Will ETH Bitcoin ETF Outflows and $5.72B Options Expiry Deepen Crash?

What if two major crypto market volatility triggers approaches at the same time? Yes, $5.72B crypto options expiry will hit on Deribit today, and Bitcoin ETF outflows along with ETH are experiencing a massive exit.

Traders are on full alert as both the top cryptocurrencies are under pressure like never before. Now the main question is: How will these options expiry impact ETH and BTC price ? More pain or a twist ahead?

Source: Ash Crypto X Account

Massive BTC and ETH ETF Outflows: Why It Matters Today

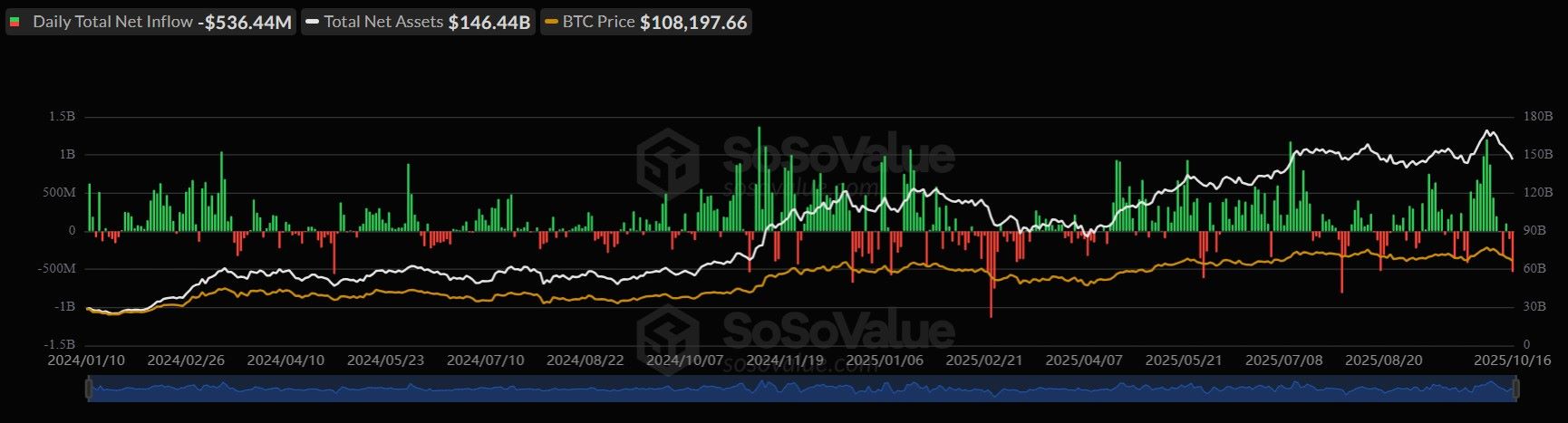

As of October 16, Bitcoin ETFs outflow saw $536.44 million leaving the market, the largest single-day withdrawal since August. These tokens exit shows that big investors are selling their shares, which also leads to a $BTC crash.

The red bars on the SoSovalue chart show fear and selling in the market, weakening confidence in the world’s largest cryptocurrency .

Ethereum ETF outflows also saw $56.88 million withdrawn, meaning investors are selling this altcoin too. Together, these withdrawals are making the market very shaky and setting the stage for today’s huge market crash.

$5.72B BTC and ETH Options Expiry: What Could Happen

Today’s $5.72B ETH and BTC options expiry can either make the crash worse or help prices bounce back.

-

After the analysis of Bitcoin latest news, its price support is at $103K for now, if it falls then panic selling will follow the asset, which may trigger even a $100K pain.

-

Outflows and expiry Ethereum news shows that the token is standing at $3,650 support level, which is very critical. If it breaks this, prices could fall to $3,000.

Note: Many crypto analysts on X are hopeful. They highlight that usually, after big ETH and BTC options expiry, markets calm down in 24–72 hours. Short-covering and new inflows might trigger a bounce.

BloodBath or Price Reversal Soon? What’s Ahead

1. At the time of writing, Bitcoin price crashed around 6% in just 24 hours, currently trading at $104,625.84, and 13% fall in a week. Volume is up 45.5%, showing panic selling. As seen in the below TradingView price chart, RSI is near 38, which means it is oversold, but MACD is still bearish and no bullish sign is showing yet. If it crashes below $103K, then Bitcoin ETF outflows could make the fall worse. But oversold conditions might attract traders to buy cheap, which could trigger a bounce.

2. $ETH price at the time of writing is standing at $3,725.75, down 8% in 24 hours, with volume up 30.94%. RSI is 39, so the altcoin is oversold but not extreme. MACD is still bearish. Combined with Ethereum ETF outflows and today’s $5.72B options expiry, it might fall more if it breaks $3,650 support. However, if the market stabilizes, short-covering and inflows might trigger a bounce.

Current Ethereum bloodbath needs a close above $3,850 to confirm a rebound. Until then, it remains under pressure with high volatility.

Conclusion: Markets at a Critical Point

Massive Bitcoin ETF outflows, Ethereum ETF withdrawals, and the $5.72B crypto options expiry are creating high volatility in the crypto market.

Traders should watch exchange traded funds flows and post-expiry price action closely. The next 48 hours are critical for both the assets. Whether they recover or experience more pain, only time will tell, so keep a close watch on their support levels.

Disclaimer: This article is for informational purposes only and does not support any financial advice. The crypto market is volatile, so always DYOR before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。