Author: Yokiiiya

In the previous series, we dissected how DeFi has built a brand new financial protocol with code—"money legos." The next few articles will continue to explore the recently popular RWA.

RWA is not a new concept—it is a question that the blockchain world has been trying to answer for the past decade: Can the value of the real world be safely, transparently, and compliantly brought onto the chain?

Similarly, the RWA series will avoid the noise and focus on the technical principles, legal frameworks, and market ecology of RWA, aiming to provide everyone with a clear and rational cognitive framework to examine the ongoing evolution of financial infrastructure.

Everyone is welcome to communicate and follow along.

1. What is RWA?

RWA, short for Real World Assets, translates to "real-world assets." Its core is to transform all valuable and income-generating assets in the real world into digital tokens on the blockchain through blockchain technology.

You can think of it as a "digital transfer" of assets. These "new immigrants" include:

Financial assets: government bonds, corporate bonds, private credit

Physical assets: real estate, commodities (gold, oil), artworks

Emerging assets: carbon credits, intellectual property, music royalties

The core logic of RWA is to achieve a paradigm revolution from "asset dormancy" to "value awakening." It addresses the dilemma of many high-quality assets being "locked" in the traditional financial system.

2. Key Nodes and Driving Forces Behind RWA

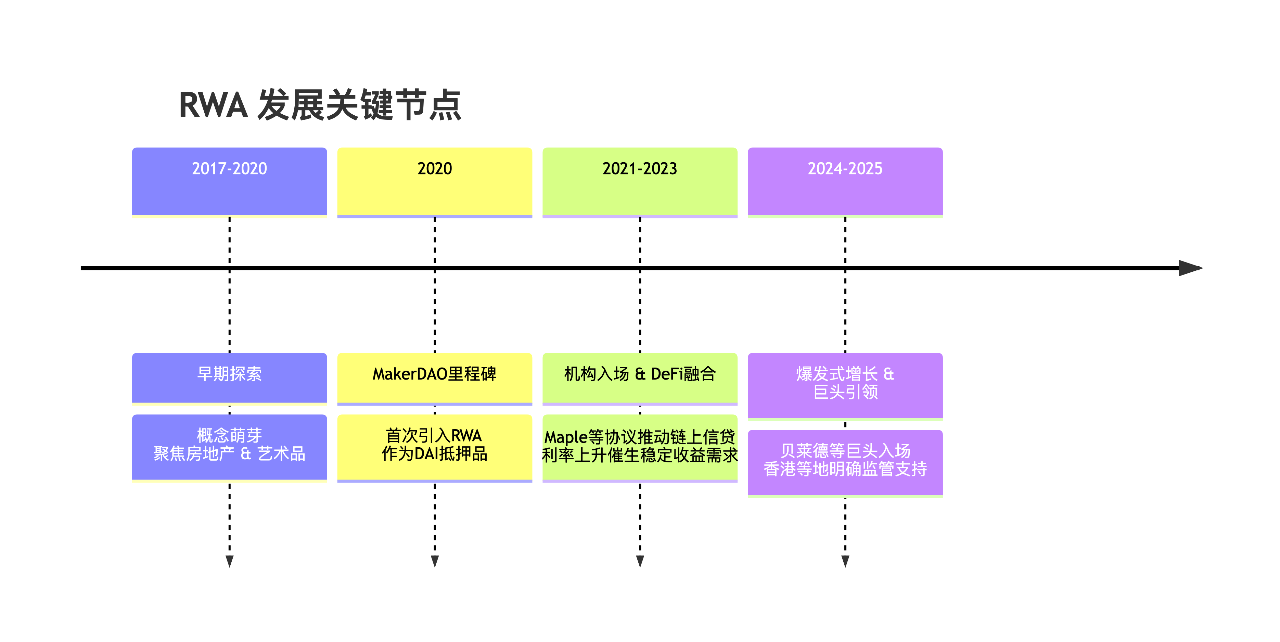

The sudden popularity of RWA is actually a concentrated explosion of long-term accumulation from technology, market, and institutional forces. The timeline below can help you quickly understand the key nodes in the development of RWA:

The rise of any trend is the result of the combined effects of timing, location, and people. The explosion of RWA is strongly driven by three engines:

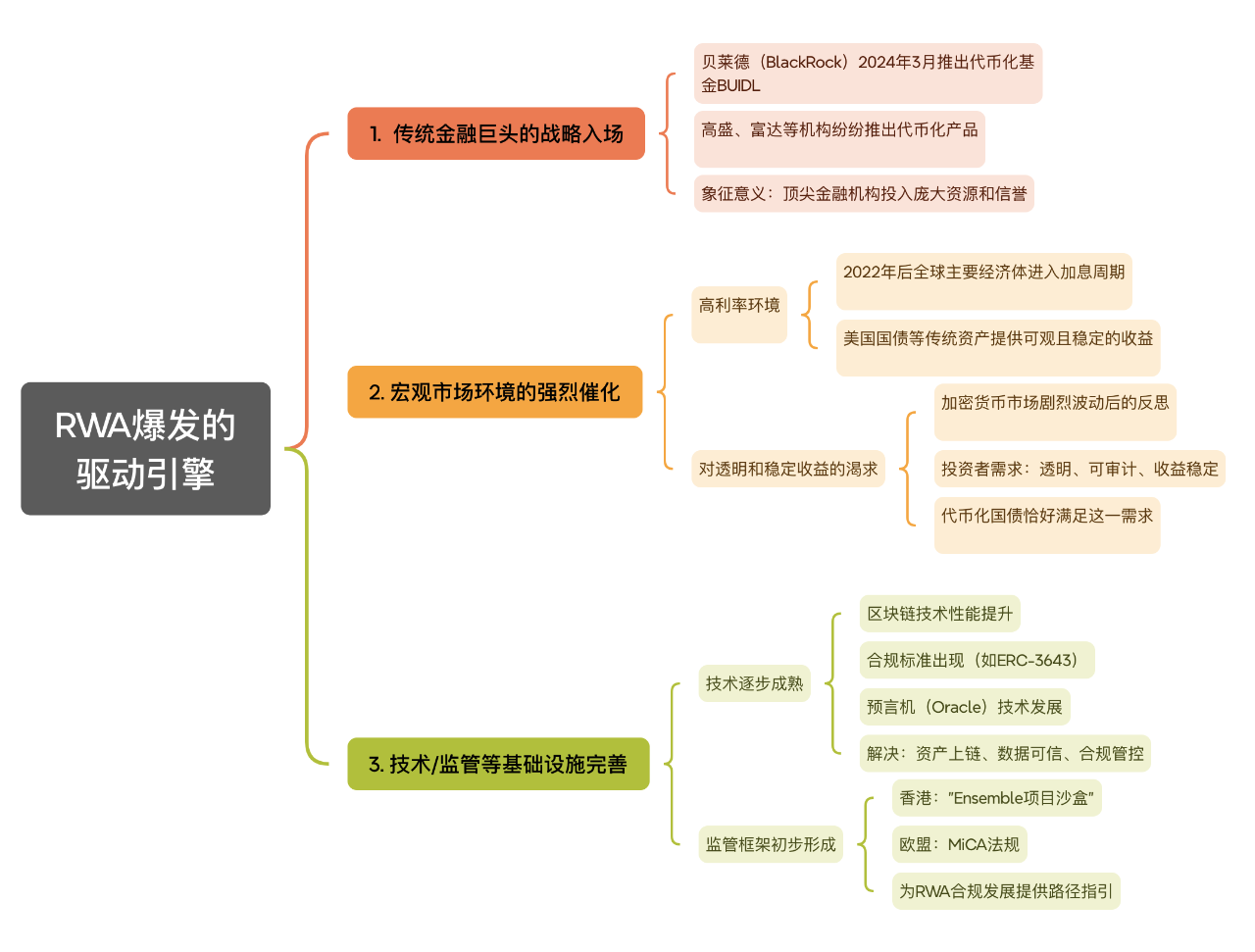

1. Strategic Entry of Traditional Financial Giants

The concentrated entry of traditional financial giants between 2024 and 2025 is the most direct catalyst for the explosive growth of RWA.

Among them, BlackRock's launch of the tokenized fund BUIDL in March 2024 is considered a key event. Its symbolic significance lies in the fact that it indicates that top traditional financial institutions are investing their vast resources and credibility into this field. Subsequently, institutions like Goldman Sachs and Fidelity also launched their own tokenized products, greatly enhancing market confidence.

2. Strong Catalysis from the Macroeconomic Environment

High-interest rate environment: After 2022, major global economies entered a rate hike cycle, and traditional assets like U.S. Treasury bonds provided considerable and stable returns. This made it very attractive to bring such asset returns into the crypto world in the form of RWA.

Demand for transparency and stable returns: After experiencing the extreme volatility of the cryptocurrency market, investors' demand for transparent, auditable, and stable return investment channels has significantly increased. RWA, especially tokenized government bonds, precisely meets this demand.

3. Improvement of Infrastructure such as Technology and Regulation

Gradual maturity of technology: The performance of blockchain technology has improved, compliance standards specifically designed for RWA (such as ERC-3643) have emerged, and the development of oracle technology has collectively addressed key issues of asset on-chain, data credibility, and compliance control.

Preliminary formation of regulatory frameworks: The gradual clarification of regulatory policies in places like Hong Kong's "Ensemble Project Sandbox" and the EU's MiCA regulations has provided initial guidance for the compliant development of RWA.

3. The Deep Logic Behind the RWA Explosion

The interplay of the above factors reveals the deep logic behind the explosion of RWA: it attempts to solve some core pain points of traditional finance and crypto finance.

For traditional finance, RWA brings efficiency improvements and cost reductions. For example, through smart contracts, the fund settlement time for a cross-border real estate transaction can be compressed from 90 days to 72 hours, reducing financing costs by 40%.

For crypto finance, RWA introduces stable returns and a richer variety of asset types. It brings assets backed by real value and cash flow onto the chain, providing a more solid value foundation for the DeFi world.

4. A Case Study to Understand How RWA Restructures Value

Let’s use a simplified case to intuitively feel the magic of RWA:

Traditional model: A new energy company wants to raise funds to build a photovoltaic power station. It needs to find investment banks, lawyers, and accounting firms, prepare a large amount of materials, and spend months issuing a corporate bond or ABS, ultimately possibly involving only a few large institutions.

RWA model:

Asset packaging: Inject the future power generation revenue rights of the power station into a legal entity.

Tokenization: Tokenize the revenue rights on the blockchain, for example, issuing 10 million "photovoltaic power station revenue tokens," each representing one ten-thousandth of the revenue rights.

Issuance and trading: Any global investor can directly purchase these tokens using stablecoins through a crypto wallet, with a minimum threshold of just $1. Smart contracts will automatically distribute the electricity sales income proportionally to all token holders.

The result is that the company gains a faster and cheaper financing channel; ordinary investors, who previously could not access green infrastructure projects, can now easily participate; and the overall capital allocation efficiency of society is comprehensively improved.

Finally

The narrative of RWA is far more than just "trading coins." It concerns how to use technological means to break through the barriers of traditional finance, allowing stagnant assets to flow and dormant value to awaken.

This is a silent yet profound revolution in financial infrastructure. Whether you are an investor, entrepreneur, or merely an observer, understanding RWA may be key to grasping the new direction of wealth movement in the next decade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。