RWA 代币化问题区块链代币代表对链外工具的索赔——美国国债、黄金等商品、机构基金、私人信贷、股票等——以便可以在公共网络上转移和结算。需求受到 24/7 可转让性、更快的结算、与链上应用的可组合性以及在没有传统铁路摩擦的情况下获得全球流动性的推动。

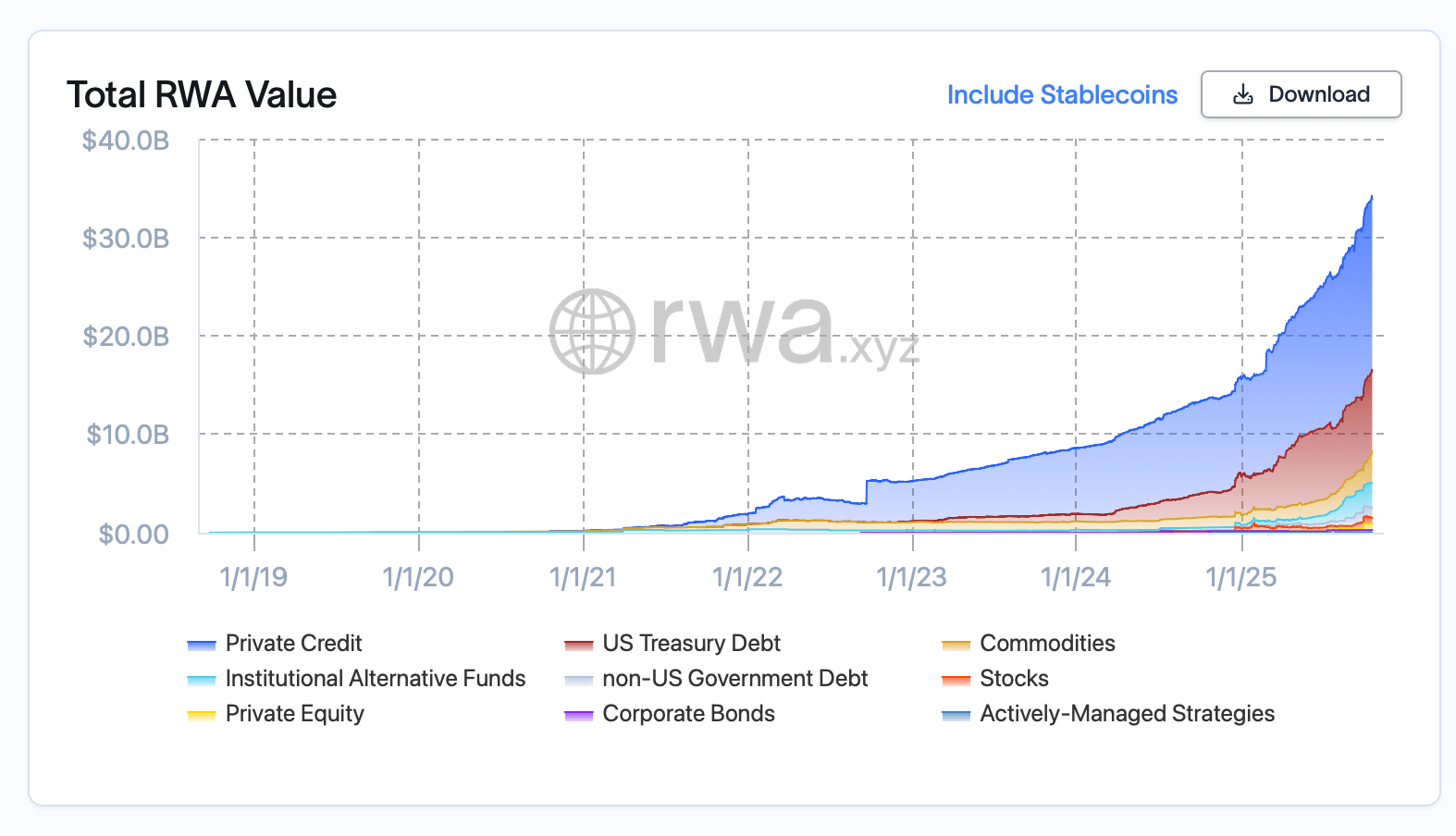

来自 rwa.xyz 的统计数据显示,参与度持续扩大。RWA 资产持有者达到 489,037,30 天增长 6.71%,活跃发行者总数为 225。rwa.xyz 上的多年度数据表明,国债和机构产品在总价值中占据领先地位,而商品、公司债券、非美国主权债务和主动管理策略则增加了增量深度。

截至 2025 年 10 月 19 日,代币化的真实世界资产 (RWA) 总价值。

按区块链计算,以太坊是主要场所,代币化价值为 124.76 亿美元,30 天增长 20.73%,市场份额为 58.24%。Zksync Era 紧随其后,代币化价值为 23.65 亿美元(-2.46%,11.04% 市场份额),然后是 Polygon,代币化价值为 11.38 亿美元(-3.74%,5.31%)。Arbitrum 在经历 122.3% 的月度增长后,持有 8.74 亿美元(4.08% 市场份额)。

Avalanche 代币化价值为 7.46 亿美元(-0.56%,3.48%),Aptos 7.25 亿美元(+0.19%,3.38%),Solana 6.96 亿美元(+5.04%,3.25%),Stellar 6.36 亿美元(+23.28%,2.97%),BNB Chain 5.15 亿美元(+14.99%,2.41%),XRP Ledger 3.62 亿美元(+3.45%,1.69%)。按市值计算的前 20 个 RWA 资产显示,国债继续吸引投资,同时黄金支持的产品和机构基金也在增长。

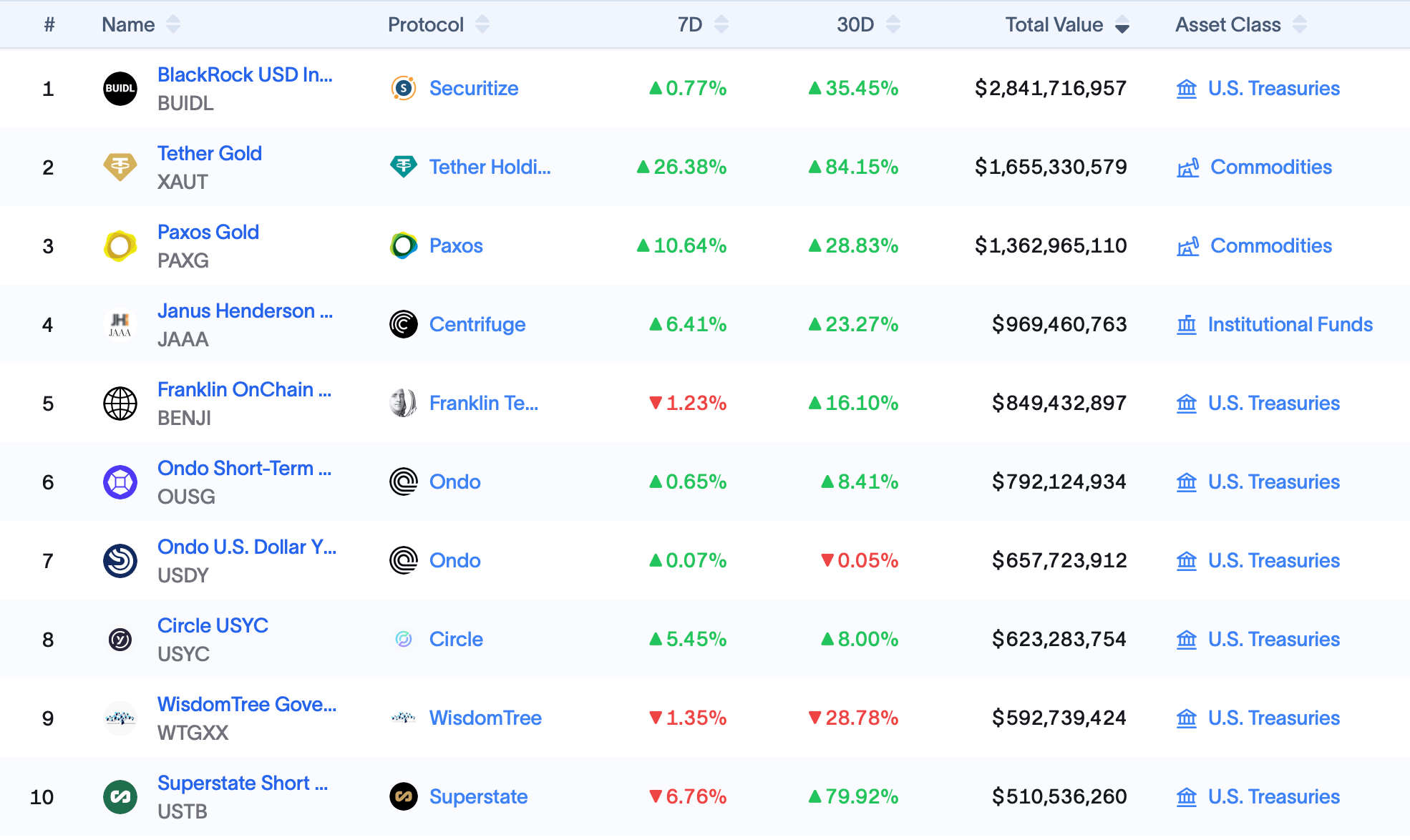

在国债方面,黑石的美元机构数字流动性 (BUIDL) 基金在七天内上涨 0.77%,在 30 天内上涨 35.45%,达到 28.4 亿美元;富兰克林邓普顿的富兰克林链上美国政府货币基金 (BENJI) 本周下跌 1.23%,本月上涨 16.10%,达到 8.49 亿美元;Ondo 短期美国政府债券基金 (OUSG) 在 7 天内上涨 0.65%(7D)和 8.41%(30D),达到 7.92 亿美元;Ondo 美元收益 (USDY) 基本持平,7 天上涨 0.07%(7D),30 天下跌 0.05%(30D),总额为 6.58 亿美元。

截至 2025 年 10 月 19 日,按市值计算的前十个 RWA 资产(不包括稳定币)。

Circle 的 USYC (USYC) 在 7 天内上涨 5.45% 和 30 天上涨 8.00%,达到 6.23 亿美元;Superstate 短期美国国债 (USTB) 在 7 天内上涨 6.76% 和 30 天上涨 79.92%,达到 5.10 亿美元;Janus Henderson 美国国债 (JTRSY) 在 7 天内下跌 14.67% 和 30 天下跌 14.51%,达到 2.95 亿美元;富达数字中期国债 (FDIT) 本周持平,本月上涨 9.21%,达到 2.22 亿美元。

在商品方面,Tether Gold (XAUT) 在 7 天内上涨 26.38% 和 30 天上涨 84.15%,达到 16.6 亿美元,Paxos Gold (PAXG) 在 7 天内上涨 10.64% 和 30 天上涨 28.83%,达到 13.6 亿美元,JSOY OIL 在 7 天内上涨 2.00% 和 30 天持平,达到 3.13 亿美元。政府和非美国主权产品包括中国 AMC 美元 (CUMIU) 在 7 天和 30 天均上涨 0.20%,达到 5.03 亿美元,Spiko 欧盟国库券 (EUTBL) 在 7 天上涨 0.57% 和 30 天下跌 0.85%,达到 3.25 亿美元。

机构基金由 Janus Henderson AAA (JAAA) 代表,7 天上涨 6.41% 和 30 天上涨 23.27%,达到 9.69 亿美元,区块链资本 (BCAP) 本周持平,本月上涨 11.49%,达到 4.05 亿美元,Superstate Crypto Cash (USCC) 在 7 天内下跌 6.87% 和 30 天上涨 10.81%,达到 2.54 亿美元,Legion Strategies (LS) 在两个时间段内均持平,达到 2.18 亿美元。

股权和私募市场的条目包括 Exodus Movement EXODB,7 天下跌 12.77%,本月持平,达到 4.8097 亿美元(私募股权),以及 Exodus Movement EXOD,7 天下跌 12.77%,30 天下跌 14.80%,达到 2.2337 亿美元(股票)。总体而言,这 20 种工具展示了国债、黄金和机构基金如何支撑该类别,同时小众投资扩展了其广度。

在结构上,RWA 的增长遵循一个简单的模式:发行者将熟悉的、产生收益或储备风格的工具包装成代币,保管人和受托人管理链外抵押品,协议处理主要发行和二级结算。链上投资者寻求可预测的收益(针对国债和机构基金)、通胀对冲(针对黄金)以及更快的赎回窗口、自动支付和与去中心化金融(DeFi)原语的集成等操作优势。

尽管 RWA 存在于许多链上,但流动性仍然集中在机构包装成熟和保管流动性建立的地方。本月的广泛增长——以及持有者数量的增加和更大的发行者集合——表明稳步、渐进的采用,而不是一次性激增,350 亿美元的门槛现在已在可达范围内。

- 什么是 RWA 代币化? 它是发行代表对链外资产(如国债、黄金、基金或信贷)索赔的区块链代币。

- 为什么需求在增长? 投资者寻求 24/7 的可转让性、更快的结算和与 DeFi 的集成,同时保留对熟悉工具的敞口。

- 哪个链领先? 以太坊以 124.8 亿美元的 RWA 价值和 58.24% 的市场份额领先。

- 现在市场有多大? 根据 rwa.xyz,链上 RWA 总额为 341.4 亿美元,30 天上涨 10.58%。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。