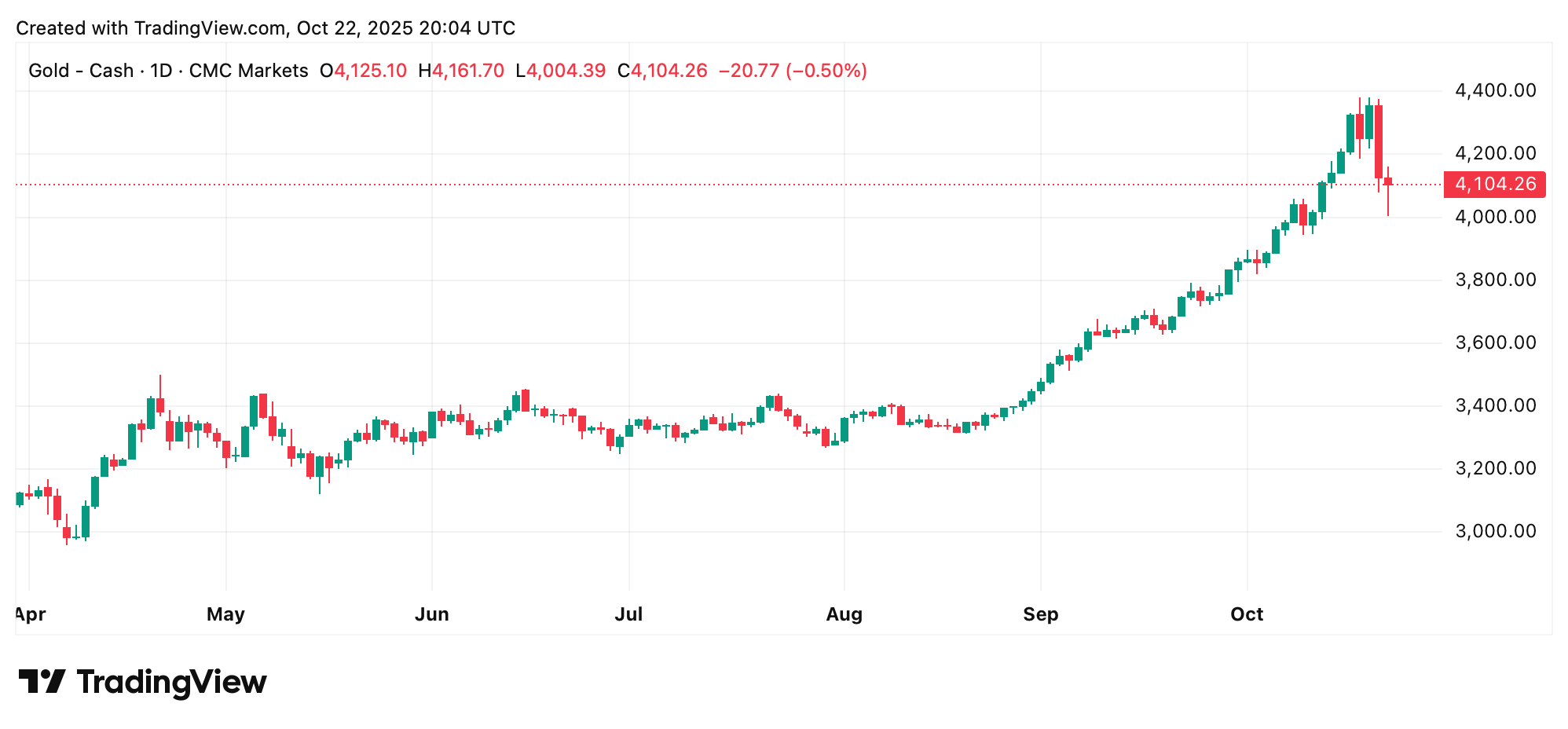

Spot gold fell 6.3% on Oct. 21 alone, then extended losses by another 1% to 2% the following day before stabilizing near $4,000 to $4,130 per ounce.

The correction followed a 55% rally in 2025 fueled by economic uncertainty, job losses, and trade war fears. Analysts now say the decline may be a healthy reset for the metal’s overheated run-up.

Several factors fueled the selloff. Gold became technically overbought after months of massive gains, prompting significant profit-taking. A 1.5% rise in the U.S. dollar made gold more expensive for international buyers, while optimism over renewed U.S.-China trade talks reduced demand for safe-haven assets.

Gold chart on Oct. 22, 2025. A troy ounce stands at $4,104 at press time.

Traders also positioned themselves ahead of key U.S. consumer price index (CPI) data, which could influence future Federal Reserve policy decisions.

The downturn was amplified by liquidations in leveraged positions and outflows from gold exchange-traded funds (ETFs), which shed around $2 billion in a matter of days. Analysts dubbed the episode a margin paradox, where forced selling cascaded across asset classes, including gold and silver.

“If gold can drop by 6.5% in one day on panic selling, imagine what can happen to bitcoin,” Peter Schiff said, taking to his keyboard during the mid-afternoon drawdown. “Such a crash may not be imaginary for long,” the gold bug added.

Despite the chaos, market observers say the pullback may not signal the end of gold’s bull market. Technical analysts point to support levels at $4,000 and $3,945 as critical zones to watch. If those levels hold, renewed buying could emerge, especially if upcoming inflation data suggests easing monetary policy.

Meanwhile, social media is buzzing with contrasting reactions. Some crypto traders mocked the metal’s volatility as bitcoin’s price jumped around 2% to 3% upward during gold’s mega dip. Others speculate that some capital fleeing gold may have rotated into digital assets, though some analysts cautioned that the evidence remains anecdotal.

Still, the debate points to shifting investor sentiment on what truly qualifies as a safe haven in 2025 — the timeless shine of gold or the digital scarcity of bitcoin. Of course, some will argue that both do well.

“Gold has dropped 8% in two days,” crypto entrepreneur Anthony Pompliano wrote on X on Wednesday. “I don’t see any headlines claiming it is a bad store of value, so why do people write those headlines when bitcoin does the same thing? The bitcoin critics are on the wrong side of history.”

- Why did gold prices fall this week?

Gold’s decline was driven by profit-taking, a stronger dollar, easing U.S.-China tensions, and exchange-traded fund (ETF) liquidations. - How much value did gold lose during the drop?

Roughly $2.43 trillion was wiped out in market value over two days. - Did bitcoin benefit from gold’s decline?

Bitcoin rose around 4% during the selloff, though direct capital rotation remains speculative. - What levels are traders watching next?

Key support zones sit around $4,000 and $3,945 per ounce, with CPI data likely to guide the next move.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。