Zhao Changpeng's wealth remains a mystery.

Written by: Long Yue, Wall Street Insights

With the booming market for cryptocurrency assets, Zhao Changpeng has recently been frequently in the headlines.

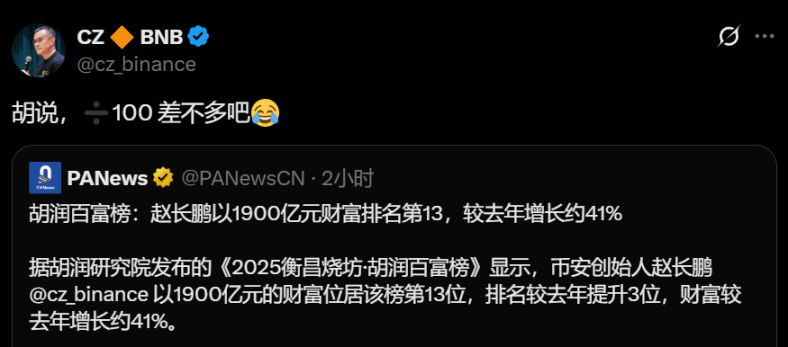

In the latest release of the "2025 Hurun Rich List," the founder of the largest cryptocurrency exchange Binance—Zhao Changpeng—appears prominently, ranking 13th with a wealth of 190 billion yuan.

Although he immediately disputed this by stating, "Nonsense, it's about 1/100 of that," speculation about his true wealth continues unabated.

In stark contrast to Zhao Changpeng's low-key statements, voices within the crypto community have emerged suggesting that his wealth is severely underestimated, even comparing Binance's profits to those of Alibaba.

Estimation of Wealth in the Hundreds of Billions and Denial from the Individual

The starting point of this controversy is the publicly available data from the Hurun Rich List. According to the "2025 Hurun Rich List," Zhao Changpeng's wealth is estimated at 190 billion yuan. The calculation methods of the Hurun Rich List are usually highly correlated with company market values or publicly traded references, but for giant private companies like Binance, the valuation methods are more complex and less transparent.

Zhao Changpeng's response directly challenges the authority of this list. His statement of "1/100" would, if true, completely overturn the public's perception of the scale of his wealth. This statement quickly spread in the market, sparking widespread discussion about whether his wealth is overestimated or if he is intentionally downplaying it.

Community Debate: Binance's Profits May Be Underestimated

On the social platform X, some opinion leaders in the crypto field have presented a completely different view.

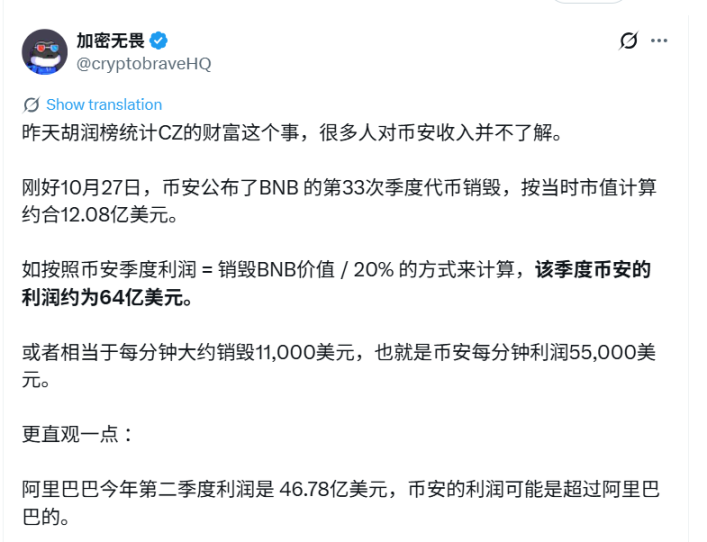

According to user @cryptobraveHQ's analysis, the valuation on the Hurun list "should be deliberately showcased, not accurately reflecting CZ (Zhao Changpeng)'s wealth."

The analysis points out that Zhao Changpeng's family office YZi Labs manages a scale of 10 billion dollars, and there are public claims that Binance's revenue reached 16.8 billion dollars in 2024. Zhao Changpeng also holds a significant amount of BNB and other cryptocurrencies like BTC.

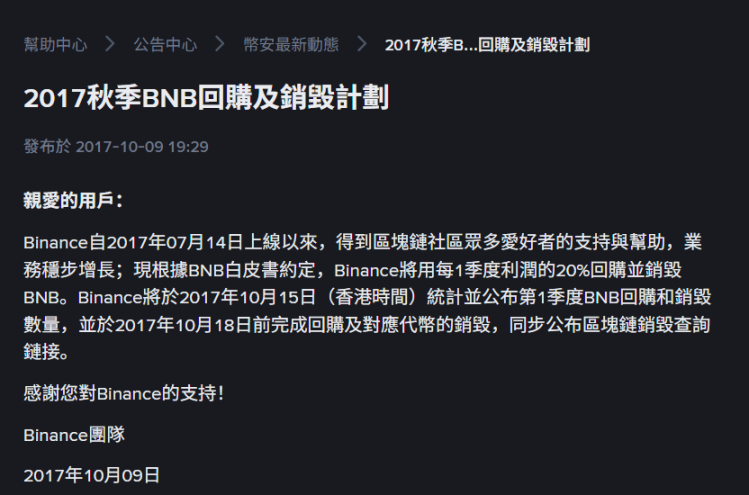

More striking calculations come from Binance's token burn mechanism. The analysis mentions that Binance completed its 33rd quarterly BNB burn on October 27, with the burned tokens valued at approximately 1.208 billion dollars. Based on the early stipulations in Binance's white paper, the value of BNB burned each quarter is equivalent to 20% of the company's profits for that quarter, which suggests that Binance's profit for that quarter is about 6.4 billion dollars. In comparison, Alibaba's profit for the second quarter of this year was 4.678 billion dollars.

Core of the Valuation Controversy: BNB Burn Mechanism

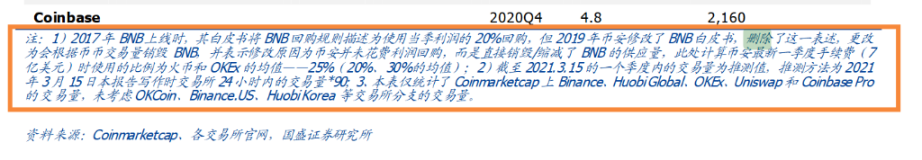

However, the foundation of the above astonishing inference is not unassailable. The core of the controversy lies in whether the calculation method that directly links the value of BNB burned to profits remains valid.

Some viewpoints suggest that Binance may have modified the rules regarding BNB burns in its white paper. The initially clear ratio of "20% of profits" may have become ambiguous in subsequent updates, and it may even have been decoupled from profits. Therefore, currently using the amount of BNB burned to accurately infer Binance's profits may lack a solid basis.

This technical detail controversy is precisely the key to the difficulty outsiders have in seeing Binance's true financial situation. In the absence of audited financial statements, any estimates based on publicly available business data (such as token burns) can only be market speculation, rather than established facts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。