Author: Haley H. (Investment Director of YZi Labs), Ella Z. (Head of YZi Labs)

Compiled by: Jiahua, ChainCatcher

Executive Summary

BNB (Build N Build) is the native token of BNB Chain, a public blockchain that is becoming a key infrastructure for the future global Web3 world. Compared to ETH (as DeFi infrastructure) or BTC (as a store of value), BNB is positioned to be an efficient trading engine for the global Web3 economy.

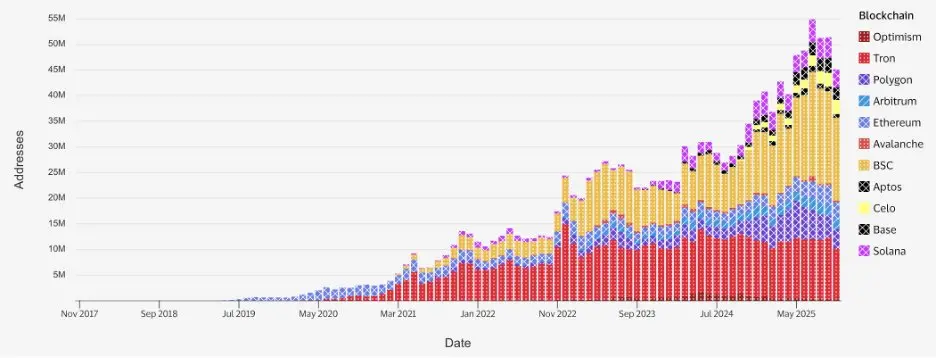

It is a top-tier token with a deflationary mechanism and design. With a fully circulating supply and decentralized on-chain ownership (approximately 67% held by the public; about 27% to be burned; CZ holds 1%, data source in the text), BNB is expected to significantly reduce unlocking and centralization risks, thereby enhancing institutional trust.

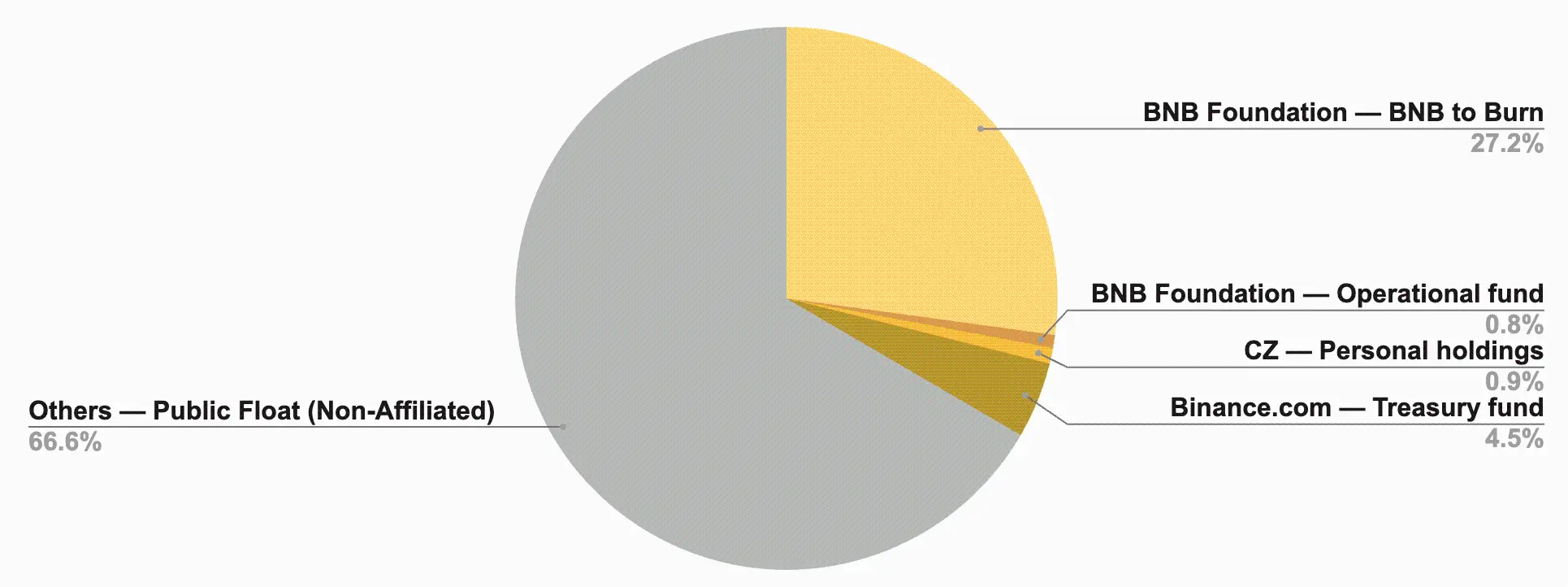

According to data from Dune and Nansen, the BNB Chain ecosystem ranks first in DEX trading volume, active users, and active stablecoin wallet addresses, covering multiple areas such as DeFi, AI, Meme, RWA, and consumer applications. BNB allows users to access a wide range of on-chain ecosystems across various fields through a single token.

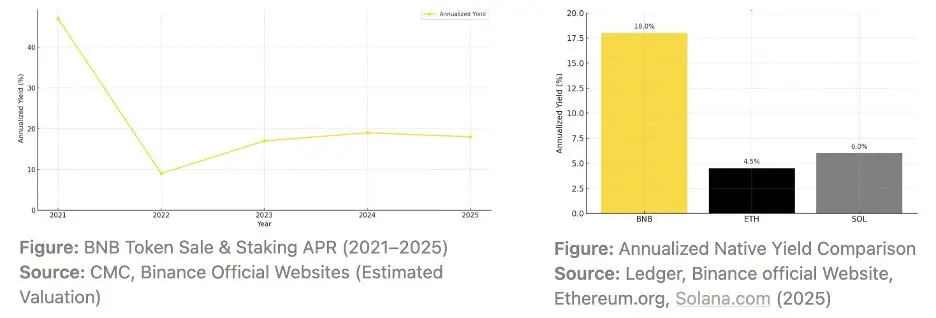

Crucially, BNB is considered the only token that may provide users with comprehensive exposure to Web3 asset issuance and distribution (historical native holding yield of approximately 15-20%). It essentially covers key Web3 assets and domains at all levels: from blue-chip stocks listed on exchanges to mid-cap narrative assets, and emerging long-tail tokens on BNB Chain. BNB enables users to directly participate in the growth and value of the entire crypto technology stack, seamlessly connecting CeFi and DeFi.

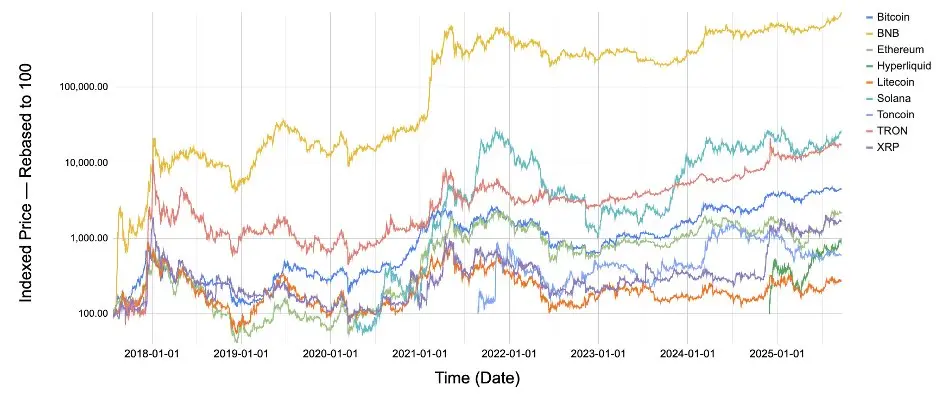

Among Layer-1 tokens supporting Digital Asset Trusts (DAT), BNB has demonstrated very strong and cyclically validated performance, with annualized price increases reaching approximately 113%, surpassing ETH, BTC, and SOL (data source in the text). For institutional portfolios, BNB is expected to provide structural decoupling and asymmetric upside potential. It can enhance diversification and improve risk-adjusted value returns in multi-asset strategies.

So far, the limited investment market for BNB in the U.S. is beginning to change: the BNB digital asset trust/ETF channel and listings on mainstream exchanges, including Robinhood/Coinbase, have been launched. Diversified BNB-priced financial products, such as BNB digital asset trusts, ETFs, and dividend funds, will further help BNB unlock liquidity from traditional finance (TradFi) and expand its financial functionality. Additionally, the recent amnesty obtained by CZ has sent a strong and positive signal to the market, providing a unique opportunity window for BNB to expand its popularity and adoption in North America and globally.

Table of Contents

- Overview of BNB

- BNB Token Economic Model

- Growth Story

- One of the Strongest Structural Performances in History

- Strategic Highlights

- Conclusion: BNB's Positioning as an Efficient Trading Engine for the Global Web3 Economy

1. Overview of BNB

1.1 Introduction to BNB

BNB is the native token of BNB Chain, serving as the core utility and governance token of the chain. Launched in 2017, BNB has evolved into a highly utilitarian, deflationary token widely used across various Web3 applications—from paying gas fees on BNB Smart Chain to validator staking and participating in on-chain governance.

In addition to BNB Chain itself, BNB is also adopted by other platforms as a utility token. For example, on Binance Exchange, users holding BNB can enjoy trading fee discounts and participate in token issuance projects such as Launchpool and Megadrop. These off-chain use cases combined with on-chain applications reflect BNB's role as a multi-scenario Web3 token that spans decentralized and centralized ecosystems, increasingly enhancing its significance.

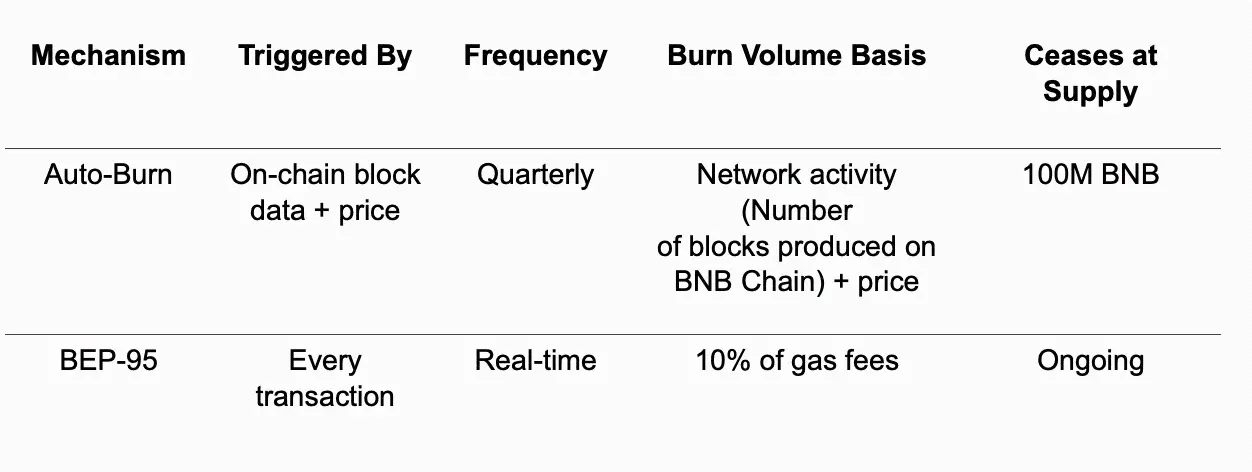

The token design of BNB includes a dual burn mechanism, comprising a programmatic automatic burn (based on on-chain activity and price) and a real-time BEP-95 burn (burning a portion of gas fees). These mechanisms are designed to continuously and systematically reduce the supply of BNB, helping to align supply with network usage. Each transaction on BNB Chain contributes to the sustainability of the network by proportionally adjusting the supply based on actual economic activity, aiming to maintain a balance between usage, capacity, and token demand.

This design aims to ensure that as the usage of BNB Chain grows, the token supply will adjust accordingly (up to a fixed cap of 100 million BNB). Currently, approximately 139 million BNB tokens are fully circulating in the market, and to date, over 62 million BNB have been removed through burns as the supply contracts towards its cap. This transparent and predictable deflationary model enhances confidence in BNB's long-term role in the ecosystem.

1.2 Utility of BNB

BNB as a Layer-1 Native Token

BNB is the inherent digital asset of BNB Chain, powering the chain on multiple levels. It is used as gas fees for transactions and as collateral for validator staking to secure the network. Holders can delegate BNB to validators and earn protocol rewards as a return for helping to secure the chain. BNB also supports on-chain governance, allowing stakers to vote on protocol upgrades and important ecosystem proposals.

It natively operates on BNB Chain, a high-performance, EVM-compatible blockchain that is currently expanding into a complete three-chain architecture:

- BNB Smart Chain (L1) – the main execution layer

- opBNB (L2) – optimized for ultra-fast transactions of dApps

- BNB Greenfield – decentralized storage powering new Web3 native applications

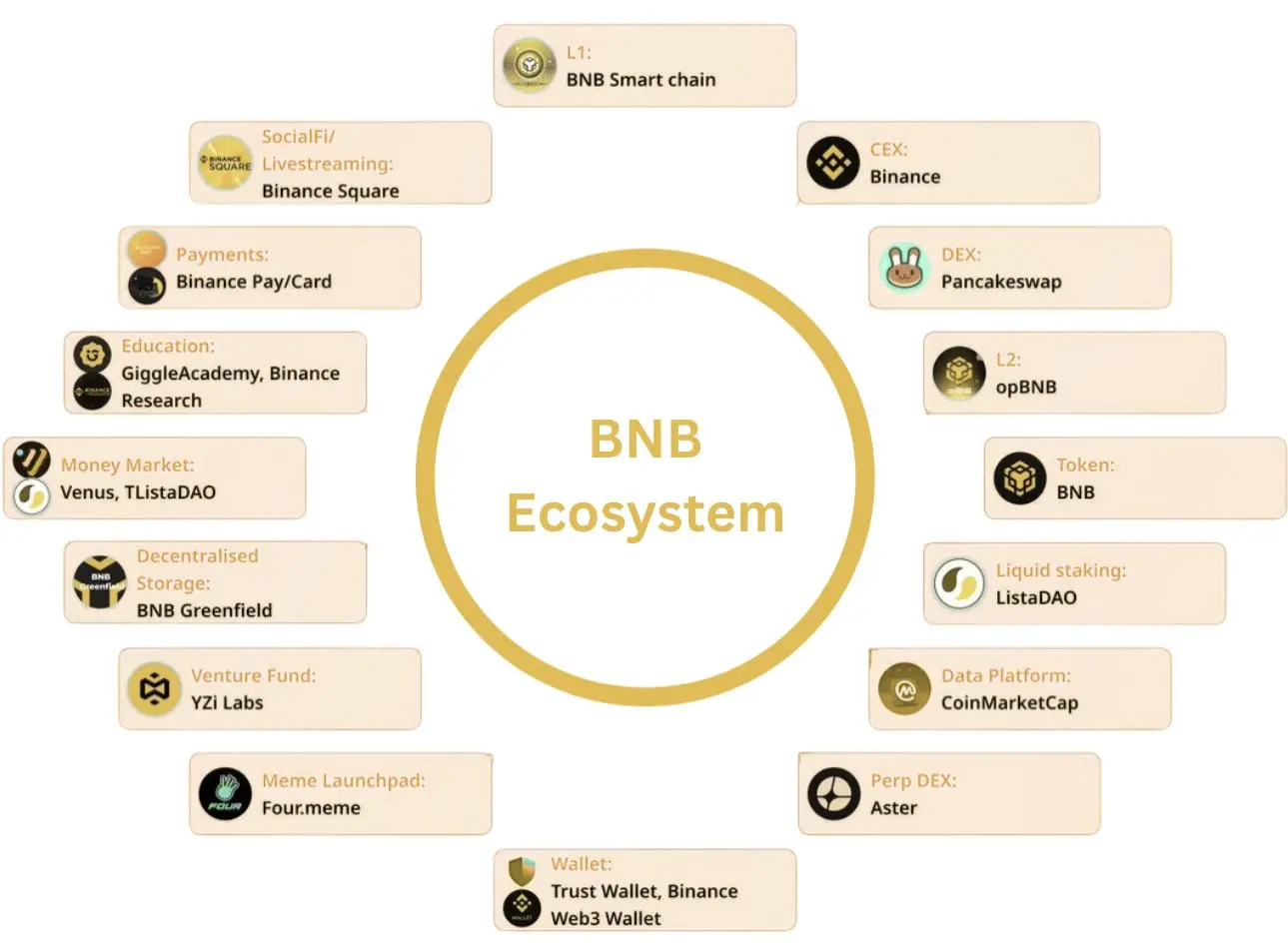

Image 1: The rich ecosystem of BNB and its industry-leading performance

BNB is deeply integrated into the DeFi ecosystem of BNB Chain, actively used as collateral, liquidity, and governance rights in protocols such as Aster (perpetual contract DEX), Venus (lending), PancakeSwap (DEX), and Lista DAO (liquid staking/BNBFi). According to data from DeFiLlama, as of October 29, 2025, the total value locked (TVL) supported by the DeFi ecosystem on BNB Chain is approximately $16.2 billion. According to data from bnbchain.org, about 26 million BNB tokens are staked on-chain, accounting for approximately 19% of the total supply. These use cases highlight the dual nature of BNB: it is both the fuel infrastructure of the network and a valuable asset in the dApp and the growing modular Web3 tech stack.

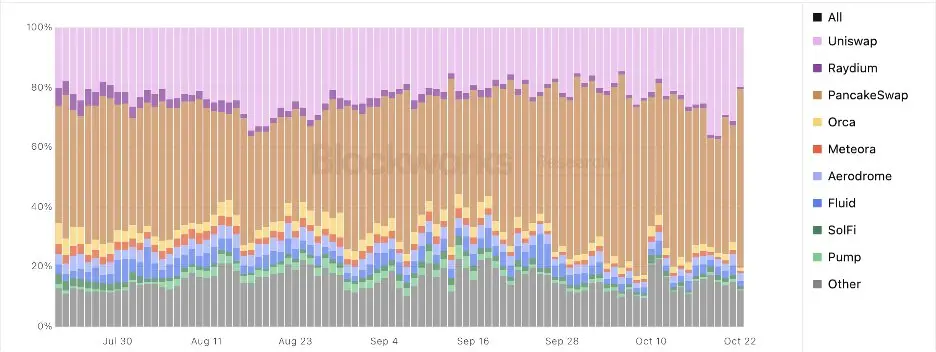

Overall, DEXs on BNB Chain are leading the decentralized trading space—especially PancakeSwap—further highlighting BNB's dominant position in on-chain liquidity and the development of its ecosystem.

Image 2: According to Blockworks Research data, BNB Chain's DEX spot market share is the largest among all DEXs

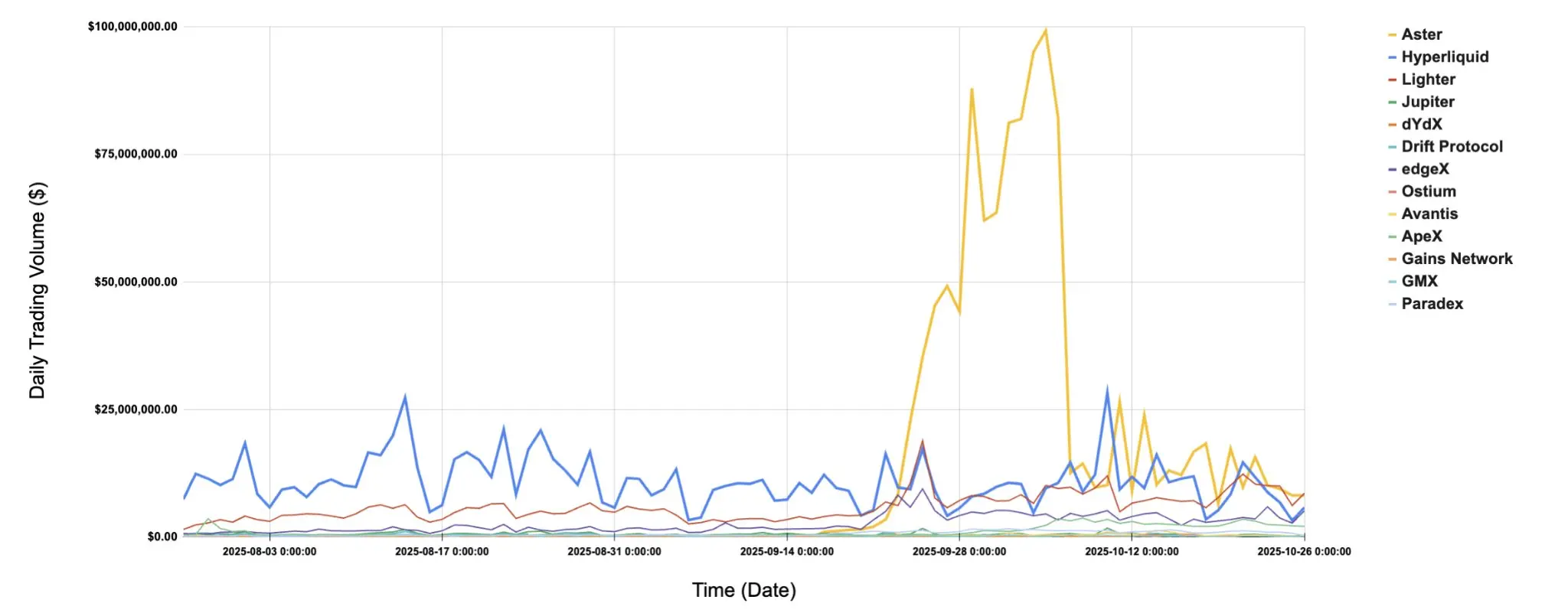

Image 3: Aster's on-chain perpetual contracts significantly lead Hyperliquid, driving breakthroughs for BNB Chain

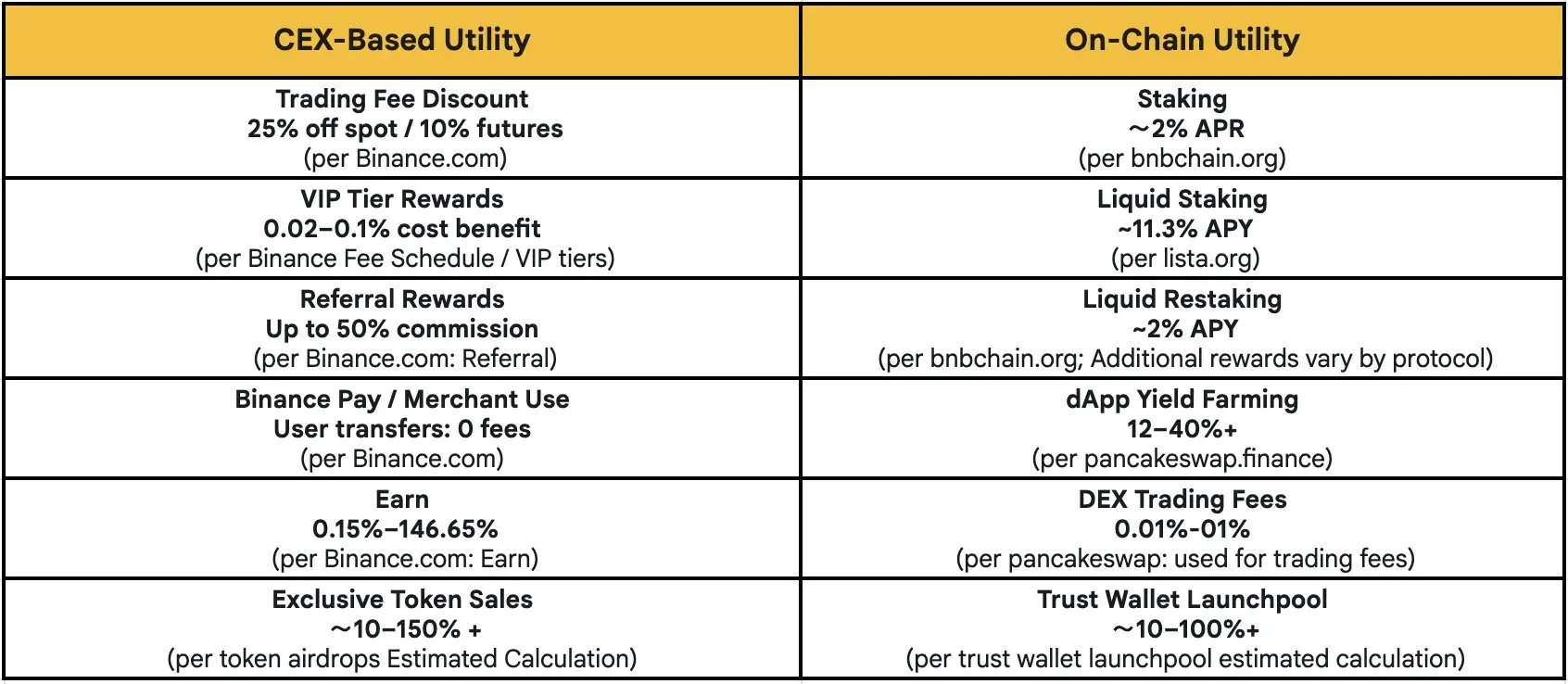

BNB as a Utility Token: Platform Token with Loyalty Programs

The utility of BNB extends to serving as a loyalty token within a broader ecosystem. Simply holding BNB can qualify users for participation in special programs and benefits. For example, BNB holders are eligible to participate in new token issuances through Launchpool, receive airdrops through programs like Megadrop and HODLer, and enjoy other community rewards such as Binance Alpha. These community member benefits encourage participants to hold tokens long-term and engage on the platform.

Holders will gain exclusive access to new token issuances, various token giveaways, substantial trading discounts, and other benefits, distinguishing BNB from typical single or even dual-use tokens.

Image 4: Overview of BNB Utility

1.3 Industry Landscape

Layer-1 Landscape

The extensive integration of BNB—from DEXs like PancakeSwap to RWA tokenization projects—demonstrates its entrenched role as infrastructure, powering on-chain finance and off-chain enterprise collaboration. The breadth of this ecosystem makes BNB one of the most operationally relevant tokens in the market—crucial for any Digital Asset Trust (DAT) aiming to participate in the entire Web3 economy.

BNB Chain is considered one of the most powerful Layer-1 blockchains by 2025, leading in user engagement and network activity. Its growth reflects a strong combination of retail adoption, developer momentum, and ecosystem depth. Compared to peers like Ethereum, Solana, Base, AVAX, SUI, and Aptos, we believe BNB Chain demonstrates relative advantages in scalability and user stickiness, showcasing its strategic value in the broader Web3 ecosystem.

Key Highlights of BNB Chain (October 2025):

- Ranked first in daily active addresses (peaked at 3.4 million on October 13)

- Ranked first in daily DEX trading volume (approximately $19 billion/day, accounting for about 61.25% market share)

- Fastest growing active addresses among all L1s (approximately 300% growth by 2025)

- Most active independent stablecoin wallet addresses (approximately 20 million)

(Data source: BscScan, Dune, DefiLlama, Blockworks Research, Visa, Nansen)

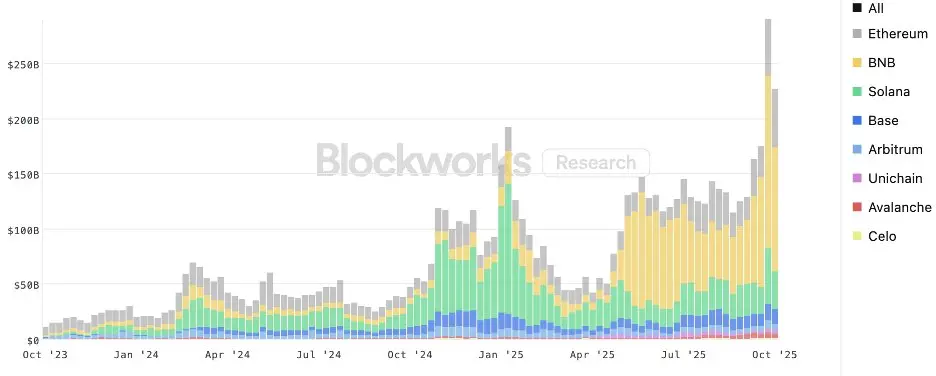

Image 5: BNB Chain DEX trading volume hits a new high, currently leading other chains with weekly trading volume peaking over $156 billion

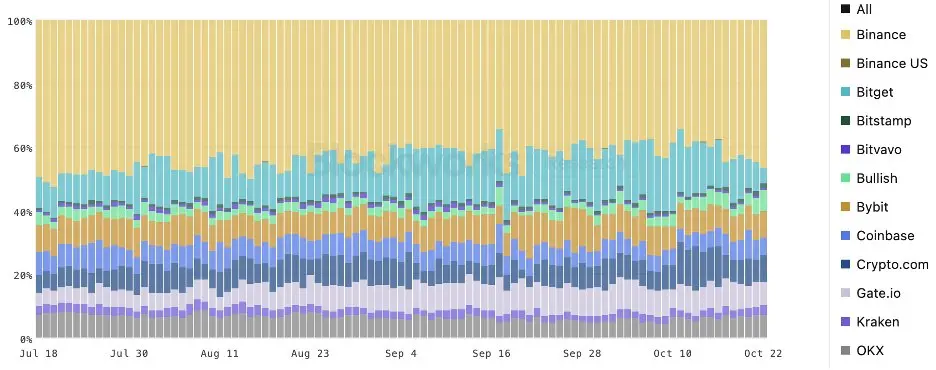

CEX Landscape

The inbound traffic to cryptocurrency exchanges represents a strategic high ground for the Web3 ecosystem and is the primary gateway for new users entering the digital asset ecosystem. Reports indicate that Binance's CEX accounts for about 55% of the inbound traffic, becoming the first touchpoint for most global cryptocurrency participants. At the center of this traffic is BNB, which has historically converted user engagement into an asset engine—transforming initial inbound traffic into sustained liquidity, network effects, and platform value capture by offering trading fee discounts, early Launchpad participation eligibility, and ecosystem rewards.

This design is strategically significant. At the exchange level, inbound traffic is the inflow of demand into the Web3 ecosystem. Linking network usage with a native token that has clear utility and governance functions allows network throughput and token utility to expand together, combining adoption incentives with market participation.

Image 6: Binance holds about 50% of the CEX spot market share, poised to become a major gateway for Web3

2. BNB Token Economic Model

BNB is programmatically self-balancing. It operates under a programmatically set cap of 100 million tokens, managed by two complementary mechanisms—Auto-Burn and BEP-95—that reduce circulating supply quarterly and in real-time based on activity and value flow.

These two mechanisms have permanently destroyed over 64 million BNB, accounting for more than 31.8% of the historical supply. Based on a BNB price of approximately $1,115 on October 26, 2025, this means that BNB worth about $72 billion has been destroyed. The model is designed to be mechanically deflationary, serving as a supply adjustment system that directly links token issuance with on-chain activity. As usage increases, the protocol automatically reduces the available supply—creating a feedback loop that stabilizes value and curbs excessive token velocity.

This structure transforms activity into balance: the more it is used, the more self-correcting its monetary base becomes. When usage and price rise, more BNB is destroyed, and supply contracts; when activity declines, the burn rate decreases, and supply stabilizes. This design principle makes BNB's supply model a stable mechanism aimed at achieving long-term equilibrium.

Image 7: BNB's value balancing mechanism has removed over 30% of the total supply to date—accumulated destruction of approximately $73.56 billion worth of BNB

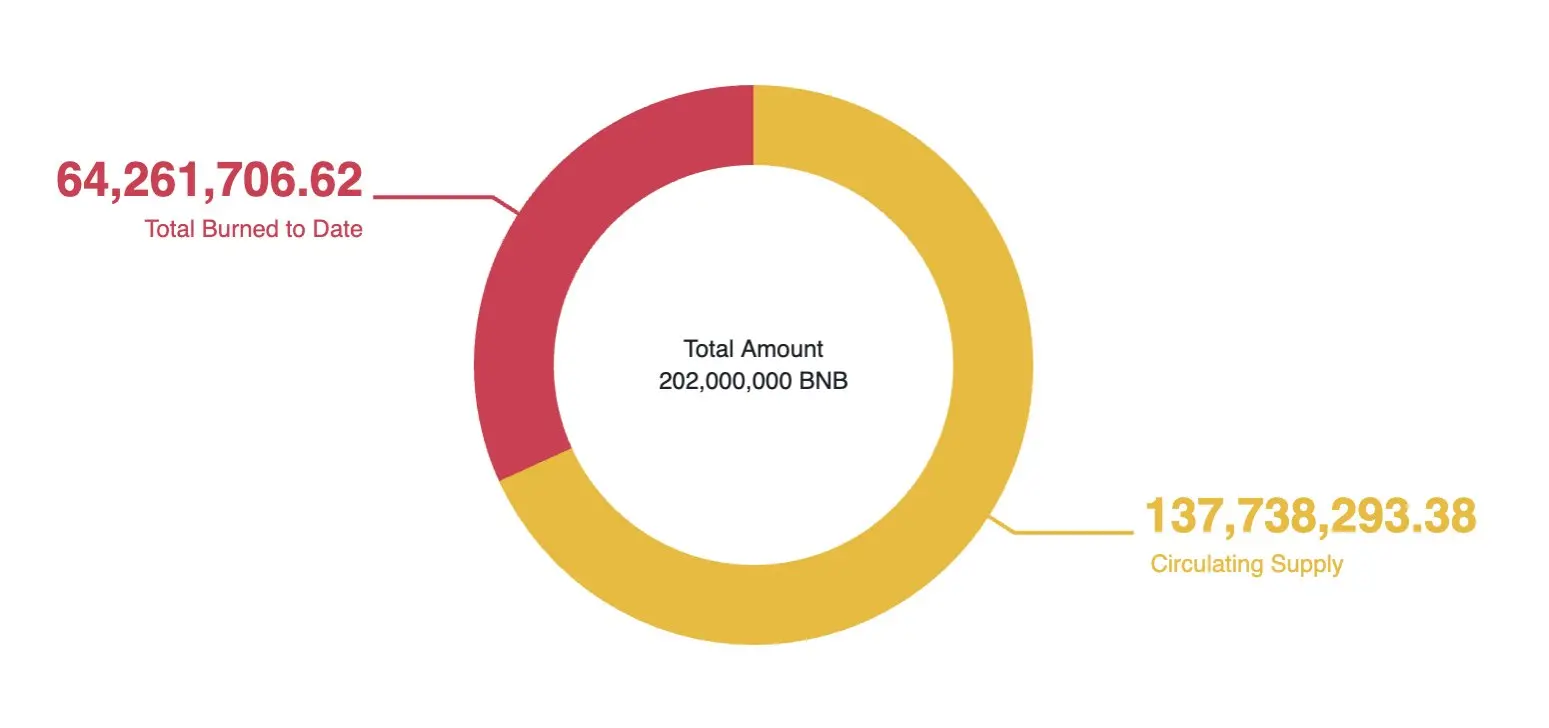

The ownership structure of BNB has evolved into a broad ecosystem of holding and usage. BNB holdings are widely distributed across the network:

Public (Non-affiliated)

- Approximately 66–67% — Non-affiliated public holders (in exchanges + self-custody)

Affiliated (Foundation / Exchange / Key Individuals)

- Approximately 27% — BNB Foundation's burn reserve (for programmatic burn; not for sale)

- Approximately 4–5% — Binance.com treasury (for operational liquidity and custody)

- 1% — CZ's personal holdings

Image 8: BNB Distribution - Decentralized and Transparent (approximately 67% public; approximately 27% burned; CZ 1%)

About two-thirds of the supply is held by non-affiliated public holders (in exchanges and self-custody), while CZ's personal holdings are less than 1%. The treasury of Binance.com holds about 4-5% of the circulating total of BNB. Approximately 27% of circulating BNB is held by the BNB Foundation and earmarked for programmatic burn (not for sale)—this is a transparent on-chain mechanism that strengthens BNB's deflationary design over time. Additionally, the largest marked wallets are for burn/operations/custody, rather than controlling positions, indicating low insider concentration and a more transparent, decentralized, and fair distribution.

3. Growth Story

3.1 BNB Chain Roadmap and Productization

BNB Chain is moving towards "a truly global decentralized financial system," an anticipated high-throughput, multi-chain platform designed for institutional-grade trading, comprehensive digital asset issuance, and real-world asset integration. The current roadmap goals include:

- >20,000 transactions per second (TPS)

- 150 milliseconds block finality time

- Native zero-knowledge privacy modules to support secure settlements and compliance-friendly confidentiality, such as zero-knowledge proof-driven transactions

A promising example is the launch of Binance Alpha in mid-2025, a liquidity incentive and builder program that triggered a sharp increase in on-chain DEX activity. BNB Chain's DEX trading volume briefly exceeded 70% of the total on-chain spot trading volume, showcasing the depth of potential user and developer engagement in the ecosystem.

Image 9: Binance Alpha led to a surge in BNB Chain DEX trading volume

Looking ahead, we have updated the goals for the next generation of BNB Chain (2026 and beyond) to achieve our next milestone: providing a CEX-like experience for millions of users in the development of a "global decentralized financial system." Here are the key features coming soon:

- Near-instant confirmation: Aiming for confirmation times below 150 milliseconds for transactions, exchanges, and interactions

- Nasdaq-level throughput: Aiming for over 20,000 TPS for complex on-chain operations

- Upgradable virtual machine: Aiming to support large-scale parallel execution beyond today's EVM limitations

- Native privacy: Aiming to effectively facilitate transfers and contract calls while providing compliance-friendly confidentiality protection

- Web2-level simplicity with Web3 control: Aiming to provide multi-signature, key rotation, and seamless authentication

These key features will collectively form a modular trading tech stack built for the issuance, discovery, and settlement of digital assets. We believe BNB Chain is poised to become the preferred infrastructure for on-chain financial markets, with BNB as a key component of that infrastructure.

3.2 Stablecoins, Payments, and Real-World Adoption

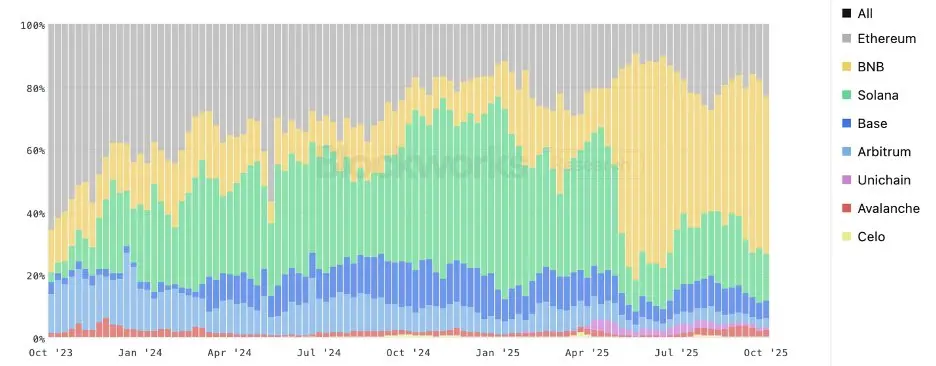

BNB enables users to interact with a wide range of Web3 assets on BNB Chain. It is evolving into a fully integrated trading and collateral asset, supporting interactions with DeFi, payments, and tokenization applications on BNB Chain. BNB Chain has consistently ranked among the top globally in stablecoin trading volume and active users.

Recent integrations have deepened BNB Chain's positioning in the following areas:

- Tokenized government bonds and interest-bearing assets (e.g., partnerships with Ondo Finance, Franklin Templeton)

- Establishing stablecoin liquidity hubs through deployment and cross-chain bridging with Circle (USDC)

- Pilot projects for RWA associated with exchanges, including Kraken xStocks and tokenized fund infrastructure

These initiatives position BNB as a fully integrated utility token that spans DeFi, payments, and even tokenized real-world applications. This broad range of use cases indicates that BNB's role is expanding from a niche in cryptocurrency to mainstream financial and practical scenarios.

BNB Chain hosts thousands of projects across decentralized finance, gaming, social tokens, and NFTs. As these metrics grow, the importance of BNB also increases—it is the unit of value flowing through the entire economy. Users looking to participate in new project issuances or use the latest DeFi applications on BNB Chain typically need BNB.

BNB is at the center of the development of both CeFi and DeFi. This unique positioning brings sustained demand and a broad user base. As Web3 continues to be adopted globally, BNB's multifaceted utility and its deflationary design may support its long-term value in a way that is related to ecosystem growth rather than speculative cycles.

Image 10: BNB Chain (BSC) leads and grows the number of active stablecoin wallets over the past 5 years

3.3 Unlocking the U.S. Market: Structural catalysts driven by CZ's amnesty, BNB digital asset trust/ETF channels, and listings on mainstream exchanges like Robinhood/Coinbase

The limited exposure of BNB in the U.S. market is beginning to change. The launch of the BNB Digital Asset Trust (DAT), BNB ETF, and listing channels on mainstream exchanges including Robinhood and Coinbase is providing indirect avenues for U.S. participants to access BNB using fiat currency. Regulatory clarity in major jurisdictions is expected to improve and accelerate institutional adoption.

The "full and unconditional" amnesty granted to CZ provides a potential pathway to alleviate the "suitable person" restrictions imposed by the U.S. government in previous cases against CZ. This presents an unprecedented opportunity for U.S. participants to embrace and benefit from BNB Chain and its new growth; at the same time, it is an opportunity for BNB Chain and BNB to accelerate developer onboarding and recommit to achieving enterprise-level integration in the U.S., covering payments, custody, and Web3 infrastructure, all of which will serve this historically underweighted region and create the next growth engine for BNB Chain.

3.4 Diversified BNB Products: Channels for Broader Investor Participation in the BNB Growth Story

A modular stack of BNB-related products includes regional BNB Digital Asset Trusts (DATs), BNB ETFs (where permitted), and BNB Yield Funds. They are transforming on-chain liquidity into regulated distribution channels. Each form of BNB-related product has its unique mission:

- BNB Digital Asset Trust (DATs) - Including BNB Network Company (NASDAQ:BNC) and potentially more BNB DATs to be launched on the roadmap - designed for investors seeking potential amplified returns;

- BNB ETF - Currently undergoing regulatory approval processes - for a broad range of broker/dealer and registered investment advisor (RIA) channels, providing intraday secondary market liquidity that mirrors the price performance of BNB tokens;

- BNB Yield Fund - For example, Hash Global BNB Yield Fund - designed for institutions that cannot hold tokens directly but can invest in income-generating, BNB-related funds.

Through effective KYC/AML, independent management/auditing, and standardized disclosures, these products are expected to reduce operational friction and expand the reachable institutional and overseas user base. From BNB Digital Asset Trusts, BNB ETFs to BNB Yield Funds, these diversified BNB financial products offer a range of options for different types of investors along the spectrum of liquidity and yield.

4. One of the Strongest Structural Performances in History

4.1 BNB: Cyclically Verified Outstanding Performance

Across multiple market cycles, BNB has demonstrated consistent structural outperformance relative to peer Layer-1 blockchains and benchmark digital assets. Its long-term value growth reflects a combination of functional utility, programmatic supply discipline, and ecosystem scale integration.

Unlike peer assets whose performance is typically closely correlated with broader market beta, BNB exhibits structural decoupling behavior. Even during bear markets (2018, 2022), BNB maintained relative strength and quickly reclaimed new highs—showcasing resilience, circulating supply compression effects, and demand stickiness, all of which should be valued by allocators focused on treasury management.

We believe that the consistency of BNB's price—rising before narrative rotations and absorbing volatility more effectively—makes it an ideal foundational asset for long-term structured products, particularly those that can earn fees or potential returns.

Image 11: BNB outperformed other assets across multiple market cycles

4.2 BNB as a Strategic Asset

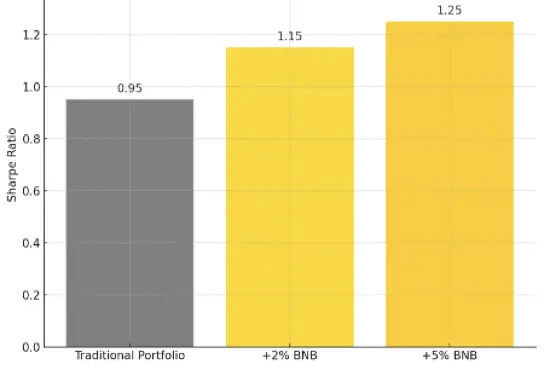

BNB is not only tailored for crypto-native users; its design is also easy for newcomers without crypto experience to understand and use. Introducing BNB could significantly improve risk-adjusted returns; for example, in a simulated model, adding 2%-5% BNB to a standard stock-bond-commodity portfolio increased the Sharpe ratio from 0.95 to as high as 1.25. This demonstrates the effectiveness of BNB as an alternative asset allocation—enhancing diversification and capturing engagement and potential returns from Web3. Current market conditions may provide asset management firms with a structural opportunity to integrate BNB as an alternative asset.

Image 12: Comparison of traditional portfolio and BNB-integrated portfolio

BNB demonstrates a rare ability to decouple from broader crypto market trends, maintaining strength even during BTC pullbacks and overall market corrections. This structural independence is driven by BNB's dual engines: on-chain economic utility and centralized platform integration. Unlike assets that purely fluctuate with macro liquidity cycles, BNB's price tends to reflect real usage, ecosystem growth, and value creation—we believe this makes it a fundamentally differentiated asset with lower correlation to speculative crypto beta.

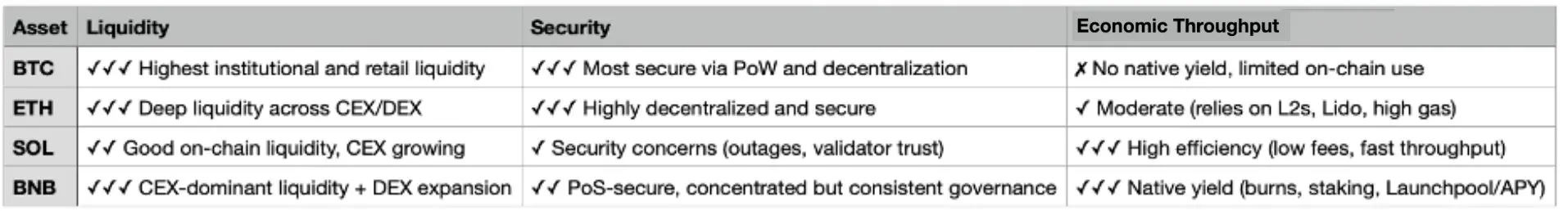

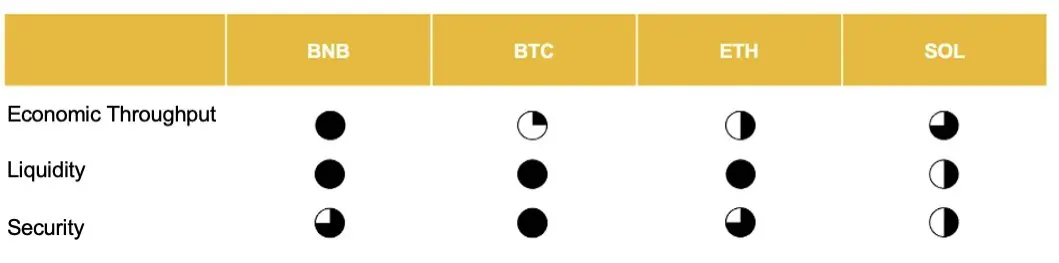

4.3 BNB as a Balanced Crypto Asset in the Asset Trilemma

In the crypto world, everything begins and ends with the nature of the asset. Compared to traditional assets, crypto assets are programmable, composable, and integrated with infrastructure, making their evaluation multidimensional and uniquely tied to three core asset dimensions: Economic Throughput, Security, and Liquidity—together forming what we call the Asset Trilemma, a native extension of the macroeconomic "policy trilemma" in the crypto space.

BNB operates within the crypto asset trilemma—we view these three forces as shaping how the network grows and sustains itself.

- Economic Throughput: The network effectively guides real user activity through transactions, settlements, and application deployments;

- Security: It robustly protects these activities through consensus, validation, and transparency;

- Liquidity: Participants can smoothly enter, exit, and trade with minimal friction.

In our experience, most systems sacrifice one dimension for another—networks with higher security often sacrifice economic throughput. BNB's architecture, through Proof of Staked Authority (PoSA) consensus and deep multi-location access, aims to maintain a near-equilibrium across these three dimensions.

The inherent utility of BNB allows it to transform from a passively held asset into an actively participating gateway. Historically, BNB's platform participation programs have provided meaningful incentives, significantly outperforming many mainstream crypto assets in terms of user engagement and retention.

BNB inherently carries certain privileges and opportunities:

- Participation in exclusive programs: BNB holders can participate in ecosystem programs, applications, and governance. Launchpool activities, airdrops, and governance voting are examples of benefits associated with BNB ownership.

- Integrated user rewards: Many initiatives on BNB Chain are designed to reward BNB holders and users. These incentives mean that even without considering price appreciation, holding BNB long-term has tangible benefits.

- A single token enabling diversified participation: Holding BNB provides a broad form of engagement. Users can simply hold BNB and use it across various domains such as lending, trading, and gaming.

This dynamic strengthens the ecosystem: as more people hold BNB to gain these advantages, it drives greater decentralization and activity on BNB Chain.

Image 13: Comparison of the crypto asset trilemma

5. Strategic Highlights

5.1 BNB Ecosystem as a Full-Stack Efficient Web3 Asset Issuance and Trading Platform

The integration of BNB across centralized and decentralized platforms makes it a core participatory token of the Web3 era. It combines infrastructure, access qualifications, and incentives, which we believe makes it an attractive utility token suitable for long-term participation.

Strategic highlights of BNB:

- Ecosystem incentives: BNB enables users to participate in various ecosystem programs, which have historically provided additional incentives and rewards for holders.

- Core participatory token: BNB serves as the core participatory token of the Web3 era, connecting users with a wide range of blockchain applications and communities.

- Sustainable value model: The combination of BNB's utility and deflation can create a sustainable value model. Increased usage drives more burns and demand for more participation programs, thereby enhancing utility value.

- Supportive ecosystem: The BNB ecosystem has supportive venture capital ecosystem participants, such as YZi Labs, which are uniquely positioned to introduce investment projects from the initial proof-of-concept stage through financing and initial distribution, and subsequently provide support.

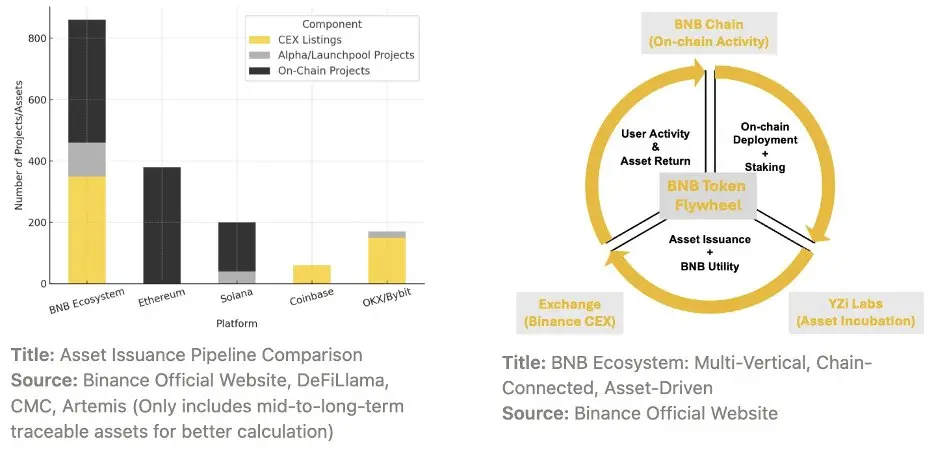

Images 14 & 15: BNB uniquely provides end-to-end exposure to the complete lifecycle of Web3 asset issuance, discovery, and participation within the BNB ecosystem

The BNB ecosystem, through its supportive venture capital partners (like YZi Labs), provides a powerful, efficient, and comprehensive platform for asset issuance. These venture partners are strategically positioned to introduce investment projects from the initial proof-of-concept stage, guiding these projects through financing and initial distribution, and subsequently facilitating global trading and decentralized ecosystem growth for these projects through BNB Chain. By ensuring the establishment of top-performing trading pairs (via CEX), BNB is becoming one of the most powerful and perhaps the most effective full-cycle asset issuance centers in the Web3 space.

In short, the BNB ecosystem integrates:

- YZi Labs and other venture capital participants: incubation starts here

- BNB Chain: core deployment layer, growth, and on-chain utility

- Exchanges: liquidity, Launchpool, and trading

to build a complete system that provides full-stack Web3 exposure—asset issuance, discovery, and participation, all powered by the BNB ecosystem.

5.2 BNB's Yield and Access: Exceptional Native Yield Generation, Potentially Creating 15-20% Annual Value

Mechanisms like Launchpool continuously drive large-scale BNB locking and create attractive yields for users, historically averaging 15-25% annual value gains during peak cycles. This dynamic not only programmatically reduces token circulation but also enhances user retention and ecosystem participation, making BNB a powerful engine with both potential value and long-term platform synergy.

Images 16 & 17: With a 15-20% annual value increase and deep ecosystem integration, BNB transforms traditional asset holding into a more efficient participation method.

This multifaceted integration makes BNB a unique and compelling asset for long-term Web3 exposure. Our research indicates that among major Layer-1 assets, BNB has consistently led in economic value. Historically, BNB has provided competitive annual value gains of 15-20%, significantly outperforming other assets (for example, according to third-party data, SOL is about 6.5% / ETH is about 4.5%, and we believe both are more reliant on external staking protocols), highlighting BNB's high asset issuance and value yield capability.

Unlike Bitcoin (which we believe behaves like digital gold) and Ethereum (which we consider akin to foundational infrastructure), we believe BNB is best described as a "technology platform" of the Web3 era. We believe it combines unparalleled ecosystem entry brought by Binance CEX's massive traffic, robust infrastructure provided by BNB Chain, and a comprehensive operational token system offering practical features like Launchpool and Alpha.

6. Conclusion: BNB's Positioning as an Efficient Trading Engine for the Global Web3 Economy

BNB combines access qualifications, utility, and a programmatic price stabilization mechanism. It provides holders with extensive channels to enter the Web3 ecosystem and practical utility across numerous applications, while the built-in burn mechanism aims to ensure long-term supply aligns with network activity.

BNB is not just a platform token—it is a Web3 infrastructure token that:

- Combines on-chain growth, built-in incentives, top-tier ecosystem access, and long-term supply compression.

- Provides users with exposure to the full spectrum of Web3 asset issuance and distribution.

- Covers key Web3 assets and domains at all levels: from blue-chip stocks listed on exchanges to mid-cap narrative assets, and emerging long-tail tokens on BNB Chain.

As ETH anchors DeFi infrastructure and BTC serves as a store of value, BNB is positioned to become an efficient trading engine driving the global Web3 economy, providing a configuration tool for investors entering the Web3 world.

About YZi Labs

YZi Labs manages over $10 billion in assets globally. Our investment philosophy emphasizes impact-first—we believe meaningful outcomes will naturally follow. We invest in companies at various stages, prioritizing projects with solid fundamentals in Web3, artificial intelligence, and biotechnology.

The YZi Labs portfolio includes over 300 projects from more than 25 countries across six continents. More than 65 portfolio companies have undergone our incubation program. For more information, please follow YZi Labs on X.

Disclaimer

This document is for informational purposes only and does not constitute investment, legal, or tax advice. It is not an endorsement, analysis, or recommendation of any digital asset, financial instrument, asset, service, entity, issuer, or any individual, entity, or matter. It is not an offer to sell or a solicitation to purchase any digital asset, security, or other asset. The information in this document is believed to be accurate as of the date of publication, but is subject to change without notice. Recipients should conduct their own due diligence and consult professional advisors before making any purchase or investment decisions. Past performance is not indicative of future results. The risk of using this information is borne solely by you.

Forward-Looking Statements

This document contains forward-looking statements, including predictions, estimates, and expectations regarding the future performance, adoption, and market conditions of BNB and related technologies. These statements are based on current assumptions and beliefs but involve risks and uncertainties that could lead to significant differences in actual results. Terms such as "expect," "anticipate," "intend," "plan," "believe," and similar expressions are indicators of forward-looking statements. Any references to "growth," "network effects," or "ecosystem expansion" reflect the potential scalability and adoption of decentralized technologies, not financial returns or profit-sharing mechanisms. These statements are not guarantees of future performance. We do not undertake any obligation to update these statements after the date of this presentation.

Key Risk Factors

The following risks and uncertainties described in this document are not intended to be an exhaustive list of all possible relevant risks. Additional risks, including those currently unknown or considered insignificant, may also have a significant adverse impact.

Loss Risk: Investing in or purchasing digital assets and projects related to distributed ledger technology (including DeFi projects) involves significant risks, including the risk of total loss. This document does not take into account the investment objectives, financial situation, or specific needs of any particular person, and we urge each individual to consult their legal and financial advisors before making any purchase or investment decisions.

Regulatory Uncertainty: Digital assets and related projects are subject to rapidly evolving and uncertain regulatory frameworks globally. Future regulatory developments may impose restrictions or obligations that could significantly impact operations, liquidity, and value. Relevant regulatory authorities may determine that a digital asset constitutes a security, derivative, or other regulated product, triggering licensing, registration, and compliance obligations.

Legal Risks: Failure to comply with applicable laws may result in investigations, fines, cease-and-desist orders, or other enforcement actions that could adversely affect operations. Additionally, individuals may bring civil lawsuits against the company due to any of these risk factors or other adverse circumstances.

Cybersecurity and Technical Risks: Digital assets may be permanently lost due to cyberattacks, private key leaks, phishing, malware, or custodial failures. Coding or design flaws in protocols or smart contracts may be exploited, leading to unintended behavior, loss of funds, or governance failures. Digital assets may be subject to 51% attacks, Sybil attacks, or other consensus-level threats.

Operational and Business Risks: High transaction volumes or network interruptions may lead to settlement delays, increased gas fees/transaction costs, or impaired functionality. Failures of cloud providers, node operators, custodians, or integrated DeFi protocols may adversely affect operations. Network upgrades may not succeed, may introduce errors, or may lead to ecosystem splits (e.g., hard forks).

Market Volatility and Liquidity Risks: Digital asset prices can experience extreme and unpredictable volatility, potentially leading to significant losses. There may not be enough buyers or market-making support to provide an active trading market, limiting exit opportunities. Exchanges and custodians may experience bankruptcy, fraud, data breaches, or operational failures, affecting our access to or ownership of assets. Valuations may rely on unregulated markets, leading to price manipulation, unreliable price discovery, or sudden loss of value.

Governance and Tokenomics Risks: Token-based voting may be susceptible to manipulation or centralization, allowing a small number of individuals to exert excessive control. Token issuance plans may dilute value or change due to network governance or unforeseen circumstances. Management authority may be abused, exploited, or lost, affecting token functionality or the security of funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。