Bluwhale token BLUAI will be launched today on Binance Alpha and Binance Futures.

Written by: angelilu, Foresight News

The cryptocurrency trading competition for AI large models is in full swing, and the crypto market's attention is once again turning to the integration of AI and Web3, coinciding with the upcoming TGE of a project called Bluwhale. According to an official announcement from Binance, Bluwhale's native token BLUAI will be launched today (October 21, 2025) on Binance Alpha and Binance Futures.

Bluwhale is a decentralized AI personalization protocol within the Sui ecosystem, with a vision to build an "Intelligence Layer" for Web3, empowering a consumer-driven decentralized AI infrastructure by connecting AI agents and smart applications. The project is backed by a team led by serial entrepreneur and Forbes 30 Under 30 honoree Han Jin, with capital support from institutions including SBI, Cardano, and Animoca Brands.

Bluwhale Architecture

Bluwhale's starting point is to address the "data monopoly dilemma" in the current digital world. The solution proposed by Bluwhale is a decentralized, open AI personalization protocol, with the core goal of empowering users to truly own, control, and ultimately tokenize their digital profiles, transforming data from passive objects of harvesting into actively held assets by users.

To achieve this goal, Bluwhale has designed several core conceptual products:

WhaleScore

The technical core of Bluwhale is its "decentralized user knowledge graph." It employs a hybrid model aimed at combining the flexibility of real-time data queries with the controllability of user sovereignty. This architecture uses AI technology to associate on-chain wallet address activity data with off-chain social identities voluntarily provided by users, thereby constructing comprehensive user profiles. Users can "claim" their profiles by connecting wallets and verifying social media accounts, and can choose whether to share their preferences and data with the DApp ecosystem, thus participating in value creation and earning rewards.

WhaleScore is the key product of Bluwhale. It is a comprehensive financial health index ranging from 0 to 1000. This score aggregates various data from users on-chain (such as DeFi activities, NFT holdings) and off-chain (requiring user authorization) to comprehensively assess their liquidity, consumption, savings, earnings, and diversification levels.

The Agentic Layer

Building on WhaleScore, Bluwhale introduces the concept of "The Agentic Layer." This is not a simple automation tool, but a series of personalized AI agents that act as dynamic financial coaches for users. These AI agents continuously learn from users' wallet behaviors, consumption patterns, and investment portfolios, enabling them to proactively identify potential inefficiencies, such as discovering idle funds or high-risk exposures.

Furthermore, the agentic layer can transform raw data into specific, actionable recommendations. If a user's WhaleScore declines due to liquidity imbalance, their AI agent can recommend more suitable asset rebalancing strategies. If a user holds too many stablecoins and misses out on earning opportunities, the agent can proactively suggest staking options or liquidity pools that align with their risk preferences. This marks a shift from passive data analysis to proactive, intelligent decision support, aimed at helping each user build wiser financial habits over time.

Whale Tank

Whale Tank is a tool for issuing and trading user profile tokens (Profile Tokens), allowing users to create and sell profile data NFTs (non-fungible tokens) and purchase others' profile tokens.

Founder's Journey

Behind every project stands a founder with a unique background. The resume of Bluwhale's co-founder and CEO Han Jin provides profound insights into the strategic choices of this project. Born in China and raised in Germany, he graduated from the University of California, Berkeley, with a degree in engineering, and is a serial entrepreneur with a global background and Silicon Valley genes.

Before founding Bluwhale in 2022, Han Jin was best known as the co-founder and CEO of Lucid VR. Since 2015, he led the team in developing LucidCam—one of the world's first consumer-facing VR180 3D cameras. Lucid VR achieved remarkable success, with its products entering mainstream retail channels like Amazon and Best Buy, and winning multiple industry awards, including the Edison Award. However, beneath the accolades lies the harsh reality of entrepreneurship. Han Jin admitted in interviews that due to the complexities of hardware, the long consumer VR market cultivation cycle, and heavy reliance on manufacturing, Lucid VR was one of the "most cash-consuming startups" he could imagine.

This challenging journey in the hardware field has undoubtedly shaped the strategic direction of Bluwhale. Han Jin's past writings and thoughts show that he is highly focused on business models and value creation, rather than just the technology itself. He pointed out that many first-wave startups in emerging industries fail often due to a lack of a viable business model when customer needs are still unclear.

From this perspective, the birth of Bluwhale is not only a pivot in the track but also a strategic elevation based on past experiences. It is almost the "opposite" of Lucid VR's business model:

From heavy assets to light assets: Transitioning from a capital-intensive, low-margin hardware business to a software protocol with extremely low marginal costs and unlimited scalability.

From application to platform: Shifting from creating a single consumer product to providing underlying infrastructure for all other applications, avoiding the significant uncertainties of directly facing the end consumer market.

From traditional financing to Web3 economy: Moving from the long cycles of relying on traditional venture capital to utilizing token economics to build an endogenous business model and financing mechanism.

Therefore, Bluwhale is not just another "new idea" from Han Jin, but a systematic transformation of the profound lessons learned from his decade-long entrepreneurial career into a solution.

Bluwhale's Investor Lineup

A clear vision and technical architecture require solid capital support, and Bluwhale's funding history demonstrates its market validation.

In the seed round of financing in March 2024, Bluwhale successfully raised $7 million. This round was led by SBI, with participation from Cardano, Animoca Brands, and others. In January 2025, Bluwhale completed a strategic financing round, bringing its total funding to $100 million. This funding is a mixed composition, including seed round and subsequent equity financing, a $75 million token purchase commitment, various grants, and node sales revenue. This round attracted a more diverse group of participants, including Cointelegraph, SwissBorg, DWF Labs, Master Ventures, and Hub71.

Ecosystem Token BLUAI and Points Token BLUP

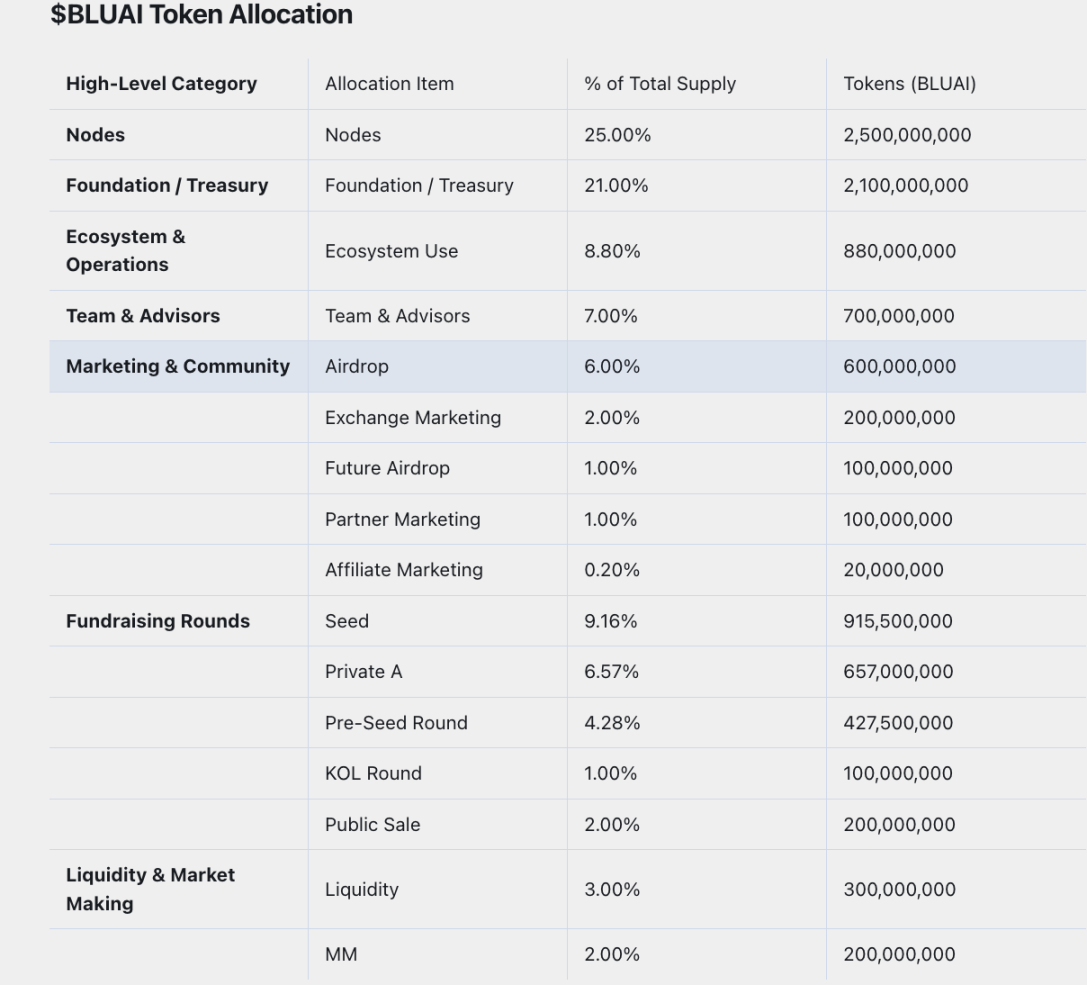

In the Web3 world, the economic model of a project is the core of its vitality. The total supply of its ecosystem token BLUAI is fixed at 10 billion, with an initial circulation of 1.228 billion at the TGE (Token Generation Event), accounting for 12.28% of the total supply.

The specific allocation ratio of the tokens is as follows: the largest portion (29.8%) is allocated for ecosystem and operations to support strategic expansion and community building plans; node incentives account for 25%, used to reward validators maintaining network operations. The foundation and treasury hold 21% for R&D and long-term development; 23% is allocated to participants in various rounds of financing; the share for the team and advisors is 7%; and the remaining 5% is used to ensure initial liquidity and market-making in the secondary market.

The token share allocated to the team and advisors is set with a lock-up period of 12 months, after which it will be released linearly over 36 to 48 months. This is a positive signal indicating that the core team's interests are deeply tied to the long-term success of the project, helping to reduce the risk of early internal personnel selling impacting the market.

Bluwhale's ecosystem also introduces a points token BLUP (Bluwhale Points Token), which is positioned as the project's official "community-first meme token," used for internal access, reputation representation, and platform payments. Points accumulated in Bluwhale accounts can be exchanged for BLUP in the future, but after redemption, they cannot be used to exchange for BLUAI airdrops.

AI+Web3 Track Becoming Crowded

Overall, Bluwhale is a player worth paying attention to in the AI+Web3 track. It possesses many elements of a successful project: a serial entrepreneur with market-tested experience and profound lessons learned; a vision that addresses Web2 pain points and proposes clear Web3 solutions; a lineup of top strategic investors; and a market launch strategy in collaboration with Binance.

However, the road ahead is not without challenges. The narrative of AI+Web3 is rapidly heating up, and the track is becoming increasingly crowded. In the on-chain data analysis field, there are pioneers like Nansen and Dune Analytics that have already established moats; in the decentralized identity (DID) field, protocols like Lens Protocol and Farcaster are actively building social graphs; and in the Web3 customer relationship management (CRM) track, focused solutions like Formo and Holder have emerged. Bluwhale's positioning spans these several areas, meaning it needs to prove its unique value across each dimension.

Its ultimate success will depend on whether it can truly fulfill the promises made in its white paper—driving the large-scale adoption of DApps. Bluwhale needs to demonstrate that its "Intelligence Layer" and "Agentic Layer" are not just a more advanced data analysis dashboard, but an indispensable infrastructure that enables developers to create new experiences and achieve more efficient growth. Whether WhaleScore can become an industry-recognized value standard will be key to measuring whether its network effects can form.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。