Author: 0xBrooker

Over the weekend, the US-China trade negotiation delegation held its fifth round of talks in Malaysia this year, making final preparations for the upcoming summit between the two countries' leaders at the end of the month.

Previously, with both sides, especially the US, continuously signaling their expectations to reach an agreement, and the improvement in short-term liquidity in the US financial markets, the Nasdaq index has gradually stabilized and rebounded from the declines and fluctuations of the previous two weeks. After the release of the US September CPI data on Friday, it reached a historic high. On Sunday, both sides announced that they had reached a consensus on the "agreement framework," which stimulated a collective rise in BTC and the cryptocurrency market.

The three major market factors suppressing bullish sentiment—US-China trade conflict, short-term financial liquidity, and inflation data—have all improved, contributing to the US stock market reaching a new historical high this week. However, BTC and the cryptocurrency market remain weak due to overall risk appetite being still suppressed and historical cyclical issues. Although there was a weak rebound supported by the 200-day moving average, it has not yet returned to a bull market state. The cryptocurrency market still lacks hotspots, and Altcoins remain weaker than BTC.

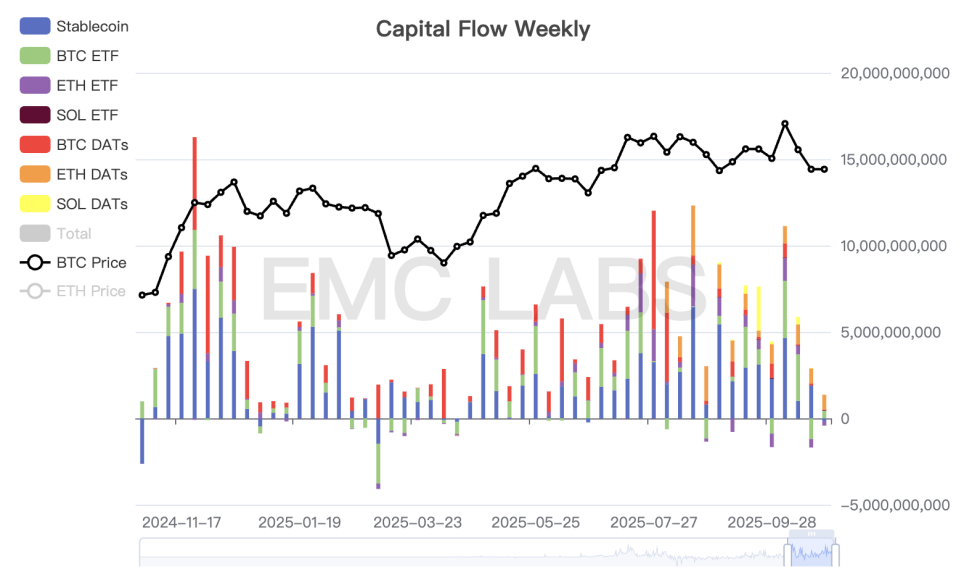

Capital inflow remains weak, making it difficult to offset the market pressure from long-position sell-offs. Moving forward, it is necessary to continue observing whether capital can return to a plentiful inflow state, reversing the downward trend, especially with the easing of interest rate cuts and the US-China trade conflict.

Policy, Macroeconomic Finance, and Economic Data

Two weeks ago, the US-China tariff cold war suddenly escalated, causing global financial markets to shake again. Subsequently, both sides, especially the US, continuously released signals of goodwill and a desire to reach an agreement, which the market gradually interpreted as a "promoting talks through pressure" behavior, leading to stabilization.

Over the weekend, both delegations held their fifth round of discussions in Malaysia. According to announcements from both sides on Sunday, within two days, they "conducted constructive discussions" on topics such as export controls, the extension of reciprocal tariffs, fentanyl and drug cooperation, further expanding trade, and the 301 'vessel fees,' "forming a preliminary consensus," which will proceed to internal approval processes. The meeting between the two countries' leaders at the end of the month is likely to take place as scheduled.

Since the US government shutdown, the market has been operating without economic and employment data, finally receiving its first key data on October 24—CPI. The data showed that the US September CPI increased by 3% year-on-year, lower than the expected 3.1% but higher than the previous value of 2.9%. This indicates that the likelihood of the Federal Reserve cutting interest rates in October is close to 100%, with the expectation for a rate cut in December reaching 91.1% on FedWatch. The continuation of the rate cut cycle has alleviated previous market concerns, and after the data release, all three major stock indices reached new historical highs. BTC also continued its weak rebound, but it is still far from its historical peak.

Due to the US government shutdown, short-term liquidity has faced issues. With Powell stating that "the Federal Reserve will soon stop QT," the market's pressure has begun to weaken.

US stocks in AI and technology sectors have started to disclose Q3 earnings reports. Tesla's earnings report was below expectations but still closed higher, indicating that AI spending remains optimistic in the market. Next week, several benchmark companies will continue to disclose earnings reports, which need to be closely monitored.

The US dollar index rebounded by 0.39% this week, closing at 98.547, remaining in a moderate state. After several weeks of forced upward movement, gold began to decline sharply on Tuesday and has since remained weak.

Cryptocurrency Market

In addition to the impact of the macro financial market, BTC and the cryptocurrency market are still constrained by historical "cyclical" influences.

This week, exchanges recorded over 130,000 BTC inflows, slightly reduced from last week, but the net outflow shrank to 2,775 BTC, reaching a recent low. This indicates that during the transition between old and new cycles, the cyclical influence on the market is significant.

Long-position holders have reduced their holdings by over 39,000 BTC, and this continuous selling during a decline often occurs during the confirmation phase of a bear market. At this time, the buying power of short-position holders is insufficient to absorb the selling pressure.

In the new market structure, the main forces absorbing the selling pressure, DATs companies and BTC Spot ETF channel funds, also performed weakly this week. According to eMerge Engine statistics, the total capital inflow into the cryptocurrency market this week was only 943 million, the lowest in months.

Weekly statistics of capital inflow in the cryptocurrency market

The weak trading state is behind the "cyclical" suppression of market sentiment that we have been emphasizing recently. A change in this state requires either the long-position forces in the new structure to actively absorb selling pressure amid a global increase in risk appetite or the relentless selling from both long and short positions to confirm the bear market.

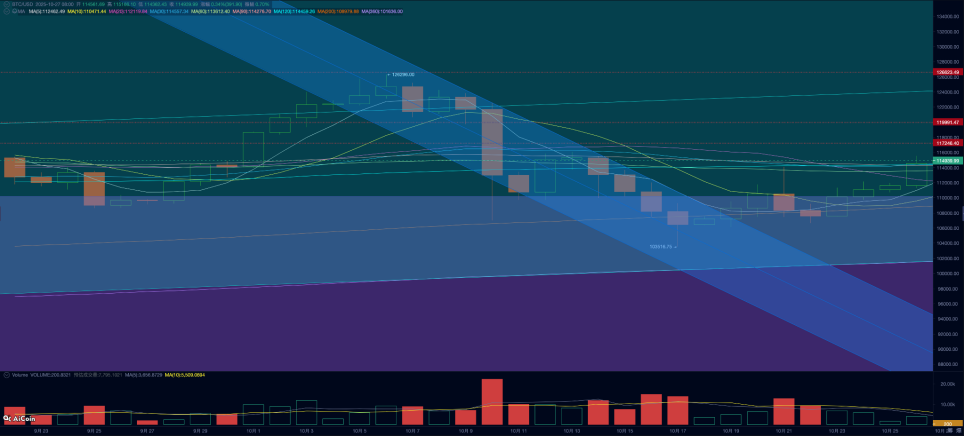

Technically, BTC stabilized above the 200-day moving average and the "Trump bottom" (the $90,000 to $110,000 range) this week, continuing its weak rebound with a 5.4% increase for the week. ETH also stabilized above the 120-day moving average.

BTC price trend daily chart

The renewed US-China conflict has led to continuous liquidations in the contract market, resulting in a loss of over $20 billion in nominal value. Recently, BTC has rebounded weakly alongside US stocks, but the total number of open contracts remains low, indicating that leveraged funds are unlikely to become a key driving force for the rebound in the short term.

Based on multidimensional assessments, we believe that the behavior of DATs and BTC Spot ETF channel funds remains the only two forces sustaining BTC's rebound and potentially returning to a bull market state.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, indicating a transitional period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。