF outflows in months, signaling that even institutions are now moving to the sidelines fearing deeper crash.

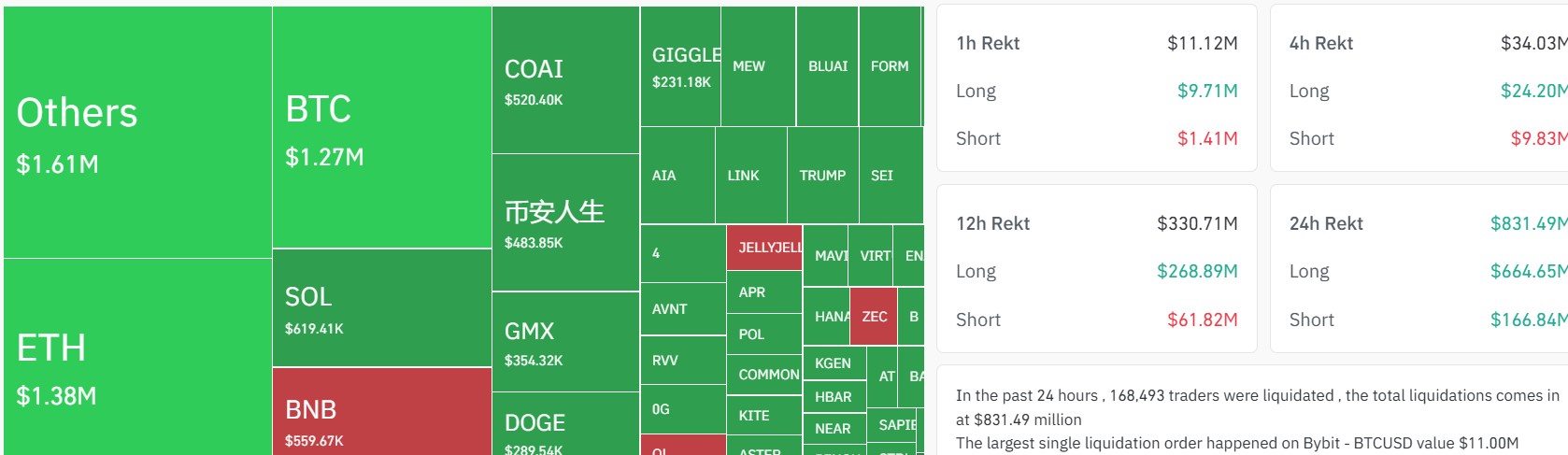

As the Fed rate cut news impact was very immediate , the picture doesn't get over here. Within 24 hours, 168,489 traders were liquidated, totaling $831.31 million in losses. As per Coinglass data , The largest single liquidation occurred on Bybit’s BTCUSD pair, a staggering $11 million order.

As a result both of the top cryptocurrencies' prices crashed hard, adding to fears of a deeper crypto crash ahead.

Why the Rate Cut Backfired? BTC Crash + Ethereum Price Crash

Despite the federal reserve rate cut announcement being widely anticipated, investors quickly realized that the tone from Chair Jerome Powell wasn’t as dovish as hoped.

At the time of writing BTC price is trading at $110,029.00, reflecting a decrease of around 3% in the last 24 hours. Earlier today Bitcoin price crashed to $108K, so this slight recovery shows that digital gold did not lose the investor confidence, and the asset might recover if any positive btc news surfaces in the market.

Meanwhile Ethereum price crashed near 3.24% in the last 24 hours, currently the asset is trading at $3,889. However its trading volume is still reflecting a 6% increase, which is a good sign for the asset.

Here’s why it rattled the crypto market:

-

Powell’s warning of a possible pause: He cast doubt on another rate cut in December, cooling investor optimism.

-

Buy the rumor, sell the news: Markets had already priced in the cut; traders simply booked profits after the announcement resulting in Bitcoin Ethereum ETF outflows surge .

-

Liquidity illusion: Even with the Fed set to print $1.5 trillion post-cut, investors fear this crash won’t flow into risk assets, and might go into Gold and Silver.

These factors combined to trigger both the tokens price crash, along with answering why ETH and BTC ETF outflows surged.

Conclusion: What More Ahead?

The chain reaction was brutal. After the 25bps cut announcement, in just one day, we saw over $552 million in Bitcoin Ethereum ETF outflows, and the only hope for the reversal is Fed's plan to $1.5 Trillion liquidity after October.

As per my analysis being a crypto expert, for now, the only certainty is volatility and massive funds exit from both the tokens have become a new pulse of checking market sentiment.

The market isn’t reacting to the rate cut itself, it’s reacting to what the Fed didn’t say: no clear promise of more cuts ahead. So, is this a long term fall or the start of a new bull run? The next few weeks could decide the future of crypto.

Disclaimer: This article is for informational purposes only, so always take experts advice and DYOR before investing in any cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。