Separate results from decision quality; a losing trade can still be a good trade.

Written by: tradinghoe

Translated by: AididiaoJP, Foresight News

Confidence is the most important quality of a successful trader. You must be able to trade in the direction of the market based on your beliefs, whether that means following or going against the crowd.

Don't be the denominator of the market

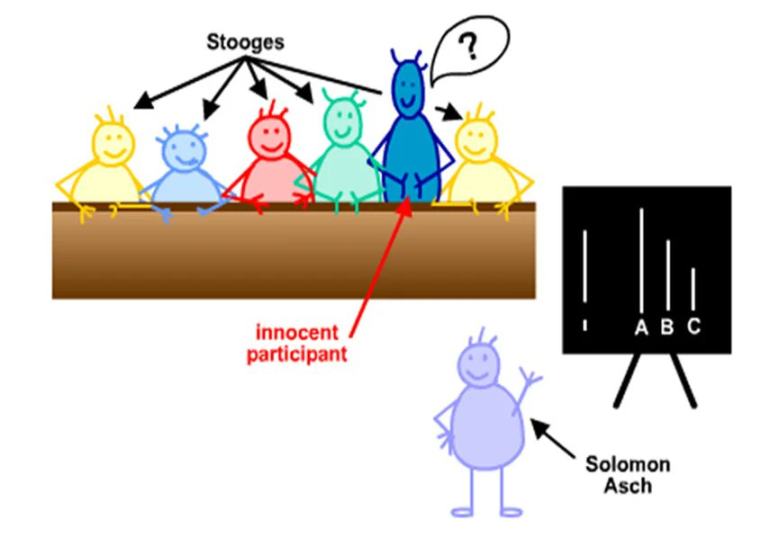

Back in the 1950s, Solomon Asch conducted a series of experiments on how individuals change their opinions to better conform to the group.

In these experiments, actors pretended that lines of different lengths were of equal length to observe whether individual non-employed participants would simply follow the consensus of the group. About 33% of the time, subjects accepted the obviously incorrect statements made by the actors. The purpose of this experiment was to demonstrate how easily we, as humans, are influenced by consensus, even when we know the truth contradicts it.

Clearly, this experiment has many similarities to trading.

Asch's conformity line experiment

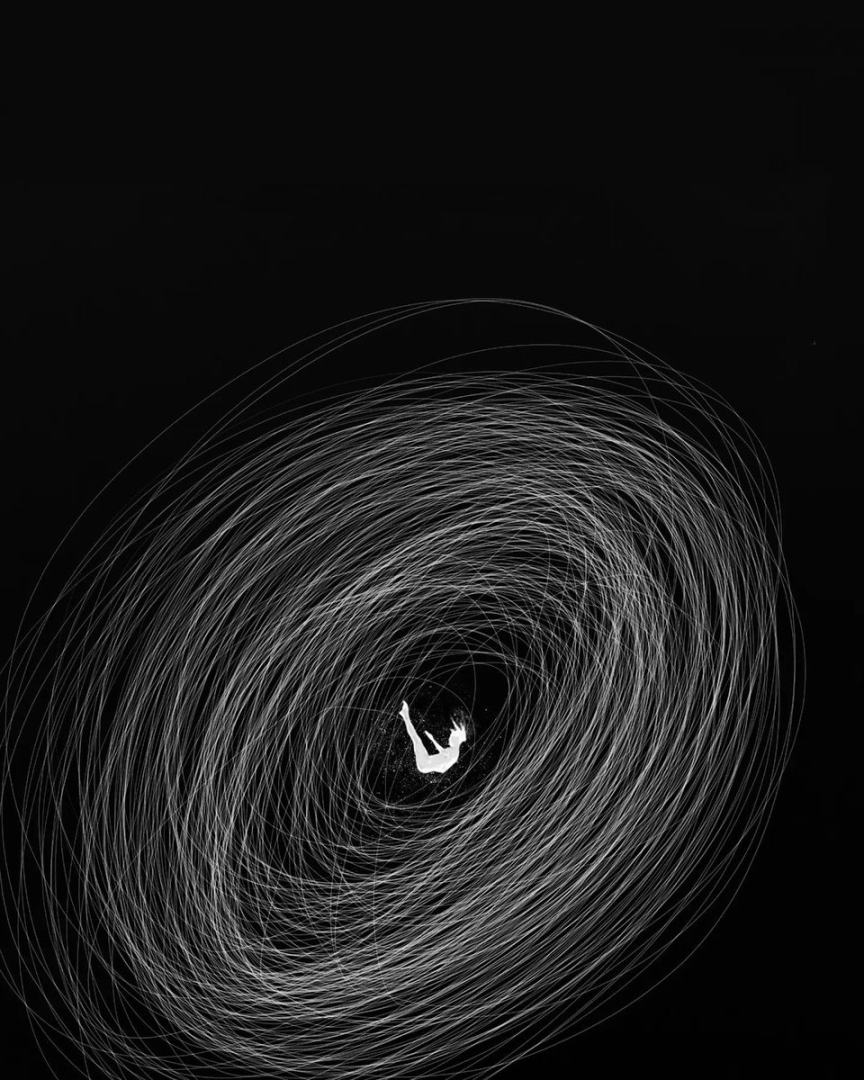

Spiral Downward: When Confidence Cracks

The loss of confidence does not announce its arrival with a catastrophic moment; it is gradually eroded.

You start to doubt trades you would have previously trusted without hesitation. You see opportunities ahead; the charts look good, the narrative is forming, the fundamentals align, and the crowd is still supportive, but something makes you hesitate. Then you watch the market take off while you miss out.

You find yourself caught in a whirlpool of self-doubt.

This creates a vicious cycle that looks like this:

Missed opportunities → Weakened confidence → Increased hesitation → More missed opportunities → Further erosion of confidence

You are not making bad trades; you are avoiding any trades. Or worse, your position is so small that even if you are right, it has no impact on your account balance. You become a bystander in your trading career, watching others trade the assets you discovered first.

What’s the cruelest part? You know that trade is good, the narrative exists, it’s a shiny new thing. Your analysis is sound, but you just can’t trust yourself enough to act.

Confidence → Belief → Capital

There is a chain reaction that distinguishes successful traders from perpetual bystanders:

Confidence breeds belief.

Without confidence, you cannot commit. The opportunity is there, everything checks out, you’ve seen this play out the same way before, but you just can’t pull the trigger.

Your hand hovers over the buy button, and then you convince yourself to back off. “Maybe I’ll wait for confirmation.” “Let me see if anyone else is discussing this.” “What if I’m wrong?”

Confidence separates signals from noise.

When you trust your judgment, you can hold on during the development phase, while most people on crypto Twitter have yet to notice; you are waiting for them to catch up to this new narrative.

You are early because you have the belief to act while others are still on the sidelines.

Being early is everything. What most traders don’t realize is that most narratives do not appear in fully formed ways. They do not emerge out of thin air, neatly tied with a bow.

Someone has to be the first to step up

The birth of a narrative follows a simple formula:

Shiny new thing + First confident voice + Traders eager for opportunity = Narrative formation.

Look back and study any major narrative that has driven the market. AI Meta (like GOAT), meme coins on Solana/BSC, RWA plays, gaming ecosystems (like footballdotfun), and even the current x402 tokens.

Each one started with someone discovering a token, posting relevant information on X or its channels, and confidently saying “this is it” while others were still indifferent.

That pioneer does not have more information than you; they do not have insider knowledge.

They have more confidence.

They are willing to publicly make mistakes, willing to be ahead of everyone on an argument that is not yet obvious.

The representatives of cycles are born through public trading.

Look at any cycle's representatives, those whom everyone follows for alpha, those who are highly respected, those who can move the market with a token code release.

Most of them solidified their reputations through a single legendary public trade, calling out that trade early and holding on for phenomenal gains.

They bought it, they talked about it, they were right, and then suddenly everyone wants to know what they are buying next.

Take Ansem and Solana's judgment as an example

Ansem was one of the first to recognize Solana's potential and is known for his relentless calls.

When you hear about the person who bought SOL at $1 and held it all the way to $200, you immediately think of Ansem.

Ansem's call on Solana at $1

Ansem did not just quietly buy SOL and hope he was right. He talked about it constantly, promoted his position, publicly articulated his argument, and took on the social risk of being wrong when the entire crowd was bearish.

He was not trading in the shadows.

SOL rose from single digits to over $200, the Solana meme ecosystem exploded, and the tokens he called early surged 50x, 100x, some even more, while Ansem became one of the most followed traders of that cycle; not because he was smarter than others, but because he had the belief to speak out loudly when things were not yet obvious.

This is how representatives are born. A public trade, immense belief, and the willingness to make mistakes in front of everyone.

Meanwhile, most traders open positions and then wonder why they are losing money, even when they can’t clearly articulate what they bought or why they bought it.

They trade in the shadows, following those representatives, yet gain none of the benefits that come from publicly establishing belief.

If you cannot explain your argument to others, do you really have an argument? Or are you just shooting in the dark and hoping for the best?

Someone has to promote the coins they hold

Here’s an unsettling truth: sometimes you have to buy a coin and then tell others about it.

Because if they don’t know, how will they buy it?

Narratives need momentum, momentum needs attention. Attention requires someone willing to be the first to step up, willing to shout it out loud, willing to take the risk of saying “this is it” when things are not yet obvious.

If @0xmert_ can promote ZEC to his entire timeline, what’s stopping you from talking about the coin you bought?

The difference between a token you bought that is stagnant and one that becomes a narrative is not always the fundamentals. Sometimes it’s simply because no one is talking about it, no one is creating social proof, no one is putting it on other traders' radars.

You always miss narratives early because you are waiting for others to create them, not realizing you can be that person.

Think about it, every token that suddenly skyrockets has a first buyer, a first person to tweet about it, a first trader willing to take the risk to bet on something unproven and say, “I think this might have some potential.”

The main issue is not whether you can find good trades. The issue is whether you have the belief to be the first, to be the one shouting it out loud, and to take responsibility regardless.

That’s where your advantage lies.

Confidence controls your position size

Here’s an intangible advantage that separates great traders from mediocre ones: knowing when to increase position size and when to decrease it.

This does not come from spreadsheets or Kelly formula calculators. It comes from the ability to recognize patterns developed through experience + the confidence to act on them.

When you’ve made hundreds of trades, when you’ve witnessed tokens rise 10x and also seen them rug pull, when you’ve been early and late, when you’ve won big and lost big; you develop an intuition. You know deep down what belief feels like.

Take the first meme coin in a new ecosystem play as an example

You’ve seen this pattern unfold across multiple cycles. A new chain launches or gains momentum, and within days or weeks, a meme token emerges as the cultural flagship of that ecosystem. It first captures attention and becomes synonymous with the chain itself.

Trillions on the Plasma chain

The first flagship meme coin on the Plasma chain. If you’ve gained pattern recognition from previous ecosystem launches, you know this play.

Your advantage here will be to establish a position early at a low cost or to invest when there is still room for growth at a reasonable market cap.

Ping on the X402 ecosystem

The same pattern, the X402 ecosystem launches, hype slowly builds, and Ping emerges as the attention-grabbing meme coin.

Take the "thirsty play" model as an example

The market goes through dry spells, with no major narratives, no clear entry opportunities, traders are thirsty, bored, holding cash with nowhere to deploy it.

Then something good enough appears; not perfect, but credible. Because everyone is craving a play, liquidity rushes in.

$$Aster and $$AVNT are perfect examples. After traders experienced a period lacking major plays, people discovered these might be high liquidity competitors on different chains.

It’s not just about the fundamentals; it’s about the timing of its emergence. Traders are ready to deploy funds into something with a narrative.

There’s also the first-mover advantage in new technology

Every cycle introduces new mechanisms, new protocols, new ways to financialize things that didn’t exist before. And each time, the first credible implementation of new technology captures a massive amount of attention and capital.

Take Token strategic release

This protocol launched DATS (Decentralized Autonomous Tokens) for an NFT series, a mechanism for financializing blue-chip NFTs.

PunkStrategy was the first strategy coin launched from experiments related to CryptoPunks.

If you recognized this pattern (first implementation of new technology + blue-chip NFT brand + a novel mechanism traders have never seen before), you know it’s worth taking a larger position.

The market cap of $PNKSTR has risen to over approximately $300 million.

Why? Because it is the first DAT launched by Token Strategy. It has the credibility of the CryptoPunks brand behind it. It is something new that traders can understand and are willing to dive into. By the time the second or third NFT DAT is launched, the novelty has worn off, and the returns are significantly compressed.

Confident traders sometimes do not need to perfectly understand the technology. They just need to recognize: "This is the first credible implementation of something new, and it’s worth taking a position."

A confident trader can instantly assess: "This is a 0.5% position" versus "This is a 5% position, maybe more." You are not just gambling; you are calibrating based on accumulated wisdom and trusting yourself to execute.

When confidence is intact, you trust your judgment.

When confidence collapses, everything feels like the same blurry bet. You keep all your positions very small (or don’t open any at all) because you no longer believe in your ability to distinguish high-belief opportunities from marginal ones.

In your mind, every trade becomes a coin toss, even if your analysis tells you otherwise.

Your advantage comes not just from finding trades; it comes from knowing how much to invest.

Rebuilding: The Advantage Before Losing Money

The market is always there, money is always there, but if you lose your advantage; that is, your belief in your ability to identify opportunities and take action, then you have already lost the game before you lose all your money.

Before you fix your profit and loss curve, you must rebuild your confidence:

Make small, high-belief trades

Not to make money, but to prove to yourself that you can still execute. You are retraining your brain to trust your judgment again.

Document your trades

Separate results from decision quality. A losing trade can still be a good trade. A winning trade can still be a bad trade. Focus on the execution of the trade itself.

Your trading journal can be a Telegram channel created just for yourself, or your X account, to record your trades and thoughts; some good examples are @DidiTrading, @onchainsorcerer, @real_y22 (100k to 1M challenge).

Celebrate correct execution, even if the trade results are poor

Your position size is appropriate. You have a basis for judgment, and you managed the risk. This is a victory and an experience gained, regardless of profit or loss.

Remember, every trader you respect has been in your current situation.

Everyone has gone through crises of confidence, self-doubt, and paralysis. The difference is that they regained their confidence.

They decided to trust their execution, even when it felt uncomfortable; they made the trades they originally wanted to avoid. When the inner fear whispered to reduce positions, they instead increased them. They acted first and executed their trades without waiting for the crowd's confirmation. They viewed both winning and losing trades as experiences gained.

The advantage you lost long before losing money is the only truly important advantage.

Protect it as you would protect your portfolio.

Because the fact is true.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。