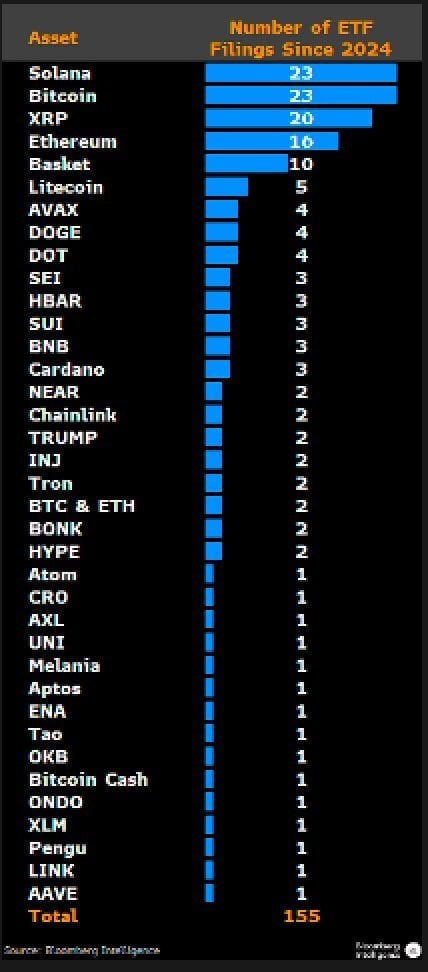

随着加密交易所交易产品(ETP)申请激增,数字资产领域正掀起一股乐观浪潮,这标志着机构对市场发展轨迹的强劲信心。彭博社ETF分析师埃里克·巴尔丘纳斯(Eric Balchunas)在10月21日分享称,自2024年以来,共提交了创纪录的155份ETP申请,涉及35种不同的加密货币。巴尔丘纳斯将这一申请潮形容为历史性的,并表示在未来一年内,申请总数可能超过200份,因为资产管理公司争相推出新的加密投资基金。

该分析师强调了这一势头的规模,并在社交媒体平台X上表示:

现在有155份加密ETP申请,跟踪35种不同的数字资产。未来12个月内,可能会看到超过200份进入市场。总的来说是一场土地争夺战。

他澄清道,这个列表仅反映待处理的申请,不包括已经交易的ETF,这也解释了为什么比特币和以太坊在数量上并不领先。“这只是申请,不包括市场上的ETF。这就是为什么比特币和以太坊没有排在前面,因为有很多申请通过了SEC。这只是排队等待的那些,”他解释道。

自2024年以来的加密ETF申请数量。来源:彭博社分析师。

根据数据,索拉纳(SOL)和比特币(BTC)各自领先,均有23份申请,其次是XRP有20份。以太坊(ETH)有16份,篮子产品占10份。莱特币(LTC)记录了5份申请,而雪崩(AVAX)、狗狗币(DOGE)和波卡(DOT)各有4份。SEI、海达(HBAR)、SUI、币安币(BNB)和卡尔达诺(ADA)各记录了3份。

市场策略师将申请激增解读为加密投资领域的看涨信号。许多发行人正在为潜在的美国证券交易委员会(SEC)批准做准备,此前SEC已允许现货比特币和以太坊ETF,并批准了通用上市标准。支持者认为,更广泛的加密ETP访问可能会增加流动性,提高透明度,并帮助将数字资产确立为机构投资组合中的永久性组成部分。

- 加密ETP申请激增对投资者意味着什么?

这表明机构信心增强,数字资产市场正在成熟,准备扩张。 - 目前哪些加密货币在ETP申请竞赛中领先?

索拉纳和比特币以各23份申请位居榜首,其次是XRP、以太坊和篮子产品。 - 为什么资产管理公司急于申请新的加密ETP?

他们旨在利用潜在的SEC批准,并在快速增长的投资类别中获得先发优势。 - 更广泛的加密ETP访问可能对市场产生什么影响?

增加的访问可能推动更高的流动性,提高透明度,并进一步使数字资产在机构投资组合中合法化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。