With the x(3,3) model as the core innovation, Shadow Exchange is building a powerful DeFi ecosystem centered around liquidity incentives, with self-driving and self-evolving capabilities.

Written by: Deep Tide TechFlow

The market is undergoing reconstruction after the crash on October 11, but many have noticed an interesting contrast.

Analysis blogger @0xyukiyuki stated:

One benefit of high volatility is that, regardless of the direction, DeFi can achieve some nice additional APR. The Shadow Exchange of the Sonic ecosystem is a great example. Due to a surge in trading volume, their weekly rewards doubled last week.

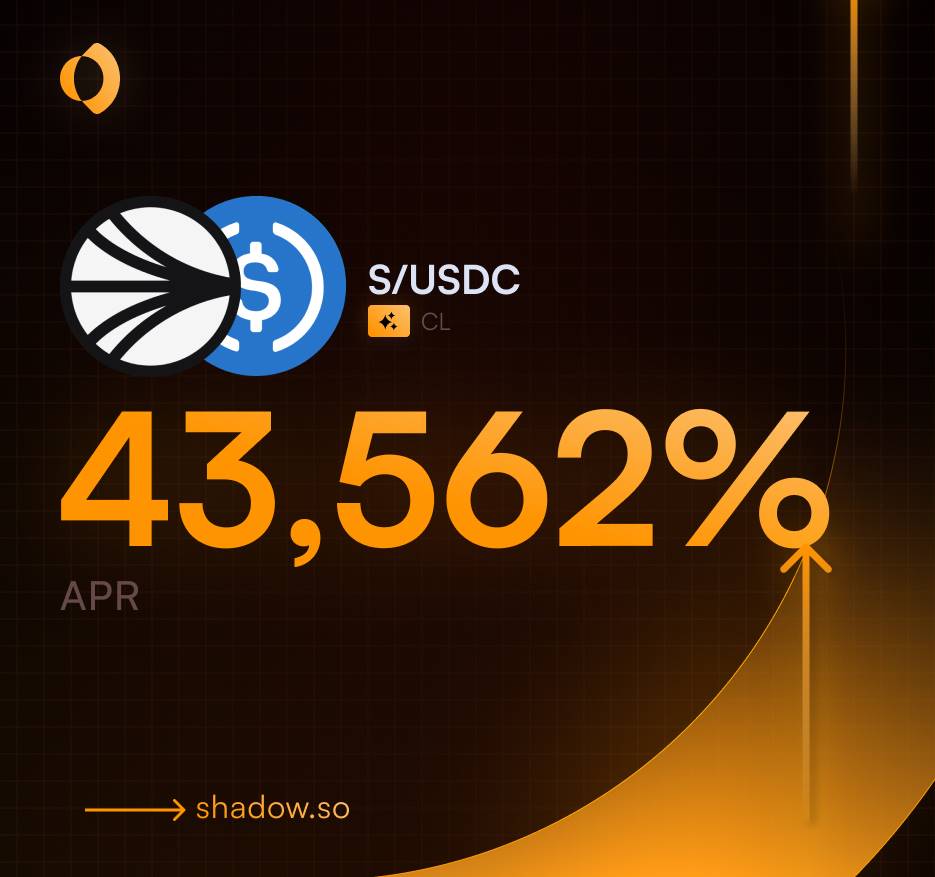

Further investigation reveals that on October 11, amidst severe price fluctuations, the $S / $USDC liquidity pool APR of the leading DEX Shadow Exchange in the Sonic ecosystem reached 43,562%, with a 24-hour trading volume exceeding $12.8 million and rewards surpassing $45,000.

In the wake of the crash, Shadow's income is higher, the rewards for ecosystem participants are also higher, and the enthusiasm for participation among all parties in the ecosystem has increased.

Such data is hard not to provoke curiosity.

The crypto market believes in "crisis as opportunity." As DEX competition continues to heat up and on-chain attention is siphoned off by Hyperliquid, Shadow Exchange, as the DeFi project with the highest trading volume and income in the Sonic ecosystem, easily showcased its differentiated competitive core advantage through a crash crisis:

With the x(3,3) model as the core innovation, Shadow Exchange is not just a robust and efficient trading platform but is also building a powerful DeFi ecosystem centered around liquidity incentives, with self-driving and self-evolving capabilities.

High APR Analysis: Shadow's Comprehensive Ecosystem Value Capture and Feedback

Shadow Exchange aims to "maximize LP protection + better fee capture," constructing a high-efficiency, resilient liquidity infrastructure.

Unlike the static models of traditional DEXs, Shadow Exchange emphasizes proactive intervention and value circulation, ensuring that LPs can achieve sustainable returns in any market environment.

Now, let's take the $S / $USDC liquidity pool as an example to break down how Shadow Exchange's multi-layered incentive design transforms a single liquidity contribution into a compound growth engine behind the high APR:

First, 100% of the trading fees from the liquidity pool are used to feed back into the ecosystem, forming the pillar of basic income. It is worth mentioning that Shadow supports two liquidity frameworks: one is the traditional liquidity framework, and the other is the concentrated liquidity framework. Under the concentrated liquidity framework, LPs can precisely deploy funds within specific price ranges for "targeted strikes," significantly enhancing capital efficiency while the fees generated will also multiply, bringing higher returns to LPs. Of course, high efficiency often comes with higher risks, and LPs need to closely monitor impermanent loss and use Shadow's dynamic fee adjustment mechanism to buffer potential impacts.

The $S token rewards from the Sonic ecosystem also provide a higher income base for Shadow. Sonic Labs allocates $S token rewards weekly to quality projects within the ecosystem. As the undisputed leading DeFi in the Sonic ecosystem, Shadow's liquidity pools will receive more generous income incentives, further enhancing returns for LPs.

Additionally, the $SHADOW token rewards from Shadow Exchange reflect the protocol's intrinsic incentive resilience. Shadow Exchange dynamically adjusts the $SHADOW token emission based on the protocol's income for each epoch, ensuring that rewards are linked to the health of the ecosystem.

At the same time, through integration with various DeFi products, Shadow has further opened up leverage amplification channels, such as through lending protocols to cycle and amplify principal, achieving higher returns with a smaller initial cost.

This comprehensive, all-encompassing ecosystem value capture and feedback benefits not only from the underlying boost of the Sonic ecosystem but also from Shadow Exchange's deep understanding of DeFi, which led to the launch of the x(3,3) model. This model evolves from the ve(3,3) model, integrating the advantages of three major token designs, PVP Rebase, automatic compounding, and more, propelling Shadow Exchange to become the core engine of liquidity yield in the Sonic ecosystem.

Sonic Foundation, x(3,3) Innovation: Co-building the Shadow Liquidity Incentive Flywheel

Shadow Exchange is built on the Sonic blockchain, crafted by Andre Cronje. Sonic not only inherits the high-performance genes of Fantom but also becomes a powerful accelerator for Shadow Exchange's development through a series of cutting-edge innovations.

On one hand, Sonic's comprehensive performance improvements can better support high-frequency DeFi scenarios for Shadow Exchange. Through technological innovations like SonicVM, SonicDB, Sonic Gateway, and SonicCS 2.0, Sonic achieves over 2000 TPS throughput, 0.7 seconds transaction finality, and an ultra-low transaction cost of just $0.0001, enabling Shadow to provide users with an efficient, secure, convenient, and low-cost asset trading experience.

When the crash on October 11 occurred, Sonic and Shadow experienced the test of a high-volatility market together: while other networks collapsed due to congestion and transaction failures, Sonic maintained full functionality with zero downtime. The combination of Sonic's robust infrastructure and Shadow's efficiency further ensures that users earn more liquidity while taking on lower risks.

On the other hand, Sonic's FeeM model injects sustainable economic incentives into Shadow Exchange. Sonic's FeeM model allows up to 90% of on-chain transaction fees to be directly fed back to developers and ecosystem applications, aiming to further reward high-traffic projects and attract innovative developers to build applications on Sonic.

As the leading DeFi project in the ecosystem, Shadow Exchange receives 90% of the transaction fee returns, all of which are used to reward traders, allowing users to maximize returns in a pressure-free environment, whether for position adjustments or arbitrage strategies, thereby driving overall trading volume growth.

Additionally, the previously mentioned ecosystem application rewards from Sonic Labs further boost Shadow Exchange's development. Sonic Labs distributes $S tokens as incentives based on projects' performance in key metrics such as trading volume and user count. This is not only a short-term traffic subsidy but also the cornerstone of long-term ecosystem governance. As the leading DeFi project in the Sonic ecosystem, Shadow receives a large number of $S token rewards, which are then redistributed to users, achieving sustained growth.

Another easily overlooked point is that whether Andre Cronje re-engaging or continuing the advantages of Fantom, Sonic undoubtedly possesses strong DeFi genes, with various DeFi infrastructure and innovative projects blooming within the ecosystem. Through deep integration with the Sonic DeFi network, Shadow will bring users a richer trading experience.

For more technical details and introductions to the reward mechanisms of Sonic, interested readers can review our previously published in-depth article: "Changing the Soup but Not the Medicine, How is the Reconstructed Sonic Developing Now?"

Beyond the series of advantages brought by building on Sonic, the x(3,3) model as a core innovation is also an important part of Shadow Exchange's realization of "comprehensive and all-encompassing ecosystem value capture and feedback."

As a trading platform, it is essential to balance the interests of three core roles: low-cost execution and incentives for traders, risk buffering and high returns for LPs, and governance rights and long-term appreciation for token holders, thereby constructing a self-reinforcing ecosystem.

The x(3,3) model creates a tightly connected "incentive chain" through three major tokens, achieving a positive cycle from value creation, capture, distribution to the return of participants.

$SHADOW is the foundational entry of the ecosystem:

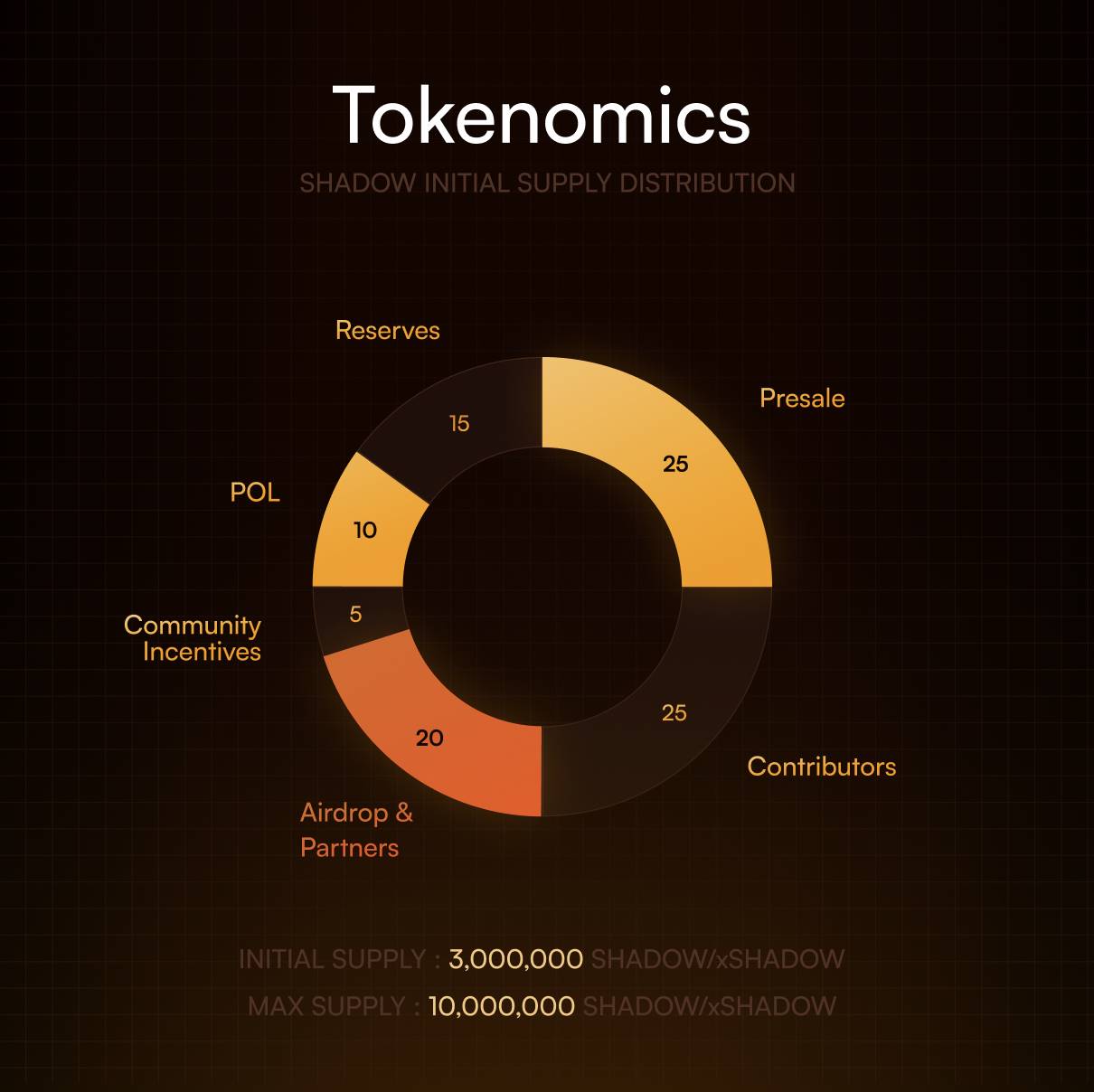

$SHADOW is the native token of the Shadow ecosystem, serving purposes such as trading, liquidity mining, and ecosystem incentives. The initial supply is 3 million, with a maximum supply of 10 million.

$SHADOW is emitted per cycle, and its emission amount will be flexibly adjusted based on protocol income to adapt to the specific development of the protocol. When the protocol's income exceeds the emission amount over multiple cycles, it largely indicates that a period of rapid development is approaching.

$xSHADOW is the core of ecosystem governance:

Users can stake $SHADOW to earn $xSHADOW.

Shadow allows users to exit their $xSHADOW lock-up at any time, but early withdrawal incurs a corresponding penalty, which is 100% returned to holders through the PVP Rebase mechanism, thereby protecting long-term holders.

$xSHADOW holders vote weekly through Epochs to determine the token rewards for different liquidity pools in Shadow, while the project team can attract $xSHADOW holders to vote by offering additional rewards.

Under the FeeM model of the Sonic ecosystem, 90% of the transaction fees received by Shadow will be fully returned to $xShadow and $x33 holders.

$x33 is the core vehicle for ecosystem liquidity release and compounding creation:

Since $xSHADOW is only used for governance and cannot be freely traded, users can mint $x33 at a 1:1 ratio using $xSHADOW.

As a liquidity version of $xSHADOW, $x33 can be freely traded as an asset and can be applied to other lending or derivative DeFi protocols, allowing users to release liquidity while retaining governance rights and earnings, thus creating greater value.

At the same time, $x33 has an automatic compounding feature, with $xSHADOW continuously growing through $x33, pushing up the exchange rate between $xSHADOW and $x33, attracting arbitrage bots to participate.

For more specific introductions and technical details about the Shadow x(3,3) model, interested readers can review our previously published in-depth article: "Sonic Ecosystem's Dual Leader in Trading Volume and Revenue: Can Shadow with x(3,3) Evolve DeFi Liquidity Incentives to the Ultimate?"

In this way, Shadow Exchange has created a precise positive cycle through the x(3,3) model:

Ecosystem incentives attract user participation → More active trading generates higher protocol revenue → Higher protocol revenue leads to greater ecosystem incentives → Greater ecosystem incentives attract broader user participation.

In this cycle, traders benefit from low-cost, high-frequency execution, LPs gain dynamic protection and amplified returns, and holders lock in long-term appreciation through governance and Rebase. By maximizing the balance of interests among the three major roles, Shadow truly achieves the underlying momentum for long-term sustainable development.

Data Performance: The Absolute DeFi Leader of the Sonic Ecosystem

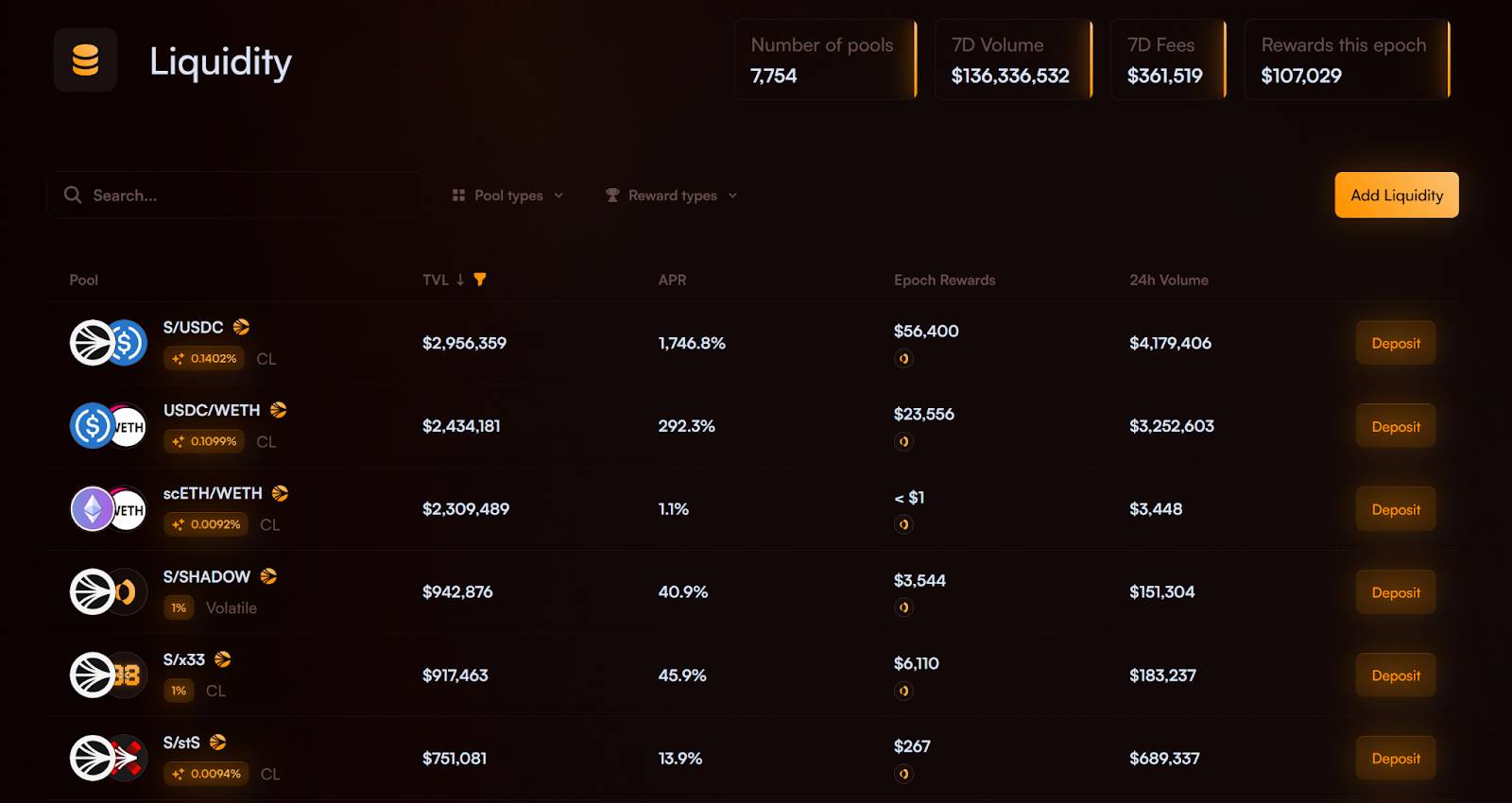

Currently, Shadow Exchange supports a rich variety of liquidity pools, including core stablecoin pairs, high-volatility meme coin pools, and cross-ecosystem assets, covering a wide range of scenarios from traditional DeFi to emerging narratives.

Beyond the product data dimensions, Shadow's core position as the DeFi leader in the Sonic ecosystem is further reflected.

According to DeFi Llama data, Shadow Exchange's cumulative DEX trading volume has surpassed $12.517 billion. On February 21, 2025, Shadow's 24-hour trading volume reached $252,856,099, setting a historical high and surpassing Hyperliquid.

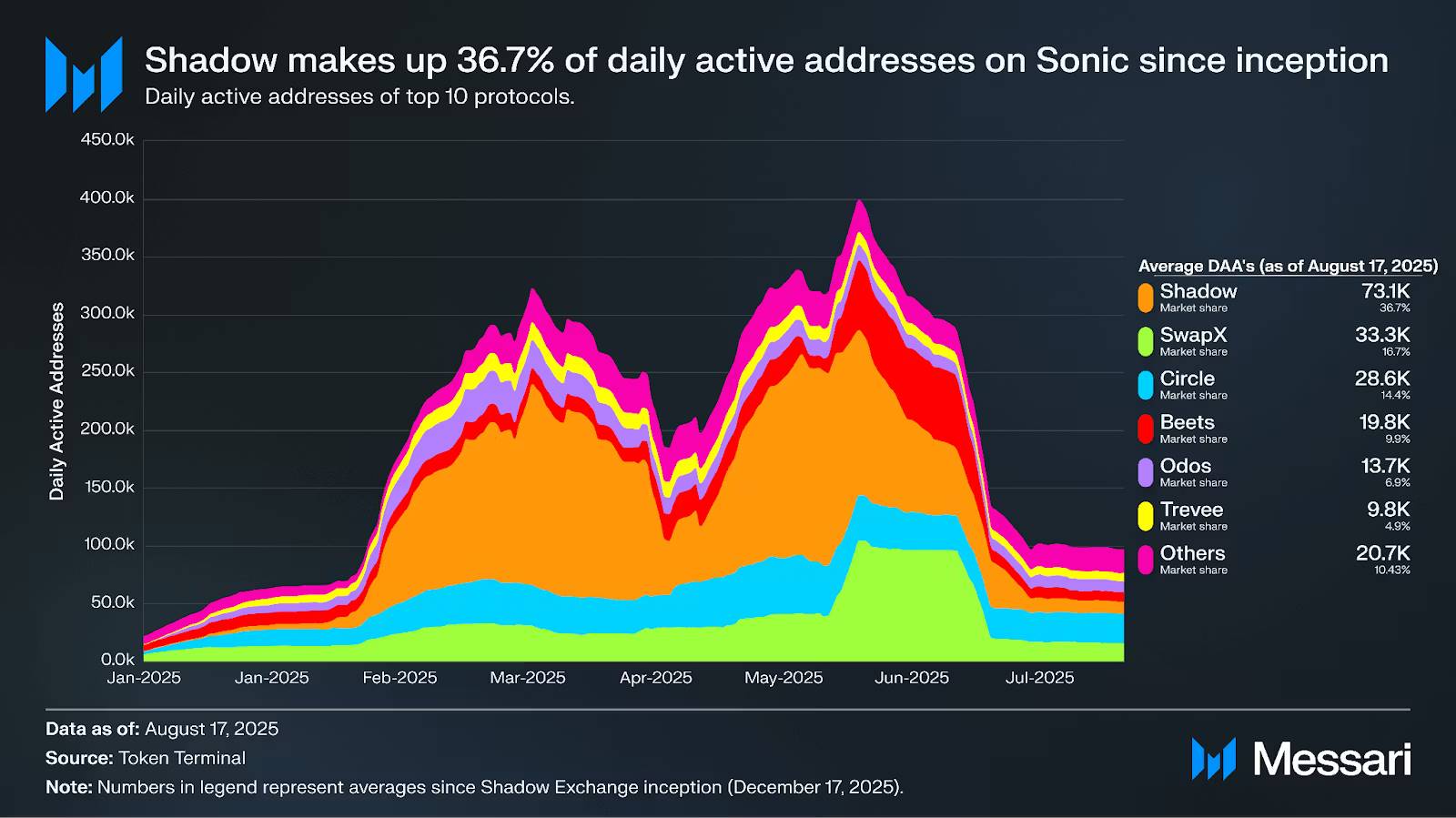

On the user side, according to a Messari report, its daily active users (DAU) reached as high as 73,071, far exceeding most protocols within Sonic, reflecting strong community stickiness.

Protocol revenue and reward distribution are also noteworthy. According to official data, Shadow has currently achieved over $38 million in fee revenue and over $25 million in platform revenue.

During the week of the October 11 crash, Shadow's dynamic fees better protected LPs from significant impermanent loss while prioritizing the earning of the highest possible fees, generating $172,243 in fees and excellently achieving its goal of "maximizing LP protection + better fee capture" during the downturn.

According to official data, on October 16, 2025, Shadow distributed over $353,737 in rewards, with over $194,000 in $Shadow emissions during the 38th epoch.

In terms of penetration and coverage within the Sonic ecosystem, Shadow Exchange has even more impressive data performance:

In terms of trading volume, according to a Messari report, Shadow accounted for 53.0% of the Sonic ecosystem's trading volume in the second quarter of 2025, holding 47.3% of the trading volume since its launch, peaking at as much as 69% of the trading volume.

In terms of revenue, Shadow is the top protocol in the Sonic ecosystem, contributing approximately 86% of Sonic's revenue during peak periods.

In terms of users, 80% of Sonic's active users use Shadow.

Market Focus on DEX: Multi-dimensional Measures Accumulate Shadow's Future Growth Power

As the DeFi leader of the Sonic ecosystem, Shadow Exchange has built a self-reinforcing liquidity incentive flywheel through the innovative x(3,3) model. From a cumulative trading volume of $12.5 billion to capturing 53% of the Sonic ecosystem's market share and covering 80% of the ecosystem's users, Shadow has proven its position as a key liquidity hub in Sonic.

With the continued rise in on-chain trading activity, the market's multiple favorable conditions are accelerating the release of Shadow's future growth potential.

On one hand, under the leadership of the popularity of Hyperliquid and Aster, on-chain trading activity in 2025 continues to climb, with more and more people focusing on DEX competition. In the search for the next Hyperliquid or Aster, Shadow, with its unique innovation in reshaping liquidity incentives through the x(3,3) model, may become one of the competitors at the DEX table.

On the other hand, the Sonic ecosystem is showing signs of recovery. Although the growth in TVL is not significant, data from major platforms indicate that Sonic's DEX trading volume, stablecoin address count, and other metrics are showing growth trends, signaling an initial recovery in the Sonic ecosystem. As the core of the Sonic ecosystem's DeFi, Shadow will directly benefit.

It is also worth noting that due to market volatility, whether in terms of TVL, trading volume, or token price, Shadow is currently in a "low starting point, high rebound potential" phase, which may indicate a larger growth base for investors optimistic about the Sonic ecosystem and Shadow.

In recent months, Shadow has also been accumulating the power for another explosion through continuous product refinement and ecosystem building.

On one hand, continuously optimizing incentive measures:

Shadow's incentive plan of 3 million $S tokens is ongoing. Since the Sonic second quarter airdrop will no longer support GEM tokenization, Shadow will release 50% of the expected rewards for the second quarter airdrop in advance for liquidity incentives and proactive market-making strategies, further encouraging user participation to drive ecosystem growth.

At the same time, Shadow has modified its issuance framework to directly allocate $SHADOW to LPs, replacing the previous model of issuing rewards in the form of $xSHADOW, further enhancing capital flexibility.

On the other hand, product functions are continuously iterated and improved, and ecosystem partners are constantly expanding:

In terms of product optimization, Shadow has introduced limit orders and time-weighted average price (TWAP) functions to further expand trading capabilities.

In terms of ecosystem building, Shadow is actively promoting cooperation with more projects, launching diversified trading pairs that cover a comprehensive spectrum from stablecoins to high-volatility pairs.

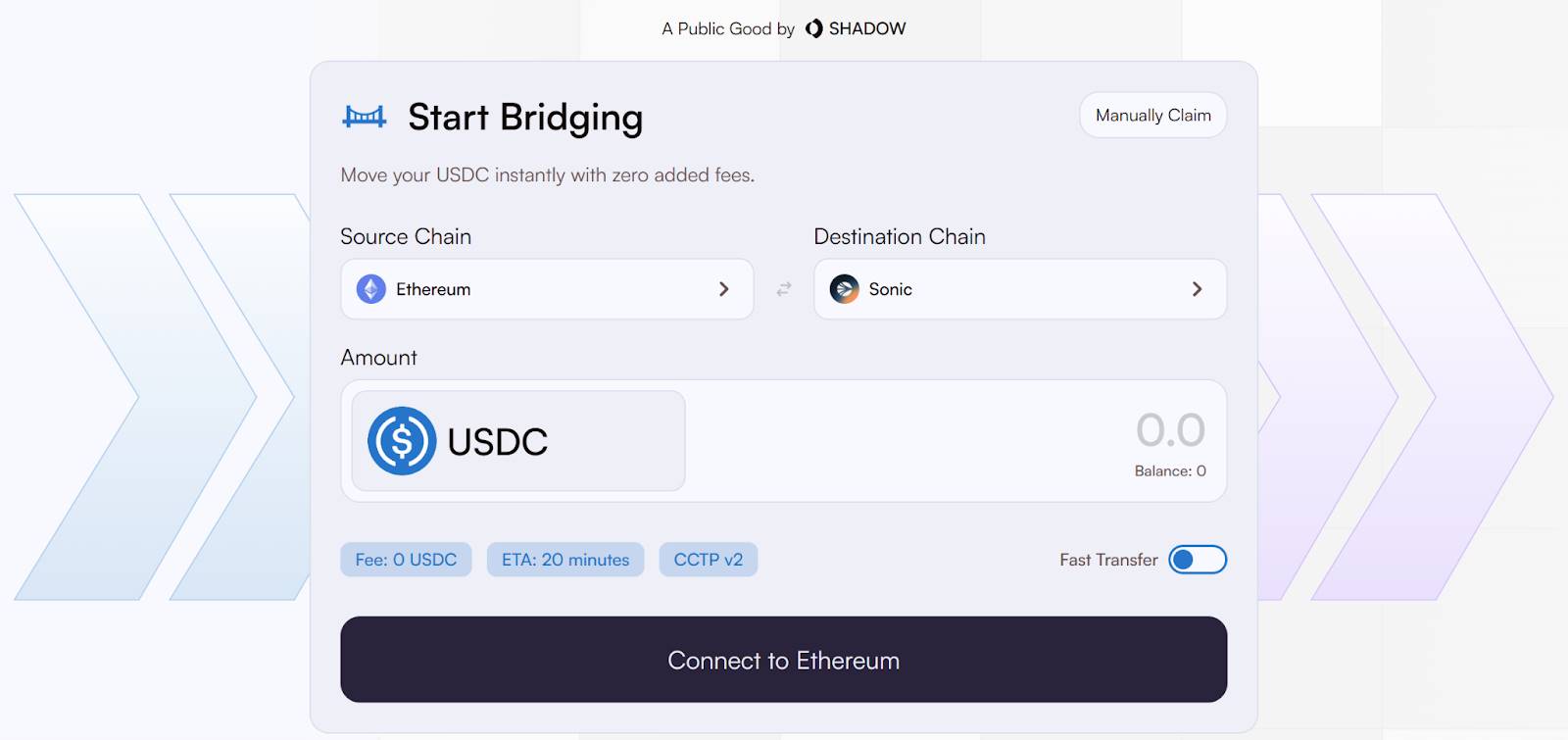

Additionally, Shadow has joined the Circle Alliance Directory and integrated versions 1 and 2 of CCTP to provide users with a seamless cross-chain experience.

In the near future, a series of key products and features from Shadow are set to be officially launched:

On one hand, a buyback arbitrage system and delayed reward mechanism will go live, further protecting LPs and strengthening the flywheel effect of x(3,3).

On the other hand, more disruptively, a lending market based on $x33 will position $x33 as a collateralizable asset, supporting leveraged lending and derivative strategies, maximizing the potential of $x33.

As the essence of DeFi is to make finance more efficient and democratic, Shadow Exchange is practicing this concept through technological innovation and incentive mechanism design, having withstood the test of a crashing market.

As the jewel in the crown of Sonic ecosystem DeFi, with the continuous improvement of product functions and the deepening of ecosystem construction, the community witnesses and anticipates that Shadow is accumulating strength for the next stage of a comeback, once again becoming an important player in leading DeFi liquidity innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。