Highlights of This Issue

This week's newsletter covers the statistical period from October 17 to October 23, 2025. The RWA market continues to grow under institutional leadership, with the total on-chain market capitalization surpassing $34.5 billion, a week-on-week increase of 11.45%. However, the number of issuers has only slightly increased, further highlighting the trend of market concentration. The transaction volume of stablecoins surged by 37.42%, and the number of active addresses has also rebounded, indicating that the market has transitioned from a low-speed equilibrium to an efficiency-driven phase, significantly accelerating capital turnover. In terms of regulation, the UK and South Korea are preparing to further clarify the regulatory framework for stablecoins, intending to align with the United States. On the project side, BlackRock's BUIDL fund has invested an additional $500 million in Aptos, while major players Robinhood and Kraken have seen significant growth in the total number and trading volume of tokenized assets. Meanwhile, Ant Group and JD.com have paused their plans to issue stablecoins in Hong Kong, reflecting the strategic adjustments and compliance considerations faced by issuers in different markets.

Data Insights

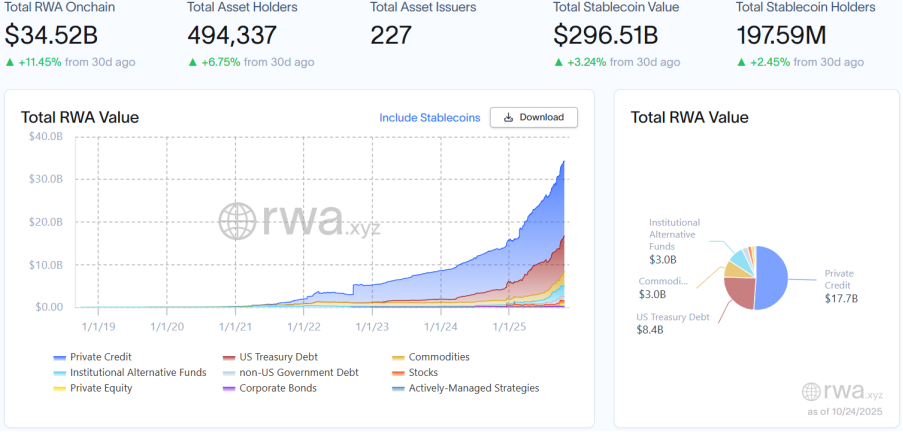

RWA Landscape Overview

According to the latest data from RWA.xyz, as of October 24, 2025, the total on-chain market capitalization of RWA reached $34.52 billion, an increase of 11.45% compared to the same period last month, maintaining a double-digit growth trend. The total number of asset holders rose to 494,300, up 6.75% from the same period last month. The total number of asset issuers is only 227, indicating that market expansion is still dominated by existing institutions, with new participants entering slowly.

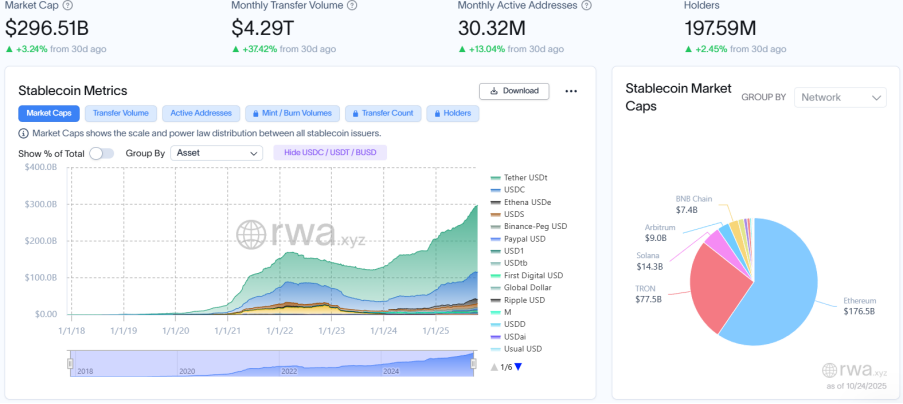

Stablecoin Market

The total market capitalization of stablecoins reached $296.51 billion, a 3.24% increase compared to the same period last month, with growth rates continuing to slow. Monthly transaction volume soared to $4.29 trillion, a significant increase of 37.42% compared to the same period last month. The total number of monthly active addresses rebounded to 30.32 million, up 13.04% from the same period last month. The total number of holders is approximately 198 million, a slight increase of 2.45% compared to the same period last month, both confirming the recovery of market activity and liquidity. Data indicates that the market has moved away from the "low-speed equilibrium" phase and entered an efficiency-driven growth stage. The growth rate of transaction volume far exceeds that of market capitalization, reflecting a significant improvement in the turnover efficiency of existing funds, and the rebound in active addresses suggests a partial recovery in retail trading willingness. The leading stablecoins are USDT, USDC, and USDe, with USDT's market capitalization increasing by 4.79% compared to the same period last month; USDC's market capitalization slightly increased by 2.81%; while USDe continued its downward trend, plummeting by 20.78% compared to the same period last month.

Regulatory News

According to Jinshi News, the Hong Kong Securities and Futures Commission expressed support for market-driven regulatory compliance at a seminar held last week by the Hong Kong and Greater Bay Area Fund Administrators Association. The seminar aimed to enhance industry awareness of regulatory compliance standards in the rapidly developing digital asset industry. Dr. Ye Zhiheng, Executive Director of the Intermediaries Division of the Hong Kong Securities and Futures Commission, delivered a keynote speech at the seminar. The Hong Kong and Greater Bay Area Fund Administrators Association discussed several risk management and monitoring measures to support the management of digital asset funds and tokenized funds.

Notably, the discussion emphasized the importance of internal collaboration within the fund industry to enhance the adoption of innovative technologies in fund management while improving the technical and regulatory compliance capabilities related to digital assets. Dr. Ye stated, "The Securities and Futures Commission is committed to enhancing professional standards and promoting mutual trust in the digital asset market. By supporting industry professionals in their ongoing commitment to comply with regulatory requirements in managing digital asset funds and tokenized funds, we hope to establish a safe, reliable, sustainable, and competitive digital asset fund ecosystem based on robust risk management and investor protection."

UK Plans to Establish Stablecoin Rules by End of 2026, May Align with US Regulations

According to Bloomberg, citing informed sources, the UK plans to establish stablecoin rules by the end of 2026 and will initiate consultations on stablecoin regulation on November 10. Sources indicate that due to tensions between the Bank of England and the government on this issue, the Bank of England believes its framework will align with the implementation of US regulations.

According to Yonhap News, Lee Ik-hyun, Chairman of the South Korean Financial Services Commission, stated on October 20 during a National Assembly audit that interest payments on payment-type stablecoins for holding or using them will not be allowed in principle.

Lee mentioned that South Korea will follow the relevant principles of the US "Genius Act" to prohibit such behavior. Additionally, he stated that they will explore a bank-led alliance model, limiting fintech companies to being only technology partners and prohibiting virtual asset exchanges from issuing stablecoins independently. Regarding the second phase of the virtual asset legislation, he confirmed that it will be submitted within the year and is currently in the final coordination stage. He also mentioned the overseas demand potential for stablecoins in areas such as virtual asset trading, payment settlement, and cross-border remittances, planning to expand applications and prepare relevant work in advance.

EU Imposes Sanctions on Stablecoin A7A5 Pegged to the Russian Ruble

According to INTERFAX.RU, the EU has imposed sanctions on the stablecoin A7A5, which is pegged to the Russian ruble. The 19th round of sanctions against Russia, announced on Thursday, stipulates that transactions with A7A5 will be prohibited starting November 25 of this year. The A7A5 ruble stablecoin is issued by A7 Company, with the Russian Foreign Trade Bank (PSB) as its investor, and was launched in February 2025 in Kyrgyzstan. It is backed by deposits from the Russian Foreign Trade Bank and is pegged to the Russian ruble at a 1:1 ratio. In August, the US had already imposed sanctions on A7 Company and several related companies.

Local Developments

Insiders: Ant Group and JD.com Pause Plans to Issue Stablecoins in Hong Kong

According to Lianhe Zaobao, citing informed sources, Chinese tech companies such as Ant Group, a subsidiary of Alibaba, and e-commerce giant JD.com have paused their plans to issue stablecoins in Hong Kong. Hong Kong passed the "Hong Kong Stablecoin Regulation Draft" in May this year, which officially took effect on August 1. As of the end of September, a total of 36 institutions had submitted applications for stablecoin licenses. Ant Group had previously stated in June this year that it would participate in the Hong Kong stablecoin pilot project, and JD.com had also indicated it would join the pilot program.

Project Progress

Robinhood Adds 80 Stock Tokens on Arbitrum Chain, Total Tokenized Assets Approaching 500

According to Cointelegraph, Robinhood has expanded its tokenization program on the Arbitrum blockchain, deploying 80 new stock tokens in the past few days, bringing the total number of tokenized assets close to 500. According to Dune Analytics data, Robinhood has tokenized 493 assets, with a total value exceeding $8.5 million. The cumulative issuance exceeds $19.3 million, but approximately $11.5 million in destruction activities offset this loss, indicating that market trading is active and continuously growing. Stocks account for nearly 70% of all deployed tokens, followed by ETFs at about 24%, with less allocation to commodities, cryptocurrency ETFs, and US Treasury bonds.

Research analyst Tom Wan noted that the latest batch of tokenized assets includes Galaxy (GLXY), Webull (BULL), and Synopsys (SNPS). He pointed out, "Thanks to tokenization, Robinhood's EU users now have access to a broader range of US stocks, equities, and ETF assets."

Aptos tweeted that BlackRock's BUIDL has added an additional $500 million to Aptos. As a result, Aptos has returned to the top three in RWA, with on-chain tokenized assets exceeding $1.2 billion and ranking second in BUIDL adoption.

Kraken's Tokenized US Stock Trading Volume Exceeds $5 Billion

According to The Block, Kraken announced that the cumulative trading volume of its "xStocks" tokenized US stocks (for non-US users) launched in collaboration with Backed has exceeded $5 billion, with on-chain trading volume surpassing $1 billion, covering over 160 countries and having more than 37,000 unique holders, in collaboration with Bybit, Phantom, OKX Wallet, and Telegram.

According to Nikkei News, Japan's MUFG Bank, Sumitomo Mitsui Financial Group, and Mizuho Bank will jointly issue a stablecoin pegged to the value of the yen and the dollar. The first phase will be used for fund settlements by Mitsubishi Corporation, with the issuer using bank deposits and other assets as collateral to ensure the currency's value.

Stablecoin Protocol STBL Plans to Mint 100 Million Stablecoins USST in Q4 of This Year

The stablecoin protocol STBL announced on platform X that it will mint 100 million USST stablecoins in the fourth quarter of this year, with related work starting in phases. The initial minting of $2 million USST stablecoins has already been completed.

Stablecoin Payment Provider Cybrid Completes $10 Million Series A Funding

According to Axios, Cybrid, a company providing infrastructure for stablecoin and fiat payments, has raised $10 million in Series A funding, as revealed by CEO Avinash Chidambaram.

Payment Company Modern Treasury Acquires Stablecoin Startup Beam for $40 Million

According to Fortune magazine, payment infrastructure company Modern Treasury, valued at $2.1 billion, has acquired stablecoin startup Beam. Sources indicate that the acquisition is an all-stock deal valued at approximately $40 million. As part of the transaction, Beam's founders will join Modern Treasury and help lead the company's expansion into the stablecoin payment sector.

Beam, founded in 2022, provides software for banks and other businesses to send and receive stablecoins. Modern Treasury initially joined the Y Combinator incubator in the summer of 2018, positioning itself as a one-stop service provider for businesses managing cash flow.

Swedish Bank Nordea Joins Banking Alliance to Launch Euro-Pegged Stablecoin

Swedish bank Nordea has announced its participation in an alliance of nine major European banks to launch a euro-pegged stablecoin. The alliance continues to develop AI solutions in various new areas, including risk management and transaction monitoring.

According to CoinDesk, blockchain company Plasma, focused on stablecoin networks, announced significant business expansion in Europe to provide regulated payment services. The company stated on Thursday that it has acquired an entity in Italy with a Virtual Asset Service Provider (VASP) license, allowing it to legally handle cryptocurrency transactions and custody assets in the region. As part of its EU expansion plan, the company will open a new office in Amsterdam, Netherlands, and has appointed a Chief Compliance Officer and an Anti-Money Laundering Reporting Officer. Plasma did not disclose the name of the acquired entity, and its spokesperson did not immediately respond to requests for comment.

The company also plans to apply for Crypto Asset Service Provider (CASP) status under the EU's new Markets in Crypto-Assets Regulation (MiCA) and seek an Electronic Money Institution (EMI) license. These initiatives will enable Plasma to conduct asset exchanges, issue cards, and hold customer funds under regulatory protection. Plasma stated that its goal is to support its stablecoin-based new bank, Plasma One, through these licenses.

Insights

Mis-Minting 300 Trillion PYUSD: The Governance Crisis Behind Paxos' "Fat Finger" Incident

PANews Overview: In October 2025, the well-known stablecoin issuer Paxos accidentally minted up to 300 trillion PYUSD due to a simple parameter input error (commonly referred to as a "fat finger" mistake), an amount 110,000 times its circulation, even exceeding the total global GDP. Although Paxos quickly destroyed the mistakenly minted currency after the incident, preventing a market collapse, this "blunder" profoundly exposed a fatal weakness of centralized stablecoins: even if the issuer has sufficient asset reserves and is subject to strict regulation, its technical systems and internal processes may still have significant vulnerabilities, allowing a single human error to be magnified through its "God mode" (the power to mint and destroy currency at will), thereby threatening the stability of the entire crypto ecosystem. This serves as a wake-up call for all stablecoin issuers—stricter risk control measures must be established (such as setting transaction limits and introducing multi-signature approvals) to minimize human operational risks while maintaining rapid intervention capabilities.

The Endgame of RWA 3.0: When TradFi Collides with Crypto, When Will New Financial Species Emerge?

PANews Overview: RWA (Real World Asset) tokenization has entered the 3.0 stage, characterized by the deep integration of traditional finance and crypto finance, marked by the tokenization of core traditional financial assets such as stocks and ETFs on-chain. This is not merely about "moving" assets onto the chain; it is about creating entirely new financial species through the composability of blockchain, such as combining stock tokens with cryptocurrencies into hybrid assets or using equity for lending in DeFi, thus enabling functionalities like 24/7 trading that traditional finance cannot achieve. However, this integration may also lead to changes in the landscape; when "certain" assets like US stocks are massively tokenized on-chain, it may squeeze the space for high-risk native crypto assets, prompting investors to shift towards more stable and transparent assets. Despite facing regulatory challenges, the ultimate goal of RWA is to build a unified and efficient global financial infrastructure, representing a key turning point for blockchain's move into the mainstream economy.

PANews Overview: This article mainly discusses how stablecoin QR code payments can bridge the "last mile" between cryptocurrency and real-world payments by integrating with localized unified QR code systems in various countries (such as VietQR in Vietnam, PIX in Brazil, Tourist DigiPay in Thailand, and SGQR in Singapore). The article points out that this payment method showcases diverse application scenarios in different countries, whether in Southeast Asia or South America: Vietnam and the Philippines focus on financial inclusion, allowing unbanked populations to make daily payments using stablecoins (such as USDT and USDC), with the system automatically converting stablecoins into local currency, so merchants do not need to handle cryptocurrencies; Brazil aims to combat inflation and attract international crypto funds by incorporating stablecoins into a regulated payment system; Thailand focuses on the tourism economy, allowing tourists to pay directly with stablecoins, avoiding high fees and opaque exchange rates associated with traditional currency exchanges; Singapore demonstrates how to achieve compliant stablecoin payments in a strictly regulated environment, enhancing the legitimacy and stability of payments. Overall, this model utilizes a unified QR code as an entry point, stablecoins as the source of funds, and an intermediary clearing layer to convert cryptocurrencies into fiat payments for merchants in real-time, preserving the oversight capabilities of regulatory agencies while enhancing payment convenience and liquidity, gradually integrating crypto assets into everyday economic activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。