Total bitcoin futures open interest (OI) stands at $70.75 billion, representing roughly 642,590 BTC across major exchanges. CME holds the pole position with $16.42 billion in OI—accounting for 23.2% of the market—closely followed by Binance at $12.79 billion (18.1%) and Bybit with $7.46 billion (10.5%).

While CME and Binance both posted modest intraday gains of +1.49% and +1.58%, overall daily OI slid 2.19%, hinting at slight position unwinding ahead of upcoming expiries.

Kucoin showed the sharpest hourly uptick (+2.86%), while MEXC saw the steepest 24-hour contraction at –18.06%, reflecting possible liquidations or profit-taking. Gate’s OI also dipped –6.30%, suggesting lighter leverage on mid-tier venues.

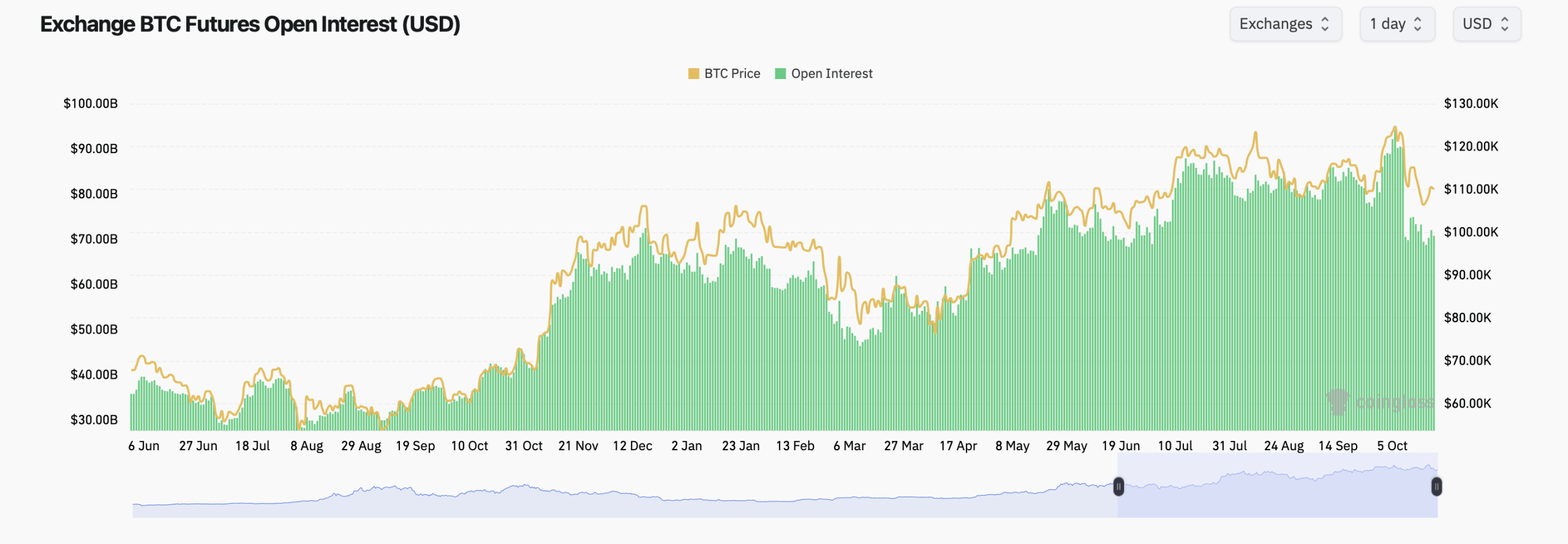

Coinglass futures statistics show that OI in dollar terms has climbed sharply since June, trailing bitcoin’s price climb from the $60,000s to above $110,000. Despite occasional shakeouts, OI remains elevated, signaling sustained speculative and hedging interest as traders anticipate volatility into year-end.

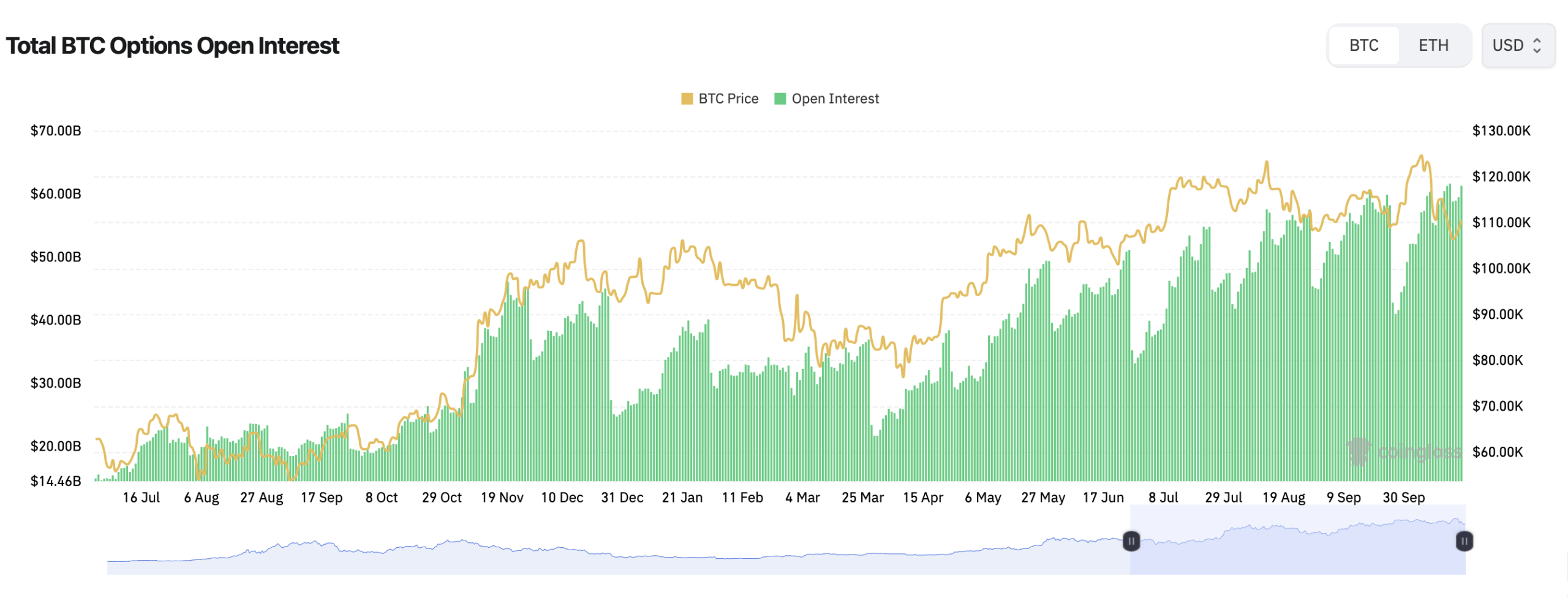

Over in the options arena, bullish sentiment is quite evident. Calls make up 59.3% of total open interest, amounting to 290,060 BTC, compared with 199,107 BTC in puts (40.7%). In the last 24 hours, call volume reached 30,682 BTC versus 27,717 BTC in puts, keeping the tone moderately bullish even as traders hedge against near-term dips.

The largest open interest contracts on Deribit are stacked in December 2025, led by the $140,000 call (10,099 BTC), followed by $200,000 and $120,000 calls. This distribution underscores long-term bullish expectations—some traders are clearly betting on six-figure bitcoin by year-end 2025.

In 24-hour volume, the $150,000 call (26DEC25) leads with 3,875 BTC traded, followed by $100,000–$105,000 puts expiring Oct. 31, highlighting near-term hedging as bitcoin consolidates near $110K. The balance between aggressive upside positioning and protective downside plays reflects the market’s ongoing tug-of-war between optimism and caution.

According to Coinglass’s Max Pain data via Deribit, the current max pain point sits near $114,000, meaning that’s the strike price where the most options would expire worthless. With bitcoin hovering just under that level, traders may see increased gamma friction as expiry approaches—potentially pinning prices in that zone unless momentum forces a breakout.

- What is bitcoin’s total derivatives open interest today?

Bitcoin’s combined futures and options open interest totals roughly $70.75 billion, spanning major exchanges and contract types. - Which exchange leads in bitcoin futures open interest?

CME currently leads with $16.42 billion, followed by Binance and Bybit. - What’s the call vs. put ratio in bitcoin options?

Calls dominate at 59.3% of open interest, while puts account for 40.7%, showing a bullish bias. - Where is bitcoin’s current max pain level?

The max pain point is around $114,000, suggesting that’s where most traders face neutralized profit potential near expiry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。