Why Is Crypto Market Up Today: Will Fed Rate Cut Ignite Bull Run?

Why is crypto market up today? The global cryptocurrency is witnessing a major rally, driven by investor optimism, strong macroeconomic signals, and anticipation ahead of the upcoming Fed meeting on October 29. With Bitcoin and Ethereum surging to new highs, traders are bracing for what could be a defining week for digital assets.

Bitcoin and Ethereum Lead the Crypto Comeback

As of today, the global market cap stands at $3.97 trillion, reflecting a 2.3% jump in the last 24 hours. The total trading volume has reached $167 billion, with Bitcoin maintaining a 57.8% dominance and Ethereum holding 12.6%.

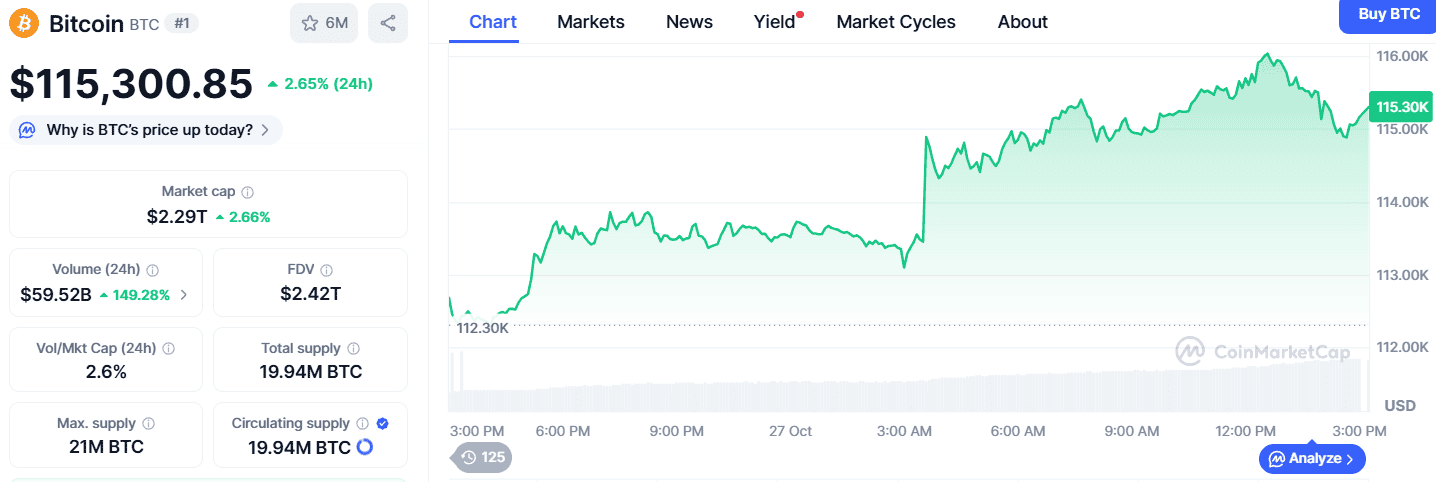

Bitcoin price (BTC) surged 2.56% in a day and nearly 4% in a week, now trading at $115,280.33 with a $2.29 trillion market cap and $57.95 billion in 24-hour trading volume. Since October 23, BTC has climbed from $106,904 to a high of $116,035 before settling at its current level — marking one of its strongest five-day rallies this quarter.

Source: CoinMarketCap

Source: CoinMarketCap

Ethereum (ETH) mirrored this bullish pattern, jumping 4.42% in a day to $4,163.44, boasting a $502.52 billion market cap and $39.2 billion in daily volume. ETH also began its surge on October 23, moving from $3,725 to $4,249 before stabilizing — signaling renewed investor confidence in the digital assets.

Fed Crypto Meeting Fuels Investor Optimism

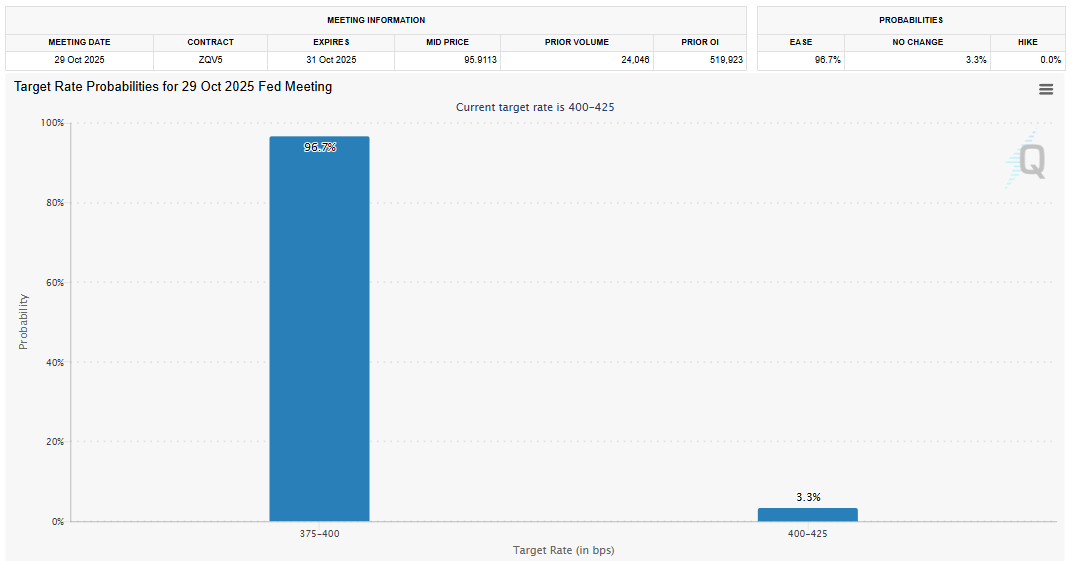

A major catalyst for this rally is the upcoming Federal Reserve meeting scheduled for October 29. The previous September 2025 meeting saw Jerome Powell cutting interest rates by 25 basis points (bps). Now, with the current rate between 400–425 bps, markets are pricing in a 96.7% probability of a 50 bps rate cut — while only 3.3% expect another 25 bps move.

Source: FedWatchTool

Source: FedWatchTool

The expectation of a rate cut has ignited bullish momentum across risk assets, including cryptocurrencies. A lower interest rate environment typically boosts liquidity and investor risk appetite, encouraging greater capital inflows into volatile assets like Bitcoin and Ethereum. This explains why crypto is going up today ahead of the Fed conference.

Global Stock Market Rally Adds Fuel to the Fire

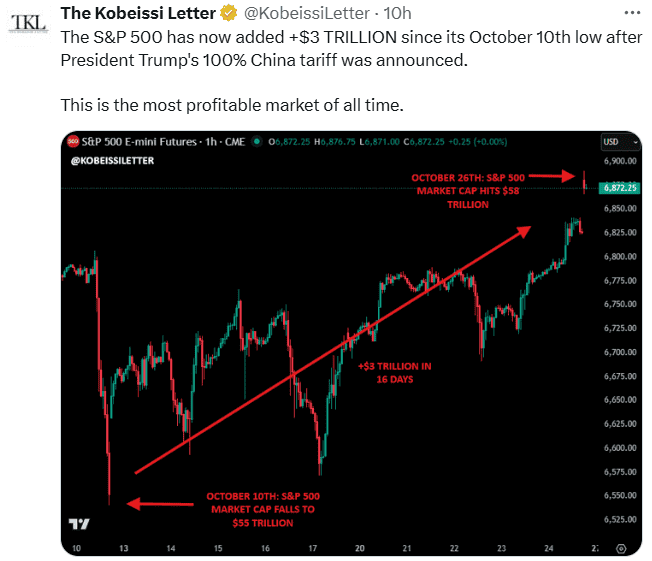

Adding to the positive sentiment, Japan’s Nikkei 225 broke through the 50,000 mark for the first time in history, surging 65% since April 2025. The S&P 500 has added $3 trillion in value since October 10, rebounding strongly after President Trump’s 100% China tariff announcement.

Source: X

Source: X

Meanwhile, Nasdaq 100 futures are up nearly 1%, driven by optimism around a US-China trade deal. This synchronized global bull run has spilled into digital assets, reinforcing the belief that digital assets are now part of the broader macro growth narrative.

What’s Next for the Crypto Market?

All eyes are now on the October 29 Fed meeting. If the 50 bps rate cut is confirmed, it could unlock another wave of bullish sentiment, potentially pushing Bitcoin past $120K and Ethereum beyond $4.5K. However, if the Fed maintains caution, short-term corrections might follow before another leg up.

Conclusion

The crypto market is rallying today due to a powerful mix of rate cut optimism, stock strength, and macro momentum. As investors await the Fed crypto meeting, Bitcoin and Ethereum’s surge signals renewed faith in digital assets. Whether this rally sustains depends on the Fed’s next move — but for now, the bulls are in control.

Disclaimer: This article is for informational purposes only, not to be considered as financial advice. Do your own research before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。