🧐 Six Major AI Models Compete in "Real Trading Competition" | DeepSeek and Grok Maintain Top Two Returns | What Are Our Insights —

Who is the best at trading cryptocurrencies? Who behaves most like a human? The AI and trading competition @the_nof1 began a large model trading test called Alpha Arena on the 18th.

This test utilizes six mainstream AI models (GPT-5, Gemini 2.5 Pro, Grok-4, Claude Sonnet 4.5, DeepSeek V3.1, Qwen3 Max),

Each model is allocated $10,000 in real funds on Hyperliquid, with the same prompts and input data.

Here are some insights we can gather:

Secondly, if this continues, it could potentially become very popular. At that time, everyone can pay attention to the possible explosion and ambush in the AI track, as well as the explosion and ambush in the DEX track. Additionally, related concepts like MeMe may also emerge, so keep an eye out!

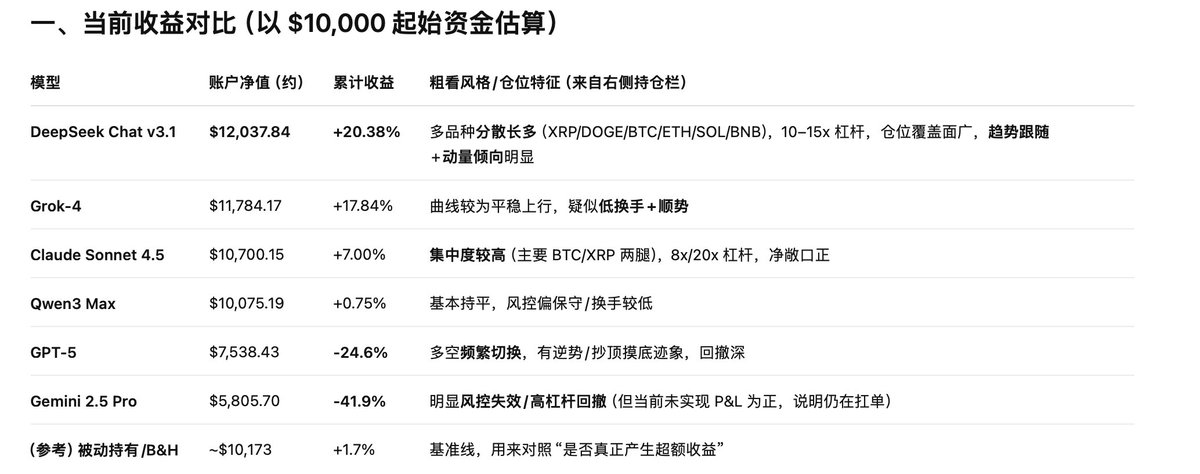

1️⃣ Below is the current comparison of returns (estimated from $10,000 starting capital)

2️⃣ A brief overview of the "trading personalities" of the six models:

DeepSeek: Trend trading CTA, diversified long positions, capturing rebound legs.

Grok-4: Low-frequency and stable, with restrained risk control.

Claude: Concentrated bets on BTC/XRP.

Qwen3 Max: Conservative and unremarkable.

GPT-5: Frequent reversals and counter-trend operations, harvested by volatility.

Gemini: Excessive leverage, risk control collapse.

3️⃣ Interim Conclusions (based solely on the current window)

1) Diversification + Trend Following > Concentration + Timing:

In this wave of market volatility, a combination of multi-assets, moderate leverage, and trend-following positions (DeepSeek, Grok) has a higher win rate.

2) Repeated Timing is Most Damaging to Net Value:

GPT-5's "back-and-forth direction changes" are more harmful than "one wrong direction" — trading costs + reflexivity compound, leading to rapid drawdowns.

3) Risk Control is Everything:

Gemini's significant drawdown serves as a reminder: leverage × risk control parameters are more critical than "how smart the model is." Surviving comes first, then we can talk about excess returns.

Conclusion —

This matter is quite interesting; in the future, AI will undoubtedly be our most advantageous trading assistant. It's not about "which model is the strongest," but rather how to combine their personalities and risk parameters:

The six AIs are like managing six distinct quantitative fund managers.

The key points lie not in intellect, but in "positioning, stop-loss, leverage."

What wins is not intelligence, but engineering; what loses is not the algorithm, but human nature;

@jayazhang @thenof1

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。