Gold's "mad bull" suddenly staged a "high dive."

In the past 24 hours, after breaking through the historical high of $4,300, gold prices plummeted sharply, falling over 6% within 24 hours, with a market value evaporating by $2.1 trillion—this figure is more than half of the total market capitalization of the entire cryptocurrency market at that time. According to TradingView data, this decline also set a record for the largest single-day drop since 2020.

In recent months, the rise in gold prices has been driven mainly by three forces:

Central bank gold purchases—According to data from the World Gold Council (WGC), net gold purchases by central banks reached 483 tons in the first half of 2025, a year-on-year increase of 26%.

Geopolitical risk aversion—Tensions in the Middle East and the expansion of the U.S. deficit have made gold a "safe anchor."

Expectations of a weak dollar—The Federal Reserve's interest rate cut expectations once suppressed real interest rates, pushing up gold prices.

However, when prices break through the market's psychological range too quickly, liquidity risks emerge. Some large funds chose to take profits, while the demand gap between retail and institutional investors widened, forming a typical "crowded trade"—when everyone is bullish, it is the prelude to a correction.

It is worth noting that the decline in gold did not trigger systemic panic. Futures market data shows that COMEX gold open interest only fell by 4%, and ETF holdings remained stable, indicating that institutional investors view this as a short-term fluctuation rather than a trend reversal.

However, some speculative funds have begun to shift towards more elastic asset classes—among them, Bitcoin has become the main beneficiary.

Bitcoin Benefiting?

Bitcoin unexpectedly became a beneficiary of gold's volatility. As gold prices retreated from their highs, BTC rebounded strongly from a low of $108,200 to $113,800, with an intraday increase of about 5%, bringing its market value back to $2.1 trillion. This performance echoed the slight recovery in U.S. stocks, with the S&P 500 index rising over 1%, indicating that market risk appetite is warming up.

Against the backdrop of corrections in both gold and oil, and the Nasdaq moving sideways, Bitcoin's steady performance is interpreted by the market as a "precursor to capital rotation."

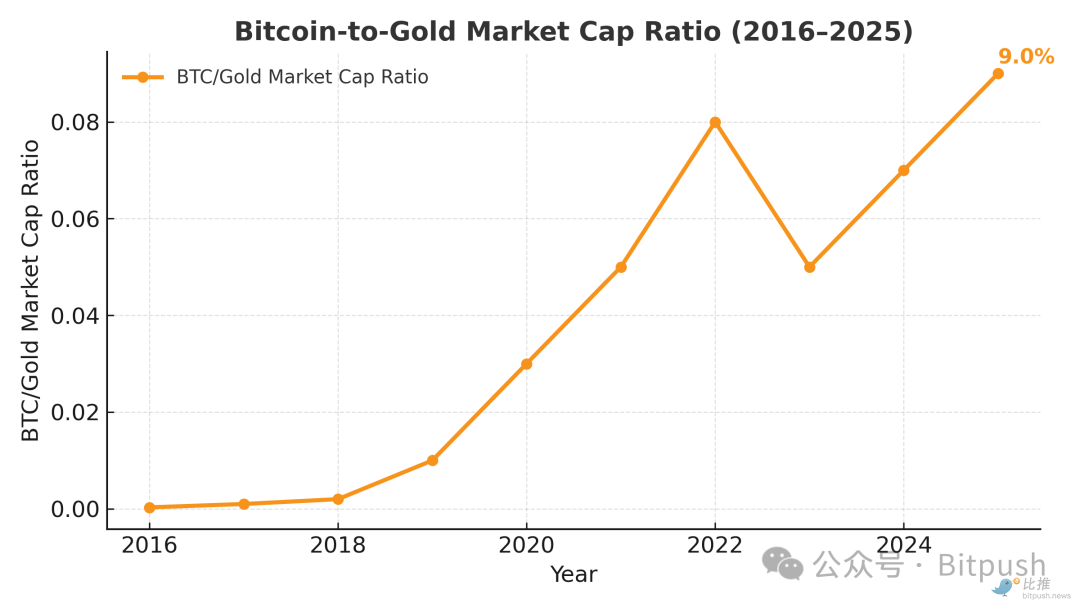

Data confirms this trend. The Block data shows that since mid-August, the BTC/gold ratio has dropped from 37 to 25, reaching a new low since April 2025. Over the past two months, Bitcoin has fallen by 12%, while gold has surged by 30%. This pattern is now changing: as gold shows signs of peaking, the market is beginning to reassess the appeal of digital scarce assets.

From a more macro perspective, Bitcoin remains a "lightweight player" in the traditional financial system. Although its market value has reached $2.1 trillion, this is only 1/14 of gold's market value, accounting for less than 2% of global financial assets. It is this significant "market value gap" that institutions see as future growth potential.

From a more macro perspective, Bitcoin remains a "lightweight player" in the traditional financial system. Although its market value has reached $2.1 trillion, this is only 1/14 of gold's market value, accounting for less than 2% of global financial assets. It is this significant "market value gap" that institutions see as future growth potential.

Bitwise's latest report estimates that if just 3%-4% of the funds in gold portfolios were to shift to Bitcoin, it would be enough to double the BTC price to the range of $160,000 to $200,000. Specifically, from a $30 trillion gold market value, even if only 1% (about $300 billion) were reallocated, it could bring over 15% market value growth to Bitcoin.

Market data indicates that this "minor rebalancing" is quietly underway:

- In the futures market, CME Bitcoin holdings have increased by 22% since August, with institutional holdings rising to 71%.

- In the ETF channel, BlackRock's IBIT fund saw a net inflow of $1.85 billion this month, achieving seven consecutive weeks of net subscriptions.

- The skew indicator in the options market has narrowed from -8% to -2%, indicating a significant alleviation of market panic.

These signs collectively depict a new trend: Bitcoin is gradually shedding its label as a high-volatility speculative asset and is steadily evolving towards a role of "non-correlated allocation" in investment portfolios.

Bitcoin vs. Traditional Finance Market Cap Ratios (Major Asset Market Comparison)

Asset Class

Estimated Total Market Value (USD)

Proportion of Global Liquidity

Remarks

Gold

≈ $30 trillion

About 16% of global wealth

Traditional "hard currency" benchmark

Global Equities

≈ $110 trillion

About 60%

Includes major indices and ETFs

Global Bonds

≈ $140 trillion

About 75%

Includes sovereign and corporate bonds

Global M2 Money Supply (Fiat M2)

≈ $110 trillion

—

"Printable liquidity"

Bitcoin (BTC)

≈ $2.1 trillion

2% of Gold

"Digital scarce asset"

Ethereum (ETH)

≈ $420 billion

0.5%

"Smart contract layer" representative

Data Source: TradingView, Bitwise, IMF World Economic Outlook 2025 estimates.

Logic of Capital Rotation

1. Macroeconomic Background

The latest data from the IMF shows that global total debt increased by $14 trillion in the first half of 2025, reaching $337 trillion, a record high. Although the global average nominal interest rate has decreased by about 120 basis points from its peak in 2023, it remains significantly higher than pre-pandemic levels.

In a high-debt environment, "non-printable assets" are regaining attention.

Gold has historically been trusted as a safe haven, while Bitcoin has emerged as a new generation choice due to its "code scarcity." The difference lies in: gold's liquidity is constrained by its physical form—transportation, storage, and customs costs are high; Bitcoin, on the other hand, is borderless, divisible, can be transferred across borders in minutes, and costs as little as a few dollars.

In the past six months, the trends of gold and Bitcoin have shown a clear "risk cycle differentiation":

- When the market expects easing (Q4 2024 – Q1 2025), gold strengthens due to "lower real interest rates";

- When the market shifts to risk appetite (after Q2 2025), Bitcoin benefits from "liquidity preference."

In short, gold and Bitcoin represent different stages of monetary policy expectations:

Macroeconomic Cycle

Policy Status

Dominant Asset

Driving Logic

Early Easing

Interest rates decline, inflation remains high

Gold

Hedging against falling real interest rates

Mid to Late Easing

Liquidity rebounds, risk appetite improves

Bitcoin

Liquidity overflow and risk repricing

The current market may be in the early stages of the second phase. CME FedWatch shows a 99.4% probability that the Federal Reserve will cut rates by 25 basis points in October, and the release of liquidity is creating upward conditions for high-beta assets.

2. Intergenerational Wealth Redistribution

Cerulli Associates predicts that by 2045, $84 trillion in wealth will be transferred from the Baby Boomer generation to the Millennial and Generation Z cohorts. Among the latter, about 54% already hold crypto assets, while only 8% of the Boomer group do. This means that over the next 20 years, asset preferences will systematically tilt towards digital assets.

Although the logic of capital rotation is valid, there are still two potential risks in the short term:

- Volatility clustering: After BTC's annualized volatility (30-day) fell to a low of 27% in early October, a rapid repricing in the market could trigger a short-term pullback.

- Policy variables: If the pace of Fed rate cuts slows or geopolitical tensions worsen again, gold may regain safe-haven buying, interrupting the rhythm of capital migration.

In the medium term, the "substitutive relationship" between gold and Bitcoin is not zero-sum but is more likely to present a complementary pattern: gold provides stronger stability as a central bank reserve asset, while Bitcoin offers a higher beta coefficient and digital liquidity in private capital and high liquidity markets.

Conclusion

The current market changes are not simply "gold down, Bitcoin up," but rather capital is being repositioned.

Gold still holds its value in the early stages of the interest rate and liquidity cycle. However, as digital assets are gradually accepted by institutions and liquidity improves, some safe-haven funds are shifting from "physical gold" to "code Bitcoin."

For ordinary investors, three points to consider are:

- Flexible allocation: Hold both gold and Bitcoin, adjusting the ratio at different stages to reduce overall volatility;

- Seize volatility opportunities: Use options and other tools to position for potential future directions when the Bitcoin market is relatively calm;

- Track capital movements: Monitor the inflows and outflows of Bitcoin ETFs and the on-chain address changes of large institutions to gauge the rhythm of capital rotation.

In an era of continuously depreciating fiat currency and fluctuating policies, the competition for value storage has shifted from "visible metals" to "invisible codes." Overall, the current market is in a state of coexistence between the "old anchor of gold" and the "new wave of Bitcoin." In the short term, who is stronger will depend on where the capital flows more vigorously next.

Disclaimer: The content of this article is for informational sharing only and does not constitute any investment advice. Investment should be approached with caution, and decisions should be made rationally based on individual circumstances, with risks borne by the investor.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。