Original: Odaily Planet Daily

Author: Azuma

With new progress in tariff negotiations between China and the United States, the sentiment in the cryptocurrency market is rapidly warming.

From last night to this morning, the market has once again experienced a significant rise. According to the OKX market data (as of 9:30), BTC broke through 115,000 USDT, reaching a high of 115,590 USDT, with a 24-hour increase of 3.02%; ETH approached 4,200 USDT, peaking at 4,194.84 USDT, with a 24-hour increase of 5.88%; SOL reclaimed the 200 USDT mark, reaching a high of 205.09 USDT, with a 24-hour increase of 5.58%.

In addition to BTC, ETH, and SOL, the altcoin market has finally seen a decent recovery, with some tokens showing impressive gains. For example, the consistently strong ZEC reached 368 USDT, with a 24-hour increase of 30.03%; influenced by the renewed enthusiasm for AI concepts, VIRTUAL reached 1.5761 USDT, with a 24-hour increase of 22.25%; popular protocols like PUMP, PENDLE, and ENA also performed well, with 24-hour increases of 17.64%, 10.06%, and 9.22%, respectively…

Due to the overall upward trend, the total market capitalization of cryptocurrencies has rapidly rebounded. CoinGecko data shows that the current total market capitalization of cryptocurrencies has returned to 3.984 trillion USDT, with a 24-hour growth of 3.5%, just one step away from reclaiming the 4 trillion USDT mark. The panic sentiment among cryptocurrency users has also significantly dissipated, with today's fear and greed index reaching 51, shifting from "fear" to "neutral."

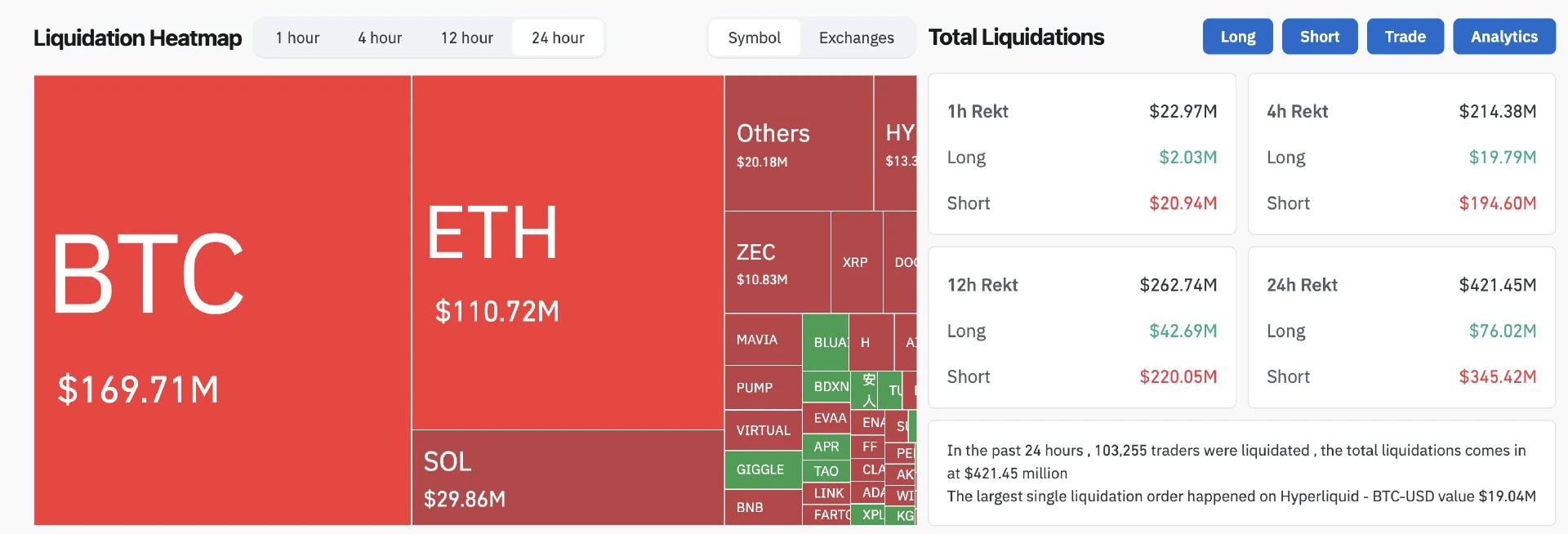

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the total liquidation across the network was 421 million USDT, with the vast majority being short liquidations, amounting to 345 million USDT. In terms of cryptocurrencies, BTC had liquidations of 169.7 million USDT, and ETH had liquidations of 110.7 million USDT.

Tariff Clouds Temporarily Lifted

From the news perspective, the most direct reason for the rapid market recovery is undoubtedly the new achievements in tariff negotiations between China and the United States.

From October 25 to 26, the Chinese side led by Vice Premier He Lifeng and the U.S. side led by Treasury Secretary Yellen and Trade Representative Tai held trade negotiations in Kuala Lumpur.

Li Chenggang, the Chinese Ministry of Commerce's international trade negotiation representative and vice minister, stated after the negotiations that both sides reached a preliminary consensus on several important trade issues of mutual concern, and the next step will be to follow their respective domestic approval procedures.

After the talks, U.S. Treasury Secretary Yellen told U.S. media that after the two-day talks in Kuala Lumpur, the two sides reached a "very substantive framework agreement," laying the groundwork for a meeting between the leaders of the two countries, and the U.S. side has "no longer considered" imposing a 100% tariff on China. U.S. Trade Representative Tai also stated at a press conference that the U.S.-China trade negotiations were productive, covering various topics, and both sides are discussing the final details of a trade agreement proposal that is almost ready for submission to the leaders of both countries.

Since Trump suddenly reignited the tariff issue earlier this month, clouds have loomed over the cryptocurrency market and even the global financial market. On October 11, the market experienced a historic crash, and as the related conflicts gradually eased, the market naturally began to warm up — that said, this seems to be another classic example of Trump's "raise high and gently put down" strategy, but wealth has completed a significant transfer between the ups and downs.

This Week's Focus: Interest Rate Decision

The focus of the market in the coming week is undoubtedly the Federal Reserve's interest rate decision early Thursday morning — on October 30 (Thursday) at 2:00 AM Beijing time, the Federal Reserve FOMC will announce the interest rate decision and economic outlook summary; subsequently, at 2:30 AM, Federal Reserve Chairman Powell will hold a monetary policy press conference.

Last Friday, the U.S. Bureau of Labor Statistics released the overall and core inflation indicators for September, both of which were below expectations, paving the way for the Federal Reserve to further advance interest rate cuts — the U.S. September unadjusted CPI year-on-year rate recorded 3%, a slight increase from last month's 2.9%, marking the highest since January 2025, but the increase was slightly lower than the market's general expectation of 3.1%; the September adjusted CPI month-on-month rate recorded 0.3%, an increase lower than the market expectation and the previous value of 0.4%. The U.S. September unadjusted core CPI year-on-year rate recorded 3%, lower than market expectations and the previous value of 3.1%; the September adjusted core CPI month-on-month rate recorded 0.2%, also lower than market expectations and the previous value of 0.3%.

After the CPI data was released, traders increased their bets that the Federal Reserve would cut interest rates twice more this year. CME "FedWatch" data shows that the probability of a 25 basis point rate cut in October is currently reported at 97.3%, while the probability of maintaining the current rate is only 2.7%; the probability of a cumulative 50 basis point rate cut in December is 95.5%.

"Insider" Whale Movements: Continuing to Be Bullish

Setting aside all traditional influencing factors with uncertainty, abstracting the market trend into a very simple question, the most influential individual recently is undoubtedly the whale with a 100% win rate since the significant drop on October 11.

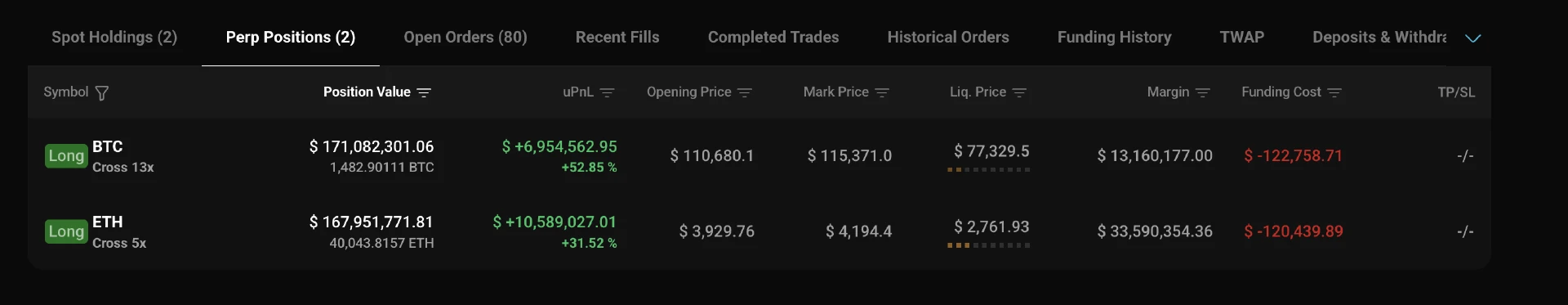

HyperBot data shows that the "100% win rate whale since October 11" currently holds 13x BTC long positions and 5x ETH long positions, with an unrealized profit of approximately 17.54 million USDT, and has not yet taken profits. Three hours ago, this whale even added 1,868 ETH long positions. Currently, the total value of this whale's holdings is approximately 339 million USDT, with BTC long positions valued at approximately 171 million USDT, with an opening price of 110,680 USDT; ETH long positions valued at approximately 168 million USDT, with an opening price of 3,929 USDT.

Clearly, this whale continues to be bullish. Whether it is insider information or technical analysis, closely following this whale's rhythm may be the optimal solution to navigate the current market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。