作者:Nancy,PANews

昨夜,美股上演历史性时刻。科技巨头英伟达市值突破5万亿美元,书写资本传奇。而这一刻,却让币圈彻底“破防”了。

放眼全球资本市场,黄金和股票正同场共舞,反观加密市场却深陷悲观泥潭,赚钱难度不断升级,收益表现远逊于传统资产。比特币虽曾短暂触及12万美元高位,却更像一场缺乏散户的资本独角戏;山寨币更是陷入流动性枯竭,创新乏力,热点转瞬即逝。

加密市场进入“地狱模式”,股市与黄金走强加速资金虹吸

本轮加密牛市疲态尽显,市场并未如期等来普涨的“减半行情”。比特币虽然屡创新高,但上涨步伐放缓且以华尔街机构主导;山寨币屡创新低,散户在“1011”事件中严重受损或者愤而离场,市场流动性紧缩。加密市场可谓是被推入地狱级难度的周期。

相比之下,随着股票和黄金轮番走强,资本正流向更具可见性的盈利与确定性机会。

谁能想到,英伟达只用了113天,再度上演了资本市场的“AI奇迹”,成为全球首家市值突破5万亿美元的上市公司。这一数字,超过了除美国与中国外几乎所有国家的年度GDP,也远超整个加密市场的总市值(约3.8万亿美元)。

来源:网络

事实上,以英伟达为首的“七巨头”带动了美股的集体狂欢。标普500指数已连续125个交易日站在50日均线之上,今年以来的回报率已超过了比特币。市场情绪高涨,美股多头甚至吹响7000点的号角。

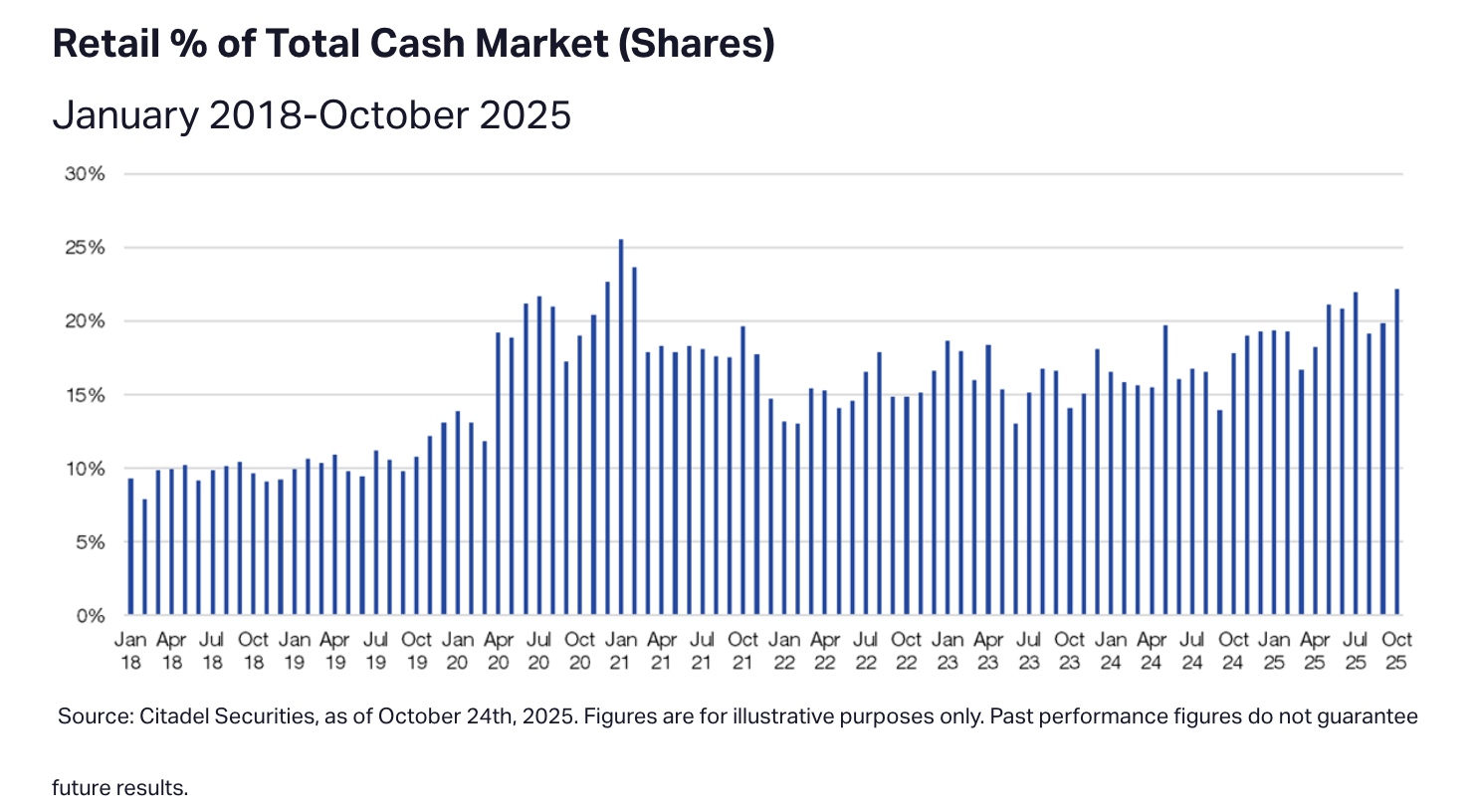

数据也印证了这一热度。纳斯达克数据显示,仅在2025年上半年,美国散户投资者累计买入约3.4万亿美元股票,卖出约3.2万亿美元,交易总额超过6.6万亿美元。而根据全球知名做市商Citadel Securities分析,散户如今占美股整体交易量的22%,创下自2021年“迷因股狂潮”以来的最高水平。目前散户平均每天交易量高达12亿股。

这股投资热情也不仅限于美股。以韩国为例,韩国KOSPI指数已经突破4000点大关,年初至今累计上涨近70.9%,成为全球表现最佳的主要股指之一。这种市场情绪也让原本热衷炒币的韩国交易活跃度明显下降。10月29日当日,当地虚拟资产成交额约36.1亿美元,仅为KOSPI交易额的23.2%,而在过去这一比例一度超过80%。

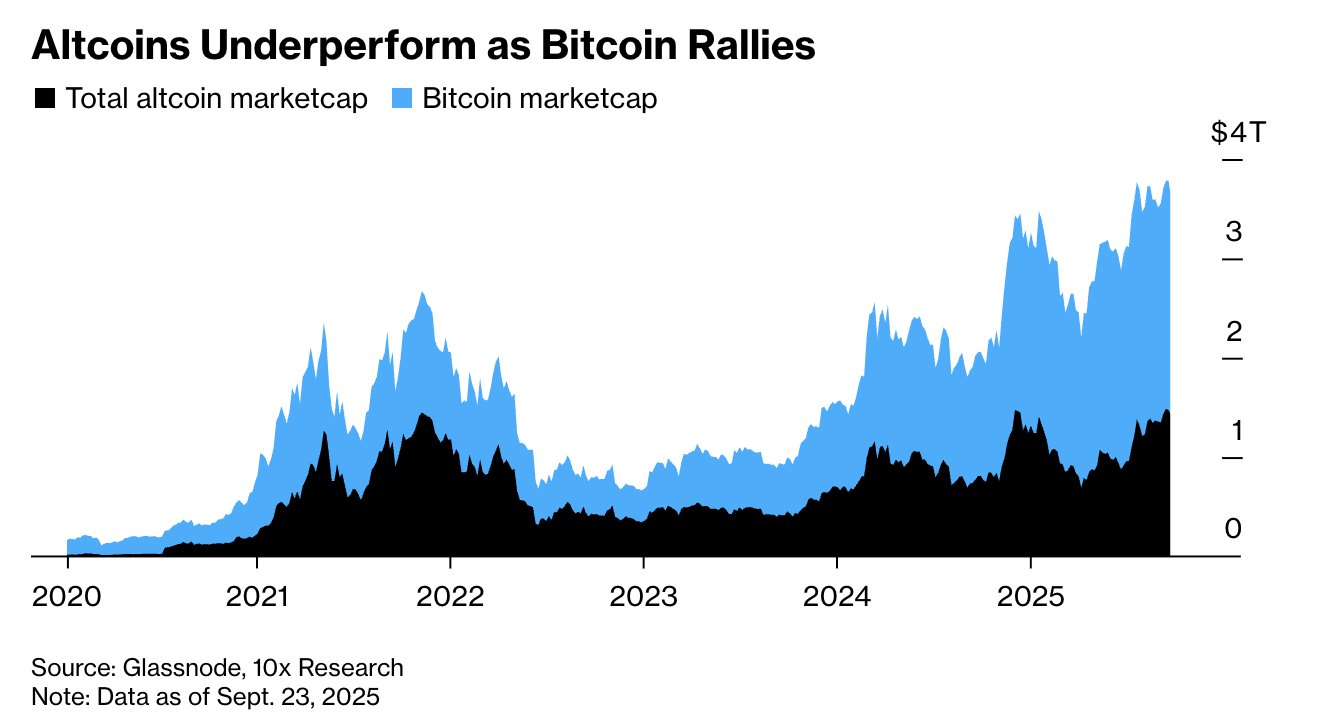

与此同时,部分资金也在流向加密概念股。据彭博社报道,多年来,比特币和山寨币的总市值大多同步变动,但这次情况不同,比特币在机构投资者中日益受欢迎,再加上投机资金转向与加密货币相关的股票,比特币和山寨币之间存在近万亿美元的差距。10x Research CEO Markus Thielen表示,若散户投资者(尤其是韩国散户)没有将注意力转向相关股票,山寨币总市值本应多出约8000亿美元。但在当前周期内,山寨币缺乏新资金流入,且这一缺口短期内难以弥补。而历史上韩国加密交易者偏爱山寨币,当地交易所其交易量占比曾超80%,全球平台则以比特币和以太坊为主。

面对股票需求的高涨,Robinhood、Coinbase、Kraken等交易平台推出了股票代币化业务,以满足现有加密用户需求并探寻新增量,这种布局也在一定程度上分流了加密市场的交易活跃度。

除此之外,在风险偏好上升与宏观不确定并存的环境下,黄金成为了首选的避险配置资产,并跻身2025年表现最好的资产之一。据高盛分析,相较于黄金,比特币回报虽更高但波动率极大,在风险偏好强时比特币表现往往类同股票,但一旦股市下跌,比特币对冲效果不及黄金。因此黄金目前在避险方面更为可靠,而比特币仍处于从风险资产向避险资产过渡的阶段。

近日大A都重返4000点,“炒股的爸,炒黄金的妈,拿着ETH的我,大家集体相聚在4000。”“我在加密市场躲牛市”,社群中大家自嘲道。

加密市场陷入内外困局,保持耐心等待创新和资金

除了股市和黄金形成的资金虹吸效应,将大量投资者和散户资金带走,使加密资产在资本配置中被边缘化外,加密市场的内外困境还源自多方面因素。

一方面,当前加密市场的创新缺乏爆发性。相比以往能够打破圈内外认知的DeFi、NFT和元宇宙等叙事,如今市场更多停留在技术迭代阶段,而叙事却不断重复。即便部分叙事在短期内能够吸引资金,也往往迅速冷却,使市场活跃度和投资者信心难以维持。而RWA、DAT、稳定币等新兴叙事则主要由机构主导,收益效应有限,散户参与度低,难以形成广泛的市场共鸣。

更深层的问题在于,大多数山寨币缺乏明确的场景价值和落地应用,难以形成可持续的资金吸引力。例如,MEME像一把双刃剑,一方面降低了进入门槛,使更多散户能够参与;但另一方面,这类项目过度依赖故事和情绪驱动,加速了场内资金的PVP化,最终演变为纯粹的资金博弈,缺乏真正的价值创造。

“当前加密市场的问题不是缺衍生品,而是链上‘虚’的东西太多。我们现在更需要的是把更多链下的真实资产和服务搬上链。金融最终要与实体相结合,Web3行业必须抓紧靠拢主流叙事,比如AI和Agent Economy(智能体经济) 。明年上半年,无论是AI还是外部股票和币圈,都可能有一个巨大的牛市。但这个牛市必须建立在与现实结合的基础上。行业应该努力在万物上链和Agent Finance方面做出实际的东西,这样才能吸引更多资金和人才,走向可持续的发展,而不是停留在炒MEME的内耗里。”前沿科技投资人郑迪在播客《支无不言》中指出。

在加密KOL@Sea看来,加密行业需要耐心与长期主义,“AI和美股是很热,但如果就因此把大部分资金、注意力转移过去,不管是投资还是创业,去那边就会比在币圈有更强的相对优势吗?币圈是一个好市场 / 好行业,虽然每天都是左手捏鼻子,右手在一堆屎里掏金子,但是自由市场的快速出清和自我迭代能力、全球开发者的聚集,就是更有可能诞生奇迹。”

“加密产品已经找到了产品市场契合点,或者至少为已实现PMF的加密垂直领域开辟了道路。尽管这样的产品尚不多,但随着每一个建设周期的推进,基础设施的不断完善以及知识的复合积累,我们正创造出更多具有实际价值的产品。这些产品不仅在重塑市场结构,还开创了预测市场、永续合约等全新资产类别。如今,当华尔街精英和美国政府高层人士终于开始关注并认可加密货币作为正式行业之际,早期参与者更应坚定信念。”加密研究员Monk发文指出。

另一方面,加密市场作为典型的高风险资产,其增长往往依赖于上游资金的溢出效应。随着利率逐步下降,低风险资产(如存款、债券等)的收益减少,资金会逐步流向高风险领域,如科技股、创业板以及加密货币。然而,这种资金传导并非即时完成,而是存在一定时间滞后。正如前文提到的,在股市和黄金已经提供相对稳定收益的背景下,投资者往往优先配置于这些可见盈利、风险相对可控的资产,加密市场很难立即成为首选。换言之,只有在降息周期逐步释放流动性,并通过股市等风险资产逐级传导后,加密市场才能获得增量资金。

此外,监管缺失是当前加密市场面临的核心问题之一。以“10·11事件”为例,这一风险事件不仅暴露了行业在基础设施和风险管理方面的短板,对市场流动性造成了严重冲击, 同时影响了传统资金对加密资产的信心。要知道,与传统金融不同的是,加密市场是7*24小时,所以发展速度更快,对消息反应也更即时,参与者结构也更为多元。这意味着风险事件的冲击往往更加集中和剧烈,对散户资金和整体市场信心的影响也更直接。

“建立流动性缓冲基金和引入类似美股的熔断机制是非常有必要的。传统金融市场用血的教训换来了这些风控经验,币圈应该借鉴。在10·11这种事件中,如果一个流动性缓冲基金能入场争取时间,让套利商有机会重新入场,很多问题是可以避免的。”郑迪指出。这一观点也凸显了加密市场在风险管理和制度建设上的迫切需求。

总的来说,加密市场正经历一次炼狱式洗礼。然而,加密市场依然具备快速迭代、全球化参与和技术创新等独特优势,唯有聚焦实际落地与价值创造,坚守耐心与长期主义,或将成为当前市场中生存与突围的关键策略。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。