The distribution power is the real moat.

Author: Simon

Translation: Deep Tide TechFlow

The Moat of Tether and Circle is Shrinking: Distribution Capability Outweighs Network Effects

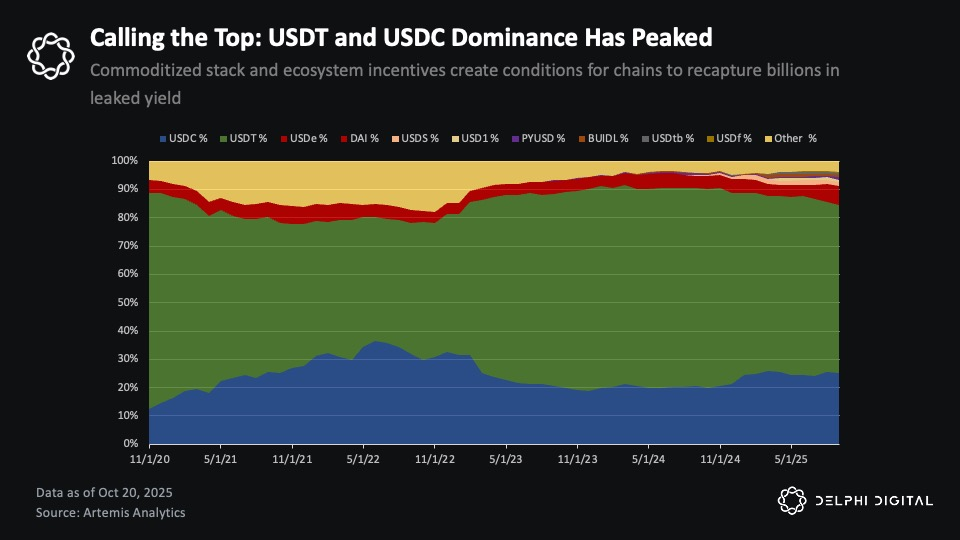

According to the analysis in Delphi's comprehensive report "Apps and Chains, Not Issuers," Tether and Circle's dominance in the stablecoin market has reached a relative peak, even as the overall supply of stablecoins continues to grow. It is expected that by 2027, the total market capitalization of stablecoins will exceed $1 trillion, but this growth is no longer primarily driven by existing giants as it was in the previous cycle. Instead, an increasing share of the market will flow to ecosystem-native stablecoins and white-label issuance strategies, as blockchains and applications gradually internalize revenue and distribution capabilities.

Currently, Tether and Circle account for about 85% of the circulating stablecoin supply, totaling approximately $265 billion.

Background data: Tether's valuation reportedly reaches $500 billion, seeking to raise $20 billion, with a circulating supply of $185 billion. Circle's valuation is around $35 billion, with a circulating supply of $80 billion.

The network effects that once solidified their dominance are weakening, and there are three major driving forces behind this shift:

- Distribution capability takes precedence over network effects

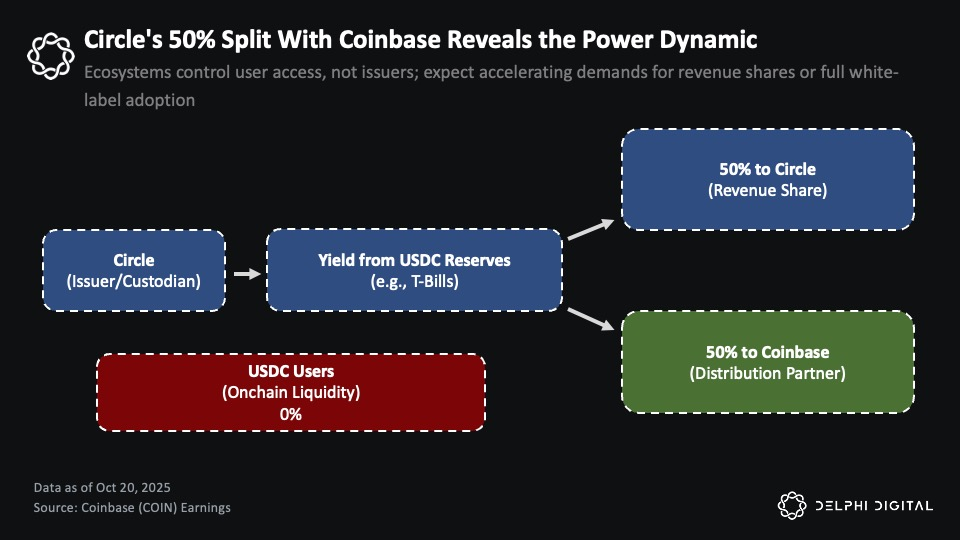

The partnership between Circle and Coinbase clearly illustrates this point. Coinbase receives 50% of the residual income from Circle's USDC reserves and exclusively captures all the income from USDC held on its platform. In 2024, Circle's reserve income is expected to be around $1.7 billion, of which approximately $908 million is paid to Coinbase. This indicates that distribution partners can capture a significant portion of the stablecoin economy's revenue, leading players with strong distribution capabilities to launch their own stablecoins rather than continuing to create value for issuers.

- Cross-chain infrastructure makes stablecoins more interchangeable

The development of cross-chain technology has made the interchange costs between stablecoins nearly zero. Upgrades to standard bridging on major L2 networks, universal messaging protocols from LayerZero and Chainlink, and the popularity of smart routing aggregators have made on-chain and cross-chain stablecoin exchanges efficient and user-friendly. Users can quickly switch stablecoins based on liquidity needs, significantly reducing the importance of which stablecoin to use.

- Regulatory clarity lowers the entry barrier

Legislation like the GENIUS Act creates a unified framework for domestic stablecoins in the U.S., reducing the risks for infrastructure providers holding stablecoins. Coupled with an increasing number of white-label issuers lowering the fixed costs of issuance, and the attractiveness of treasury yields driving the monetization of floating funds, the stablecoin stack is becoming commoditized and more interchangeable.

This commoditization undermines the structural advantages of existing giants. Any platform with strong distribution capabilities can now internalize the stablecoin economy without having to share revenue with others. Leading players include fintech wallets, centralized exchanges, and an increasing number of DeFi protocols.

DeFi is the area where this trend is most evident and has the most far-reaching impact.

From Outflow to Income: DeFi's Stablecoin Strategy

This shift has already begun to manifest in the on-chain economy. Compared to Circle and Tether, certain chains and applications demonstrate stronger product-market fit (PMF), user stickiness, and distribution capabilities, adopting white-label stablecoin solutions to leverage existing user bases and capture revenue that historically flowed to the giants. For on-chain investors who have long overlooked stablecoins, this dynamic change presents a real opportunity.

Hyperliquid: The First Major "Defection" Case

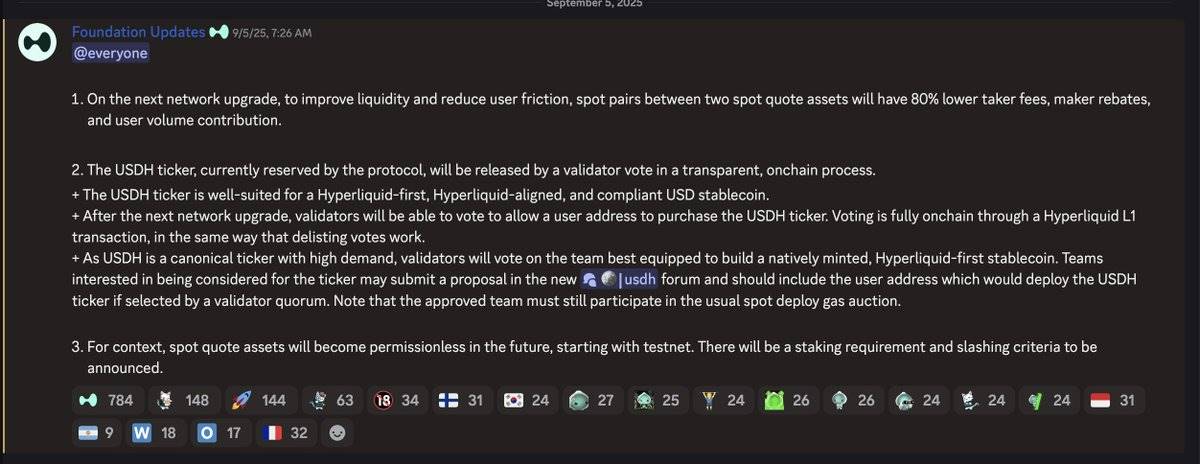

In the DeFi space, this trend is first reflected in Hyperliquid. At that time, approximately $5.5 billion in USDC reserves were tied up in its USDH proposal, meaning that $220 million in additional revenue could flow to Circle and Coinbase each year instead of remaining internal.

In an upcoming validator vote, Hyperliquid announced plans to launch a native minting, Hyperliquid-centric stablecoin. This decision marks a significant shift in the power dynamics of the stablecoin economy.

For Circle, being a major trading pair asset in Hyperliquid's core market has been a highly profitable position. They directly benefit from Hyperliquid's explosive growth while contributing almost nothing to that growth. For Hyperliquid, this means a significant loss of value to a third party that has made little effort, which contradicts its "community-first, ecosystem-aligned" philosophy.

Hyperliquid's USDH selection process attracted bids from nearly all major white-label stablecoin issuers, becoming one of the first large-scale competitive cases in the application layer stablecoin economy.

In the competitive bidding for USDH distribution, several major white-label stablecoin issuers, including Native Markets, Paxos, Frax, Agora, MakerDAO (Sky), Curve Finance, and Ethena Labs, submitted proposals. This process highlights the immense value of distribution capability in the stablecoin economy.

Ultimately, Native Markets won with a proposal that better aligned with Hyperliquid's ecosystem incentive mechanisms.

Native's model is issuer-neutral and regulated, with its stablecoin backed by off-chain reserves managed by BlackRock, and on-chain infrastructure provided through Superstate. The key is that 50% of its reserve income will flow directly into Hyperliquid's aid fund, while the remaining 50% will be reinvested to expand USDH's liquidity.

Although USDH will not replace USDC in the short term, this decision reflects a broader trend of power transfer: the moats and leverage effects in DeFi are gradually shifting towards applications and ecosystems with sticky user bases and strong distribution capabilities, rather than traditional issuers like Circle and Tether.

The Rise of White-Label Stablecoins: SaaS Model Opens a New Chapter

In recent months, this trend has accelerated as more ecosystems adopt white-label stablecoin models. Ethena Labs' "Stablecoin as a Service" solution is at the core of this transformation, with on-chain players like Sui, MegaETH, and Jupiter already integrating or announcing plans to issue their own stablecoins through Ethena's infrastructure.

What sets the Ethena model apart is that its protocol directly returns revenue to holders. For example, USDe's revenue comes from basis trades. Although yields have compressed to about 5.5% as supply exceeds $12.5 billion, this is still higher than the approximately 4% treasury yield and far superior to the zero-yield situation of holding USDT or USDC on-chain.

However, as other issuers enter the market and directly pass on treasury yields, Ethena's comparative advantage is diminishing. Treasury-backed stablecoins offer substantial yields with lower execution risks, making them more attractive at present. But if the future interest rate cut cycle continues, the basis trade spread may widen, which would again enhance the appeal of Ethena's revenue model.

You may wonder how this model aligns with the GENIUS Act, which technically prohibits stablecoin issuers from directly paying yields to holders. However, the reality may not be as strict as it seems. The GENIUS Act does not explicitly prohibit third-party platforms or intermediaries from distributing rewards to stablecoin holders, which can be funded by issuers. This gray area is not yet fully clarified, but many believe this loophole still exists.

Regardless of how the regulatory framework evolves, DeFi has always operated in a permissionless manner at the regulatory edge and may continue to do so. The underlying economic realities seem more important than legal details.

The "Tax" of Stablecoins: The Mainstream On-Chain Value Leakage Phenomenon

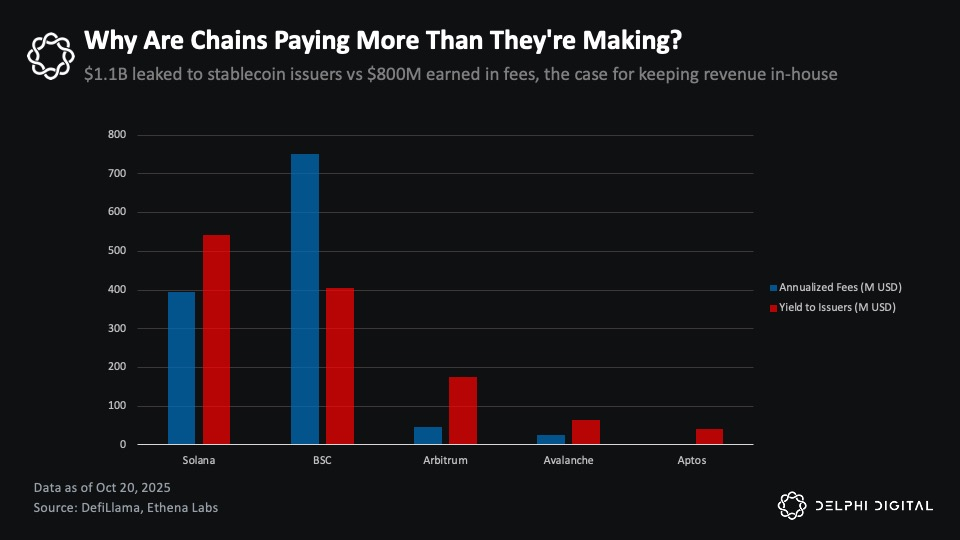

Over $30 billion in USDC and USDT is idling on chains like Solana, BSC, Arbitrum, Avalanche, and Aptos, contributing approximately $1.1 billion in annual revenue to Circle and Tether (assuming a reserve yield of 4%). This figure is about 40% higher than the total transaction fee revenue of these chains. This imbalance highlights that stablecoins have become the largest under-monetized area in L1, L2, and applications.

On chains like Solana, BSC, Arbitrum, Avalanche, and Aptos, approximately $1.1 billion in annual revenue flows to Circle and Tether, while the total transaction fee revenue of these ecosystems is only $800 million.

In other words, these ecosystems lose hundreds of millions of dollars each year due to the outflow of stablecoin revenue. If even a small portion of this revenue could be recaptured, it could fundamentally reshape their economic structure, establishing a more stable and counter-cyclical revenue base than merely relying on transaction fees.

Why can't these chains recapture this revenue? The answer is: they absolutely can!

In fact, these chains have various ways to recapture this portion of revenue:

Directly negotiate revenue-sharing agreements with Circle or Tether, similar to Coinbase's partnership model;

Follow Hyperliquid's approach by initiating competitive bidding through white-label stablecoin issuers;

Collaborate with "Stablecoin-as-a-Service" platforms, such as Ethena, to launch native ecosystem stablecoins.

Each method has its trade-offs:

Collaborating with existing stablecoin giants allows for the retention of familiarity, liquidity, and trust that has been stress-tested in the market with USDC or USDT;

Launching native stablecoins provides more control and a higher revenue capture rate, but requires overcoming challenges during the startup phase, and its infrastructure is relatively less market-validated.

Regardless of the chosen path, the necessary infrastructure already exists, and different chains will adopt different strategies based on their priorities.

Reshaping On-Chain Economics: Stablecoins May Become Revenue Engines

Stablecoins have the potential to become the largest source of revenue for certain chains and applications. Currently, when the economic structure of a blockchain relies solely on transaction fees, its growth is subject to structural limitations. The network's revenue only increases when users pay more fees, and this misalignment not only suppresses user activity but also limits the ability to build a sustainable, low-cost ecosystem.

MegaETH's strategy clearly demonstrates the current transformation trend. They launched the white-label stablecoin USDm in collaboration with Ethena Labs, which is based on USDtb. USDtb is primarily supported by the on-chain short-term treasury product BUIDL launched by BlackRock. By internalizing the revenue from USDm, MegaETH can operate its blockchain sequencer at cost and redirect the revenue to "community-oriented projects."

As the leading decentralized exchange aggregator on Solana, Jupiter is implementing a similar strategic transformation through its stablecoin JupUSD. JupUSD is deeply integrated into its product ecosystem, including collateral for Jupiter Perps (which is expected to gradually replace the $750 million in stablecoins in JLP with JupUSD) and liquidity pools for Jupiter Lend. In this way, the protocol can reinject stablecoin revenue back into its own ecosystem rather than paying 100% of the revenue to external issuers. This revenue can be used to reward users, buy back tokens, or fund new incentives, which is clearly more attractive for enhancing ecological value compared to external payments.

The core of this transformation is that the revenue that was previously passively flowing to stablecoin issuers is now actively reclaimed by applications and blockchains and retained within the ecosystem.

Applications vs. Blockchains: Discrepancies in Valuation and Reshaping

As this trend gradually unfolds, both blockchains and applications have the potential to generate more stable and lasting sources of revenue than at present. This revenue will no longer rely on the cyclical fluctuations of the "internet capital markets" and will not be highly dependent on on-chain speculative behavior. This transformation may even help them achieve an economic foundation that matches their valuations.

Current valuation frameworks are mostly based on measuring value through total on-chain economic activity. In this model, on-chain fees equal the total costs paid by users, while on-chain revenue is the portion of fees distributed to protocols or token holders through mechanisms like burning or treasury inflows. However, this framework has obvious flaws: it assumes that as long as economic activity occurs on-chain, value will naturally be captured by the blockchain, while actual economic benefits often flow elsewhere.

This model is beginning to change, with applications leading the transformation. For example, the two standout applications of this cycle, Pumpfun and Hyperliquid, allocate nearly 100% of their revenue (rather than fees) to buy back their native tokens, while their valuation multiples are far lower than mainstream infrastructure layers. These applications generate transparent, real cash flows rather than implied earnings.

Currently, most mainstream public chains have valuations that are hundreds or even thousands of times their revenue, while leading applications achieve higher revenues at far lower valuation multiples than public chains.

For example, in the past year, Solana generated approximately $632 million in fees and $1.3 billion in revenue, with a market capitalization of about $105 billion and a fully diluted valuation (FDV) of $118.5 billion. This means its market cap-to-fee multiple is about 166 times, and its market cap-to-revenue multiple is about 80 times, which is already a relatively conservative valuation level among mainstream L1s. Many other public chains have FDV multiples that are even in the thousands.

In contrast, Hyperliquid's revenue is $667 million, with an FDV of $38 billion, corresponding to a 57 times FDV multiple, or 19 times circulating market cap. Pump.fun achieved $724 million in revenue, with an FDV multiple of only 5.6 times, and a market cap multiple of just 2 times. These data indicate that applications with strong product-market fit and distribution capabilities are achieving substantial revenues at valuation multiples far below those of infrastructure layers.

This phenomenon clearly reveals the power shift the industry is undergoing: the valuations of applications are increasingly based on the actual revenue they generate and their contributions to the ecosystem, while public chains are still seeking rationalization for their high valuations. The valuation premium of L1 public chains is gradually being eroded, and the future trend is becoming clearer.

If public chains cannot find ways to internalize more of the value flowing through their ecosystems, then these lofty valuations will continue to face the risk of compression. White-labeled stablecoins may be the first genuine attempt by public chains to recapture some value, transforming passive "monetary plumbing" into active revenue sources, giving public chains the opportunity to redefine their economic models.

The Coordination Dilemma of On-Chain Competition: Why Some Public Chains Run Faster?

The transformation of stablecoins around ecosystem alignment is accelerating, but the pace of progress varies significantly among public chains due to their coordination capabilities and sense of urgency.

Take Sui as an example: although its ecosystem is far less mature and complete than Solana's, Sui's actions are remarkably swift. Sui has partnered with Ethena to launch sUSDe and USDi, both of which are stablecoins supported by BUIDL, similar to those adopted by Jupiter and MegaETH. This is not a grassroots movement initiated from the application layer, but rather a strategic decision at the chain level aimed at seizing the initiative in stablecoin economics and changing user behavior before path dependence sets in. These products are expected to launch in the fourth quarter, and although they are not yet online, Sui has become the first major public chain to actively implement this strategy.

In contrast, Solana faces a more urgent and painful situation. Currently, there are about $15 billion in stablecoins on Solana, of which over $10 billion is USDC. These USDC generate approximately $500 million in interest income for Circle each year, a significant portion of which flows directly to Coinbase through revenue-sharing agreements.

So, where does Coinbase use this revenue? The answer is to subsidize Base—one of Solana's most direct competitors. Liquidity incentives, developer funding, and ecosystem investments are partially sourced from stablecoins on the Solana chain. In other words, Solana is not only losing revenue but also indirectly funding its biggest competitor.

This issue has already sparked widespread concern within the Solana ecosystem. Notable voices like Helius's @0xMert_ have called for Solana to launch ecosystem-aligned stablecoins and proposed frameworks such as using 50% of the revenue for SOL buybacks and burns. The leadership of stablecoin issuer Agora has also suggested similar alignment structures. However, compared to Sui's proactive approach, these proposals have received little response from Solana's leadership.

The logic is straightforward: stablecoins have become a "commodity," especially after regulatory frameworks like the GENIUS Act have provided clearer guidance. As long as stablecoins maintain their peg and have liquidity, users do not care whether they hold USDC, JupUSD, or other compliant stablecoins. So why default to a stablecoin that funds a competitor?

Solana's hesitation may partly stem from its desire to maintain "trust neutrality." This is particularly important as the Solana Foundation strives for institutional recognition on par with Bitcoin and Ethereum. Attracting major issuers like BlackRock—whose institutional endorsement can drive large capital inflows and allow traditional finance to view it as a commoditized asset—may require Solana to maintain a certain distance in ecosystem politics. Even supporting an ecosystem-aligned stablecoin could be seen as favoring certain ecosystem participants, complicating its path toward this goal.

Additionally, the scale and complexity of Solana's ecosystem make decision-making more challenging. With hundreds of protocols, thousands of developers, and billions in total value locked (TVL), coordinating the transition from USDC is much more difficult than for a younger, less dependent chain like Sui. However, this complexity itself is a reflection of the maturity and depth of the Solana network, rather than a flaw.

But the problem is that inaction also has a cost, and this cost will continue to grow over time.

The impact of path dependence is intensifying every day. With each new user defaulting to USDC, the switching costs further increase. Every protocol optimizing liquidity around USDC makes it more difficult for other alternatives to launch. Technically, the existing infrastructure could support this transition overnight, but the real challenge lies in coordination capabilities.

Currently, within the Solana ecosystem, Jupiter is leading this transformation through JupUSD, explicitly committing to reinvesting revenue back into the Solana ecosystem and deeply integrating it into its product stack. The question is whether other major Solana applications will follow suit. Will applications like Pump(.)fun adopt similar strategies to internalize stablecoin economics? At what point will Solana have to guide from the top down? Or will they choose to let applications within the ecosystem harvest this portion of revenue on their own? While it may not be the ideal outcome from the chain's perspective to cede stablecoin economics to applications, it is undoubtedly far better than capital leakage or, worse, being used to fund competitors.

From the perspective of the chain or the broader ecosystem, the current key lies in collective action: protocols need to tilt liquidity towards aligned stablecoins, treasuries need to make conscious allocation decisions, developers need to adjust the default user experience (UX), and users need to vote with their capital. The $500 million that Solana currently subsidizes for Base will not disappear due to a command from the foundation. This portion of funding will only truly remain within the ecosystem when enough participants decide to stop funding competitors.

Conclusion: A New Direction for Stablecoin Economics

The next wave of stablecoin economics will no longer be determined by who issues the tokens, but by who controls the distribution rights and who can coordinate actions more quickly.

Circle and Tether built a massive business by being the first to issue and establish liquidity. However, as the stablecoin tech stack becomes commoditized, this moat is weakening. Cross-chain infrastructure makes stablecoins interchangeable, regulatory clarity lowers the barriers to entry, and white-label services reduce issuance costs. Most importantly, platforms with the strongest distribution capabilities, sticky users, and mature monetization models are beginning to internalize revenue rather than pay it to third parties.

This transformation has quietly begun. Hyperliquid is capturing $220 million in annual revenue that flows to Circle and Coinbase by switching to USDH. Jupiter is deeply integrating JupUSD into its entire product stack. MegaETH is using stablecoin revenue to operate its sequencer at cost. Sui has deployed ecosystem-aligned stablecoins in collaboration with Ethena before path dependence sets in. These are merely attempts by early actors, and now every chain losing hundreds of millions annually due to capital leakage has a reference guide for action.

For investors, this change provides a new perspective for evaluating on-chain ecosystems. The question is no longer "How much on-chain activity is there?" but rather "Can they overcome coordination challenges, monetize liquid capital, and capture stablecoin revenue at scale?"

When public chains and applications internalize hundreds of millions in annualized revenue and redistribute it to token buybacks, ecosystem incentives, or protocol revenue, participants in the liquid market can directly price and invest in these revenue flows through the native tokens of these platforms. Protocols and applications that can internalize this portion of revenue will have more robust economic models, lower user costs, and tighter alignment of interests with their communities. Those that cannot complete the transformation will continue to pay the "stablecoin tax," while their valuations will continue to shrink.

The most interesting investment opportunities are no longer about holding equity in Circle or speculating on high FDV (Fully Diluted Valuation) stablecoin issuer tokens, but rather identifying which chains and applications can successfully complete this transformation, turning passive infrastructure into active revenue drivers.

Distribution rights are the true moat. Those who control the flow of funds, rather than just providing infrastructure, will define the next stage of stablecoin economics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。