Author: HY & Adam, Xianrang

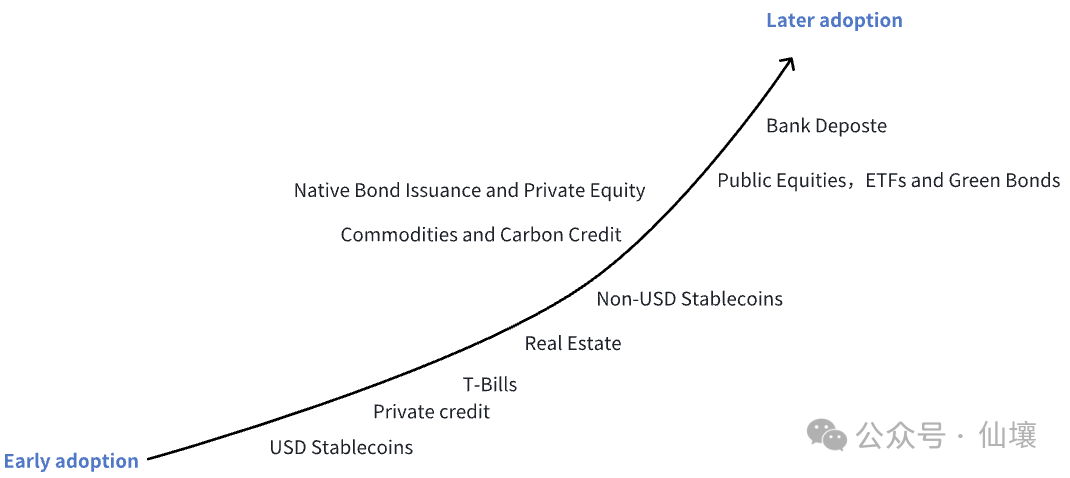

The development history of blockchain has fully proven that only business scenarios related to financial transactions can survive in Web3. RWA cleverly combines the advantages of real-world assets and on-chain transactions, attempting to reshape the global financial landscape. Through blockchain technology, RWA transforms traditional assets such as commodities, credit, and stocks into on-chain tokens, achieving efficient management and transfer of ownership while significantly lowering the transaction threshold for financial assets.

According to current data, the total circulating market value of RWA, excluding stablecoins, has surpassed $33 billion, but this is just the beginning. According to a forecast by the Boston Consulting Group (BCG), by 2030, the scale of on-chain RWA will reach $16 trillion.

The potential of RWA is undoubtedly enormous, but which public chain will the mainstream RWA narrative first become a reality on?

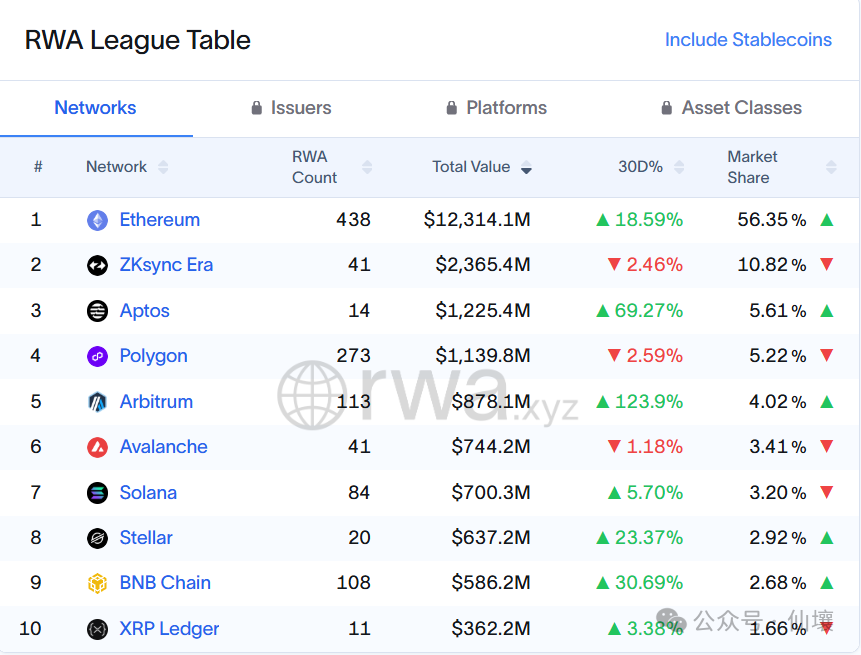

As the largest public chain in the DeFi space, Ethereum holds over 50% of the RWA market share. Solana, with its high-intensity ecosystem development, occupies 3.2% of the RWA market, ranking 7th among major public chains, which should not be underestimated. With giants like BlackRock introducing billions of dollars in RWA assets into Solana through the Securitized platform, its RWA ecosystem has entered a phase of rapid development.

In today's article, we will delve into the current state of Solana in the RWA track, providing a comprehensive and systematic investigation for investors, developers, and industry observers.

Comprehensive Analysis of Solana's RWA Projects

Many users in the RWA market come from traditional stock or commodity markets. For these individuals, whether the platform can respond to user requests in a short time and provide a low-latency, low-cost trading experience is a key factor.

To address trading delays, many RWA projects adopt a strategy of multi-chain deposit absorption and single-chain transaction settlement. Solana, with its high TPS, is particularly suitable as an execution platform for RWA business. The choice of Solana for the launch of CMBMINT, a chain-based RWA fund by CMB International, is enough to demonstrate its attractiveness.

Additionally, RWA applications often involve a large number of small transactions, such as rent distribution and interest payments. If gas fees are too high, they will severely erode yields. Taking the well-known real estate tokenization platform Homebase as an example, it needs to handle thousands of small rent distributions each month. This micro-payment model has extremely strict requirements for low fees, and Solana has a natural advantage with its ultra-low transaction fees.

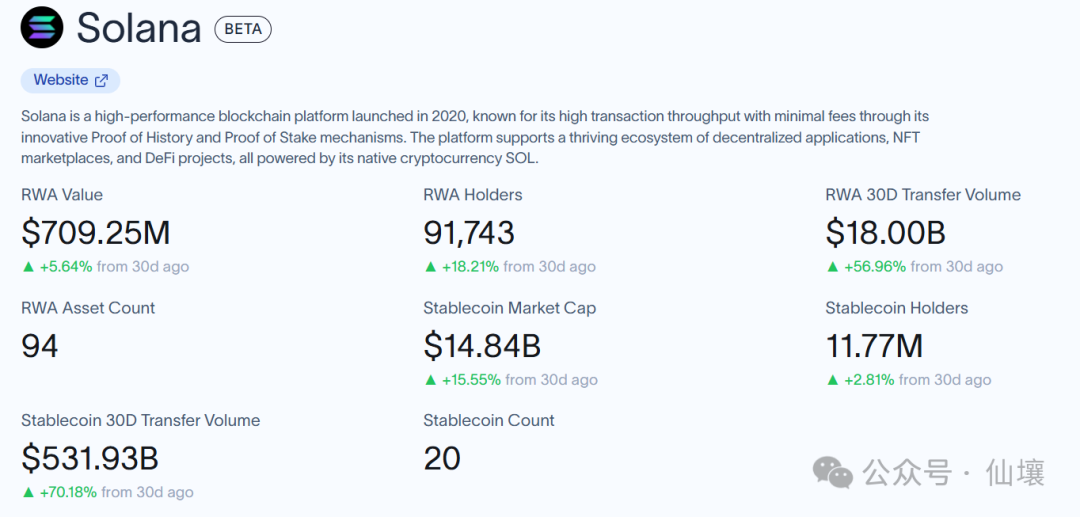

From the data, although Solana's RWA ecosystem is still in its early stages, it has shown strong growth momentum. According to RWA.xyz, the current number of RWA assets in the Solana ecosystem has reached 94, with a total market value of $700 million. In the last 30 days, the amount of RWA transfers on the Solana chain reached $18 billion, with transaction volume second only to Ethereum.

Currently, Solana's RWA ecosystem has formed a diverse structure, covering a wide range of assets from physical assets to financial instruments. Below, we will introduce typical RWA project cases in a categorized manner.

Government Bonds

Currently, government bonds on-chain are one of the most prominent and popular types of RWA assets, as they offer stable, risk-free returns and have always been favored by financial markets. Compared to traditional financial markets, tokenizing government bonds allows for round-the-clock trading and can provide retail access through fragmentation, while also integrating with the DeFi ecosystem to enhance liquidity.

We will analyze a few typical cases below. Note that yield-bearing stablecoins backed by government bonds essentially put government bonds on-chain and enjoy the returns from them; this article also categorizes such RWA products under government bonds.

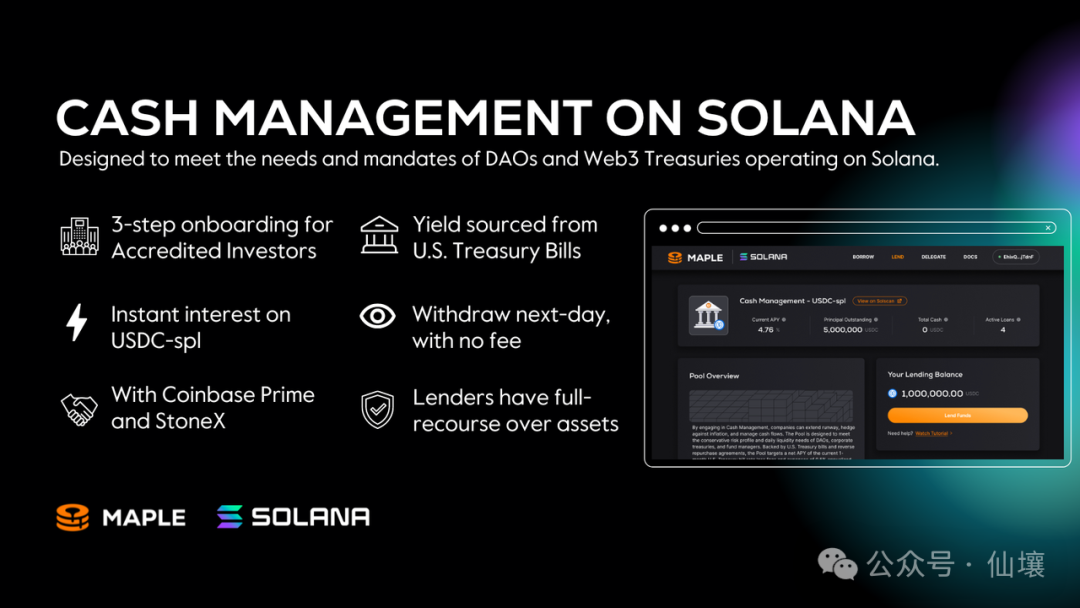

Maple Finance (USDC-SPL)

Maple is a well-known RWA project related to government bonds on Solana, founded by Sid Powell and Joe Flanagan, focusing on institutional-level lending and asset management. Since its launch in May 2021, it has facilitated over $7 billion in loans and managed over $1.7 billion in assets.

In May 2023, Maple launched the asset management solution Maple Cash Management Pool, providing users with a net APY of around 4.8% based on government bond yields, allowing free entry and exit from the pool without lock-up or redemption fees, making it the first government bond-related RWA in the Solana ecosystem. The product has now been expanded to USDC lending, but considering its pioneering role in the Solana ecosystem, it is also recorded in this article.

Based on the yield principles of government bond RWA, we can break down Maple's workflow into the following steps:

- Capital Input: Lenders deposit USDC into Maple Finance's fund pool and receive LP tokens representing their share of the funds.

- Loan Issuance: The fund pool lends USDC to the Solana wallet of the U.S. crypto investment firm Room40 Capital.

- Government Bond Investment: The borrowed USDC is converted into dollars through Circle and invested in government bonds. Room40 Capital, as the borrower, is responsible for managing the government bonds to generate returns.

- Yield Distribution: The returns generated from the government bond investments flow back to the fund pool through the Maple platform, and lenders receive returns based on their LP shares.

In the above case, due to the transparency and immutability of on-chain data, Room40 cannot conceal the flow of USDC funds. Relevant real-time auditing agencies will review Room40's investment yield status off-chain. If the government bond yield reported by Room40 does not match the yield distributed on-chain, USDC lenders can immediately detect anomalies.

To prevent entities like Room40 from engaging in misconduct, Maple Finance requires all participants on the platform, including lenders and borrowers, to undergo KYC and AML verification, with their identities and operational backgrounds subjected to Maple's strict due diligence. It can be said that the combination of on-chain and off-chain operations mitigates the possibility of investment institutions engaging in fraud.

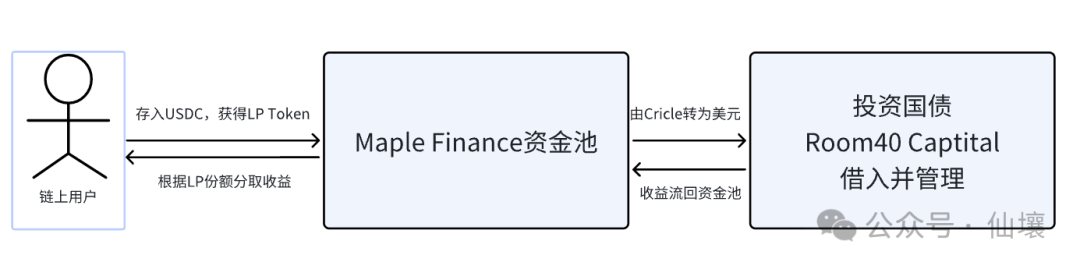

Ondo Finance (USDY & OUSG)

Currently, Ondo Finance has become a leader in the RWA track, with its flagship products USDY (Ondo USD Yield) and short-term government bond tokenized asset OUSG being the most representative RWA products in the Solana ecosystem. With high transparency, high liquidity, and stable yields, they have attracted a large number of investors.

As of October 2025, the circulation of USDY has reached $250 million, making it the leading government bond RWA project on Solana and the largest non-stablecoin RWA asset by circulation on the current Solana chain.

In terms of functionality, USDY operates similarly to Maple: users deposit stablecoins like USDC into the fund pool through the Ondo platform, and Ondo then invests these funds in U.S. government bonds through regulated brokers. The yields from government bonds are distributed to holders in the form of USDY tokens, with APY typically ranging from 4% to 5.2%.

USDY not only provides a stable source of income, but holders can also transfer USDY to other chains like Ethereum and Polygon through cross-chain bridges for lending, collateral, or liquidity mining in DeFi protocols, effectively making it an interest-bearing stablecoin.

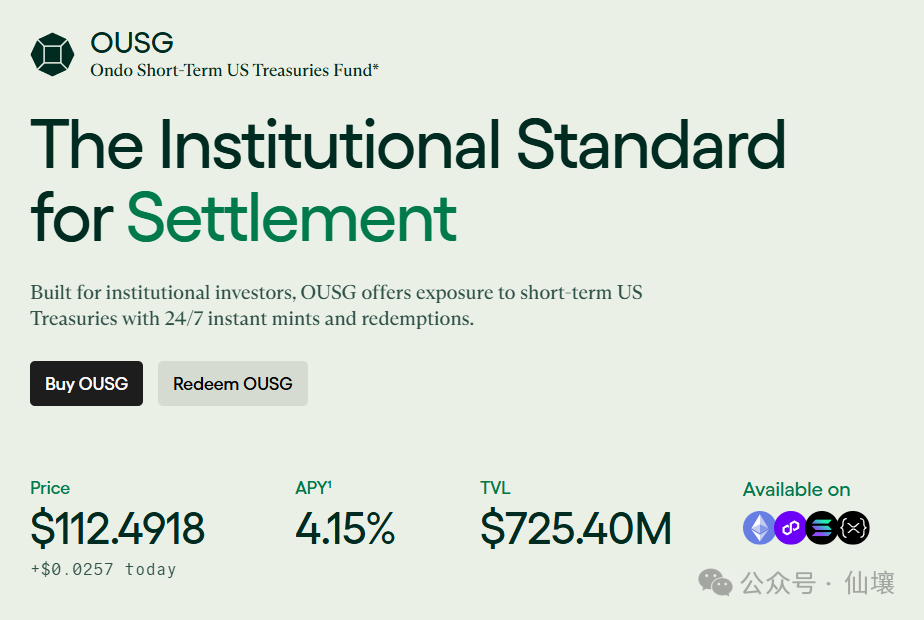

In addition to USDY, another major product from Ondo is OUSG. After absorbing USDC, the Ondo platform invests it in BlackRock's short-term government bond ETF (SHV), and the interest generated is shared among OUSG holders. Currently, the circulation of OUSG has reached $79 million. The difference from USDY is that OUSG primarily invests in short-term U.S. government bonds.

The annualized yield of OUSG is typically slightly lower than that of USDY, but its stability is favored by institutional investors. The reason for the difference between the two is that USDY, in addition to U.S. government bonds, also invests in some bank deposit notes, which usually carry slightly higher risks and returns than government bonds.

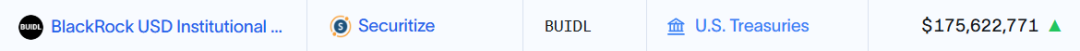

Securitize (BUIDL & VBILL)

Securitize is the first company capable of issuing tokenized securities in the U.S. and Europe. In January 2025, Securitize partnered with Wormhole to bring Apollo Global Management's $1.3 billion credit fund $ACRED to Solana.

Securitize's two main RWA projects on Solana are BUIDL and VBILL, both backed by U.S. government bonds, combining Solana's high throughput and low costs to provide investors with efficient and transparent yield-generating investment tools.

BUIDL, launched jointly by BlackRock and Securitize, is BlackRock's first tokenized fund, initially issued on Ethereum in March 2024 and expanded to Solana in March 2025. VBILL, launched in collaboration with asset management firm VanEck and Securitize, was issued on Solana, Avalanche, BNB Chain, and Ethereum in May 2025. Currently, the market values of BUIDL and VBILL on Solana are approximately $175 million and $23 million, respectively.

Etherfuse (TUSOURO & EUROB & CETES & GILTS)

In 2024, Etherfuse launched the Stablebonds platform on Solana, focusing on tokenized government bonds from various countries. Its main RWA projects on Solana include TUSOURO (Brazilian government bonds), EUROB (EU bonds), CETES (Mexican government bonds), and GILTS (UK government bonds), with a total circulating market value of approximately $3.9 million on Solana.

Stocks

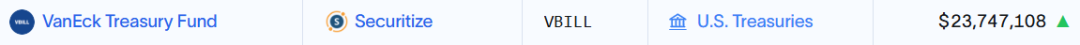

xStock

xStocks is a tokenized stock product launched by Backed Finance, which almost dominates the entire landscape of tokenized stocks on Solana. Within a month of its launch, the total trading volume of xStock on-chain exceeded $300 million, fully demonstrating the market demand for stock tokenization.

Each xStock token is pegged 1:1 to real-world stocks or ETFs, with actual shares held by regulated custodians, ensuring that the token value is linked to the underlying assets. Price data is synchronized to the chain in real-time via Chainlink oracles, ensuring transparency and accuracy. Currently, xStocks covers over 60 stocks and ETFs, including assets like Apple, Tesla, NVIDIA, and the S&P 500 ETF, with most blue-chip stocks included.

Currently, the total market value of xStocks exceeds $94 million.

Private Credit

Private credit is typically provided by non-bank institutions and targets borrowers with lower credit ratings, such as small and medium-sized enterprise loans, accounts receivable financing, consumer credit, or supply chain finance. This type of credit offers high returns but also carries significant risks.

After the 2008 financial crisis, private credit quickly became one of the hottest investment targets on Wall Street, with the market size growing from $250 billion in 2010 to approximately $2 trillion by 2025. Currently, the main private credit project on Solana is Credix Finance. There have been attempts by projects like Alloy X, but they were not sustainable.

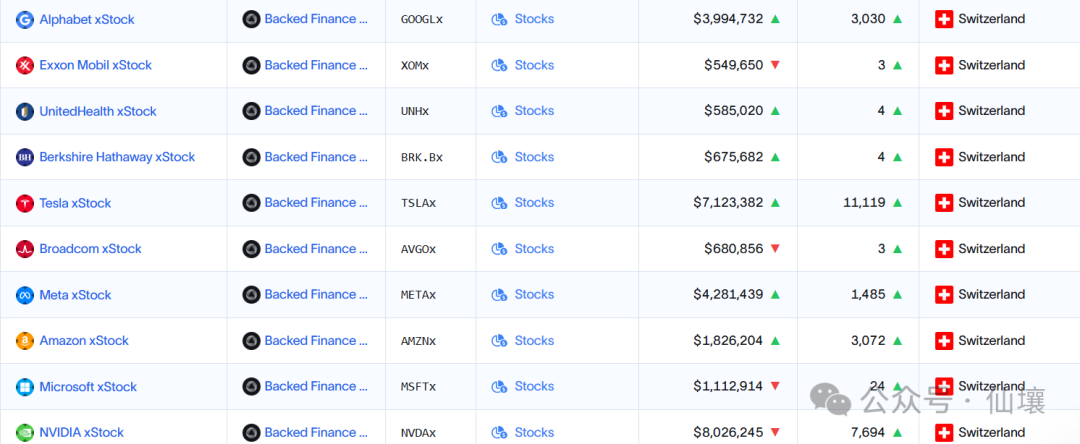

Credix Finance

Credix Finance was founded in 2021, focusing on private credit RWA. The logic behind Credix is relatively simple; it can be seen as a lending intermediary platform between on-chain and the real world: borrowing USDC from on-chain users, converting it into local currencies, lending it to various types of borrowing entities, and providing lending returns to on-chain users.

It is worth mentioning that Credix's Twitter has only been updated once since November 2024, and there has been almost no information about it in the media over the past year.

Real Estate Tokenization

Real estate on-chain RWA, which tokenizes real estate through blockchain technology, has always been one of the main application scenarios in the early vision of RWA.

Among various public chains, Solana is the primary testing ground for real estate on-chain projects. The most well-known real estate RWA project on Solana is Homebase, where users can invest in NFT-ized properties for as little as $100. However, the platform's official Twitter has not been updated since August 2024, and there have been no news articles in over a year, with the "Available" property listings on its official website showing as empty.

Currently, the active real estate RWA projects on Solana include Parcl and MetaWealth.

Parcl

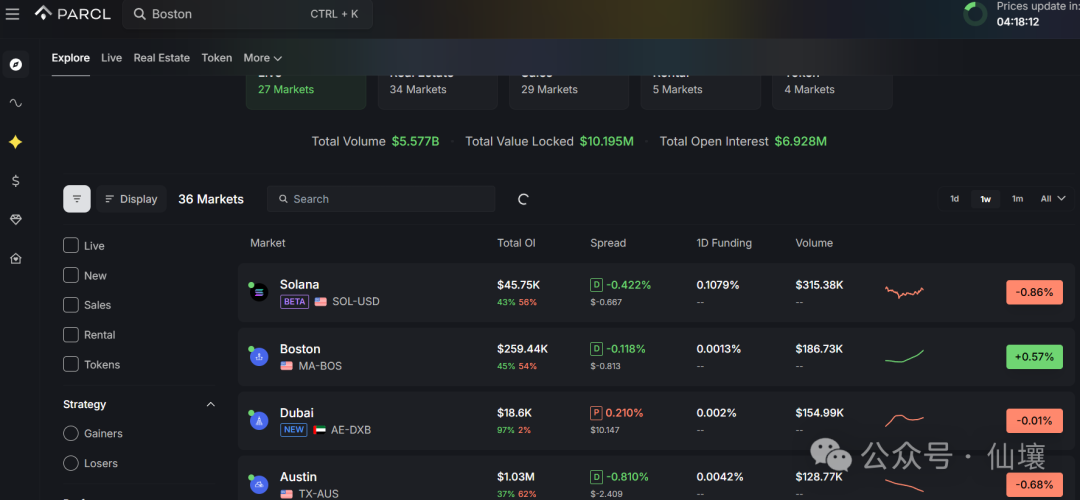

Parcl is a real estate derivatives protocol that focuses on tokenizing real estate market price indices, allowing users to gain market exposure by investing in real estate price indices.

Parcl creates city real estate price indices (City Indexes), enabling users to invest in the price volatility of real estate markets in specific geographic areas, similar to perpetual contracts that allow users to go long or short on property prices. These indices are based on the average price per square foot or square meter of residential properties, with data provided by Parcl Labs, updated daily, aggregating millions of data points globally to ensure the indices reflect real-time market value.

We can directly understand Parcl as a PerpDEX, with the underlying asset being real estate. In addition to going long and short, users can also provide USDC to the liquidity pool to earn trading fees. Furthermore, users can participate in investments with as little as $1, significantly lowering the investment threshold.

As of now, the TVL on Parcl is approximately $7 million.

MetaWealth

MetaWealth is a real estate tokenization platform open to the EU and Canada, providing users with fractional ownership of real estate that generates passive income.

After completing audits and research with third-party quality assessment agencies, MetaWealth acquires and rents qualified properties, while fragmenting the ownership of the properties, allowing users to participate in investments with a low threshold of $100 and share rental income based on their investment's proportion of the total property price.

Currently, MetaWealth has tokenized 138 properties, generating $850,000 in revenue, with 50,000 investors and managing $36 million in properties. In April 2025, MetaWealth launched three regulated RWA real estate bonds, becoming the first project in the Solana ecosystem to achieve this milestone.

In June 2025, Czech fund company APS, managing $13.7 billion in assets, purchased $3.4 million worth of tokenized Italian real estate through MetaWealth. For both retail and institutional investors, MetaWealth provides an innovative, transparent, and efficient investment platform.

Commodities

Commodities typically include industrial raw materials, precious metals, or primary products, with a wide range of industrial and commercial uses. The primary focus of RWA in this area is to put gold on-chain, such as Paxos Gold, where each token represents one ounce of gold, primarily circulating on Ethereum. The main commodity RWA projects on Solana include BAXUS, which tokenizes high-end alcoholic beverages, and Elmnts and Powerledger, which focus on energy.

BAXUS

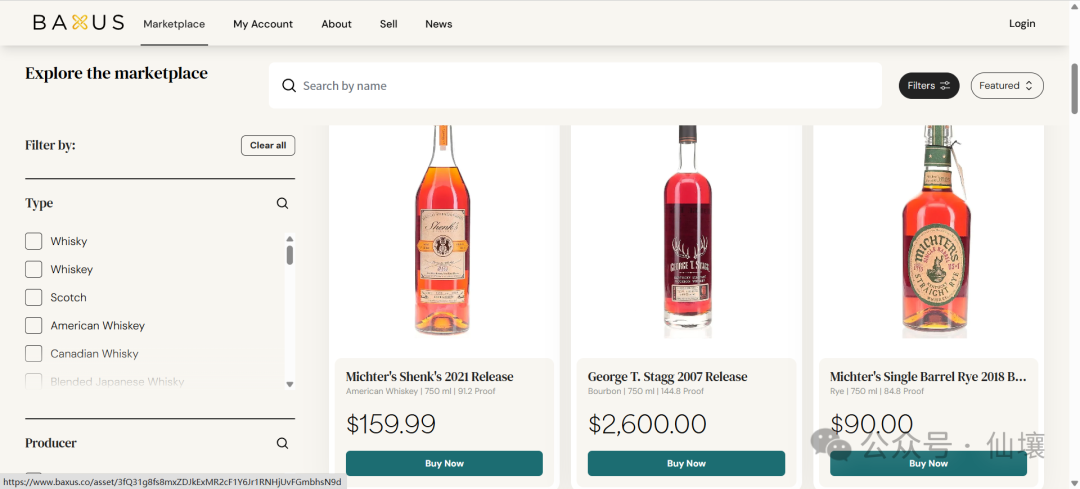

BAXUS stores high-end alcoholic beverages (such as rare whiskey and wine) in secure temperature-controlled warehouses, generating a unique NFT for each bottle through blockchain technology, serving as a digital ownership certificate that records the bottle's origin, certification, and transaction history. It also provides a marketplace similar to Opensea, allowing users to trade rare alcoholic beverages directly, supporting traditional payment methods like USDC and credit cards.

Elmnts

Elmnts focuses on converting commodity assets such as oil and gas mining rights into digital tokens on the blockchain. These tokens represent partial ownership of the mining rights assets, allowing investors to earn royalty income from oil and gas extraction by purchasing tokens. Through tokenization, traditionally high-threshold and low-liquidity mining rights investments become more divisible and tradable, lowering the investment entry barrier.

Powerledger

Powerledger is an Australian energy technology company founded in 2016, dedicated to promoting decentralization and sustainability in the energy industry using blockchain technology. Powerledger enables tracking, trading, and provenance of renewable energy through its platform, covering applications such as peer-to-peer energy trading, virtual power plants (VPP), carbon credit trading, and renewable energy certificates (RECs).

Powerledger tokenizes renewable energy assets such as solar and wind energy on the Solana blockchain, generating POWR tokens or other tokens for trading and tracking. These tokens represent specific energy units, carbon credits, or renewable energy certificates, allowing users to conduct peer-to-peer transactions directly on the blockchain, reducing intermediaries and improving efficiency.

Summary

The RWA ecosystem on the Solana chain encompasses five categories: stablecoins, government bonds, private credit, real estate, and commodities. With its advantages of high throughput and low costs, it demonstrates tremendous potential in the RWA track. However, issues related to network stability, compliance and regulatory challenges, and intense market competition remain significant obstacles to its development. In the future, Solana needs to overcome these challenges through technological optimization, compliance solution development, and ecosystem expansion to become an important platform connecting traditional finance and blockchain, achieving long-term sustainable development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。