The directional trader with the correct fundamental view could still lose money.

Consider a trader who is long HYPE and believes it will outperform SOL.

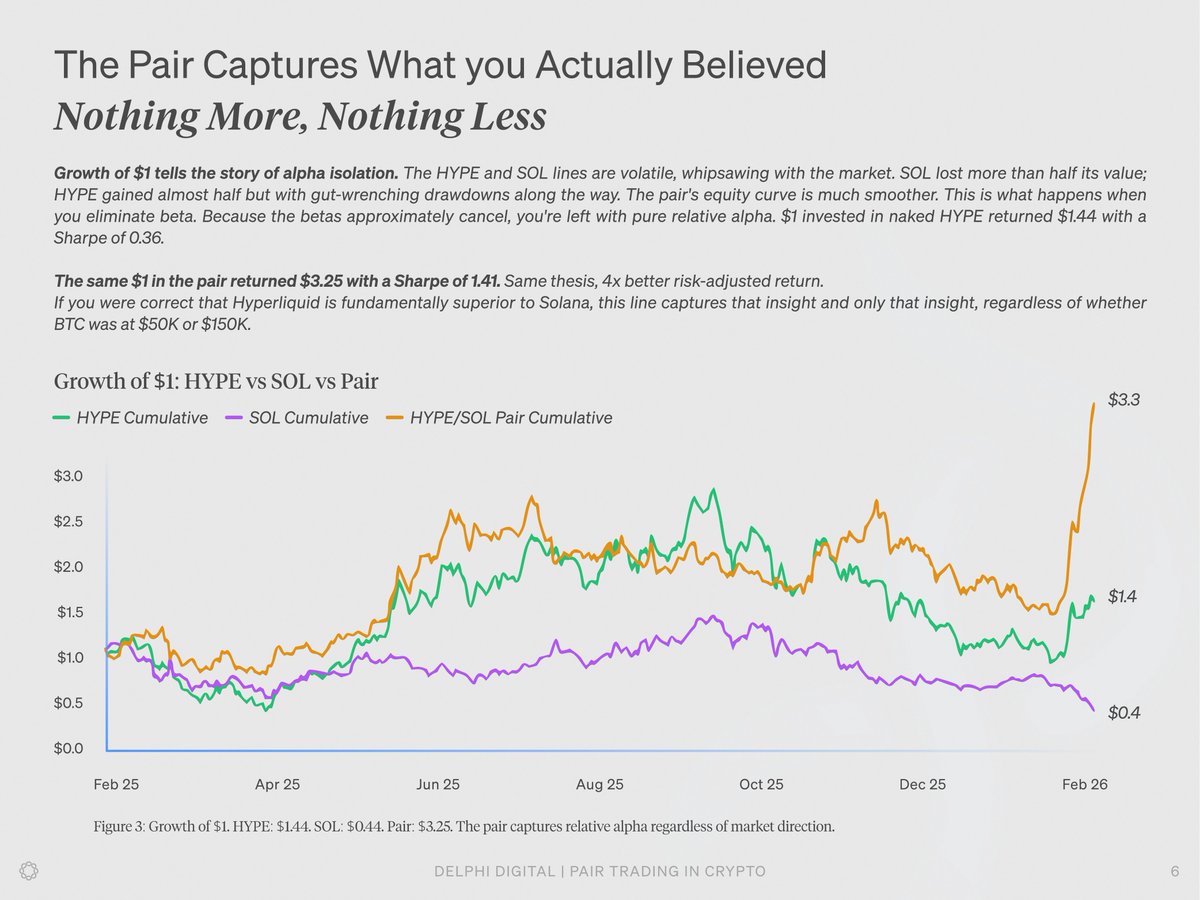

In a bull market, HYPE could rise 50% while SOL gains 30%,and the directional trader wins.

But in a bear market, HYPE might fall 40% while SOL drops 55%. The thesis was right but the position is underwater.

The same pattern holds in capitulation events.

The directional trader loses despite being correct about relative performance.

The pair trader fares better in these scenarios because the exposure is to the spread rather than the absolute price.

In a capitulation where both assets drop 60-70%, the directional trader faces a significant drawdown. The pair trader is down less and may even profit if the spread held.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。