Author: Nancy, PANews

The once quiet cryptocurrency market has become lively again, with the open-source protocol x402 suddenly gaining popularity in recent days, quickly becoming the focus of market attention. Related trading volume and activity have significantly surged, and ecological projects have become a new hotspot for capital.

Trading Data Soars Tens of Times in a Week, Driven by Multiple Factors Including MEME, CEX, and Ecological Parties

In May of this year, the Coinbase developer platform officially announced the launch of the x402 protocol, aimed at activating the long-reserved but underutilized HTTP 402 (Payment Required) status code, transforming it into an on-chain payment layer for new application scenarios such as API service providers, content creators, and contextual protocols.

Observing on-chain data, the x402 protocol had relatively low ecological activity for several months after its launch, until a significant explosive growth occurred recently.

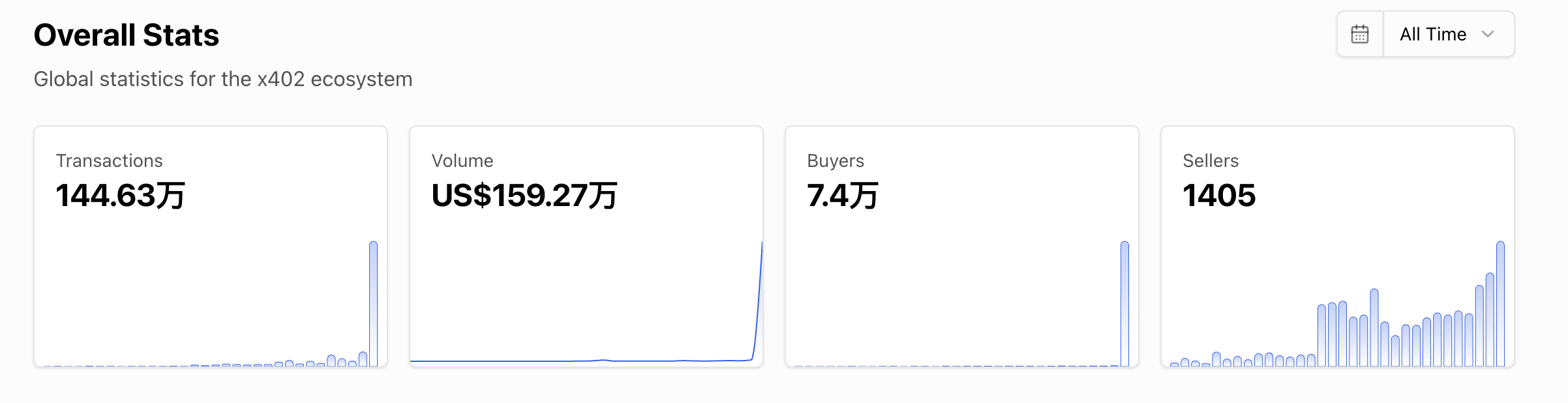

According to data from the x402scan browser, as of October 26, the cumulative number of transactions on the x402 platform has exceeded 1.446 million. From the time distribution, from its launch until October 23, the daily average transaction volume mostly remained in the range of hundreds to thousands, with overall performance relatively stable and limited ecological activity. Starting from October 24, the x402 ecosystem experienced a significant leap, with daily transaction numbers reaching hundreds of thousands, surging tens to hundreds of times compared to before, and the transaction numbers in just one week accounted for 63.8% of the cumulative total.

Transaction amount data also shows a high degree of short-term concentration. Before October 23, the daily transaction amount of x402 was usually only tens to hundreds of dollars, but in the following days, the daily transaction amount surged to hundreds of thousands of dollars, contributing approximately $1.59 million in cumulative transaction volume in just three days, accounting for 69.1% of the overall transaction amount.

The explosion in trading volume is closely related to the rapid expansion of the number of buyers and sellers. As of October 26, the current number of buyers for x402 has reached 74,000, an increase of 70,000 in the past week; the number of sellers is 1,405, with a growth of 327.1% in the past three days.

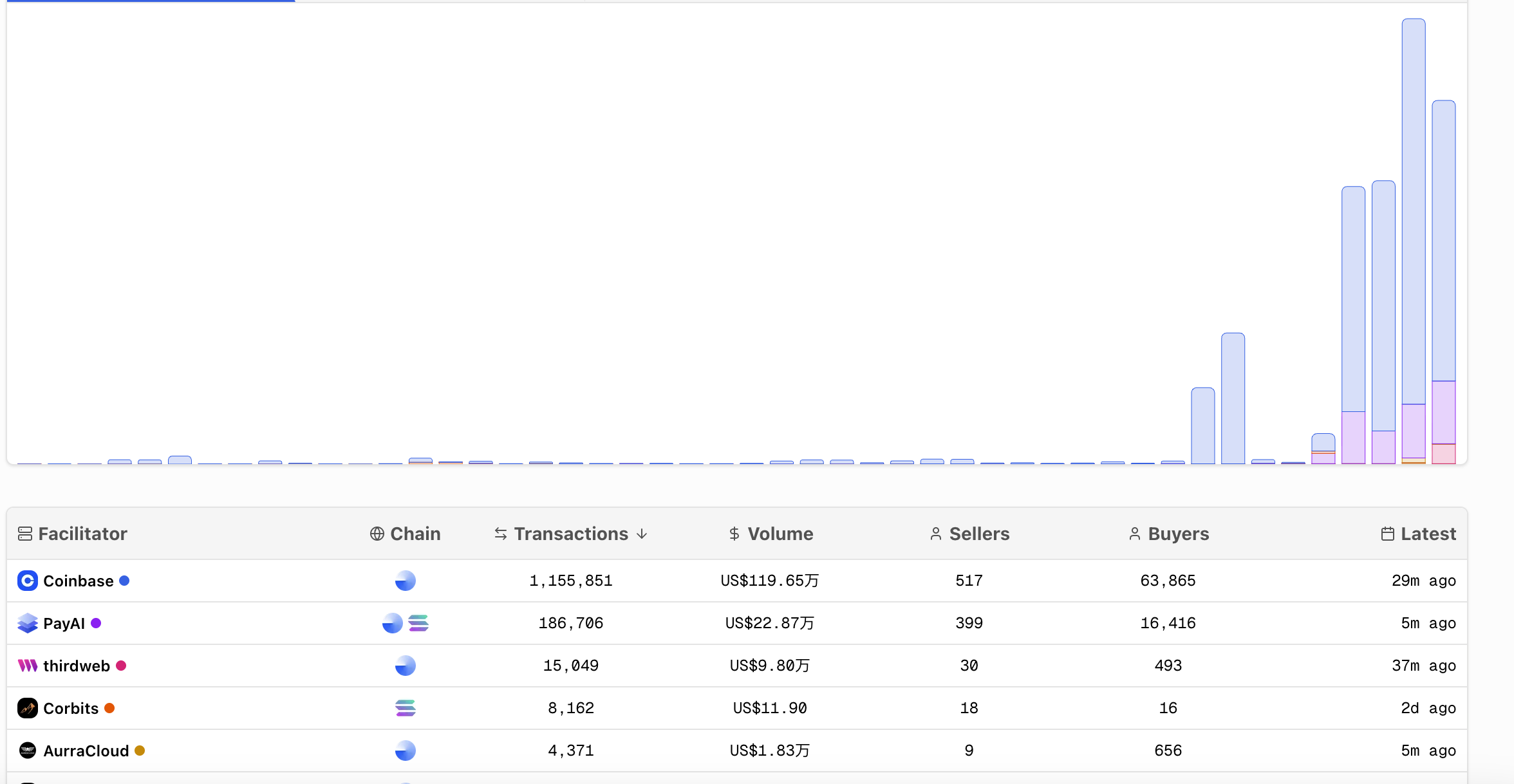

From the perspective of trading execution entities, Dune data shows that trading activity is highly concentrated in a few core Facilitators. Among them, Coinbase Facilitator (Base) is the largest "payment custodian," having processed over $1.004 million in transaction volume and more than 1.16 million transactions; the second largest Facilitator, PayAI (Base and Solana), has processed over $219,000 in transaction volume and more than 175,000 transactions; the remaining Facilitators have relatively smaller processing scales.

The recent short-term explosion in the x402 ecosystem was primarily triggered by the surge of the first MEME coin launched through this protocol, PING, which attracted a large influx of trading and speculative funds. Additionally, with the listing on mainstream exchanges like Binance and OKX, as well as concentrated promotion from ecological parties like Base, a highly concentrated exposure effect was formed, rapidly activating x402 in a short period.

Behind the Rapid Growth, Market Differentiation is Obvious, with Funds Flowing to Practical Projects

With the rapid increase in market attention and continuous influx of funds, the scale of the x402 ecosystem is showing a rapid expansion trend, covering types such as client integration, services/interfaces, infrastructure and tools, learning and community resources, and Facilitators. According to the latest data from CoinGecko, there are a total of 41 projects in the x402 ecosystem, with a total market capitalization exceeding $780 million, and an overall increase of 351.3% in the past 24 hours.

From the market performance perspective, most projects saw varying degrees of increase last week, with nearly half of the projects achieving triple-digit or even quadruple-digit growth. However, it is important to note that these high-growth projects are mostly smaller market cap projects, which are easily driven by funds and can experience significant short-term volatility, posing higher risks.

In terms of trading activity, the trading volume in the x402 ecosystem reached $240 million in the past 24 hours. Among them, the established project EigenCloud accounted for nearly half of the share, approximately $114 million. The only projects with trading scales in the tens of millions of dollars are PING and PAYAI, while projects with daily trading volumes in the millions of dollars are less than one-third, with most other projects' trading amounts only in the tens of thousands to hundreds of thousands of dollars, indicating a clear Matthew effect within the ecosystem.

From the market scale perspective, EigenCloud is the main market cap support, reaching approximately $450 million. Although this project achieved instant payment functionality for stablecoins through the integration of the x402 payment standard in October this year, its market cap growth is not primarily driven by the x402 ecosystem; there are only nine medium-sized projects with market caps in the tens of millions of dollars, including Bankr, PAYAI, OpenServ, PING, etc.; about 75% of the remaining projects have market caps in the millions or even hundreds of thousands of dollars, showing a highly differentiated market structure.

From the project type perspective, leading projects are mainly focused on AI Agents and MEME coins. MEME coins are primarily influenced by market heat; for example, PING once surged to become a leader outside of EigenCloud's track but was subsequently overtaken by AI projects like PAYAI and OpenServ, indicating that funds are gradually flowing towards projects with practical application value.

Overall, the short-term explosion of the x402 ecosystem stems from the market's attention to this new narrative of on-chain payment protocols, rapidly heating up under the promotion of early growth space, wealth creation effects, and concentrated marketing, mainly concentrated in leading projects. As the craze spreads, the market is beginning to pay more attention to the actual application value and sustainable development capabilities of the ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。