Kalshi and Polymarket started as polar opposites.

Now the race is close and both are converging on the same technology.

The prediction market wars have shifted from tech to distribution.

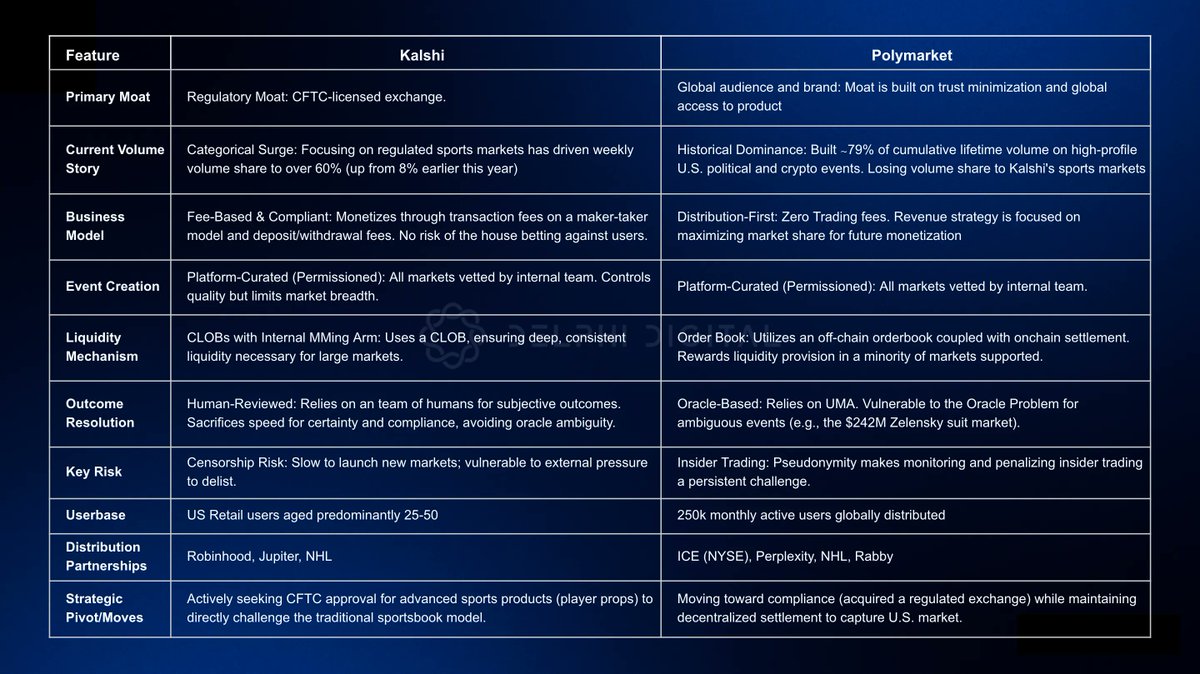

@Kalshi targets US retail investors who value regulatory oversight. Their CFTC-licensed DCM status and Robinhood integration unlock mainstream users that offshore competitors can't touch. Their plan is to become the "S&P 500 of events," positioning as infrastructure rather than a betting platform.

@Polymarket targets a global crypto audience that values easy access. By operating onchain and outside of direct US jurisdiction, they have built a moat by being the most culturally relevant prediction market in the world.

Both platforms now center on a CLOB supported by third-party professional market makers to ensure robust liquidity. Kalshi also operates an internal market making arm to provide additional liquidity.

Both focus on the same core markets: sports betting and political outcomes.

But one key difference is how they determine truth.

Kalshi has built a sound resolution system using defined rules at market creation and independent third-party information sources.

This allows for human nuance which is essential for interpreting edge cases, but creates a centralized point of attack and becomes resource intensive as the number of markets increase.

Polymarket uses UMA's Optimistic Oracle, a decentralized system that is censorship resistant and flexible but has led to controversial resolutions.

The rivalry started as a clash of philosophies, but both platforms are converging across most design decisions.

The battle from here will be around distribution and solving user pain points: liquidity, discovery, expression, market creation speed, and resolution trust.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。