From deposits to stablecoins, the banking industry is undergoing the biggest transformation in 200 years.

Author: Decentralised.Co

Translated by: Deep Tide TechFlow

Whoever masters the foundation of stablecoins will control the future of banking. For the past 200 years, banks have expanded their scale by absorbing deposits; fintech companies have expanded their businesses by renting deposits. Now, stablecoins have made deposits movable, and this change is reshaping the landscape of global banking.

Every revolution in banking begins with a transformation in the way funds are stored.

In the 19th century, banks issued private notes backed by gold, but trust was limited to local areas and was very fragile.

In the 20th century, centralized trust through the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) gave rise to banking giants like JPMorgan Chase and Citibank.

In the 2010s, fintech companies established new types of banks through digital means, such as Revolut and Nubank.

Today, stablecoins have completely extracted deposits from banks, enabling them to be programmable, borderless, and highly liquid on an internet scale.

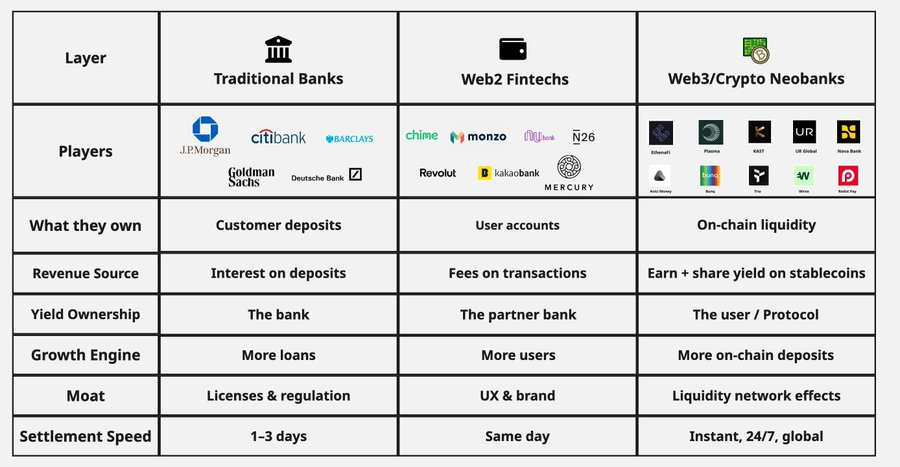

Fintech companies of the Web2 era indeed redesigned the interface of banking, but the underlying infrastructure remained unchanged.

For example, Revolut holds customer deposits at Lloyds Bank; Nubank's reserves ultimately sit at the Central Bank of Brazil; Wise still settles through SWIFT. These companies have changed the way people interact with money, but they have not changed where the money is actually stored.

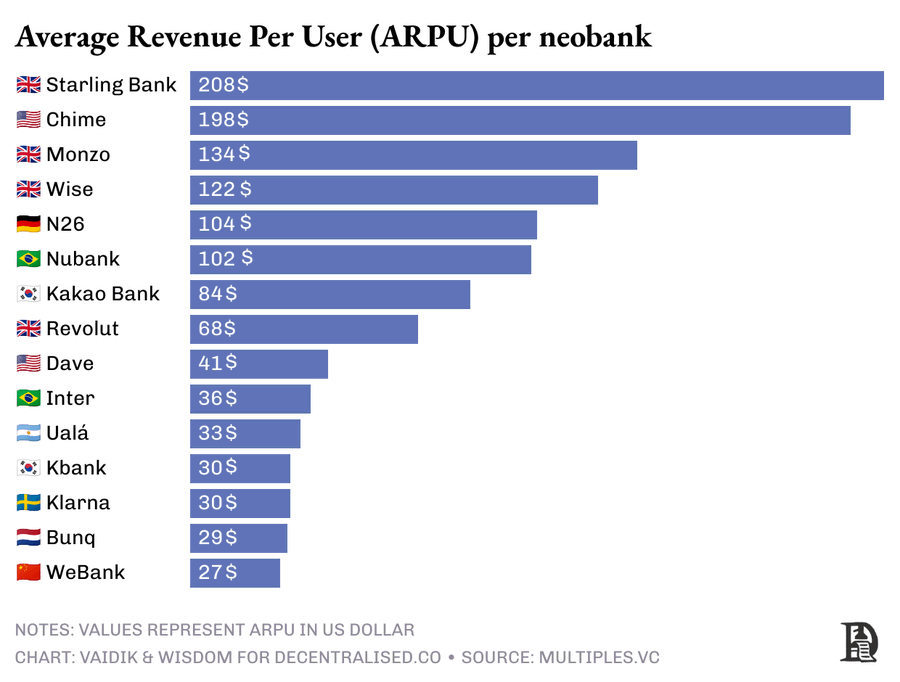

As a result, among the 15 largest new banks globally, 9 still earn less than $100 per user annually.

Web2 fintech companies have created better banking applications, while new banks in the crypto space (Crypto neobanks) are building better banks.

These banks operate by directly holding stablecoin deposits on-chain and using these balances as their funding base. Similar to traditional banks, they also deploy deposits, but unlike them, they do not lend through opaque balance sheets; instead, they direct liquidity to transparent on-chain markets, such as tokenized U.S. Treasuries or decentralized finance (DeFi) lending pools.

Users can see the flow of funds and, in some cases, share in the profits.

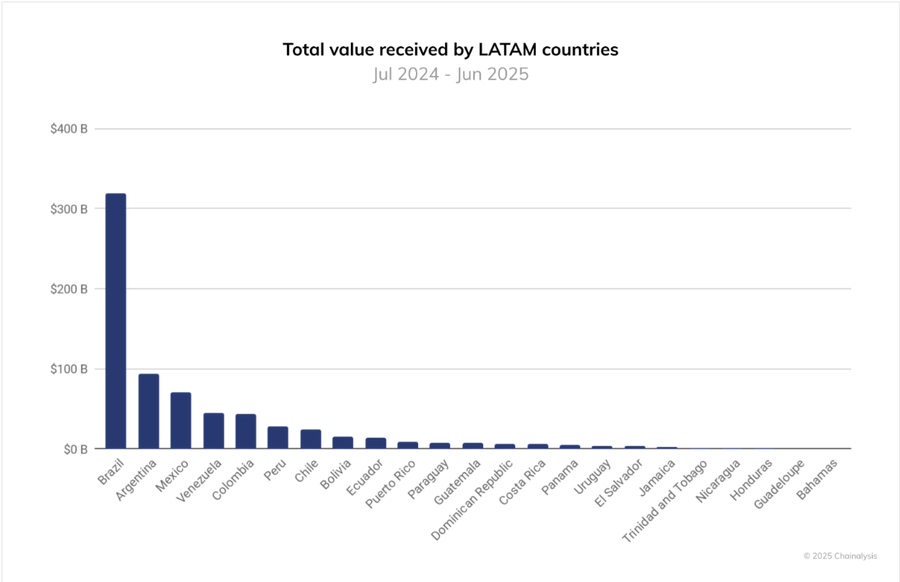

Because programmable finance does not require physical branches, it can achieve the fastest expansion in areas where traditional banks cannot provide services.

In regions where many banks cannot protect asset value, new banks driven by stablecoins have become the default method for storing, paying, and transferring funds.

According to Chainalysis data, last year, the total cryptocurrency inflow in Latin America exceeded $1.5 trillion, with Brazil alone reaching $319 billion, nearly 90% of which came from stablecoins used for savings, wages, and remittances.

As stablecoins enter the mainstream, deposits are also beginning to accumulate outside the banking system.

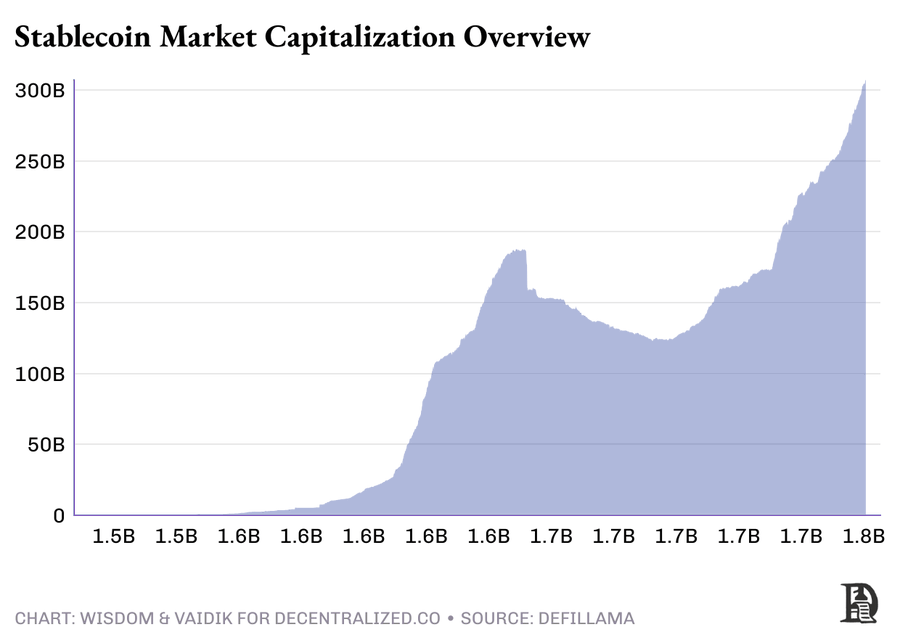

Today, over $300 billion flows between digital dollars in wallets and tokenized Treasuries, and although these flows have not yet been coordinated, the scale is already quite large.

A similar situation occurred in the 19th century: hundreds of "free banks" issued their own notes, each backed by different reserves. This led to frequent bank runs and a collapse of trust until institutions like JPMorgan began consolidating deposits to restore stability and unify the entire system.

New banks in the crypto space are addressing the same issue by organizing decentralized digital dollar deposits to achieve systematization.

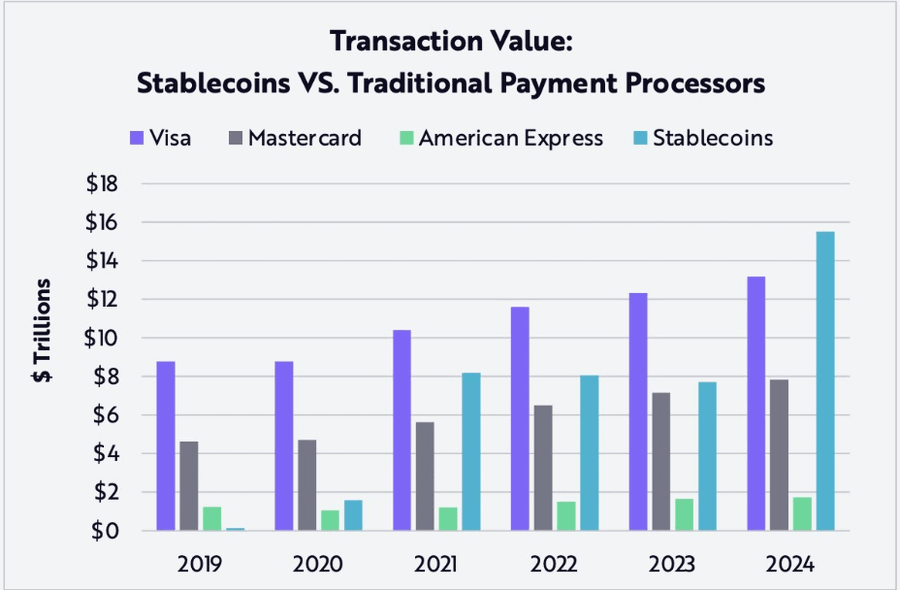

According to ARK Invest's "BIG IDEAS 2025" report, the settlement amount of stablecoins will exceed $15.6 trillion in 2024, surpassing the combined total of Mastercard and American Express.

Platforms managing these fund flows, such as wallets, exchanges, and crypto neobanks, are quietly becoming the new settlement layer of global finance.

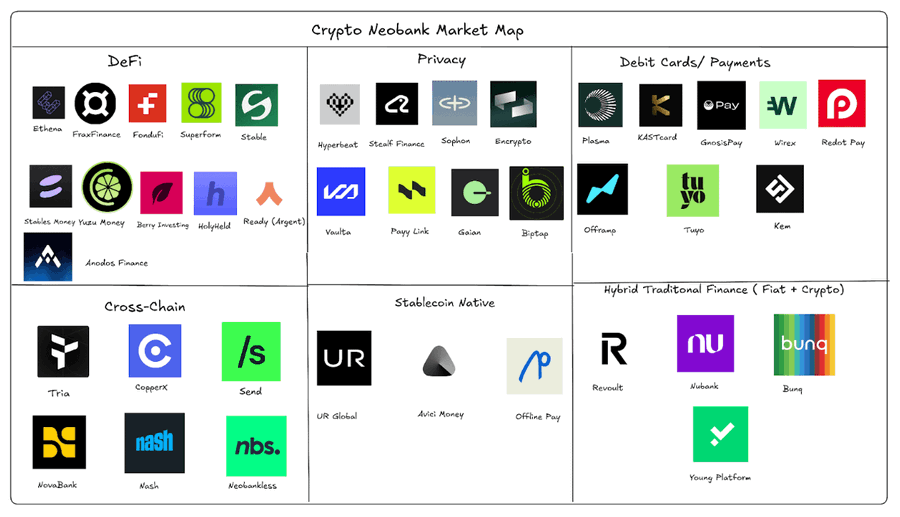

Protocols like KAST, Tria, and Plasma are becoming the default hubs for stablecoin liquidity, similar to how JPMorgan centralized dollar clearing or Stripe's role in online payments.

KAST is a payment neobank; Tria builds self-custody accounts for users; Plasma provides on-chain infrastructure to drive fund flows.

As a result, giants like BNY Mellon and Visa are competing to integrate stablecoin payment networks, while Stripe is building its own Layer 1 blockchain. They are all chasing the same goal: to control the storage of digital dollars, as all other businesses in finance are built upon this.

Traditional banks earn a few percentage points from loans and securities by investing deposits but rarely return profits to users.

With tokenized dollars, profits are no longer hidden beneath the bank's balance sheet. Users can see in real-time where the profits come from and where they go, and even share in the profits directly.

The total amount of global commercial deposits is about $87 trillion.

As more and more funds migrate on-chain, this capital will no longer need intermediaries to transfer or earn profits but will require efficiency. Whoever can build these on-chain payment networks will dominate the next round of transformation in the banking industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。