Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

As the "explosion" in the U.S. credit market drives up risk-averse sentiment and expectations for interest rate cuts by the Federal Reserve increase, spot gold has set a historical high for the fourth consecutive trading day, surging $115 in a single day to over $4,300 per ounce. Against this backdrop, Bitcoin's "safe-haven attribute" has not manifested, with its movements showing a higher correlation with U.S. tech stocks. Bitcoin fell below the $110,000 mark last night, continuing the collapse trend from last weekend's $101,100. In response, JPMorgan analysts stated that last week's significant correction in the crypto market, accompanied by large-scale liquidations, may have been driven by native cryptocurrency investors rather than institutional or retail ETF holders.

In the past 24 hours, the liquidation amount reached $700 million, affecting over 200,000 people, with the fear index dropping to 22, indicating extreme fear. A Glassnode report pointed out that without new catalysts pushing the price back above $117,100, the market faces the risk of further contraction towards the lower limit of that range. Historically, when the price fails to hold this range, it often signals a long-term medium to long-term correction. Additionally, there has been an increase in profit-taking behavior among long-term holders recently, which may indicate "demand exhaustion."

According to SoSoValue data, yesterday (October 16), Bitcoin spot ETFs saw a total net outflow of $536 million, with none of the twelve ETFs experiencing net inflows, among which Ark Invest and 21Shares' ARKB had the largest outflow.

However, more and more sovereign nations are beginning to take notice of Bitcoin, with some countries even starting to use Bitcoin as part of their asset reserves. Yet, Bridgewater Associates founder Ray Dalio believes that Bitcoin has drawbacks and that central banks will not hold Bitcoin. He also argues that stablecoins are not a good store of wealth, as they are essentially redeemable for corresponding currencies and do not generate interest. Therefore, from a financial perspective, holding stablecoins is less advantageous than holding interest-bearing fiat assets. The advantage of stablecoins lies in their global usability, serving as a convenient settlement system for transactions, making them suitable for those who do not care about interest. Regarding whether stablecoins can solve the U.S. Treasury issue, he believes that if stablecoin buyers already hold U.S. Treasuries, it is akin to transferring Treasuries from one pocket to another, and whether new demand for Treasuries can be generated remains to be seen.

In terms of Ethereum institutional holdings, according to Bitwise's latest report, publicly traded companies hold 4.63 million ETH (valued at $19.13 billion), accounting for about 4% of the total supply. Of all the ETH currently held by these companies, 95% (about 4 million) was purchased in the third quarter of this year. Ethereum treasury company SharpLink Gaming announced it raised $76.5 million by issuing shares at $17 each (12% above market price) and may raise about $79 million through a new 90-day premium purchase contract at $17.50 per share (19% above market price). BitMine is also transitioning to a public vehicle primarily holding ETH, with a market cap exceeding $15 billion and holding over 3 million ETH (about 2.5% of total supply), aiming to increase to 5% and earn income through staking while being included in major indices. BitMine chairman Tom Lee also warned that several DATs have fallen below net asset value, indicating that a bubble may have burst.

Additionally, SoSoValue data shows that among all Ethereum spot ETFs yesterday, only BlackRock's ETHA achieved net inflow, while all other products experienced net outflows. In terms of technological development, Galaxy Research Vice President Christine Kim summarized the 167th Ethereum core developer consensus call. This week, developers preliminarily finalized the mainnet activation timeline for the Fusaka upgrade.

2. Key Data (as of October 10, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

- Bitcoin: $108,744 (YTD +16.25%), daily spot trading volume $82.62 billion

- Ethereum: $3,910 (YTD +17.16%), daily spot trading volume $64.62 billion

- Fear and Greed Index: 22 (Extreme Fear)

- Average GAS: BTC: 1 sat/vB, ETH: 0.13 Gwei

- Market Share: BTC 58.9%, ETH 12.8%

- Upbit 24-hour trading volume ranking: XRP, BTC, ETH, SOL, DOGE

- 24-hour BTC long-short ratio: 48.82%/51.18%

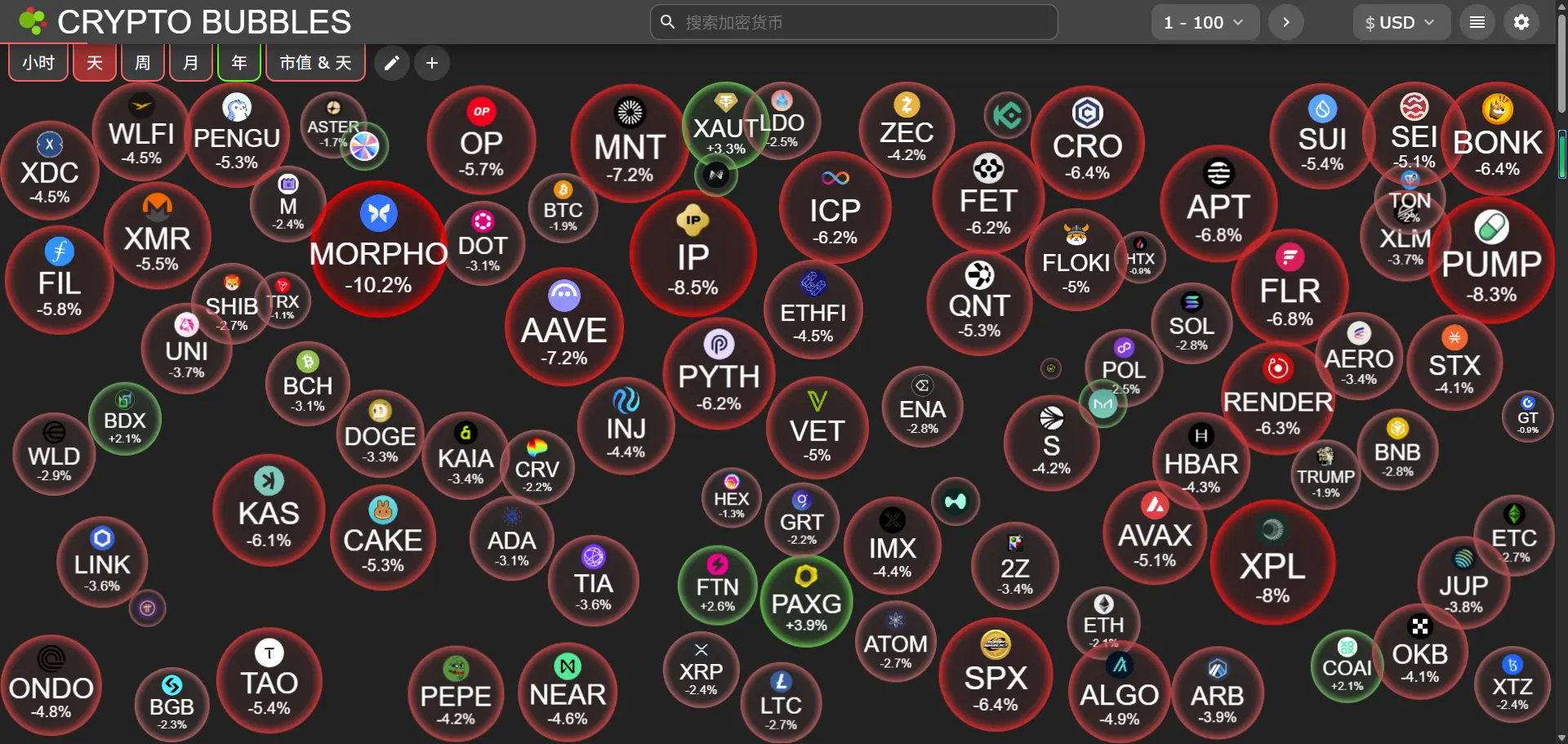

- Sector performance: DePIN sector down 5.88%, GameFi sector down 5.35%

- 24-hour liquidation data: A total of 205,791 people were liquidated globally, with a total liquidation amount of $720 million, including $235 million in BTC, $167 million in ETH, and $72.97 million in SOL

- BTC medium to long-term trend channel: upper line ($114,919.40), lower line ($112,663.37)

- ETH medium to long-term trend channel: upper line ($4,158.11), lower line ($4,075.77)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of October 16)

- Bitcoin ETF: -$526 million

- Ethereum ETF: -$56.88 million

4. Today's Outlook

- U.S. Treasury seeks innovative regulatory input on stablecoins under the GENIUS Act

- U.S. SEC crypto task force to hold a roundtable on financial regulation and privacy on October 17

- ETHShanghai 2025 hackathon to officially launch on October 18

- Cronos (CRO) to unlock approximately 1.017 billion tokens, representing 1.7% of the current circulation, valued at about $214 million

- Caldera (ERA) to unlock approximately 51.63 million tokens, representing 5.16% of the current circulation, valued at about $27.9 million

- Lombard (BARD) to unlock approximately 11.35 million tokens, representing 1.14% of the current circulation, valued at about $11.49 million

Today, the top gainers among the top 100 cryptocurrencies by market cap: PAXG up 3.9%, COAI up 3.5%, XAUT up 3.3%, BDX up 2.5%, FTN up 2.5%.

5. Hot News

- Tether froze 13.4 million USDT across 22 addresses on Ethereum and Tron networks yesterday

- Analysis: A single entity is suspected of controlling half of the high-yield COAI wallets, with total profits reaching $13 million

- South Korean blockchain infrastructure provider DSRV completes approximately $21.12 million Series B financing

- Derin Holdings partners with Antalpha to invest $100 million each in acquiring/distributing XAUT and purchasing Bitcoin mining machines

- Jack Dorsey and several Bitcoin supporters call for the Signal app to adopt Bitcoin

- Base app: will launch creator tokens, currently in early access phase

- Bloomberg: Ripple Labs plans to lead a $1 billion fundraising effort to build an XRP reserve strategy

- Charles Schwab CEO: expects to launch spot cryptocurrency trading services in the first half of 2026

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。