Author: Nancy, PANews

A new wave of TGE (Token Generation Event) is accelerating, accompanied by the rapid rise of various innovative LaunchPad platforms. With unique mechanism designs and diverse gameplay, these platforms provide investors with rich participation avenues, greatly invigorating the new token issuance ecosystem and becoming a new hotspot for retail investors to seek profits. As the enthusiasm for new token issuance continues to rise, high fundraising cases are frequently seen, and participants have achieved considerable returns, often multiplying their investments by several times or even dozens of times.

This article from PANews will review the new token issuance data and project performance of four popular LaunchPad platforms (Buidlpad, Legion, MetaDAO, Metaplex Genesis) for players' reference (Note: Echo has not yet disclosed detailed data, so it is not included in this statistical scope).

Overall, these platforms generally exhibit characteristics of high popularity, high first-day returns, and strong short-term volatility. In terms of participation scale, market funds and user sentiment remain highly active, with projects on the four major platforms generally experiencing oversubscription. Some projects even set records with dozens of times oversubscription, and the number of participants in individual projects on certain platforms has exceeded hundreds of thousands. In terms of return performance, the short-term returns of new token issuance projects are impressive, with an average return of about 4.5 times on the day of TGE, particularly with Buidlpad and MetaDAO standing out, both achieving average first-day increases of over 500%, and some star projects even recording four-digit increases. Looking at a longer time frame, there has been no significant withdrawal of funds, with the average return of all new token issuance projects since their launch being about 190.8%, of which over 70% of projects maintain positive returns, and about 30% of projects still exceed double returns.

Buidlpad

Buidlpad was launched in December 2024 and is available for KYC-compliant users from non-restricted regions. Its founder is Erick Zhang, managing partner of Nomad Capital, who was previously the head of Binance Research and responsible for the Binance Launchpad platform.

So far, Buidlpad has initiated new token issuance for four projects, and from the data statistics, these projects are generally well-received in the market, with participation numbers exceeding 100,000. The market enthusiasm has directly driven the subscription scale of the projects, with an average oversubscription multiple of about 14.1 times, particularly with Falcon Finance achieving an oversubscription multiple of 28.2 times, setting a historical record for the Buidlpad platform.

In terms of return rates on the day of TGE, participants achieved an average return of about 563.3%, with overall return performance being very impressive. Notably, Falcon Finance had a return rate of 1557.1% on that day, far exceeding other projects. Other projects such as Solayer, Lombard, and Sahara AI also showed strong short-term returns.

Looking at a longer time frame, the average return rate of these projects to date is 286.7%, mainly influenced by the high returns of Falcon Finance due to its short TGE cycle. Excluding Falcon Finance, the long-term returns of other projects are significantly lower than the TGE day returns, but most still maintain positive returns.

Overall, Buidlpad's new token issuance projects are generally highly popular, and the wealth effect is evident in the short term, but long-term returns rely more on the projects' own development and market cycle influences.

It is worth mentioning that Buidlpad recently launched a Pre-TGE HODL staking activity, with the first project being Momentum. This activity aims to encourage users to earn high returns by providing liquidity while enhancing their qualification and priority for participating in new token issuance on the Buidlpad platform, which has also driven the growth of the project's TVL (Total Value Locked).

Legion ✖️ Kraken

In September this year, the cryptocurrency exchange Kraken announced a partnership with the ICO platform Legion to conduct MiCA-compliant token sales on its newly launched Kraken Launch platform.

Legion has raised $7 million through two rounds of financing, with investment institutions including VanEck, Coinbase Ventures, Kraken, Delphi Digital, and Alliance. The platform primarily assesses user qualifications through the "Legion Score" system, which covers dimensions such as social influence, on-chain activities, and developer activities.

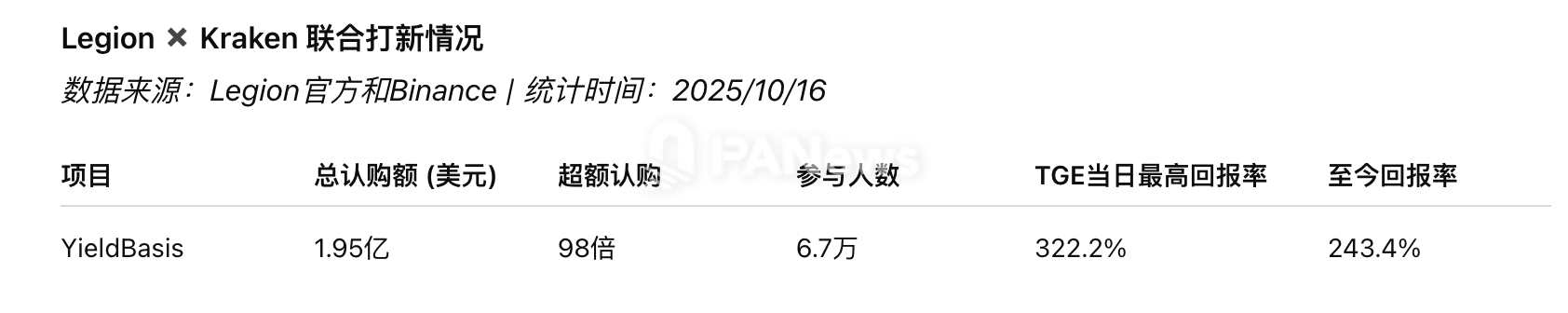

YieldBasis is the first project launched in collaboration between Legion and Kraken. In this sale, over 67,000 people applied, but only 4,187 were selected, accounting for about 7% of the total applicants, indicating fierce competition for new token issuance. YieldBasis's subscription scale exceeded $195 million, with an oversubscription rate of 98 times, demonstrating the market's high enthusiasm and recognition for the project, setting a record for the most oversubscribed token sale on the Legion platform to date.

In terms of return performance, the average return rate on the first day of TGE was about 322.2%, with overall returns remaining at 243.4%. This performance is related to the project just being launched, with market enthusiasm supporting its strong performance in the secondary market.

MetaDAO

The Launchpad platform MetaDAO on Solana has recently gained popularity. The platform raised $2.2 million last year, led by Paradigm. To date, the cumulative fundraising amount on MetaDAO is approximately $9.88 million.

It is important to note that the MetaDAO community has proposed to "sell up to 2 million META at market price or at a premium," including a proposal from Proph3t representing MetaDAO to sell up to 2 million META at market price or at a premium, with this portion of tokens being newly minted.

So far, MetaDAO has conducted multiple rounds of new token issuance activities, and from the data statistics, these projects are generally receiving market attention, but the participation scale varies significantly among different projects. In terms of participation numbers, Umbra leads with 10,500 participants, while Omnipair and mtnCapital have 321 and 1,931 participants, respectively. The data indicates that MetaDAO has significantly enhanced its user reach and community mobilization capabilities in its latest projects, gradually expanding its market coverage.

In terms of subscription scale and oversubscription, the platform's popularity continues to rise. The average oversubscription multiple for these projects is about 12 times, with Umbra achieving an oversubscription of 20.6 times, far exceeding other projects. This indicates that the brand effect accumulated by early projects on MetaDAO is being released, and the funding attractiveness of new token issuance activities has significantly increased.

In terms of return performance, the average return rate on the day of TGE was about 525.3%, with this average significantly boosted by Umbra's exceptionally high return of 1172.3%. The strong growth potential of the platform's new token issuance projects has greatly increased MetaDAO's visibility and discussion in the market.

However, looking at a longer time frame, project prices generally experienced some degree of correction after the initial enthusiasm faded. The average return rate since launch is about 365.4%, which, although lower than the TGE day, still maintains a high level of returns overall. Notably, Omnipair's return rate to date has reached 902.7%, significantly raising the overall average.

Next, MetaDAO has already launched or is about to launch new token issuance activities for several projects, including Avici, Loyal, ZKLSOL, and Paystream.

Metaplex Genesis

Metaplex is a decentralized NFT infrastructure on Solana. In 2022, the platform completed a strategic financing round of $46 million, with investment institutions including Multicoin Capital, Jump Crypto, Solana Ventures, and Samsung Next. In July of this year, Metaplex announced the launch of its on-chain token issuance protocol, Genesis.

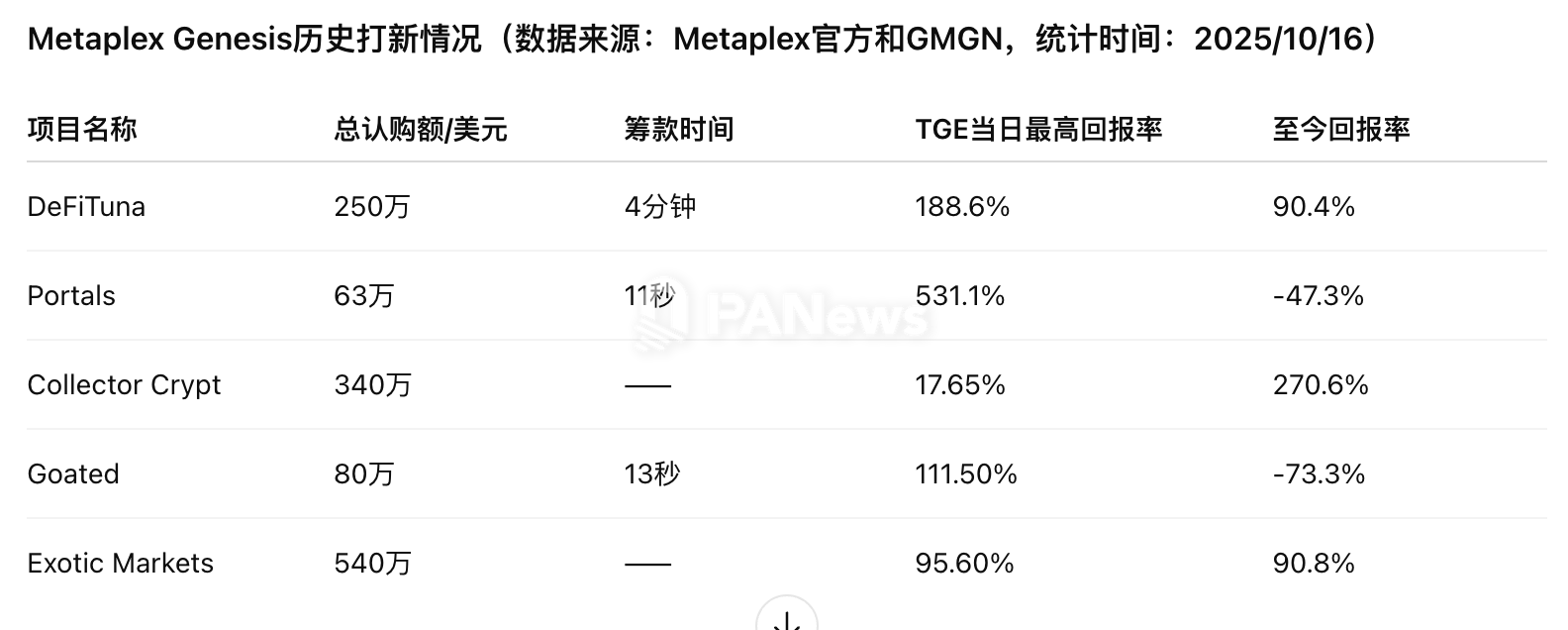

Metaplex Genesis has conducted multiple rounds of new token issuance activities, receiving widespread market attention. In terms of fundraising speed, most projects can achieve their fundraising goals within seconds to minutes. For example, Portals and Goated completed their subscriptions in just 11 seconds and 13 seconds, respectively, while DeFiTuna took only 4 minutes, demonstrating the market's high willingness to participate.

In terms of subscription scale, compared to other LaunchPads, the project sizes on Metaplex Genesis are relatively moderate, mostly in the range of several million dollars. This reflects that the platform is still primarily focused on small to medium-sized new token issuance at this stage.

In terms of return performance, the average return rate on the day of TGE was 188.9%, mainly driven by Portals' high return rate of 531.1%, which not only brought considerable returns to investors but also significantly enhanced the platform's exposure. Looking at a longer time frame, the return rates have shown significant differentiation, with an average level of about 270.6%. Collector Crypt and Exotic Markets achieved stable returns of 270.6% and 90.8%, respectively, while Portals and Goated experienced negative returns. Overall, the short-term market attractiveness of Metaplex Genesis's new token issuance projects has strengthened its influence and community appeal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。