BTC Crashes, Yet Bitcoin ETF Inflows Hit $149M: What’s Happening?

BTC getting ready for another big jump while everyone is still worried about the Fed? On October 27, data from SoSoValue showed that Bitcoin ETF Inflows reached $149 million, the third day in a row of positive inflows.

Even though price is still volatile, investors seem more confident. Many are looking beyond short-term volatility and focusing on the bigger picture: rate cuts, institutional buying, and growing trust in digital gold.

$149 Million Bitcoin ETF Inflows Explained: What Next?

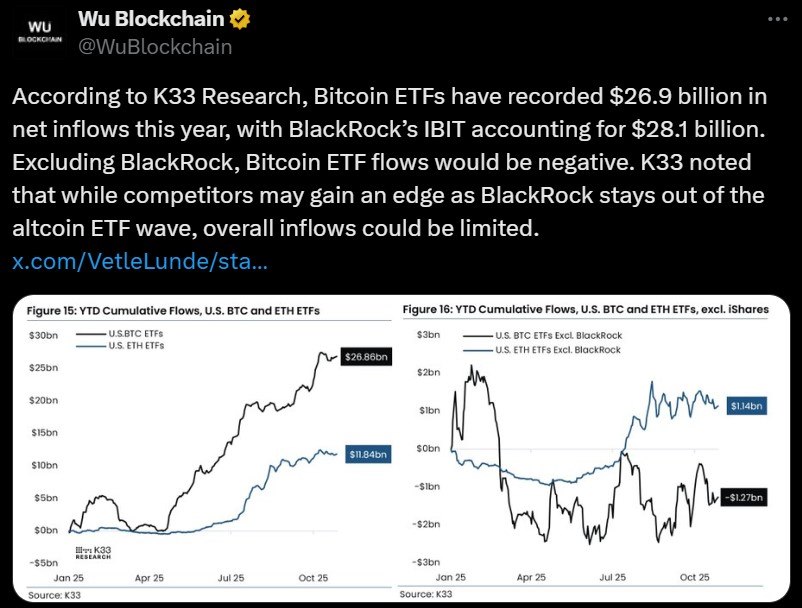

Wu Blockchain ’s recent X post conveys, according to the K33 Research, BTC ETF inflows have received $26.9 billion influx this year. The biggest part of this comes from BlackRock’s IBIT, which alone added $28.1 billion.

Without IBIT, total Bitcoin ETF inflows today would actually be negative. This shows that one major player is leading most of the action. Even when there are talks about a price crash in the short term, institutions are still invested in the asset.

4 Big Reasons Behind Rising ETF Inflows

1️. Trump-Linked Company Buys $163M

A company called American Bitcoin, linked to Donald Trump’s circle, has bought 1,414 tokens worth about $163 million. This big buy shows that large companies are still adding crypto king to their reserves.

2️. FOMC Meeting Impact on BTC

The Fed rate cut meeting happening today and tomorrow is a big reason behind market excitement. If the Fed gives a dovish message, influx could rise. But if not, there could be a small crash, bringing prices near $111K–$112K.

3️. France’s “Strategic Reserve” Proposal

France is planning a bill to buy 2% of crypto king’s total supply to build a Strategic $BTC Reserve. If passed, this move would make France one of the first countries to treat the token like a national asset, just like gold.

4️. Fidelity Predicts $1B by 2038

As per latest BTC price update today , Fidelity Investments predicts it could reach $1 billion by 2038. This may sound crazy, but it’s spreading hope among investors.

These 4 major news are fueling the bullish market momentum, while reflecting the investor sentiment neutral at 50.

Price Analysis: Technicals Show Strength Amid Volatility

Right now, bitcoin price crash is trading around $114,596 with steady strength.

-

The RSI is at 53, meaning the market is balanced

-

The MACD indicator is close to a bullish crossover, which usually hints that prices could rise soon.

Analyst Ali Martinez says $111,160 is strong support, while $117,630 is the resistance level. If it breaks above that level, the token could move up to $120,000. But if it fails, it might pull back a bit before trying again.

If Chair Jerome Powell confirms that rate cuts are coming, it could spark more Bitcoin ETF inflows and push the price beyond $116,000 to $120,000. However, if the Fed delays, then assets might fall slightly in the short term.

The Bottom Line: $BTC News Points Toward Quiet Strength

As per my research and experience being cryptocurrency expert, even though some headlines talk about today’s slight crash, the overall data tells a more positive story:

-

Bitcoin ETF Inflows are rising for the third day in a row.

-

Big companies and even governments are showing interest.

-

The Fed rate-cut outlook could be the next big trigger for a rally.

If Powell gives a dovish message this week, the asset could easily climb to $120K, proving again that it remains the strongest digital gold in global markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。