Anchorage Digital Brings Institutional Trust to Bybit bbSOL Staking

Can big investors safely stake Solana without losing control of their funds? Bybit may have found the answer with Bybit bbSOL.

As per the 29th October press release, The exchange’s liquid staking token is now supported by Anchorage Digital, a U.S.-regulated crypto bank.

This partnership gives institutions a safe and compliant path to earn rewards from Solana staking while keeping their tokens flexible.

A Big Step Toward Institutional Access

The world’s second-largest crypto exchange, announced that Bybit bbSOL has gained official custody support from Anchorage Digital. This move makes bbSOL one of the few Solana staking tokens recognized for institutional use in the United States.

Anchorage Digital is the first federally chartered crypto bank in the country. Its involvement gives holders a sigh of relief, as their assets are now protected by strict U.S. custody and compliance standards.

The two companies, together, are breaking the door open for more institutional investors to enter the Solana ecosystem .

What Set Bybit bbSOL Apart

Unlike traditional staking, this does not require investors to lock up their Solana tokens. It provides them with liquidity and yield, something attractive to funds and institutions who value flexibility.

With Anchorage Digital custody, institutions can now keep their bbSOL holdings with the same security as their bank account balances have.

The exchange's Head of Spot Emily Bao stated that the alliance represents "a big step in bbSOL's growth as an institutional-ready product."

She added that the platform is committed to presenting "a transparent and compliant gateway" to Solana's DeFi market.

Anchorage Digital CEO Nathan McCauley further commented that the partnership will "enable institutions to engage in Solana's liquid staking with robust security and controls."

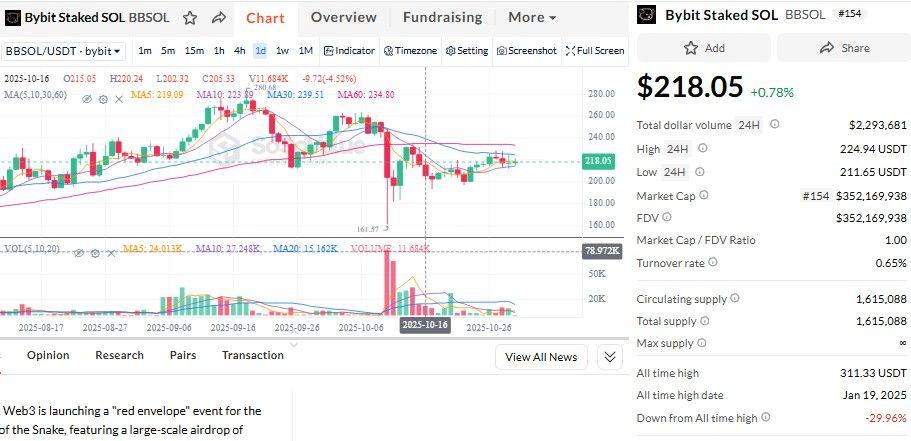

Source: Sosovalue

Currently the solana liquid staking token is trading at $218.05 with an increase of 0.78% in the last 24 hours.

Why It Matters for the Crypto Market

The collaboration is one indication of how holding tokens is moving beyond retail users and attracting serious institutional demand. It now combines exchange-grade performance with bank-grade security, a balance that could win over mainstream investors to consider decentralized finance (DeFi) for the first time.

It further reinforces Solana's reputation as a fast and reliable blockchain. With products like this token receiving regulatory recognition, more institutional capital can potentially enter Solana staking and DeFi segments.

The Future of Bybit bbSOL

For the exchange, this is more than a new collaboration; it's an indication that regulations of holding tokens may become a new norm. Bybit bbSOL is now well-placed to onboard asset managers, funds, and businesses seeking yield sources compliant with regulatory guidelines.

If the token succeeds in gaining momentum, it may encourage other exchanges to take the same route combining blockchain innovation with the security of regulated banking.

Conclusion

The Anchorage Digital partnership provides Bybit bbSOL a significant credibility lift in the institutional space. It provides safety, compliance, and flexibility three things that large investors care about the most.

As crypto and traditional finance increasingly integrate, this move is a solid example of how holding tokens can be both lucrative and secure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。