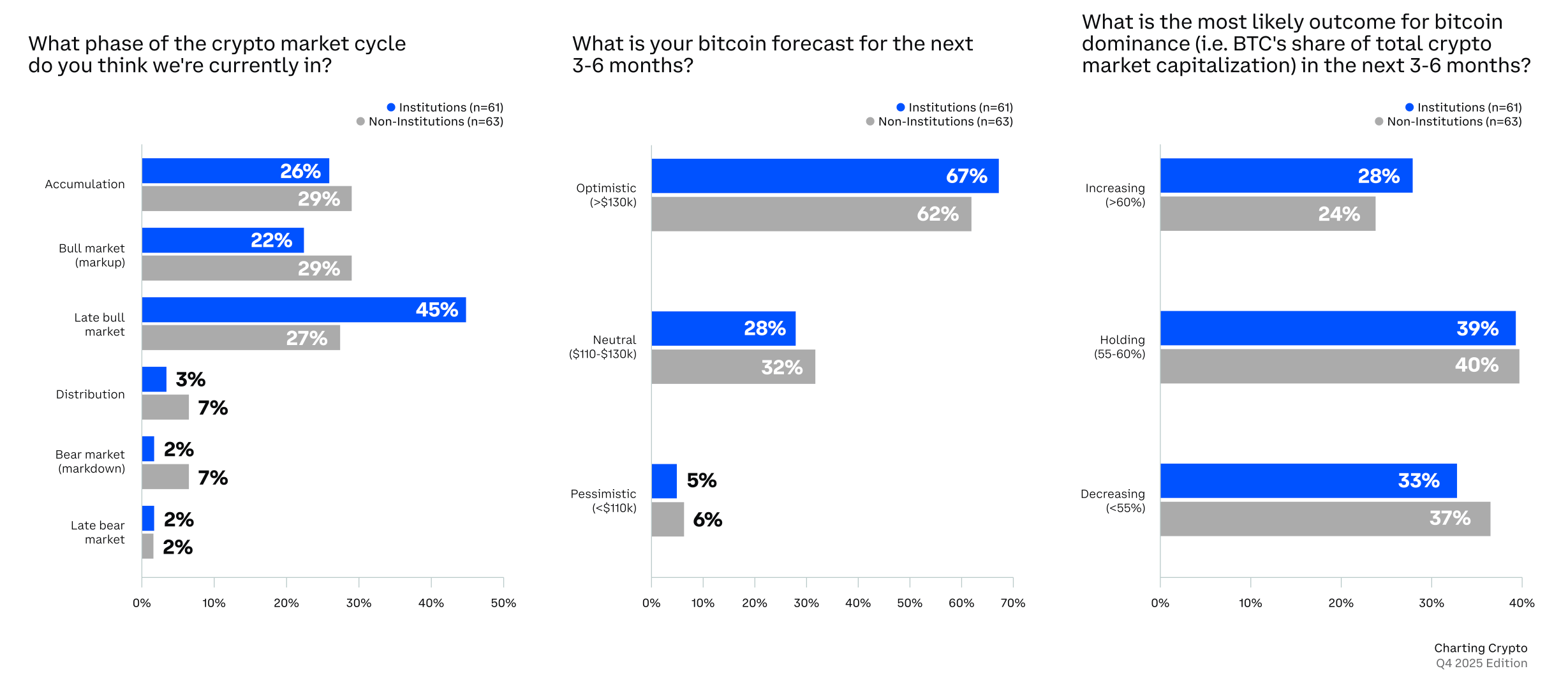

According to the analysis, institutions remain constructive on bitcoin over the next three to six months, with 67% of institutional and 62% of non-institutional respondents expressing a positive outlook.

Views on the cycle diverge: 45% of institutions say the market sits in a late-bull phase, compared with 27% of non-institutions. Macro conditions are the top tail risk for both groups (38% and 29%, respectively). The survey covered more than 120 global investors between Sept. 17 and Oct. 3, 2025.

The report’s topline view remains “cautiously optimistic” after the Oct. 10 leverage flush. The Coinbase and Glassnode authors see resilient liquidity, a favorable macro setting, and constructive policy signals—particularly in the United States—as the key pillars. They expect the Federal Reserve to cut rates twice in Q4, a path that could nudge some of the roughly $7 trillion sitting in money-market funds off the sidelines.

Source: Charting Crypto Q4 2025 by Coinbase Institutional and Glassnode.

Structurally, bitcoin may have an edge early in the quarter, while positioning in alternative assets warrants more care, the report notes. Bitcoin’s market dynamics show long-term holders largely steady, with illiquid supply down just 2% in Q3 while liquid supply rose 12%—a sign many seasoned holders kept coins parked even as prices set records.

Ether’s story features expanding participation and falling frictions: for the first time, U.S. spot ETH exchange-traded fund inflows ($9.4 billion) outpaced BTC spot ETF inflows ($8.0 billion) in Q3, while activity on Ethereum and layer-2 networks reached highs as average fees eased to two-year lows. That mix—more throughput and lower costs—aligned with improving sentiment measures for ETH through mid-year.

Institutional demand continues to be shaped by digital asset treasuries (DATs). Bitcoin DATs now hold roughly 3.5% of circulating supply; leading ether-focused DATs hold about 3.7% of ETH’s supply. While valuations for many DATs (measured by market-cap-to-NAV) softened late in Q3, the authors still expect DATs to provide meaningful demand in the quarter ahead.

The macro lens remains central. Coinbase’s custom global M2 index—historically correlated with bitcoin on a lead basis—signals favorable liquidity as Q4 opens, though it also flags a possible tightening patch in November. Policy progress, including U.S. market-structure legislation timelines, and ex-U.S. dynamics across Europe and Asia, will help define the pace and breadth of adoption by year-end.

- What is the report? A joint Q4 market briefing by Coinbase Institutional and Glassnode summarizing trends through Sept. 30, 2025.

- How many investors were surveyed? More than 120 global investors were surveyed between Sept. 17 and Oct. 3, 2025.

- What is the prevailing sentiment? 67% of institutional and 62% of non-institutional respondents are bullish on bitcoin over 3–6 months.

- What are the key macro takeaways? The report expects two Fed cuts in Q4 and highlights global liquidity trends that historically support crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。