Tom Lee Ethereum Prediction Links ETH Rise to Tokenized Finance Boom

Could Ethereum actually overtake Bitcoin as the leading cryptocurrency? Tom Lee, co-founder of Fundstrat Global Advisors, outlined his ambitious vision on ARK Invest's FYI Podcast with Cathie Wood and Brett Winton.

He broke down the reasons why It could flip Bitcoin and become the dominant layer of the financial internet.

Source: X (formerly Twitter)

Tom Lee Ethereum analysis put that possible "flippening" in perspective with what occurred after 1971 when the dollar left gold. Wall Street produced products which made the dollar dominant, he stated, and he expects the same to occur with Ether as everything gets tokenized.

BitMine's Aggressive Ethereum Strategy

BitMine Immersion Technologies, whose chairman is Tom Lee, is making a massive foray into Ether.

The company has recently bought 104,336 currency worth around $417 million, bringing its total holdings to 2.8 million ETH.

The organisation wants to become the largest publicly traded holder, bridging traditional finance and decentralized networks.

BitMine's key activities are:

Bitcoin Mining: Utilize advanced immersion cooling to maximize mining efficiency.

Hosting Services: Offering turnkey mining services to other miners.

ETH Treasury: Aggressive buying in order to accumulate its reserves.

Advisory Services: Counselling firms on treasuries and management of digital assets.

Such a move is supportive of Lee's optimism about institutional investors increasingly using Ethereum for corporate treasuries and equity-wrapped crypto exposure.

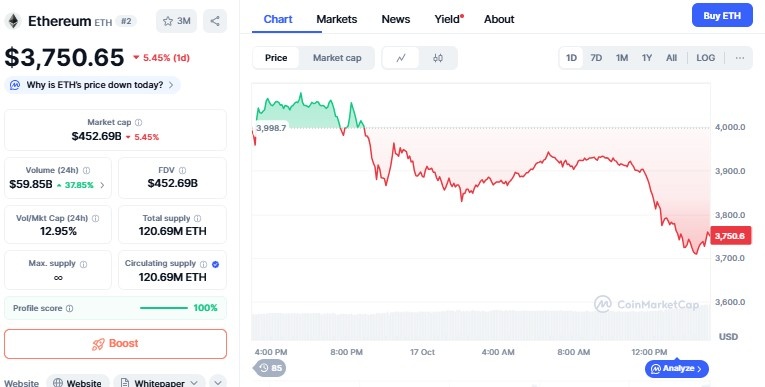

Ethereum Price: Institutional Pullback and Market Pressure

Despite Tom Lee optimism, Ethereum short-term price has some downward pressure. It fell by 5.46% to $3,750.77 over 24 hours, behind the broader market.

Source: CoinMarketCap

The main reasons are:

ETF Flows : Spot ETH ETFs experienced $56.9 million of outflows, unwinding earlier inflows, while Bitcoin ETFs shed $536 million.

Whale Shorts & Liquidations: A big $86M short with 25x leverage contributed to selling pressure, sustaining under $3,800.

Technical Analysis: ETH dipped below 30-day SMA ($4,264) and 38.2% Fibonacci level ($4,260). Bearish momentum in MACD, RSI at 40.92, yet not oversold. Analysts have $3,560 yearly VWAP as critical support, with $3,350 as the test of strength if weakness persists.

While near-term risks persist, it's long-term narrative hinges on demand for staking, with 59.88% of supply locked up through Lido, underpinning its fundamental worth.

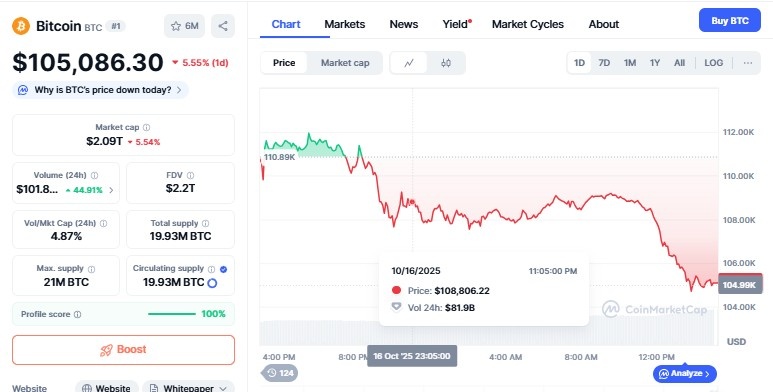

On the other hand, Bitcoin price crashed by 5.53% to $105,124 in the last 24 hours. Trading volume has increased by 46.57%.

Source: CoinMarketCap

Why Ether May Flip Bitcoin

Tom Lee Ethereum prediction are fueled by a number of catalysts:

Tokenization of assets: Equities, property, and stablecoins transferring to blockchain's platform.

Corporate Adoption: BitMine is establishing ETH treasuries for managing digital assets.

Regulatory Unlocks: 2025 could bring clarity, allowing institutional products to unlock ETH wider adoption.

Proof-of-Stake Advantages: Ether's network allows staking, liquidity backstops, and DeFi, which offer advantages in comparison to Bitcoin's proof-of-work consensus.

Although the "flippening" remains a working theory, Lee insists Bitcoin is still valuable . Trends indicate that the altcoin might ultimately take on the role of becoming the primary infrastructure layer for digital finance.

Conclusion

Tom Lee Ethereum analysis predicts a future where ETH can potentially outpace Bitcoin on the back of tokenization, institutional use, and corporate positions such as BitMine's $417M ETH reserve.

The short-term volatility is certainly there, but the long-term prospects for Ether are well placed, positioning it as an important consideration for investors and institutions seeking digital asset exposure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。