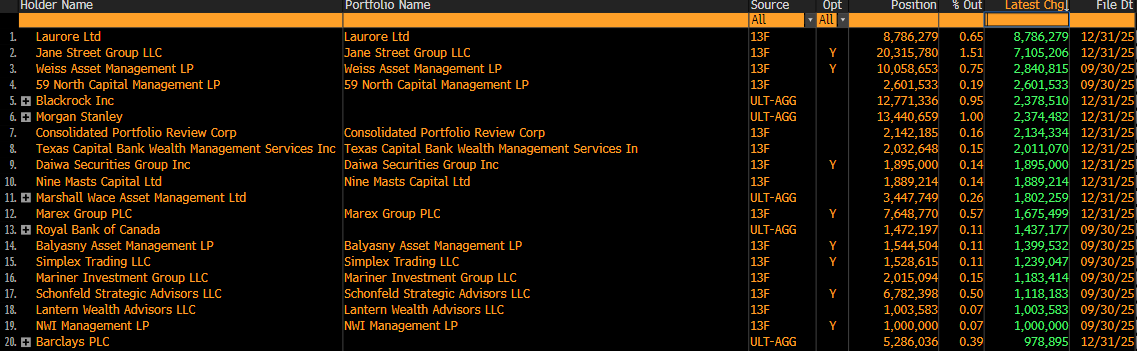

Just saw a data point, it is the 13F released fourth quarter 2025 $IBIT buying data. From this chart, we can see that among the largest holders of IBIT, the proportion of market-making or trading institutions is very high.

Among the top few in the chart are Jane Street, Morgan Stanley, Barclays, RBC, Simplex, Schonfeld, Balyasny, Weiss, Nine Masts, Marex, and so on. Many of these institutions are market makers or trading firms. The data shows that in the fourth quarter, many institutions were still buying Bitcoin spot ETFs.

Of course, this does not mean that these institutions are all bullish buying $IBIT; it is very likely that they bought it for hedging or arbitrage purposes. But that is not the key point. The key point is that most of the $BTC bought is often locked up and will rarely flow back into the market in the short term, so it actually lowers the upper limit of market liquidity.

Among them, Jane Street Group LLC held 20,315,780 shares in the fourth quarter of 2025, accounting for about 1.51% of IBIT’s circulating shares, and increased their holdings by about 7,105,206 shares in the fourth quarter. It is the institution with the largest position.

Although not much information about ETF buying Bitcoin was seen in the fourth quarter, we can see that institutions are continuing to buy.

@bitget VIP, lower fees, greater benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。